Report Overview

Global Hard Disk Drive Highlights

Hard Disk Drive Market Size:

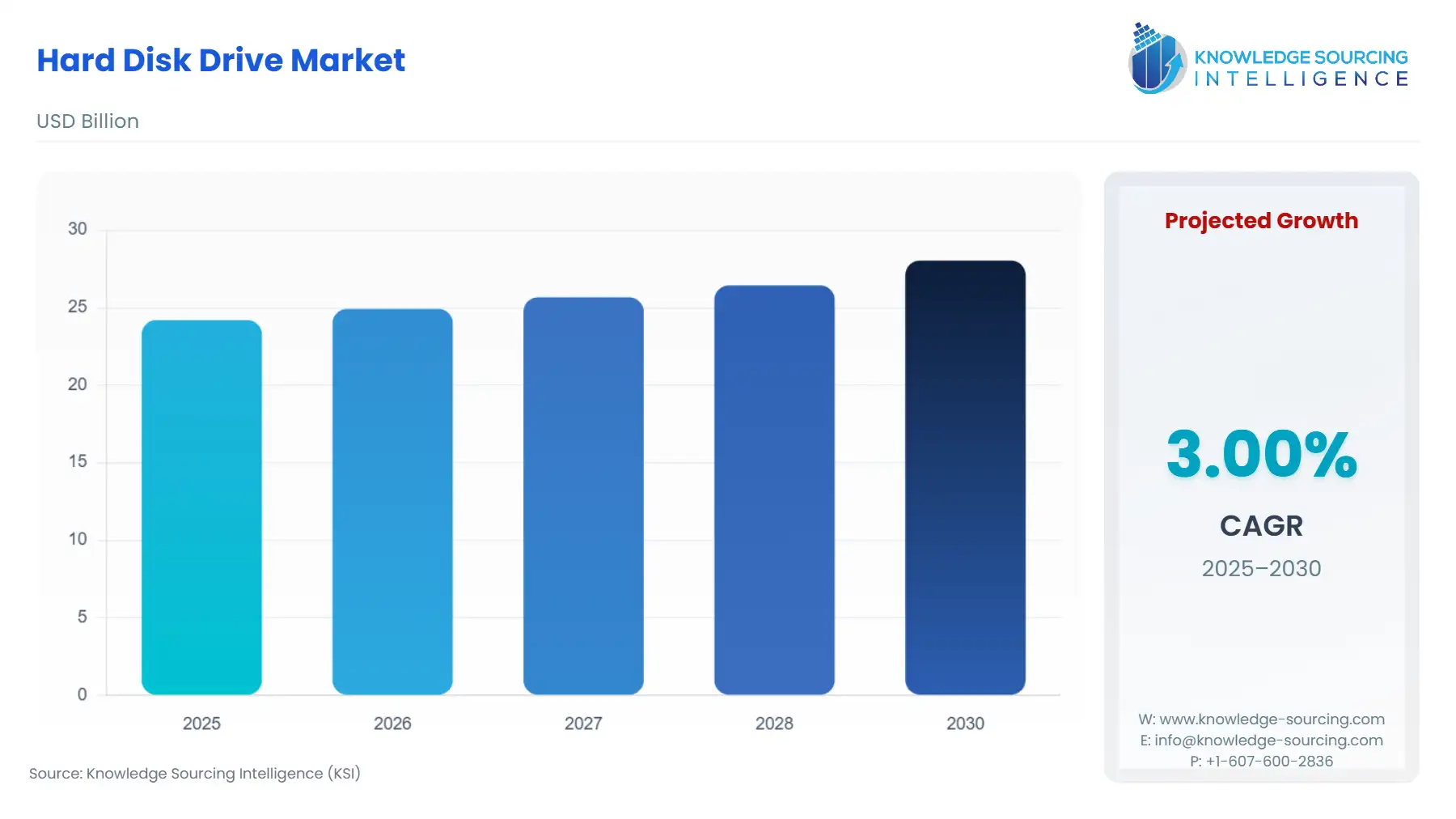

The global hard disk drive market is expected to grow at a rate of 3% CAGR, reaching a market size of USD 28.045 billion in 2030 from USD 24.196 billion in 2025.

The global hard disk drive market underpins the foundational infrastructure of data-intensive economies, where storage demands escalate from proliferating digital ecosystems. Enterprises and consumers alike depend on HDDs for their unmatched cost-per-terabyte efficiency, particularly in scenarios requiring vast archival capacities beyond the reach of flash alternatives. As data generation surges driven by sectors like cloud computing and artificial intelligence, hence HDDs maintain relevance by scaling economically to meet bulk storage imperatives.

Market dynamics hinge on the interplay between explosive data proliferation and HDDs' inherent advantages in density and affordability. Government initiatives worldwide, such as data localization mandates in China, amplify the need for robust, high-capacity storage solutions that HDDs uniquely provide at scale. Trade associations highlight that HDDs dominate nearline applications, where access speeds suffice for infrequent retrievals, freeing resources for higher-performance tiers. Yet, this equilibrium faces tests from supply disruptions and innovation imperatives, compelling manufacturers to refine production while preserving accessibility.

Hard Disk Drive Market Analysis:

Growth Drivers

Exploding data volumes worldwide directly elevate demand for HDDs, as enterprises prioritize cost-effective, high-capacity storage for archival and nearline applications. Likewise, the ongoing data centre establishment to meet the required data storage and management of enterprises has led to infrastructure expansion tied to digital transformation. This surge compels organizations to deploy HDD arrays capable of handling zettabyte-scale repositories, where alternatives like solid-state drives falter on economics. The growing electricity consumption by data centres has also impacted the demand for reliable storage solutions to manage cols data infrequently managed accessed files. According to the data provided by the International Energy Agency, in 2024, the electricity consumption of data centres was estimated around 415 terawatt hours (TWh) which accounted for nearly 1.5% of global electricity consumption and showcased a 12% per year growth for over the last five years. Likewise, the same source further that by 2030, the consumption is expected to reach up to 945 TWh thereby constituted for 3% of total global electricity consumption.

Technological advancements in areal density further catalyse hard disk drive (HDDs) adoption by unlocking unprecedented capacities without proportional infrastructure overhauls. Seagate's deployment of heat-assisted magnetic recording (HAMR) expand the storage capacity thereby directly addressing the storage demands from enterprise, data centres that generate millions terabit data daily. Likewise, the growing transition towards next-generation concepts such as Artificial Intelligence (AI) to enhance data management has also impacted the market demand for external hard disk drives (HDD). The International Energy Agency states that AI growing AI deployment in data centres is driving the demand for accelerated servers leading to higher power density. Additionally, manufacturers are responding to varied costumer concern regarding storage by engineering platters with perpendicular recording, thereby boosting bit density to 1 terabit per square inch, which slashes per-gigabyte expenses and incentivizes upgrades in enterprise environments. This technical leap not only sustains but accelerates demand, as firms retrofit legacy systems to accommodate burgeoning unstructured data from IoT sensors and video surveillance.

Cloud computing's maturation intensifies HDD reliance, with providers like AWS and Microsoft channelling investments into exabyte-class storage tiers optimized for HDD economics. The hybrid architectures pair SSDs for hot data with HDDs for bulk retention, thereby capturing a major share of enterprise storage deployments. Localization policies in regions like the European Union, mandating on-shore data residency under GDPR, further propel HDD installations to comply with sovereignty requirements, elevating import volumes for compliant, high-density units. These regulatory tailwinds ensure sustained procurement, as non-compliance risks fines exceed.

Challenges and Opportunities

Rising competition from solid-state drives erodes HDD demand in performance-critical segments, compelling a recalibration toward capacity-focused niches. Studies suggest that solid-state drive requires half of the power used by HDDs for managing data and with the growing technological adoption the transition towards modern concepts that offers computing stability drawn by latency advantages has accelerated the demand for solid state drives. Hence, the preference for SSDs over HDDs which is suboptimal for real-time analytics will witness growth in enterprise data storage thereby contracting nearline procurements in latency-sensitive environments. This shift pressures manufacturers to innovate on power efficiency, as HDDs' mechanical components draw 5-7 watts per drive versus SSDs' sub-3 watts, inflating operational costs in energy-constrained data centres and dampening adoption rates.

Opportunities abound in archival storage, where HDDs' terabyte-per-dollar supremacy aligns with exploding unstructured data troves. As cold data volume is showing constant growth, hence the HDD demand for petabyte-scale repositories in media and genomics will increase. Firms leveraging perpendicular enhancements can capture this, as buyers prioritize density over speed, yielding upliftment in annual growth in hyperscale orders. Likewise, sustainability imperatives open avenues for energy-optimized HDD variants, countering power draw critiques. European Commission eco-design regulations enforce idle-state efficiencies, spurring redesigns that reduce total ownership costs and appealing to green mandates in EU jurisdictions. This compliance edge drives exports, as certified units command premiums in carbon-regulated markets, bolstering demand amid SSDs' thermal limitations. Hybrid architectures present a pivotal opportunity, blending HDD capacity with SSD caching to reclaim performance segments at lower cost thereby revitalizing legacy investments and expanding addressable markets.

Raw Material and Pricing Analysis

HDD production hinges on a narrow cadre of raw materials, where supply concentration and pricing flux dictate manufacturing viability. Aluminium substrates form the disk core, comprising a considerable portion of material weight, sourced predominantly from bauxite refineries. The geopolitical pressures have impacted the aluminium price, for instance, according to the USGS, in January 2025, the U.S spot market price for primary aluminium was US$ 1.41 per pound which showcased 19% growth over January 2024’s price but remained unchanged in year prior.

Hence, this escalation directly compresses HDD margins, prompting assemblers to stockpile and pass most of their surcharges to buyers, thereby tempering demand in price-sensitive consumer tiers. Likewise, rare earth elements, vital for neodymium-iron-boron magnets in spindle motors, underscore dependency risks, as leading nations such as China account for nearly 70% of the global capacity triggering hikes in prices. These magnets enable precise platter rotation, essential for densities exceeding 1 terabit per square inch. Fabricators mitigate via recycling, recovering from e-waste, but yields remain low, sustaining premiums that erode competitive edges against SSDs and constraining volume shipments. Glass platters, increasingly favoured for thinner profiles in 2.5-inch drives, rely on silica sands.

Supply Chain Analysis

The hard disk drive supply chain orbits a triad of hubs including major nations such as China for components and raw materials, the United States for research & development and finishing. The varied industrial requirement in such nations needs to comply with their regulatory standards which has proven as an obstacle for raw material supply chain. Likewise, the logistical chokepoints such as Red Sea rerouting adding more to transit times has amplified dependencies on just-in-time models, where delays cascade into shipment shortfalls.

Raw material pricing, anchored in aluminum and neodymium as per USGS 2024 averages, feeds volatility, which is further affected by high hikes imposed by U.S. under Section 301 tariffs on China and other nations. This has also created friction in global market output with reciprocity strains reciprocity, as China's retaliatory duties on U.S. chips hinder controller sourcing which will contract global output. These tariffs directly curb HDD affordability, diminishing demand in tariff-exposed markets as buyers pivot to pricier alternatives.

Government Regulations & Programs

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | Section 301 Tariffs / Office of the U.S. Trade Representative | High duties on Chinese components which will elevate import costs, constraining supply for U.S. assemblers and reducing nearline demand as enterprises defer expansions; fosters diversification to non-Chinese sources, stabilizing long-term volumes but inflating short-term pricing. |

| European Union | Ecodesign Regulation (EU) 2019/424 / European Commission | Mandates idle power below 5 watts and disassembly for reuse, driving efficiency gains in compliant drives; boosts EU exports of certified units, enhancing demand in green data centres while pressuring non-compliant Asian suppliers, potentially capturing a certain market share uplift for innovators. |

Hard Disk Drive Market Segment Analysis:

By Type: External HDD

By type, the external hard disk drive (HDD) is expected to show steady growth and will account for a considerable market share. External HDDs command demand through portability and plug-and-play simplicity, catering to creators and small enterprises needing seamless backups without internal reconfiguration. The remote work surges necessitate mobile storage for terabyte-scale media files, where external units' USB-C interfaces enable drag-and-drop workflows across ecosystems. This accessibility directly propels uptake, as professionals in video editing bypass cloud latency, favouring HDDs' over SSD premiums.

Regulatory pushes for data sovereignty further entrench external HDDs in compliance-heavy sectors. EU GDPR fines incentivize offline archiving via portable drives, with external variants comprising most of small-business procurements per trade data. Their enclosure designs shield against physical threats, aligning with industrial needs like field logging in oil exploration, where vibration resistance sustains high uptime. Innovations in bus-powered models, drawing under 5 watts, address energy mandates, expanding addressable markets in mobile fleets.

External HDDs handle majority of consumer exabytes, driven by affordability that undercuts tape at scale. In hybrid setups, they bridge SSD speed with archival depth, capturing high growth in prosumer segments where creators demand RAID redundancy without server overheads. The factors including mobility, compliance, durability, and economics cement external HDDs' role.

By End-User: Commercial & Industrial

Based on end-user, the commercial & industrial end-user is projected to constitute for a considerable share. Commercial and industrial end-users drive HDD demand via mission-critical reliability in high-vibration, 24/7 environments, where downtime costs eclipse per minute. The precision underpins predictive maintenance in factories, where terabyte sensor streams demand robust and non-volatile storage immune to power fluctuations.

Industrial diversification, fuelled by Industry 4.0, amplifies procurement for ruggedized units. Sustainability regulations sharpen focus on low-power variants, as EU ecodesign caps force efficiency hikes, aligning with industrial decarbonization. Hybrid integrations with SSD caching further boost throughput will capture most of enterprise upgrades where legacy tape falters on retrieval speeds.

Hard Disk Drive Market Geographical Analysis:

The global hard disk drive market analyzes growth factor across following regions

- North America: Major regional economies such as the United States is experiencing a considerable growth in its data volume fueled by the growing internet penetration and commercial business establishment. For instance, according to the July 2024 data provided by the Office of Advocacy, the strength of large business was 19,688. And according to the Bureau of Labor Statistics, from September 2024 to December 2024, gross job gains from opening & expanding private sector establishment reached 7.8 million. Hence, such growth in corporate culture will expand the data production thereby creating demand for data centers engineered to meet the growing data management necessity in such facilities. Tech-giants such as Google, Microsoft and Amazon are investing in such establishment which has further expanded the market scope.

- Europe: The technological shift in major European economies namely Germany, the United Kingdom, and France has transformed the consumer landscape. With policies such as Germany’s “National AI Strategy” to bolster the Artificial Intelligence adoption in businesses, the data for efficient storage component will improve thereby augmenting the overall regional market growth.

- Asia Pacific: The booming internet penetration and rising in consumer electronics consumption is major regional economies namely China, India, South Korea and Japan has bolstered the overall data production which has played an integral role in the development of hard disk drives that features computing stability. According to the Press Information Bureau, as of April-June 2025, the number of internet mobile subscribers in India is 1,002.85 million.

- South America & MEA: Investing to bolster storage capacity in data centers and optimize energy consumption has impacted the demand for hard disk drive in South America, whereas establishment of tech-centers that features next-generation concepts such as machine learning (ML) and Artificial Intelligence (AI) has impacted the HDD demand for data storage and management in MEA.

Hard Disk Drive Market Competitive Environment and Analysis:

The HDD landscape concentrates among major players namely Seagate, Western Digital, and Toshiba which have shown active participation in product development.

Seagate Technology LLC, positions as the capacity vanguard with an extensive product offering including internal and external HDDs that used in personal storage, networ attached storage and video analytics. The company’s strategies centres around expanding its market reach through new development, for instance, in July 2025, Seagate Technology announced the availability of 30 plus terabyte Exos drives via Mozaic 3+ platform to meet the growing demand for high-performance storage.

Toshiba Corporation anchors reliability with product like MG10 series being offered for industrial durability. Its enterprise focus strong yields uptime, capturing surveillance and NAS segments through vibration-tuned actuators, ensuring steady growth amid global data deluge.

Hard Disk Drive Market Recent Developments:

January 2025: Seagate introduced Exos M samples up to 36 terabytes, extending Mozaic 3+ HAMR for hyperscale archival. The HDD is based on heat-assisted magnetic recording and offers unprecedented storage for large-scale data centres.

October 2024: Western Digital launched the Ultrastar DC HC690, a 26 terabyte ePMR HDD optimized for nearline cloud storage, enhancing density for AI data lakes via advanced perpendicular recording

Hard Disk Drive Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 24.196 billion |

| Total Market Size in 2031 | USD 28.045 billion |

| Growth Rate | 3% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Storage Capacity, Form Factor, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Hard Disk Drive Market Segmentation:

- By Type

- Internal HDD

- External HDD

- By Storage Capacity

- Up to 1 TB

- 1 to 4 TB

- Greater than 4 TB

- By Form Factor

- 2.5 Inch

- 3.5 Inch

- By End-User

- Residential

- Commercial & Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Others

- North America