Report Overview

Metal Cans Market - Highlights

Metal Cans Market Size:

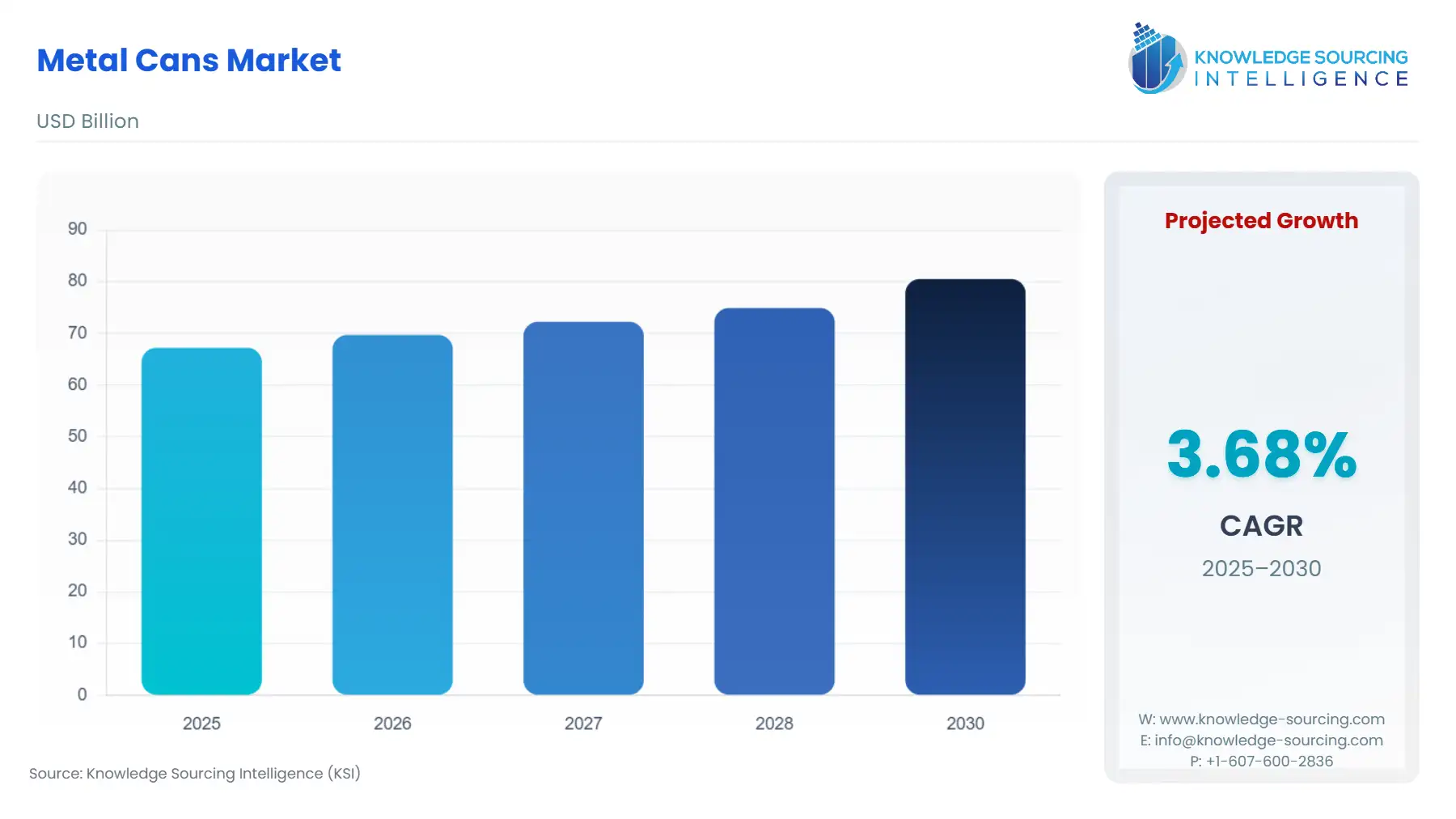

The Metal Cans Market is set to increase from USD 67.236 billion in 2025 to USD 80.546 billion by 2030, driven by a 3.68% CAGR.

Metal Cans Market Overview

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 67.236 billion |

| Total Market Size in 2030 | USD 80.546 billion |

| Forecast Unit | Billion |

| Growth Rate | 3.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Metal Type, Can Type, End-Use, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

The metal cans market is growing rapidly, driven by sustainability initiatives, technological advances, and changing consumer preferences. Metal cans continue to be widely used in multiple sectors of food, beverages, home, and industrial products. This popularity stems from their durability, product protection, and recycling capabilities. Additionally, there has been a growing emphasis on reducing the environmental footprint of packaging in recent years while still enhancing functional attributes.

Sustainability is seen as the major reason for growth, with the industry efforts focusing on ensuring the food-grade recyclable content is increasing per can, and production processes align with globally accepted decarbonization targets. It is seen that the scraps or recycled aluminium content is an effective substitute for the primary feedstock, reducing energy intensity and emissions. This has underlined the evolving use of circular economy models in this sector, which has positioned metal cans as one of the most viable packaging options for responsible consumption and production.

In conjunction with sustainability, functional innovations are becoming an important driver. There are viable functioning prototypes using smart packaging technologies that consist of systems capable of detecting food spoilage or extending the shelf life of a product, while also controlling the mechanism for the release of the product. These prototypes showcase new uses for cans besides just a containment vessel with functions that may help preserve and protect products, and for the safe storage of products, particularly in beverages, food applications, or managed-use products.

The advancements extend to include packaging with electronic features. Printable, recyclable electronic circuits provide opportunities to use smart tracking and tracing, and be embedded in the actual cans, and retaining recyclability.

The metal cans market lies at the crossroads of environmental stewardship, functional innovations, and progressive manufacturing. The metal can industry will increasingly require more recycled materials, more active and smart packaging technologies, and more automation, all boosting the market’s expansion in the future. These changes represent an industry recognising global sustainability trends while creating and seizing new avenues of innovation and competitiveness.

The bar chart comparing India's primary aluminium production for FY 2022-23, FY 2023-24, and FY 2024-25 is indicative of a growing supply that is extremely important to the metal cans market. Aluminium is used as a raw material in manufacturing cans and is one of the most widely used raw materials due to its being lightweight, non-corrosive, and recyclable. An increase in production leads to more availability of raw material, steadier costs, and increased demand from customers in growing demand in the food, beer, soft drinks, and pharmaceutical sectors.

Key players such as Ball Corporation, Crown Holdings, Ardagh Group, Silgan Containers, and Amcor are the leading companies in the metal cans market. These companies are regularly expanding the productive capacity of their facilities, while also applying a lot of focus to sustainability and innovation to remain important in the space they occupy. Their global presence and their commitment to investing in newer packaging technologies will only serve to enhance their positioning in regard to pertinent market growth.

Metal Cans Market Trends:

The rising adoption of metal cans in the food and beverage industry is driving the growth of the global metal cans market in the forecast period. This is because metal cans help in the prevention of food decomposition and thus preserve it for a long time. The changing lifestyle conditions of people owing to the growingly busy lives are further propelling the market growth, which has increased the demand for processed and canned food and beverages. Additionally, the growing trend of ready-to-eat, ready-to-cook foods will further drive the growth of the global metal cans market in the coming years and beyond. However, the rising concern regarding the impact of metal mining on the environment is restraining the market growth.

This research study examines the current market trends related to demand, supply, and sales, in addition to the recent developments. Major drivers, restraints, and opportunities have been covered to provide an exhaustive picture of the market. The analysis presents in-depth information regarding the development, trends, and industry policies and regulations implemented in each of the geographical regions. Further, the overall regulatory framework of the market has been exhaustively covered to offer stakeholders a better understanding of the key factors affecting the overall market environment.

Identification of key industry players in the industry and their revenue contribution to the overall business or relevant segment aligned to the study has been covered as part of the competitive intelligence done through extensive secondary research. Various studies and data published by industry associations, analyst reports, investor presentations, press releases, and journals, among others, have been taken into consideration while conducting the secondary research. Both bottom-up and top-down approaches have been utilized to determine the market size of the overall market and key segments. The values obtained are correlated with the primary inputs of the key stakeholders in the metal cans value chain. The last step involves complete market engineering, which includes analyzing the data from different sources and existing proprietary datasets while using various data triangulation methods for market breakdown and forecasting.

Market intelligence is presented in the form of analysis, charts, and graphics to help the clients gain a faster and more efficient understanding of the metal cans market.

The global metal cans market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various metal can types and technologies, such as aluminum cans, steel cans, and tinplate cans, while exploring applications across industries including food & beverages, pharmaceuticals, personal care, and industrial packaging. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Metal Cans Market Drivers:

Sustainability and Recyclability of Metal Cans

A major driving factor of the metal cans market is their recyclability without compromising quality and utilizing less energy for recycled material compared to the production of metal from ore, which aligns with the sustainability trend. According to 2024 data from the International Aluminium Institute, aluminium is an incredible material for sustainability and can be recycled repeatedly. It reported that about 95 percent of the aluminum requires up to 95 percent less energy than producing it from the ore. Furthermore, approximately 75 percent of the about 1.5 billion tonnes of aluminum that were ever produced globally is still productively utilized. In addition to this, about 70 percent of all the aluminum beverage cans worldwide are recycled cans, making them an ideal choice as the most recycled drink container and sustainable material on the planet.

Moreover, according to the National Packaging Waste Database by the Environment Agency, the aluminium packaging recycled in the United Kingdom was valued at 157,049 tonnes in 2024. From this, kerbside, bring and on-the-go systems recycled about 114,462 tonnes, followed by 41,635 tonnes, and other sources recycled 952 tonnes in the year. The rise in demand among consumers for sustainability, along with eco-friendly packaging material, is expected to boost the demand for metal cans globally.

Furthermore, this sustainability and recyclability trend is fuelled by an increased consumer awareness about plastic pollution and health concerns with the usage of plastics like carcinogens, and an increase in regulatory boldies push towards a decrease in plastic utilization is also boosting companies towards the use of metal cans, which provide non-reactivity with the contents along with better barrier properties.

Metal Cans Market Segment Analysis:

The pet food segment is expected to grow considerably

By application, the metal cans market is segmented into pet food, dairy products, soups and sauces, baby food, ready-to-eat meals, and edible oils. The pet food segment is observing growth in the metal can market due to the rise in pet ownership globally, which promotes the requirement for pet food, which in turn fuels the necessity for metal can packaging. This is followed by the increase in pet owners' spending on high-quality, premium, and nutritious pet food, which is usually packed in metal cans to preserve the product quality, nutritional value, and flavor. As per the data from the Health for Animals report published in September 2022, pet ownership globally was approximately 1 billion, with more than half of the pet owners estimated to be in Europe, the United States, and China.

Similarly, according to the data by the American Veterinary Medical Association (AVMA) from the report titled “2024 AVMA Pet Ownership and Demographic Sourcebook,” the total number of dog owners in the United States was 59.8 million in 2024, which is 45.5 percent, followed by 42.2 million cat owners in the country, which is 32.1 percent in the same year.

In addition, AVMA reported that the pet food and treats spending in the country is expected to account for $67.8 billion in 2025, which is more than the previous year, which was $65.8 billion. Moreover, the growing e-commerce platform utilization for purchasing pet food, combined with the rise in environmentally conscious pet owners, is increasing the demand for sustainable, durable, and recyclable packaging materials like metal cans that can withstand shipping to maintain product quality.

Metal Cans Market Key Developments:

January 2026: Ardagh Metal Packaging reports Q4 2025 results and continued global can production, Ardagh Metal Packaging released its Q4 2025 results, reaffirming its position as a global supplier operating 23 beverage can facilities across nine countries.

November 2025: Ball Corporation announces $60 million investment in Sri City, India, Ball confirmed it will expand its aluminum beverage can production capacity at its Sri City manufacturing facility, targeting fast-growing demand in India.

November 2025: Ardagh Metal Packaging prices $1.29 billion senior secured green notes, Ardagh Metal Packaging priced senior secured green notes to fund operations, refinance debt, and support sustainable metal beverage can production.

July 2025: Ardagh Group announces comprehensive recapitalization supporting metal packaging operations, Ardagh Group completed a recapitalization transaction in July 2025, strengthening its financial structure to support ongoing metal packaging and beverage can production.

Metal Cans Market Scope:

Metal Cans Market Segmentation:

By Metal Type

Aluminium Cans

Tinplate Steel Cans

Chromium-Coated Steel

Electrolytic Tin-Free Steel (ETFS)

Others

By Can Type

Aerosol Cans

Two-Piece Cans

Three-Piece Cans

Drums

Pails

Specialty Cans

By End-Use

Beverages

Food

Aerosols

Industrial Metal Cans

Others

By Distribution Channel

Direct Sales

Retailers and Wholesalers

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others