Report Overview

CBD Skincare Market Size, Highlights

CBD Skincare Market Size:

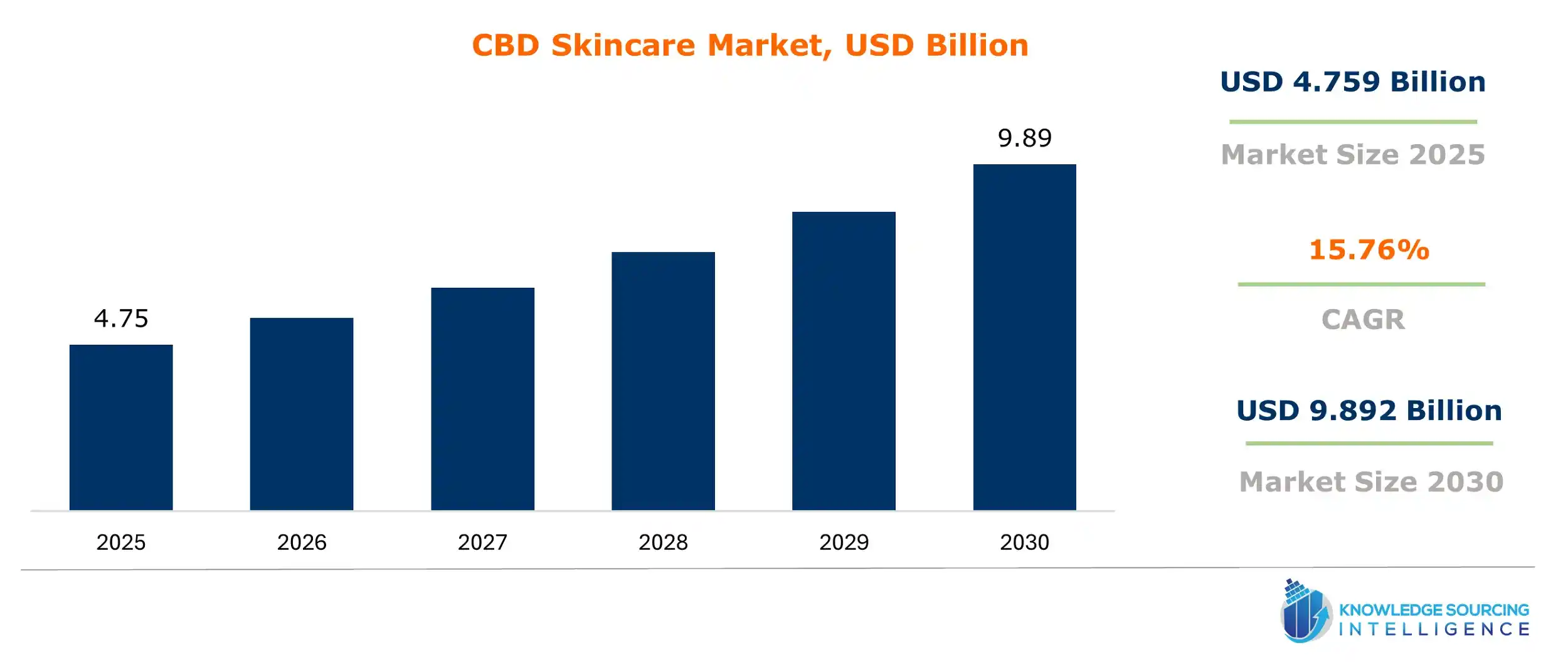

The CBD Skincare Market is expected to experience rapid growth of 15.76% CAGR, reaching a market size of US$9.892 billion in 2030 from US$4.759 billion in 2025.

Cannabidiol (CBD) is a naturally occurring chemical compound that is found in cannabis plants- hemp and marijuana. It is one of the two prime active ingredients of cannabis, the other one being THC (tetrahydrocannabinol). CBD has several antioxidant and anti-inflammatory properties that are beneficial in treating skin concerns such as dryness, inflammation, and free radical damage. It is also effective in fighting acne by reducing sebum production in the skin, as well as eczema and psoriasis.

Increasing disposable incomes and living standards have increased people's focus on personal well-being, including skincare regimes. People, especially young people, are increasingly demanding new skincare products with innovative and natural ingredients. As such, the demand for CBD skincare products is rapidly growing worldwide. Rising awareness about the various benefits of CBD as one of the ingredients in skincare products, such as serums and oils, is further fueling its market growth. Small investors are flocking to this market due to the emerging popularity of CBD skincare products. Furthermore, market players are continuously engaged in growth strategies while launching new products, thus positively impacting the market growth of CBD skincare.

CBD Skincare Market Growth Drivers:

- The value offered by CBD-based skincare products is driving the market growth

CBD has several benefits for skin health, and thus, there is an increasing demand for CBD skincare products. It has anti-inflammatory and anti-microbial benefits, offering excellent benefits to skin conditions with inflammation by reducing swelling, redness, and associated pain. It is also helpful in sebum regulation, promoting a balance in the skin oil and driving demand from oily skin type consumers. Further, it also has anti-aging properties, such as antioxidant properties promoting the reduction of oxidative stress, leading to an increase in demand from the growing anti-aging needs of people.

CBD Skincare Market Restraint:

Despite possessing multiple positive attributes, CBD isn’t without any cons. It is still illegal in several countries, which is the major restraining factor for the market’s growth. For example, in Australia, both CBD and THC are entirely banned from cosmetics. The Japanese government passed a series of amendments to the Cannabis Controls Act restricting THC amounts in CBD products. For example, it proposed a new cap of 0.001% for oils. Businesses advocate this will severely damage the growing CBD industry. These CBD-based skincare products are also quite expensive, hindering its market from reaching its full potential.

CBD Skincare Market Segment Analysis:

- CBD-based skincare oils, based on product type, will have a large market share during the forecast period

By product type, CBD-based skincare oils account for a considerable market share during the forecast period since they are considered to have both anti-aging and acne-fighting properties, thus making them popular among women who want to maintain their skin’s youthfulness. CBD oils have anti-inflammatory, antioxidant, and soothing properties, offering excellent therapeutic benefits to consumers who want to improve their skin health.

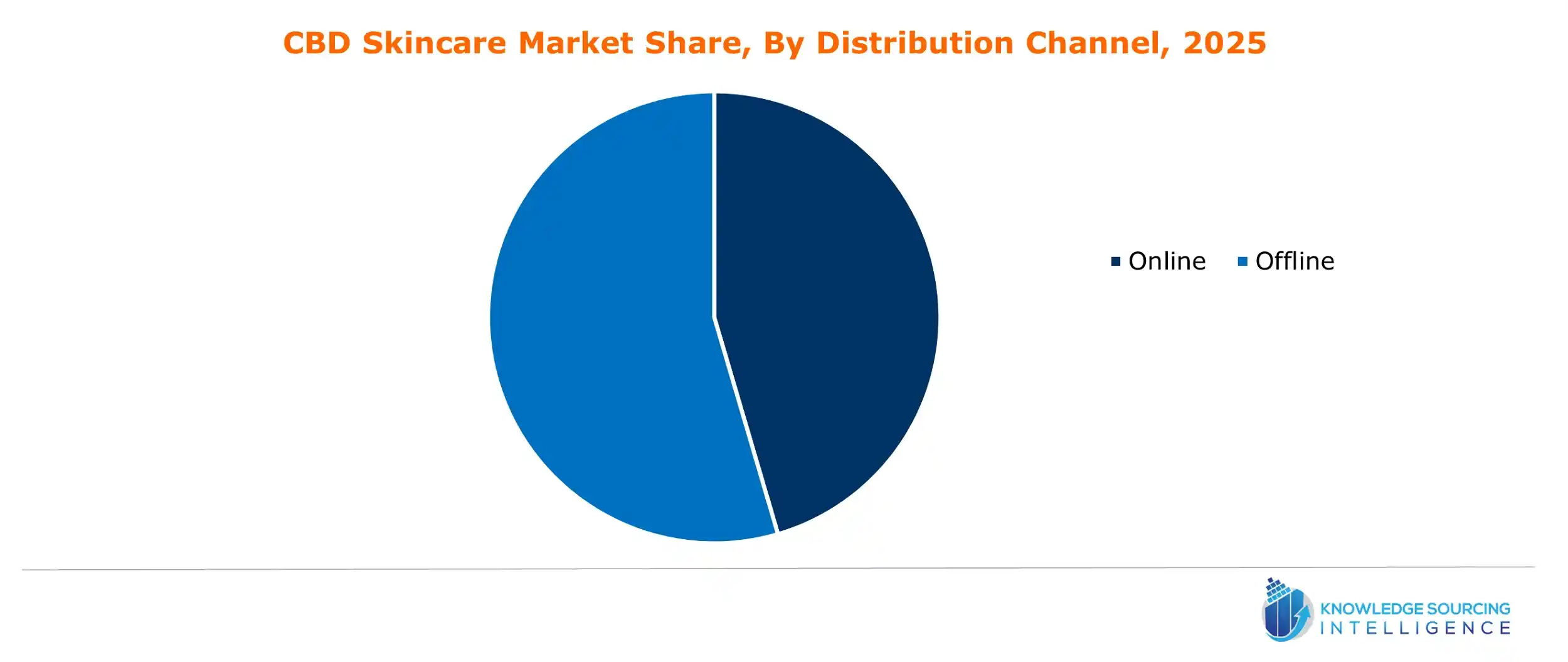

- The online segment, based on the distribution channel, will be witnessing a higher CAGR during the forecast period

The online segment is projected to witness a noteworthy CAGR during the forecast period owing to the booming global e-commerce industry. Moreover, the growing international trade of cosmetics and skin care products allows customers to choose from various international brands that are easily available online. This is also driving the market growth of CBD skincare across this segment.

CBD Skincare Market Geographical Outlook:

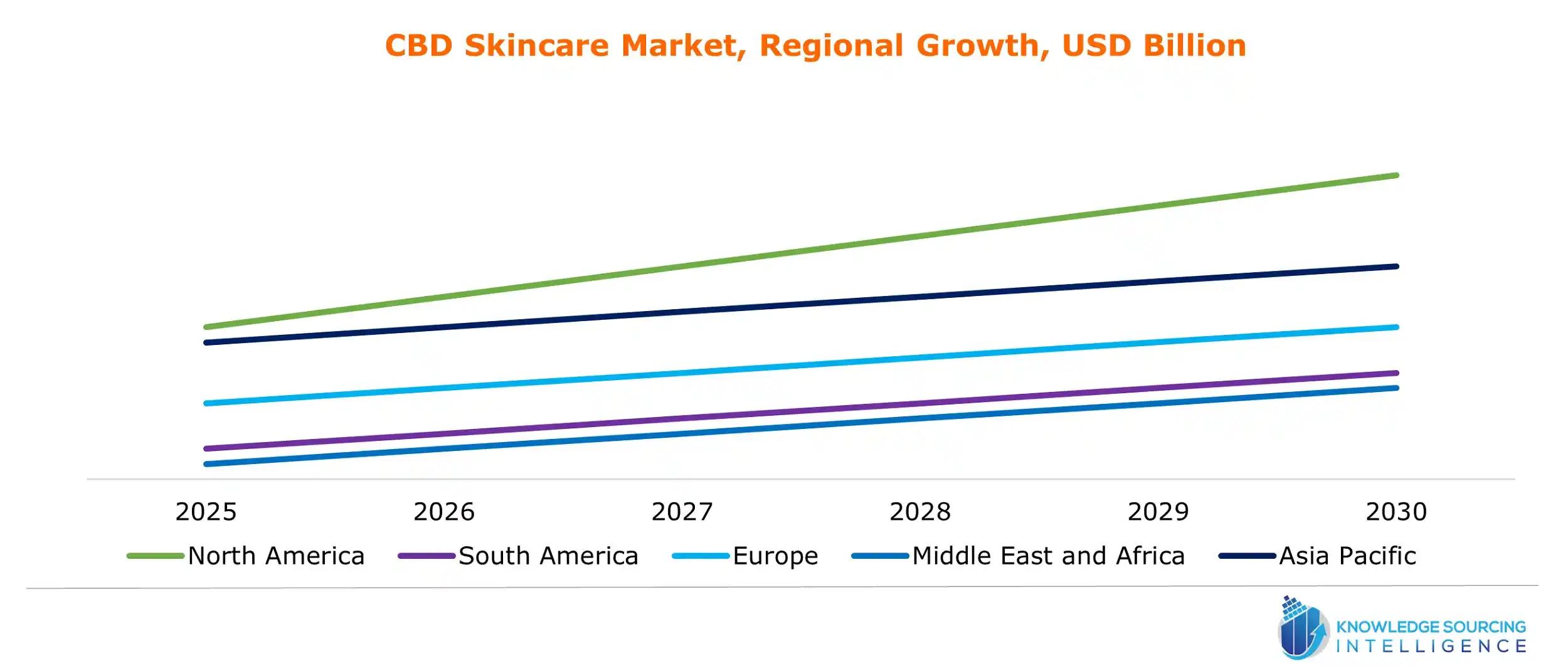

- Europe will hold the largest market share during the forecast period

Geographically, the CBD skincare market has been segmented into North America, South America, Europe, the Middle East, Africa, and Asia Pacific.

Europe is the major market for CBD skincare, as it is legal to use it for various purposes in almost every European country. The region is also home to some international beauty brands investing in R&D and launching new CBD skincare lines.

North America also holds a decent market share throughout the forecast period. The presence of major skincare companies in countries like the U.S. and Canada, coupled with rising awareness about the benefits of CBD skincare products, is driving the demand for CBD skincare products. The legalization of cannabis for recreational and therapeutic use in this region is contributing to the CBD skincare market’s expansion. This is because CBD is increasingly associated with the concept of well-being when incorporated into certain products.

APAC will witness a substantial CAGR during the forecast period since China is one of the major country-level markets for CBD skincare vendors. The country is the leading producer of hemp in the world. The rising sale of skin care products via online channels is further contributing to the regional CBD skincare market’s expansion.

CBD Skincare Market Key launches:

- In June 2024, a natural products manufacturer, NOW, launched three CBD topical body care products under its NOW Solutions line. These products contain a broad-spectrum hemp extract, including a CBD joint & muscle cream, CBD balm, and CBD massage oil.

- In February 2023, Kenneth Cole launched 6 new CBD skincare collections at its 95th Academy Awards 2023. Daily Facial Moisturizer, Soothing Salve, Replenishing Eye Stick, Muscle Relief Cream, Anti-ageing Night Serum, and others. All these collections are fused with CBD.

List of Top CBD Skincare Companies:

- Cronos Group Inc.

- Elixinol Global Ltd.

- Endoca BV

- Isodiol International Inc.

- Josie Maran Cosmetics LLC

CBD Skincare Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| CBD Skincare Market Size in 2025 | US$4.759 billion |

| CBD Skincare Market Size in 2030 | US$9.892 billion |

| Growth Rate | CAGR of 15.76% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in CBD Skincare Market |

|

| Customization Scope | Free report customization with purchase |

The CBD Skincare Market is analyzed into the following segments:

- By Source

- Organic & Natural

- Synthetic

- By Product Type

- Creams & Moisturizer

- Oils

- Face and Body Cleaner

- Serums

- Sunscreens

- Balm (Lip and Eye)

- Others (Mist, Mask, Body Wax, Bath Bombs)

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America

Navigation

- CBD Skincare Market Size:

- CBD Skincare Market Key Highlights:

- CBD Skincare Market Growth Drivers:

- CBD Skincare Market Restraint:

- CBD Skincare Market Segment Analysis:

- CBD Skincare Market Geographical Outlook:

- CBD Skincare Market Key launches:

- List of Top CBD Skincare Companies:

- CBD Skincare Market Scope: