Report Overview

Global Sealants Market Size, Highlights

Sealants Market Size:

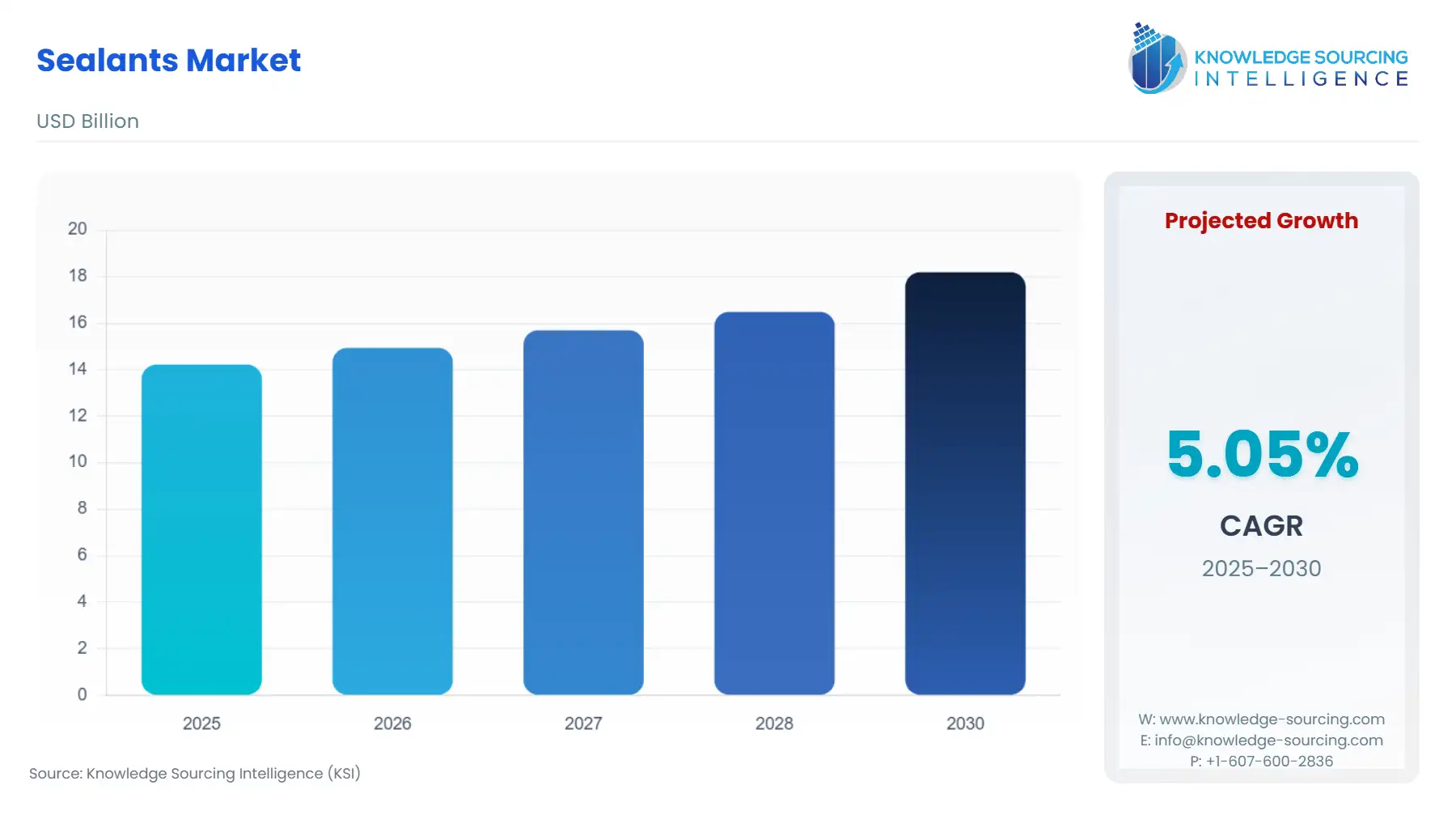

The Sealants Market is expected to grow from USD 14.219 billion in 2025 to USD 18.191 billion in 2030, at a CAGR of 5.05%.

The Global Sealants Market serves as a critical, high-specification segment of the global chemical and construction materials industry, focused on achieving non-structural barriers against environmental factors such as moisture, air, and chemicals.

The market is defined by a dichotomy between high-volume, cost-sensitive materials (like acrylics and butyls) and high-performance specialty chemistries (like silicone and polyurethane) that cater to demanding environments, including structural glazing, advanced automotive assembly, and aerospace. The central dynamic propelling this market is the global shift toward energy-efficient building envelopes and lightweight vehicle assembly, which requires sealants with exceptional flexibility, durability, and adhesion to dissimilar substrates. Furthermore, regulatory pressures targeting improved indoor air quality and reduced environmental impact are fundamentally restructuring product formulation, creating a premium on low-VOC, solvent-free, and hybrid solutions.

Global Sealants Market Analysis:

- Growth Drivers

The global proliferation of high-performance architectural design, specifically the use of advanced curtain wall and insulating glass unit (IGU) systems, acts as a profound demand catalyst. These modern façade systems require structural-grade silicone sealants that offer exceptional adhesion, maintain stability under wind load, and provide superior UV and weather resistance over multi-decade lifecycles. This imperative directly increases demand for high-specification Silicone and Hybrid Sealants. Concurrently, the increasing stringency of green building standards and energy codes mandates the use of highly effective air-barrier systems to minimize thermal transfer. This regulatory push guarantees demand for high-grade sealants used in weatherproofing and insulation applications, as they are essential for achieving the required air-tightness and energy efficiency ratings in new commercial and residential construction.

- Challenges and Opportunities

The primary market challenge is the direct price volatility of core petrochemical-based raw materials, specifically the Isocyanates and Polyols necessary for Urethane-Based Sealants. These cost fluctuations, tied to geopolitical instability and crude oil pricing, compress the operating margins of manufacturers and create procurement uncertainty for large-scale construction clients. The most significant opportunity lies in the burgeoning adoption of Hybrid Sealant Technologies, specifically Silane-Modified Polymers (SMPs). These products combine the UV stability of silicones with the adhesion and paintability of polyurethanes. This technological synergy directly addresses the construction industry’s demand for a single, versatile, solvent-free product that performs across diverse application types while meeting stringent low-VOC indoor air quality requirements.

- Raw Material and Pricing Analysis

The Sealants Market is a chemicals-intensive segment primarily reliant on specialized polymers. Silicone-Based Sealants depend on the supply and pricing of basic silicone polymers, which are generally derived from silica but require complex processing. Urethane-Based Sealants, by contrast, rely on the global petrochemical market for key inputs such as MDI and TDI (Isocyanates) and Polyols. Volatility in the crude oil complex directly translates into instability in the cost of these Urethane precursors, posing a consistent risk to manufacturer profitability. This inherent cost fluctuation compels key players to strategically dual-source and increase R&D investment into hybrid formulations and bio-based alternatives, which aim to stabilize pricing and reduce reliance on purely petrochemical feedstocks, thereby controlling the final product price in competitive markets.

- Supply Chain Analysis

The global sealants supply chain is complex, characterized by concentrated upstream production of core chemical components (silicone polymers, isocyanates) primarily in Asia-Pacific and North America, followed by regional compounding and manufacturing close to end-user markets. Key production hubs in China and the US export base polymers and formulated intermediates globally. Logistical complexity arises from transporting temperature-sensitive chemical precursors and managing the regulatory compliance of hazardous raw materials. Geopolitical tensions, notably the impact of US tariffs on Chinese-manufactured chemical goods, can increase the total landed cost for formulated sealant products entering the US market, influencing regional pricing strategies and incentivizing manufacturers to increase US or regionally-based production capacity to mitigate tariff exposure.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

EPA Volatile Organic Compound (VOC) Regulations (Environmental Protection Agency) |

The EPA regulates VOC emissions to control photochemical smog, creating a non-negotiable imperative for manufacturers to reduce or eliminate organic solvents in their sealant formulations, channeling demand exclusively towards low-VOC, water-based, or 100% solid systems. |

|

European Union |

REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

Mandates stringent registration and testing requirements for chemical substances used in sealants. This increases the compliance cost for market entry and operation, driving demand toward pre-registered, safer chemical alternatives and favoring large companies with sophisticated regulatory departments. |

|

Global |

LEED/BREEAM Green Building Standards (US Green Building Council/Building Research Establishment) |

Though voluntary, these standards are widely adopted and directly require materials (including sealants) to meet minimum indoor air quality criteria (e.g., low-VOC content) to earn certification points. This effectively creates substantial, verifiable demand for compliant, sustainable sealant chemistries in the commercial sector. |

Global Sealants Market Segment Analysis:

- By Type: Silicone-Based Sealants

Silicone-Based Sealants maintain their dominant position due to their unparalleled performance profile in extreme environments, which directly addresses the core demands of modern high-value construction and automotive applications. Their unique chemistry, based on a silicon-oxygen backbone, imparts superior resistance to UV radiation, high temperatures, and cyclical movement over long periods. This characteristic is non-negotiable for structural glazing and specialized weatherproofing applications in high-rise buildings and infrastructure where failure is catastrophic. The demand driver is further strengthened by the increasing use of advanced glazing technologies, such as Insulating Glass Units (IGUs) and structural curtain walls, which require sealants capable of bonding glass to metal while maintaining exceptional elasticity. The superior longevity of silicone sealants translates into lower maintenance cycles for end-users, compelling architects and engineers to specify them despite their higher initial cost.

- By Application: Weatherproofing

The Weatherproofing application segment is primarily driven by the global regulatory and commercial imperative to create highly energy-efficient and durable building envelopes. Demand is centered on sealants used in expansion joints, window/door perimeters, and interfaces between different building materials (e.g., masonry to metal). The demand for high-performance sealants, such as Urethane-based and high-modulus Silicone sealants, has intensified directly as modern energy codes require more stringent air-tightness testing. Sealants used for weatherproofing must accommodate significant thermal and structural movement without cracking, which is essential to prevent air and moisture intrusion. Failure to use high-quality, flexible, and durable sealants in this application directly compromises a building’s thermal performance and leads to energy losses, thereby guaranteeing non-discretionary demand for high-grade products that can withstand extreme environmental cycling.

Global Sealants Market Geographical Analysis:

- US Market Analysis (North America)

Demand in the US market is fueled by robust non-residential construction activity and stringent adherence to environmental regulations. A key local factor is the patchwork of state and regional-level VOC regulations (like those in California's CARB districts) that are often more restrictive than federal EPA rules, forcing manufacturers to produce ultra-low-VOC products specifically for these regions. This regulatory heterogeneity complicates the supply chain but elevates the overall quality of available sealants. Furthermore, US trade policy, particularly elevated tariffs on certain Chinese-sourced components and finished chemical goods, directly increases the cost pressure on manufacturers, compelling a strong preference for domestic or tariff-exempt sourcing to stabilize the landed cost for large construction projects.

- Brazil Market Analysis (South America)

Brazil’s demand is largely tied to its massive infrastructure development projects, driven by government and private investment in logistics, energy, and urban residential construction. The primary local factor influencing demand is the preference for cost-effective, high-volume Acrylic and low-modulus Polyurethane sealants over premium silicone, driven by economic constraints and a highly price-sensitive construction sector. Demand is also shaped by the significant influence of local standards (ABNT) which, while increasing in rigor, often lags behind European or North American mandates, slowing the penetration of high-end, low-VOC specialty sealants into the general contracting market.

- Germany Market Analysis (Europe)

German market demand is characterized by an absolute focus on technical certification, long-term performance, and sustainability, driven by the EU’s strict REACH chemical regulation and deep commitment to energy-neutral building standards. Local demand for sealants is propelled by the necessity to use certified, non-hazardous products in passive house construction and to meet highly specific requirements for external weather sealing and internal glazing (e.g., RAL quality assurance). This environment channels demand toward established European manufacturers and high-specification hybrid or silicone systems, as contractors prioritize verified product compliance and long-term warranties over marginal cost savings.

- UAE Market Analysis (Middle East & Africa)

Demand in the UAE is defined by monumental infrastructure projects and the extreme environmental operating conditions (intense heat and UV exposure). The most critical local demand factor is the necessity for sealants, particularly in structural glazing applications, to withstand constant, high-intensity UV radiation and thermal cycling without degradation. This environmental imperative ensures non-negotiable demand for high-performance, weather-stable silicone sealants that meet international codes like ASTM and ETAG. The large number of expatriate consultants and architects working on these projects reinforces the preference for globally recognized, high-grade specialty chemical suppliers.

- India Market Analysis (Asia-Pacific)

India represents a vast, high-growth market driven by rapid urbanization and the proliferation of organized residential and commercial real estate. Demand is currently centered on the economic efficiency of Acrylic and low-cost Urethane Sealants for general-purpose construction. However, a major demand shift is underway, propelled by the adoption of the National Building Code (NBC) and the growth of green building certifications (e.g., IGBC, GRIHA) in metropolitan areas. This regulatory push is now creating specific, increasing demand for specialty, low-VOC, and moisture-cured sealants in premium commercial towers, forcing international and domestic manufacturers to expand their production of higher-value formulations.

Global Sealants Market Competitive Environment and Analysis:

The Global Sealants Market is competitive, dominated by large, integrated chemical companies that leverage global distribution networks, substantial R&D budgets, and portfolio diversification. Competition is increasingly focused on innovation in hybrid, low-VOC formulations and strategic M&A to acquire niche technologies or geographical reach.

- Sika AG: Sika maintains a commanding position globally by focusing relentlessly on the construction and automotive sectors with high-performance solutions. The company's strategy involves aggressive, targeted acquisitions to expand both its geographical footprint and its specialized product portfolio, particularly in structural and weatherproofing sealants (e.g., the acquisitions listed below). Sika's key offering includes a broad range of high-modulus, moisture-curing polyurethane and hybrid Sikaflex sealants, which are specified globally for demanding applications like building envelope sealing, joint movement, and structural bonding, leveraging its "from-roof-to-basement" system approach.

- Dow Inc.: Dow is a dominant force in the high-performance segment, particularly Silicone-Based Sealants, through its DOWSIL™ brand. Dow's competitive advantage stems from its vertical integration into silicone manufacturing and its focus on innovative structural glazing and façade solutions. The company targets the top tier of commercial construction, where its products provide verified performance for blast resistance and structural stability in tall buildings. Dow focuses its verifiable capacity expansions (e.g., the SAS Chemicals GmbH expansion) to increase its holistic façade offering, solidifying its position as a go-to materials science supplier for highly technical construction projects.

- H.B. Fuller Company: H.B. Fuller, as the largest pureplay adhesives company, uses its deep R&D specialization to develop high-value sealants for both construction and industrial applications. The company strategically aligns its portfolio for the fastest-growing and highest-margin segments. This strategy is exemplified by the recent divestiture of its low-margin Flooring business to focus investments and capacity on higher-specification areas like roofing, insulated glass, and building envelope and infrastructure (BE&I), organizing these into the newly named Global Business Unit: BAS, to capitalize on burgeoning global infrastructure demand.

Global Sealants Market Developments:

- September 2025: Henkel launched a next-generation cardboard-based cartridge system across its construction sealants portfolio, enhancing sustainability by reducing plastic waste and improving user convenience.

- August 2025: Henkel introduced its new Darex COV sealant range for metal packaging, featuring phthalate-free and PVC-based compounds that comply with stringent REACH regulations while reducing energy consumption during curing.

- August 2025: Bostik (Arkema) launched VSR 400A, an innovative conductive seam sealant for heavy-duty trucks, utilizing silyl-modified polymer technology to eliminate the need for conductive primers in manufacturing.

- July 2025: Guangdong Girafe New Material held its 2025 Distributor Conference in Foshan, unveiling several next-generation silicone and MS sealant formulations for construction and industrial applications.

- January 2025: 3M entered the final phase of its global commitment to exit all PFAS (per- and polyfluoroalkyl substances) manufacturing and usage by the end of 2025 to meet evolving regulations.

Sealants Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 14.219 billion |

| Total Market Size in 2031 | USD 18.191 billion |

| Growth Rate | 5.05% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Sealants Market Segmentation:

- By Type

- Silicone-Based Sealants

- Urethane-Based Sealants

- Acrylic-Based Sealants

- Polysulfide-Based Sealants

- Butyl-Based Sealants

- Epoxy-Based Sealants

- Others

- By Industry Vertical

- Construction

- Aerospace & Defense

- Automotive

- Manufacturing

- Electrical & Electronics

- Marine

- Packaging

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America