Report Overview

Global Printed Tape Market Highlights

Printed Tape Market Size:

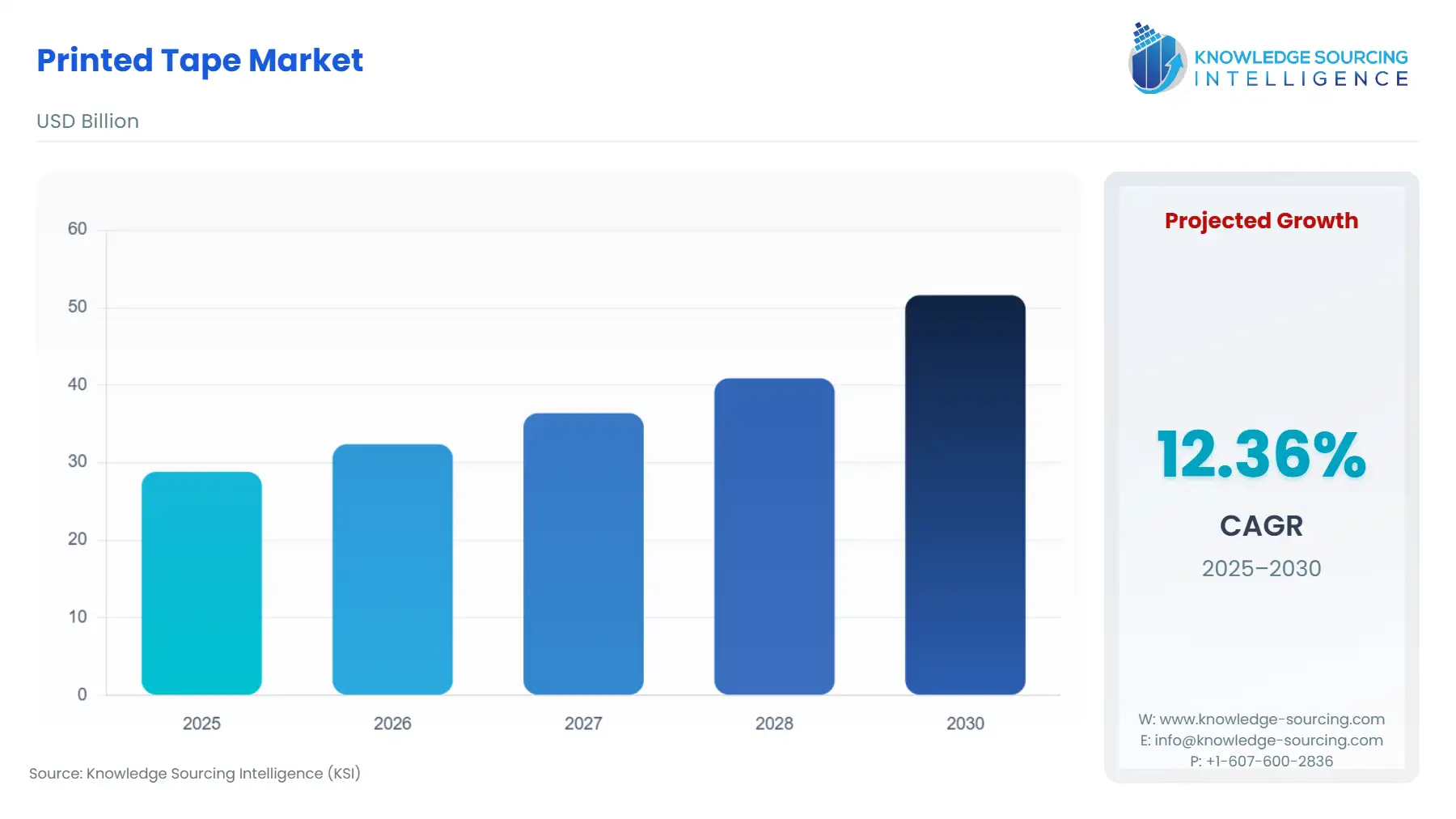

The global printed tape market is expected to grow at a CAGR of 12.35%, reaching a market size of US$51.611 billion in 2030 from US$28.825 billion in 2025.

The rising demand for the product in food and beverage applications for branding, promotion, and packaging is expected to fuel growth in the coming years. Throughout the forecast period, the product's ease of classification and ability to protect materials during transit are anticipated to fuel demand. Additionally, the use of high-strength polymer tapes in conjunction with the growing application of various technologies for particular printing requirements is anticipated to support growth.

Moreover, printed tape is expected to have a high penetration in food and beverage applications over the forecast period. It is anticipated that the primary factor contributing to the high product penetration in the food and beverage application will be the use of tapes for packaging and printing names and logos of businesses operating in the application industry. Additionally, the top printers in the market are concentrating more on software-centric technologies than on printing technologies that require large machinery. This has made it possible to print in multiple colours on higher-quality tapes. Furthermore, the market has profited from high-precision rapid printing made possible by the increasing use of digital technology. For instance, Pasky Ltd. offers materials and print options in addition to the printed adhesive tape type that was initially offered. The company offers a variety of services such as traditional adhesive tape printing using flexo print technology, sandwich printing, paper tape printing, LDPE foil printing, water-activated paper tape printing, cardboard printing, and the production of paper and plastic labels.

Printed Tape Market Growth Drivers:

- Growing e-commerce and a need for specialized packaging solutions propel the printed tape market.

The global printed tape market is expanding rapidly, owing to major factors. First of all, demand for specialized packaging solutions is rising in several industries. The significance of using packaging to establish a unique brand identity is something that businesses are realizing more and more. For businesses looking to showcase their logos, messages, and designs on their packages, printed tape provides an affordable and eye-catching solution. Customers have a unique unboxing experience as a result, which increases brand recognition and loyalty in addition to being a potent marketing tool.

The amount of goods shipped has increased exponentially as a result of the growth of online shopping. Because of this, companies are looking for strategies to differentiate their packages in a crowded market. Printed tape offers a special chance to elevate an ordinary cardboard box into a branded statement, essentially turning it into a platform for marketing. The industry is positioned for sustained growth shortly due to the trend of packaging solutions placing a higher priority on customization and the quick rise of e-commerce. For instance, through 2026, the global market for B2B e-commerce is expected to expand at a compound annual growth rate of 14.5%. Moreover, the market for printed tape is expected to grow significantly as a result of the introduction of digital printing technology. With this creative strategy, manufacturers can provide their customers with highly customizable, on-demand solutions. Businesses can use digital printing to produce complex and distinctive designs on tape with extreme accuracy and colour consistency. Businesses aiming to stand out from the competition and strengthen their brand identity through packaging will find this feature particularly appealing. Digital printing offers a platform for customized, small-batch production that not only fulfils the unique branding requirements of companies but also expands the creative possibilities in the printed tape market.

- It is projected that the global printed tape market in the Asia Pacific will grow steadily.

The substantial growth observed in the Indian printed tapes market can be primarily attributed to its widespread usage in key sectors such as packaging, along with consumer goods, notably in the thriving e-commerce industry. The expansion of these industries is propelled by India's strong economic spending on goods and a growing population. According to the Packaging Industry Association of India, the packaging sector in the country is anticipated to experience a remarkable annual growth rate of 22-25%, positioning India as a preferred hub for the packaging industry in the coming years. Consequently, the adoption of printed tapes within the e-commerce sector is expected to be a significant driver of market growth. Additionally, the application of printed tapes in branding and promotional activities is anticipated to further boost market dynamics in the projected period.

The International Trade Administration (ITA) reported a valuation of US$46.2 billion for the Indian e-commerce segment in 2020, with an anticipated surge to US$136.47 billion by 2026. With the rising demand for packaged goods from the e-commerce industry the demand for printed tapes for packaging purposes and brand identification is expected to boost the market in the coming years.

Printed Tape Market Key Developments:

Printed Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Printed Tape Market Size in 2025 | US$28.825 billion |

| Printed Tape Market Size in 2030 | US$51.611 billion |

| Growth Rate | CAGR of 12.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Printed Tape Market |

|

| Customization Scope | Free report customization with purchase |

The Printed Tape Market is analyzed into the following segments:

- By Type

- Polypropylene

- Paper

- PVC

- Others

- By End-User Industry

- FMCG

- Consumer Electronics

- Healthcare

- Retail

- Others

- By Geography

- North America

- By Type

- By End-User Industry

- By Country

- United States

- Canada

- Mexico

- South America

- By Type

- By End-User Industry

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Type

- By End-User Industry

- By Country

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- By Type

- By End-User Industry

- By Country

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- By Type

- By End-User Industry

- By Country

- China

- Japan

- South Korea

- India

- Australia

- Others

- North America