Report Overview

Skin Grafting Market - Highlights

Skin Grafting Market Size:

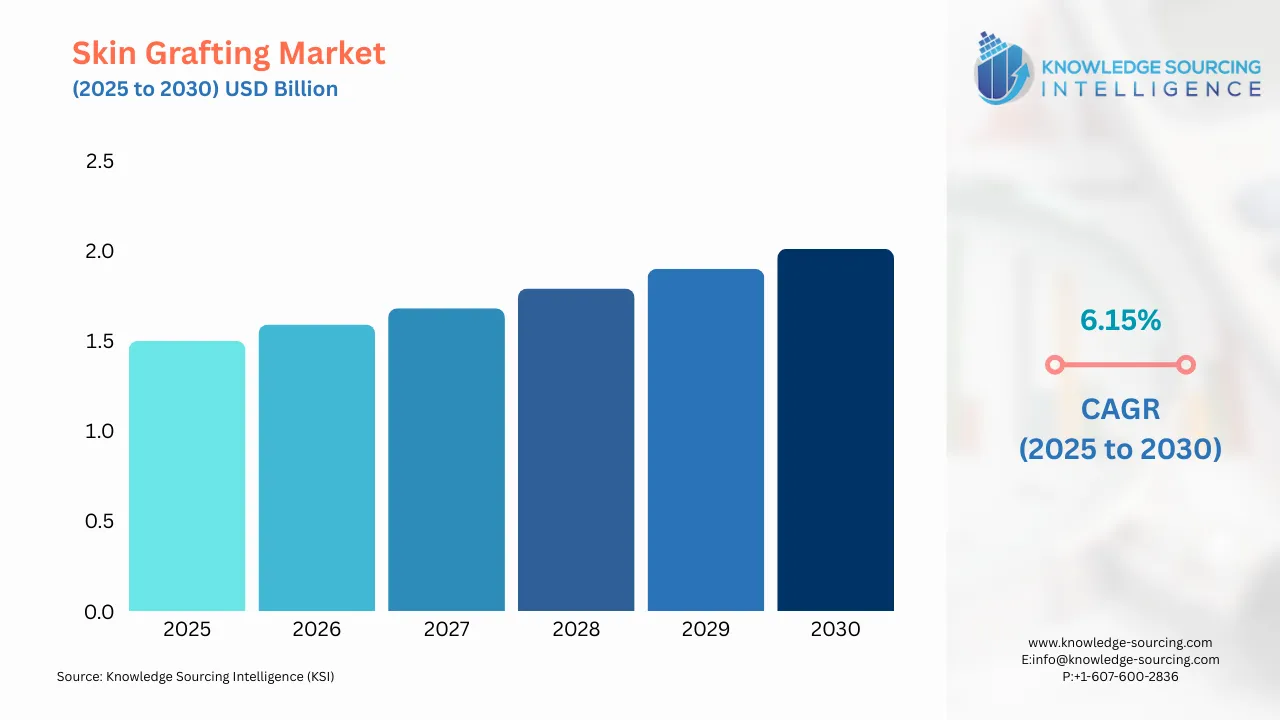

The skin grafting market is projected to grow at a CAGR of 6.15% to reach US$2.014 billion in 2030 from US$1.495 billion in 2025.

Skin Grafting Market Trends:

The skin grafting market is undergoing significant transformation, driven by advancements in medical technology, rising clinical needs, and evolving patient expectations. Skin grafting, a critical surgical procedure involving the transplantation of healthy skin to repair damaged areas, is pivotal in treating conditions such as burns, chronic wounds, skin cancer, and traumatic injuries.

Advancements in Bioengineered Skin Substitutes

One of the most prominent trends in the skin grafting market is the development and adoption of bioengineered skin substitutes. These substitutes, derived from biological or synthetic materials, aim to mimic the properties of natural skin, offering improved integration and reduced rejection risks. For instance, in October 2024, CUTISS AG performed the first U.S. grafting of its autologous bioengineered skin substitute, denovoSkin, at Massachusetts General Hospital under FDA authorization. This procedure marked a milestone in personalized regenerative medicine, showcasing the potential of tissue-engineered grafts to address severe burn wounds. Such innovations are reducing reliance on traditional autografts, which are limited by donor site availability, and allografts, which carry risks of immune rejection.

Integration of 3D Bioprinting

3D bioprinting is revolutionizing skin grafting by enabling the creation of customized skin grafts tailored to individual patient needs. In 2022, Mimix Biotherapeutics introduced FastSkin, a 3D-bioprinted skin graft using Sound Induced Morphogenesis technology, designed for acute and chronic wound treatment. By 2025, this technology has gained traction, with research institutions and companies exploring its scalability. Bioprinted grafts offer precise control over tissue composition, improving cosmetic outcomes and healing efficiency. This trend is particularly significant for complex wounds, such as those caused by diabetes or skin cancer, where patient-specific solutions enhance treatment success.

Rise of Minimally Invasive Techniques

Minimally invasive skin grafting techniques are gaining popularity due to their ability to reduce surgical trauma and accelerate recovery. Innovations in dermatome technology, particularly electric and air-powered dermatomes, have improved precision in harvesting thin skin layers, minimizing donor site morbidity. For example, advancements in robotic-assisted grafting systems, reported in recent surgical journals, have enhanced procedural accuracy, reducing complications like contractures and scarring. These techniques are increasingly adopted in hospitals and ambulatory surgical centers, catering to the growing demand for efficient and aesthetically pleasing outcomes.

Amniotic Membrane-Based Grafts

The use of amniotic membrane-based skin grafts is emerging as a key trend, driven by their anti-inflammatory and regenerative properties. In 2023, Kerecis launched MariGen Shield, a fish-skin graft integrated with a silicone contact layer for chronic and complex wounds. By 2025, amniotic membrane grafts have seen increased adoption in dermatology and burn care, offering a cost-effective alternative to synthetic substitutes. These grafts promote faster healing and are particularly valuable in regions with limited access to advanced healthcare infrastructure.

Focus on Personalized Medicine

Personalized medicine is reshaping the skin grafting landscape, with a shift toward patient-specific graft solutions. Advances in stem cell therapy and genetic engineering are enabling the development of grafts that closely match a patient’s skin profile, reducing complications and improving outcomes. Research published in The Lancet in 2024 highlighted the potential of stem cell-based skin grafts in treating chronic ulcers, emphasizing their role in personalized wound care. This trend aligns with the broader healthcare shift toward tailored treatments, appealing to both clinicians and patients seeking optimal results.

Skin Grafting Market Growth Drivers:

Rising Incidence of Burn Injuries and Chronic Wounds: The increasing prevalence of burn injuries and chronic wounds, such as diabetic foot ulcers and pressure ulcers, is a significant driver of the skin grafting market. Burns remain a major global health concern, particularly in low- and middle-income countries, where access to advanced wound care is limited. Chronic wounds, often linked to conditions like diabetes and vascular diseases, are also on the rise due to aging populations and lifestyle-related health issues. The growing burden of these conditions fuels demand for skin grafts, as they are critical for restoring skin integrity and preventing complications like infections.

Technological Advancements in Skin Grafting: Innovations in skin grafting technologies, including bioengineered skin substitutes, 3D bioprinting, and advanced dermatomes, are driving market growth by improving procedural efficiency and patient outcomes. Bioengineered grafts, such as CUTISS AG’s denovoSkin, introduced in the U.S. in October 2024, offer personalized solutions that reduce reliance on traditional autografts and allografts. Similarly, 3D bioprinting, exemplified by Mimix Biotherapeutics’ FastSkin, enables the creation of customized grafts tailored to specific wound characteristics, enhancing healing and cosmetic results.

Growing Demand for Aesthetic and Reconstructive Procedures: The rising popularity of aesthetic and reconstructive surgeries is a key driver, as skin grafting is increasingly used for scar revision, skin cancer excision, and cosmetic enhancements. Patient awareness of aesthetic outcomes, coupled with rising disposable incomes in developed regions, has boosted demand for grafts that offer minimal scarring and improved appearance.

Skin Grafting Market Segmentation Analysis:

Skin Grafting Market Segmentation Analysis by Type:

Autologous Grafts: Autologous grafts, where skin is harvested from a patient’s own body and transplanted to the affected area, dominate the skin grafting market due to their high compatibility and low risk of immune rejection. These grafts are the gold standard for treating severe wounds, burns, and reconstructive surgeries, as they integrate seamlessly with the patient’s tissue, minimizing complications like infection or rejection.

Allogeneic Grafts: Allogeneic grafts involve transplanting skin from a donor to the recipient, used primarily when autologous grafts are not feasible due to limited donor sites. These grafts are often temporary and carry a higher risk of immune rejection.

Xenografts: Xenografts, derived from animal sources such as porcine or fish skin, are used as temporary coverings for burns and chronic wounds. Products like Kerecis’ MariGen Shield, launched in 2023, exemplify the growing use of xenografts for cost-effective and regenerative wound healing.

Others: Other graft types include synthetic and bioengineered substitutes, which are gaining traction due to innovations like CUTISS AG’s denovoSkin, offering scalable and personalized solutions for severe wounds.

Skin Grafting Market Segmentation Analysis by Graft Thickness:

Split-Thickness Grafts: Split-thickness grafts involve harvesting the epidermis and a portion of the dermis, commonly used for large burns and wounds due to their ability to cover extensive areas with minimal donor site damage.

Full-Thickness Grafts: Full-thickness grafts include the entire epidermis and dermis, offering superior cosmetic outcomes and durability, making them ideal for smaller wounds and reconstructive surgeries.

Composite Grafts: Composite grafts contain multiple tissue types, such as skin and cartilage, used in complex reconstructive procedures where structural support is needed.

Skin Grafting Market Segmentation Analysis by Application:

Burns: Burns represent the leading application segment in the skin grafting market, driven by the global burden of burn injuries and the critical role of grafting in life-saving treatments. Skin grafts are essential for restoring skin integrity, preventing infections, and improving functional and aesthetic outcomes in burn patients.

Extensive Wounds: Extensive wounds, such as those caused by trauma or chronic conditions like diabetic foot ulcers, require skin grafts to promote healing and prevent complications.

Skin Cancer: Skin grafting is widely used in skin cancer treatment, particularly for reconstructing areas after tumor excision, driven by the rising incidence of skin cancer globally.

Others: Other applications include reconstructive surgeries for congenital deformities and scar revision, where grafts enhance aesthetic and functional outcomes.

Skin Grafting Market Segmentation Analysis by End-User:

Hospitals: Hospitals are the primary end-user segment in the skin grafting market, as they are equipped with the infrastructure, skilled personnel, and advanced technologies required for complex grafting procedures.

Ambulatory Surgical Centers: Ambulatory surgical centers are increasingly adopting skin grafting for outpatient procedures, particularly for minimally invasive techniques that reduce recovery time.

Others: Other end-users include specialized clinics and wound care centers, which focus on chronic wound management and aesthetic procedures.

Skin Grafting Market Geographical Outlook:

The skin grafting market report analyzes growth factors across the following regions:

North America: North America maintains its position as the leader in the global skin grafting market, driven by its widespread embrace of cutting-edge technology and stronger purchasing power compared to other regions. This dominance is further bolstered by a well-developed healthcare system and a supportive insurance framework.

Europe, Middle East & Africa: Europe is a significant market due to its advanced healthcare infrastructure and high adoption of innovative grafting technologies. The Middle East and Africa show slower growth due to limited access to advanced medical facilities.

Asia Pacific: The Asia Pacific region is expected to witness significant growth, driven by the high incidence of burn injuries and increasing healthcare investments in countries like India and China.

Skin Grafting Market Competitive Landscape:

CUTISS AG: CUTISS AG is a leader in bioengineered skin substitutes, with its denovoSkin product marking a milestone in personalized regenerative medicine for burn care.

Kerecis: Kerecis specializes in fish-skin grafts, with its MariGen Shield product offering a cost-effective solution for chronic and complex wounds.

Zimmer Biomet: Zimmer Biomet has introduced robotic-assisted grafting systems, enhancing precision and efficiency in autologous graft harvesting.

These companies are among the global leaders in skin grafting, driving innovation through advanced technologies and strategic acquisitions.

Skin Grafting Market Latest Developments:

October 2024: CUTISS AG achieved a milestone by performing the first U.S. grafting of its autologous bioengineered skin substitute, denovoSkin, at Massachusetts General Hospital under FDA authorization.

March 2024: Zimmer Biomet introduced a robotic-assisted skin grafting system, designed to enhance precision and efficiency in autologous graft harvesting.

July 2023: Coloplast Corp acquired Kerecis, an Iceland-based company specializing in fish-skin grafts, enhancing the availability of MariGen Shield for chronic and complex wounds.

Skin Grafting Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.495 billion |

| Total Market Size in 2030 | USD 2.014 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Graft Thickness, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Skin Grafting Market Segmentation:

By Type

Autologous Grafts

Allogeneic Grafts

Xenografts

Others

By Graft Thickness

Split-Thickness Grafts

Full-Thickness Grafts

Composite Grafts

By Application

Burns

Extensive Wounds

Skin Cancer

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others