Report Overview

Global Skin Care Market Highlights

Skin Care Market Size:

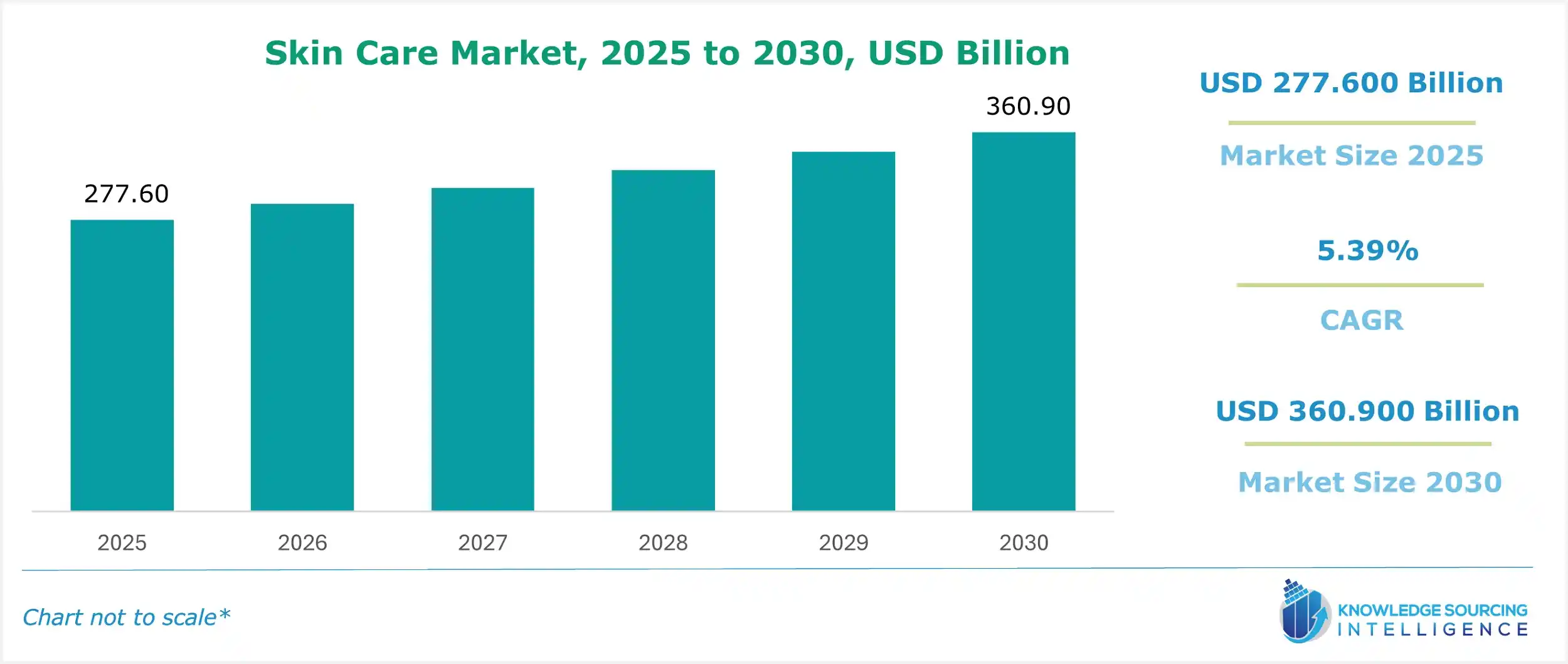

The global skincare market, valued at US$360.900 billion in 2030 from US$277.600 billion in 2025, is projected to grow at a CAGR of 5.39% through 2030.

Skin Care Market Introduction:

The global skin care market, a vital segment of the beauty and personal care industry, is thriving within the broader skin health market. Driven by evolving cosmetic market trends, it encompasses dermatology skincare solutions and consumer skincare products tailored to diverse skin concerns. The global beauty industry is witnessing robust growth as demand for innovative, science-backed formulations rises. From anti-aging serums to hydrating moisturizers, the market caters to heightened consumer awareness of skin health and aesthetics. Advancements in ingredient technology and personalized offerings are positioning the sector as a dynamic force in addressing global beauty and wellness needs.

The global skincare product market is driven by the increasing demand for sun creams, body lotions, face moisturizers, and other skincare products. The demand is increasing due to rising disposable income, urbanization in developing countries, changing lifestyles, and advanced skincare products. Skincare products are used for both beauty enhancement and as medicine for skin-related problems. The market is expected to expand significantly as consumers become more conscious of their appearance and skin quality. People are increasingly sensitive about skincare products, leading them to choose more carefully what suits their needs. The rise in global warming and climate change has increased the use of skin care products due to harsh sunlight and dusty & dry weather, which causes the skin to turn dark, dry, and cracked.

Skin Care Market Trends:

The global skin care market is evolving with technology and sustainability at its core. Personalized skincare AI and skin diagnostic tools deliver tailored regimens, while AR beauty tech enhances consumer engagement. Smart skincare devices, like cleansing brushes, integrate with apps for optimized routines. The recent trend of Skinimalism promotes minimal, effective products, and blue light protection skincare addresses digital exposure. Hybrid beauty products combine makeup and care, while sustainable packaging and ethical beauty align with eco-conscious demands. Social commerce, beauty, and DTC skincare drive direct engagement, with online platforms offering curated experiences, reflecting a tech-driven, value-based shift in the industry.

Skin Care Market Overview & Scope:

The global skincare market is segmented by:

- Product: The product segment is categorized into face products and body products. The face product category is expected to grow significantly and is further segmented into sun protection, face moisturizers, face brightening, and others.

- Distribution Channel: By distribution channel, the skincare market is segmented into online and offline. The offline segment of the global skincare market is expected to grow consistently. The offline retail sectors, which include hypermarkets, supermarkets, and convenience stores, witnessed a major increase and offered consumers a hands-on experience.

- Region: The Asia-Pacific region is expected to be the fastest-growing regional skincare market during the forecast period. The changing lifestyle, increase in disposable income, and rising demand for quality skincare products and premium products used by young people boost market growth.

Top Trends Shaping the Skin Care Market:

1. Growing cosmetic technology sector

- Cosmetic technology combines science and beauty, utilizing technologies like AI to enhance the efficiency of the cosmetic sector.

Skin Care Market Growth Drivers vs. Challenges:

Opportunities:

- Rising pollution is increasing the demand for skin care products: The market for skin care products is rising due to adverse effects of weather on the skin, like dryness, darkness due to strong sunlight, cracks because of roughness, and other skin diseases. The market for skincare products is also growing due to the increasing need and importance of grooming and personal hygiene among men and women. The face product market has a significant share of the global skincare market.

- Growing utilization of e-commerce platforms: The growing use of the internet and smartphones is increasing the skin care product market. This growing internet penetration has created a new platform for companies to sell their products. According to World Bank data, the number of people using the internet has grown two-fold in a decade. The increase in the internet user population will further propel this market’s growth as more companies will sell their products online due to its convenience and low investment.

Challenges:

- Demand for organic products: The increasing global demand for organic products is among the key factors challenging market growth.

Skin Care Market Regional Analysis:

- North America: The North American region is expected to have a significant share in the skincare market due to the early adoption of new products and better technology. The rising investment in research and development to expand the product line and increasing advertising and marketing through social media platforms for raising sales are also driving the market’s growth.

Skin Care Market Competitive Landscape:

The market is fragmented, with many notable players, including L'Oréal S.A., Estée Lauder Companies Inc., Avon Products, Inc., Coty Inc., Revlon, Shiseido Co., Ltd , among others:

- Operation Launch: In December 2024, Patyka, a global leader in the skincare market, launched its operations in the Middle East region. The company offers a wide range of skin and personal care products made using natural ingredients.

List of Top Skin Care Market Companies:

- Unilever N.V.

- Procter & Gamble Company

- Beiersdorf AG

- Johnson and Johnson

- A.G. Industries

Skin Care Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Skin Care Market Size in 2025 | US$277.600 billion |

| Skin Care Market Size in 2030 | US$360.900 billion |

| Growth Rate | CAGR of 5.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Skin Care Market |

|

| Customization Scope | Free report customization with purchase |

Skin Care Market Segmentation:

By Product

- Face Products

- Sun Protection

- Face Moisturizers

- Face Brightening

- Others

- Body Products

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa