Report Overview

Food Certification Market - Highlights

Food Certification Market Size

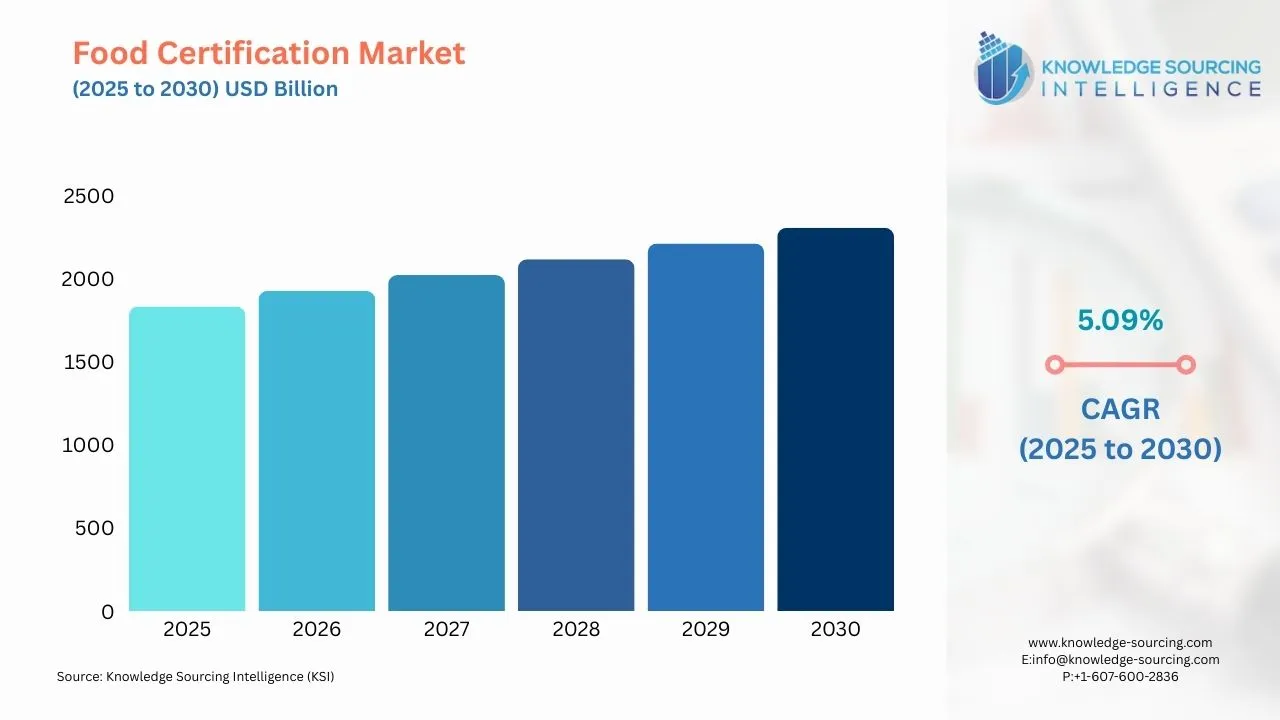

The food certification market is evaluated at US$8.284 billion for 2025, growing at a CAGR of 5.09%, reaching a market size of US$10.616 billion by 2030.

Food certification refers to the verification of products, processes, or systems in the food supply chain to meet the accepted safety parameters based on different food safety standard types. It implies that the food product complies with the respective food standards and is considered safe for consumption after numerous tests, inspections, and audits. The growing consumption of food production globally due to increased consumption may be attributed to the rising global population. Growing food exports are significantly contributing to market growth during the next five years.

Stringent government regulations regarding the consumption of healthy food and the presence of strict standards in the food applications segment are also positively driving the food certification market during the coming five years. The growing number of cases related to foodborne diseases further increases the burden on food-producing companies to make food safer and cleaner for human consumption. This, in turn, is further propelling the market players' business growth opportunities over the forecast period.

Food Certification Market Growth Drivers:

- Growing concerns regarding food safety

One of the key factors supplementing the food certification market growth includes increasing concerns regarding food safety by governments and food companies worldwide. The WHO considers the promotion of good health by making sufficient amounts of safe and nutritious food for the people. As per the organization, more than 200 diseases can be caused by unsafe food containing harmful bacteria, viruses, parasites, or chemical substances.

Moreover, one out of ten people falls ill due to the consumption of contaminated food, and almost 420,000 people die every year. Thus, food certification plays a key role in ensuring the safety and cleanliness of the food, which in turn plays a major role in bolstering the food certification market growth during the forecast period.

Food Certification Market Segment Analysis:

- The food certification market is segmented into certification type and food type.

The food certification market has been classified based on certification type, food type, and geography. By certification type, the market has been categorized based on ISO 22000, BRC, IFS, halal, kosher, and others. Based on food type, the segmentation has been done into meat and poultry, dairy, infant foods, bakery and confectionery, and others.

- Halal certification is expected to see rapid growth

By certification type, the halal certification segment is anticipated to witness significant growth during the forecast period. The demand for halal-certified food is increasing, further providing an impetus for this segment’s growth. Moreover, strict certifications regarding the import of halal meats, especially in the Middle Eastern region, will further support the market growth during the coming years.

The kosher certification segment is also expected to grow significantly due to the rising acceptance of kosher food worldwide. Additionally, the increasing production of kosher food, particularly in the Middle East and African regions, is bolstering this segment's growth until the end of the forecast period.

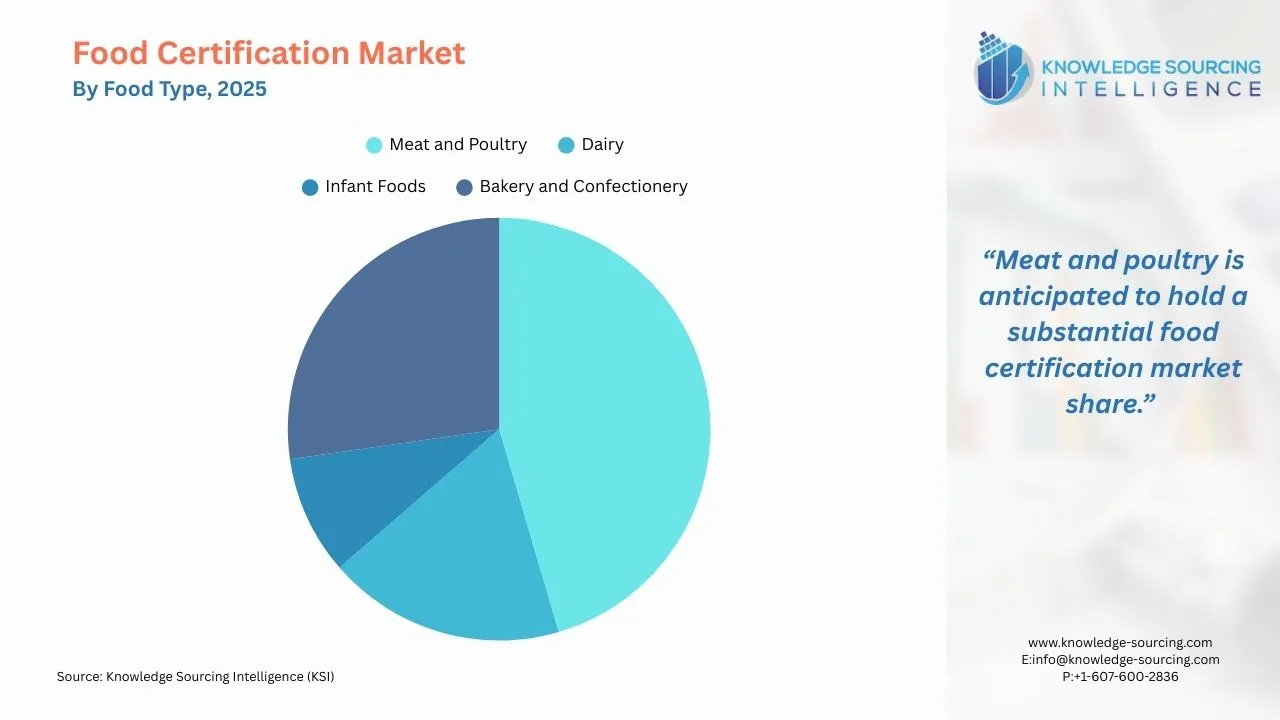

- Meat and poultry will account for a sizable portion

By application, the meat and poultry segment is anticipated to hold a healthy market share during the next five years, which is attributable to the fact that there has been a significant increase in the consumption of meat products, and it is projected to grow substantially over the coming years. For example, as per OECD statistics, sheep meat consumption is estimated to grow from 1 kg per capita in 2022 to 1.1 kg per capita in 2030. Similarly, in OECD countries, poultry meat consumption rose from 21.6 kg per capita in 2022 to 22.6 kg per capita in 2030.

Food Certification Market Geographical Outlook:

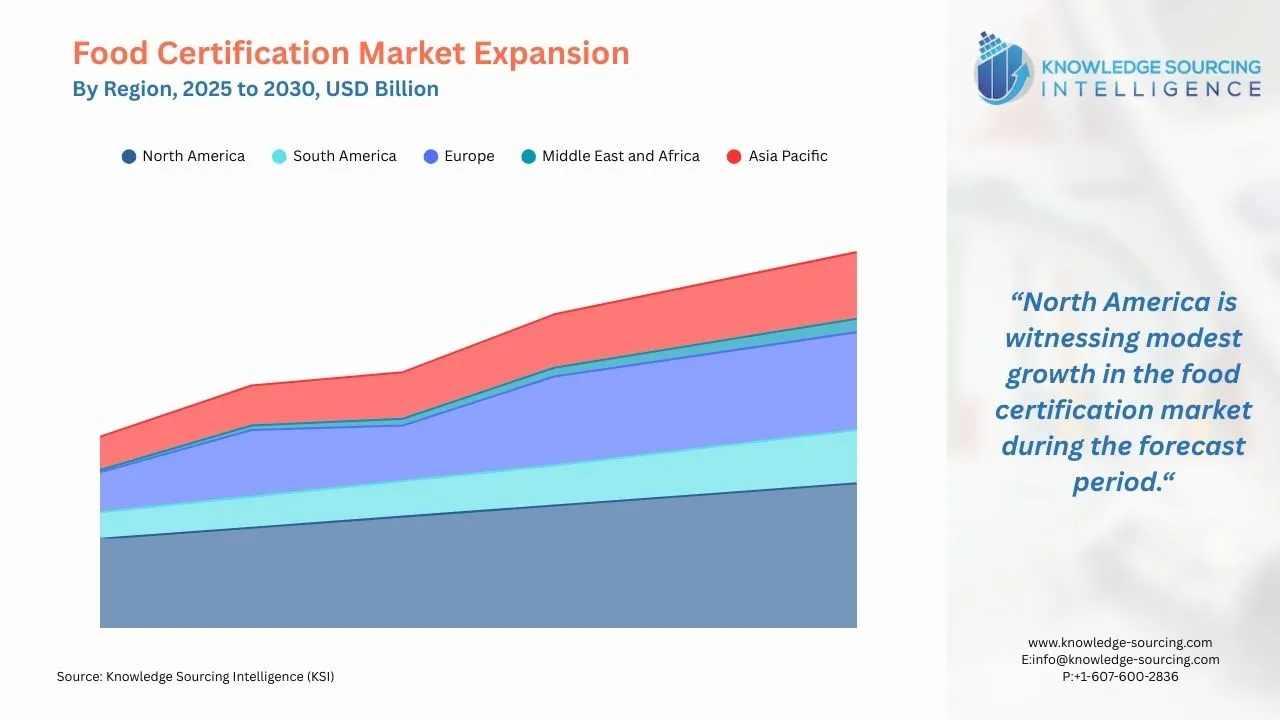

By geography, the food certification market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the food certification market. In India, the market size of the food processing sector in India is estimated to reach US$1,274 billion in 2027 from US$866 billion in 2022. The factors propelling the growth are the rise in population, changing lifestyles, and food habits due to rising urbanization.

The European region is anticipated to hold a significant market share owing to the regulations and standards in various food application segments. These regulations and standards apply to various food application segments.

Food Certification Market Key Developments:

The major leaders in the Food Certification market are SGS SA, NSF International, The British Standards Institution, Bureau Veritas, Intertek Group plc, Eurofins Scientific, and Kiwa NV. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In November 2024, The Food Safety & Standards Authority of India (FSSAI) reinforced compliance requirements for e-commerce FBOs. The e-commerce FBOs must adopt practices to ensure a minimum shelf life of 30 percent or 45 days before expiry at the time of delivery to the consumer.

- In November 2024, Veeva and FSSC partnered to simplify audit certification for food & beverage supply chains. Together, these companies are poised to modernize audit certificate management across global food supply chains by seamless integration of their digital platforms. Over 100,000 certificates are issued annually within the F&B industry, with 36,000+ coming from FSSC alone.

- In October 2024, Bureau Veritas acquired Aligned Incentives, an innovative provider of AI-powered sustainability planning solutions. This acquisition enhances Bureau Veritas' Scope 3 emissions analysis and life cycle assessment (LCA) capabilities. Aligned Incentives are developers for AI technology and deep expertise in sustainability metrics. Its system combines top-tier LCA expertise, an extensive database, and AI-powered AITrack software. These new services will also address the growing demand for transparent, data-driven sustainability reporting.

- In August 2024, The Global Food Safety Initiative (GFSI), The Consumer Goods Forum’s Coalition of Action on Food Safety, and BRCGS announced that BRCGS Food Safety Issue 9 successfully achieved recognition against GFSI Benchmarking Requirements v2020.

List of Top Food Certification Companies:

- SGS SA

- Intertek Group plc

- Bureau Veritas

- Kiwa NV

- DNV GL

Food Certification Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food Certification Market Size in 2025 | US$8.284 billion |

| Food Certification Market Size in 2030 | US$10.616 billion |

| Growth Rate | CAGR of 5.09% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Food Certification Market |

|

| Customization Scope | Free report customization with purchase |

The Food Certification Market is segmented and analyzed as below:

- By Certification Type

- ISO 22000

- BRC

- IFS

- Halal

- Kosher

- Others

- By Food Type

- Meat and Poultry

- Dairy

- Infant Foods

- Bakery and Confectionery

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports

Navigation

- Food Certification Market Size

- Food Certification Market Key Highlights:

- Food Certification Market Growth Drivers:

- Food Certification Market Segment Analysis:

- Food Certification Market Geographical Outlook:

- Food Certification Market Key Developments:

- List of Top Food Certification Companies:

- Food Certification Market Scope:

- Our Best-Performing Industry Reports

Page last updated on: September 12, 2025