Report Overview

Global Specialty Tin Cans Highlights

Specialty Tin Cans Market Size:

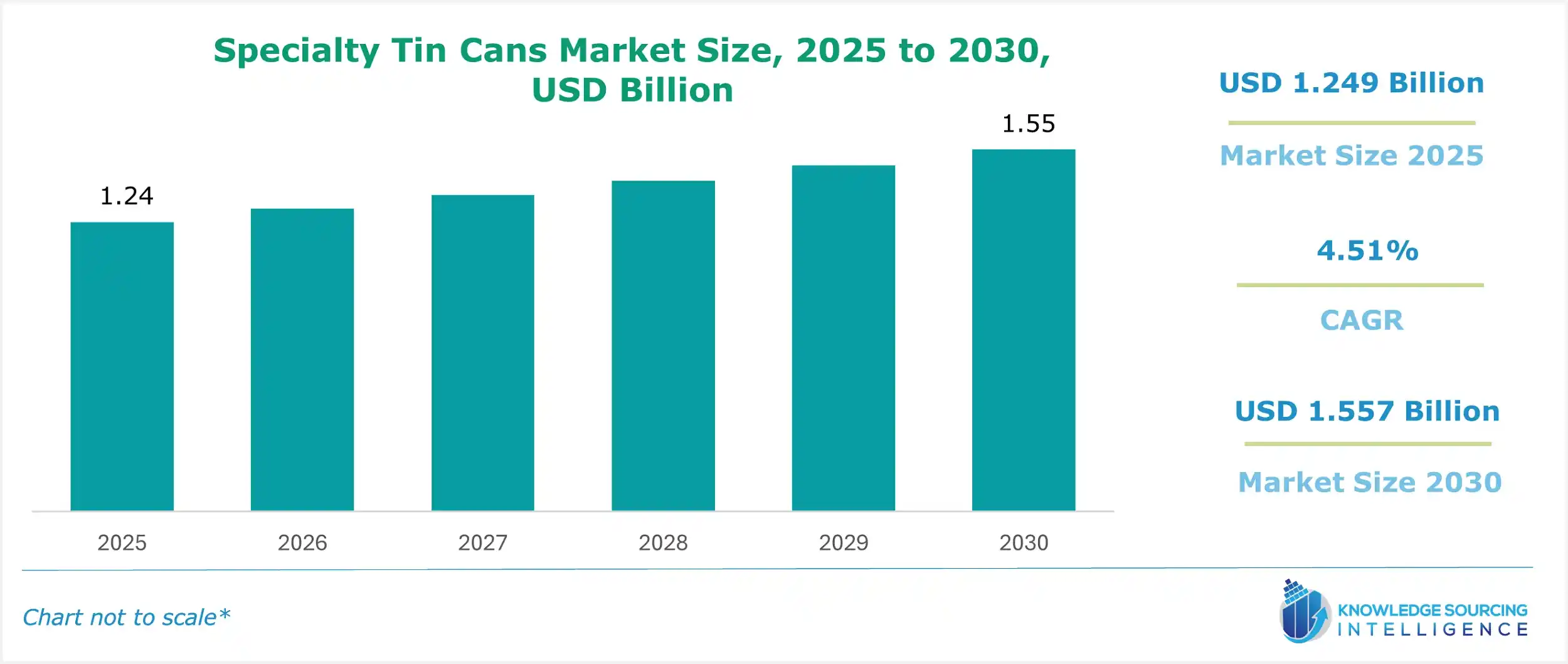

The specialty tin cans market is expected to grow at a CAGR of 4.51%, reaching a market size of USD 1.557 billion in 2030 from USD 1.249 billion in 2025.

The specialty tin cans market is a vital segment of the global packaging industry, focusing on durable, recyclable, and customizable metal containers crafted from tinplate or tin-coated steel. These cans are engineered to meet specific functional and aesthetic requirements, distinguishing them from standard metal packaging.

Renowned for their ability to protect contents from environmental factors such as moisture, air, and light, specialty tin cans are integral to industries like food and beverages, cosmetics and personal care, and industrial applications. Their versatility, coupled with high recyclability, positions them as a preferred choice in an era of increasing sustainability demands. This report provides an in-depth exploration of the specialty tin cans market, tailored for industry experts, with insights into key drivers, restraints, geographical trends, and segment analyses, supported by recent industry developments and authoritative sources.

Specialty Tin Cans Market Overview:

Specialty tin cans are designed to offer enhanced functionality, such as tamper-evident seals, easy-open lids, and decorative finishes, making them ideal for premium and specialized packaging needs. Unlike aluminum cans, which dominate lightweight beverage applications, tin cans are favored for their robustness and corrosion resistance, particularly in sectors like paints and industrial chemicals.

The global packaging industry, valued at approximately $1 trillion in 2024, recognizes metal packaging as a cornerstone due to its sustainability and ability to preserve product quality. Within this, the specialty tin cans market is gaining traction, driven by consumer demand for eco-friendly solutions, technological advancements in can design, and the growth of end-use industries.

The market is segmented by type into aerosol cans, beverage cans, paint cans, and others, and by application into food and beverages, cosmetics and personal care, and industrial and others. Geographically, it spans North America, South America, Europe, the Middle East, and Africa, and the Asia Pacific, each with distinct growth dynamics shaped by economic, cultural, and regulatory factors. Recent innovations, such as lightweight tin cans and eco-friendly coatings, reflect the market’s adaptability to modern challenges, ensuring its relevance in a competitive landscape.

Specialty Tin Cans Market Drivers:

Several factors are fueling the growth of the specialty tin cans market:

-

Sustainability and Regulatory Push: Increasing environmental awareness and stringent regulations on plastic waste are driving demand for recyclable packaging. Tin cans, with a global recycling rate of around 70%, offer a sustainable alternative. For instance, in 2023, the European Union introduced policies to curb single-use plastics, boosting metal packaging adoption.

-

Growth in Food and Beverage Sector: The global food and beverage industry, projected to reach $4.5 trillion by 2027, relies on specialty tin cans for packaging shelf-stable products like canned fruits, vegetables, and beverages. Urbanization and demand for convenient foods, particularly in emerging markets, are key growth drivers. In 2024, global canned food exports grew by 4%, reflecting robust demand.

-

Technological Innovations: Advances in can manufacturing, such as resealable lids and BPA-free linings, enhance functionality and safety. In 2024, a leading packaging firm introduced laser-activated pigment printing, reducing waste and improving recyclability, a significant step toward sustainable production.

-

Industrial Demand: The construction and automotive sectors’ need for durable packaging for paints, coatings, and chemicals drives the market. Tin cans’ impact resistance and corrosion protection make them ideal for these applications, with global paint production reaching 55 million tons in 2024.

Specialty Tin Cans Market Restraints

The specialty tin cans market faces challenges that could hinder its growth:

-

High Manufacturing Costs: Producing tin cans, which involves coating steel with tin, is costlier than manufacturing aluminum or plastic alternatives. This can deter adoption in cost-sensitive markets, particularly in developing regions.

-

Competition from Alternative Materials: Bio-based plastics and polyethylene terephthalate (PET) are gaining popularity due to lower costs and perceived environmental benefits. Despite their lower recyclability, these materials challenge tin cans’ market share, especially in beverage packaging.

Specialty Tin Cans Market Geographical Analysis:

- Asia Pacific

The Asia Pacific region dominates the specialty tin cans market, holding over 40% of global demand in 2024, driven by rapid industrialization, urbanization, and a growing middle class. China leads due to its vast manufacturing base and high consumption of canned beverages, such as energy drinks and beer, with a 5% volume increase reported in 2023 by China’s Ministry of Industry and Information Technology. India’s market is expanding, fueled by rising disposable incomes and demand for canned foods, with companies like Hindalco Industries commissioning new tinplate facilities in 2023 to meet regional needs. Innovations, such as Ball Corporation’s lightweight aerosol cans introduced in 2022, which cut carbon emissions by 50%, further bolster the region’s growth.

- North America

North America, particularly the United States, is a significant market, driven by a mature food and beverage industry and strong consumer preference for sustainable packaging. In 2024, the U.S. metal packaging sector saw steady growth, supported by innovations like resealable can tops for craft beverages, introduced by Augusta Label + Packaging in 2022. Regulatory pressures to reduce plastic waste, combined with demand for premium cosmetics packaging, drive market expansion. Canada and Mexico contribute through growing food exports and proximity to U.S. manufacturing hubs, with Mexico’s canned goods exports rising by 3% in 2023.

Specialty Tin Cans Market Segment Analysis:

- Beverage Cans

Beverage cans are a cornerstone of the specialty tin cans market, driven by global consumption of carbonated drinks, energy drinks, and alcoholic beverages. In 2024, the global beverage can market saw strong demand, particularly in craft beer and specialty coffee, where tin cans are valued for their durability and premium branding potential. For instance, Suntory Spirits launched a 100% recycled aluminum can in 2022, reducing carbon emissions by 60%, a trend that tin can manufacturers are emulating. The beer segment accounts for a significant share, with craft breweries adopting tin cans for their aesthetic appeal and recyclability.

- Aerosol Cans

The aerosol cans segment is experiencing rapid growth, driven by demand in cosmetics, personal care, and industrial applications. Tin-based aerosol cans are prized for their ability to withstand high pressure and provide hermetic seals, making them ideal for deodorants, hairsprays, and industrial sprays. In 2023, Ball Corporation acquired Alucan, a European leader in aerosol technology, to expand its sustainable packaging portfolio. The cosmetics sector, fueled by rising demand for personal care products, is a key driver, with global deodorant sales increasing by 4% in 2024.

Specialty Tin Cans Market Recent Developments:

-

Sustainability Efforts: In 2024, Ball Corporation partnered with Recycle Aerosol LLC to enhance aerosol can recycling in the U.S., aligning with circular economy goals.

-

Innovative Designs: Crown Holdings introduced a round-to-square tin can in 2021, targeting luxury markets with customizable, recyclable finishes.

-

Strategic Expansions: Mauser Packaging Solutions acquired Taenza SA de CV in 2023, boosting its tin-steel aerosol can production in Mexico to meet growing demand in the Americas.

List of Top Specialty Tin Cans Companies:

- Independent Can Company

- Crown Holdings Incorporated

- GM Metal Packaging

- Silgan Holdings

- Ardagh Metal Packaging S.A.

Specialty Tin Cans Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Specialty Tin Cans Market Size in 2025 | USD 1.249 billion |

| Specialty Tin Cans Market Size in 2030 | USD 1.557 billion |

| Growth Rate | CAGR of 4.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Specialty Tin Cans Market |

|

| Customization Scope | Free report customization with purchase |

Specialty Tin Cans Market Segmentation:

-

By Type

-

Aerosol Cans

-

Beverage Cans

-

Paint Cans

-

Food Cans

-

Decorative/Promotional Cans

-

Others

-

-

By Application

-

Food & Beverages

-

Cosmetics & Personal Care

-

Industrial

-

Household Products

-

Promotional & Gifting

-

-

By Geography

-

North America

-

United States

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

United Kingdom

-

Germany

-

France

-

Spain

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Others

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Taiwan

-

Others

-

-