Report Overview

Global Ultrafast Lasers Market Highlights

Ultrafast Lasers Market Size:

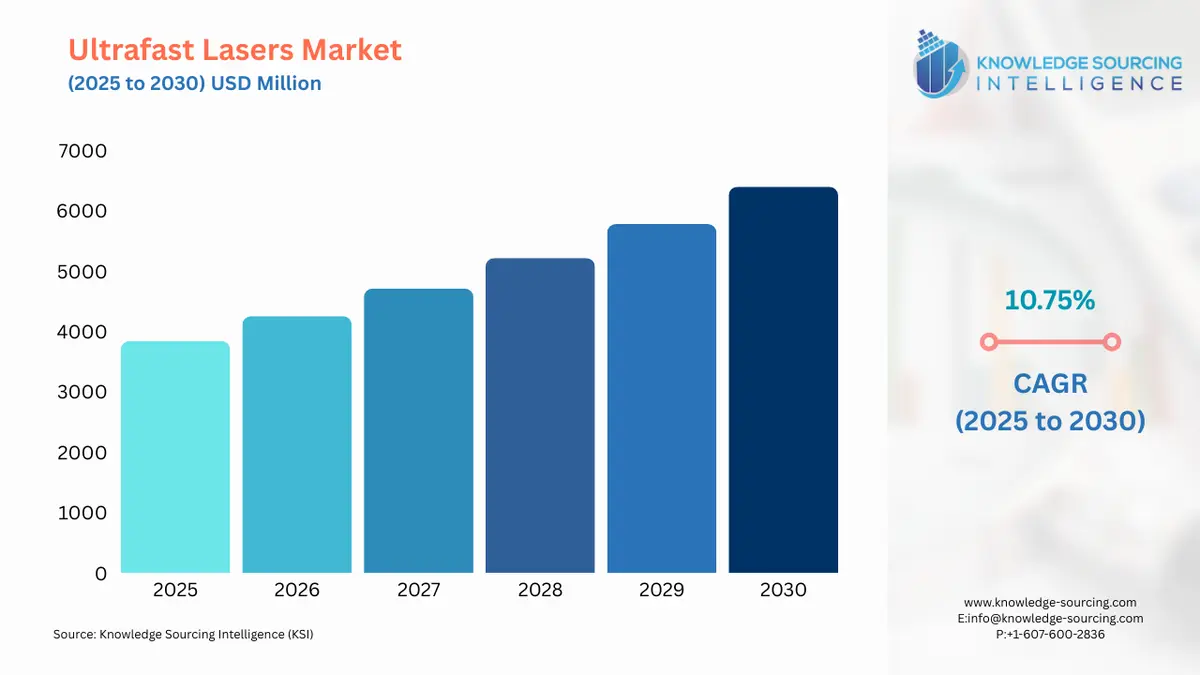

The Global Ultrafast Lasers Market is projected to grow at a CAGR of 10.75% from 2025 to 2030, reaching US$6,401.22 million in 2030 from US$3,841.726 million in 2025.

Ultrafast Lasers Market Trends:

The expanding applications of ultrafast lasers across industries and increasing demand for precision in manufacturing across various industries, such as semiconductor, electronics, healthcare, and others, are the key factors propelling the global ultrafast lasers market. At the same time, the advancement in ultrafast laser technology, such as growth in femtosecond fiber lasers and integrated systems, is boosting its adoption. Besides, increasing investment in scientific research and growing automation and demand for non-thermal, ultra-clean processing in 3D printing and other industries in the wake of growing industrial automation and revolution in industries as Industry 4.0, are leading the market to grow. Also, rapid industrialization in the Asia-Pacific is driving the market.

Global Ultrafast Lasers Market Overview & Scope:

The Global Ultrafast Lasers Market is segmented by:

- Type: The Global Ultrafast Lasers Market is segmented by type into Titanium-Sapphire Lasers, Nd: YAG Lasers, Yb-Doped Lasers, Fiber Lasers, Diode-Pumped Lasers, and Others (including Thin Disk Lasers, Optical Parametric Oscillators (OPOs), and CO2 Ultrafast Lasers). Fiber lasers will dominate the market.

- Pulse Duration: By pulse duration, the market is categorized into Femtosecond Lasers and Picosecond Lasers.

- Application: By application, the market is segmented into Research, Spectroscopy and Imaging, Material Processing, Telecommunications, Biomedical Processing, and Others. Material Processing holds the largest share as ultrafast lasers are used extensively in precision manufacturing and electronics.

- End-User Industry: Based on end-user industry, the market includes Electronics and Semiconductors, Automotive, Healthcare, Academic and Research Institutes, Aerospace and Defense, and Others. The Electronics and Semiconductors segment leads the market, driven by demand for precision manufacturing in the electronics and semiconductor industry.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America leads the market in terms of overall revenue share, while Asia-Pacific is growing at the highest rate due to rapid industrialization in the region’s countries.

Top Trends Shaping the Global Ultrafast Lasers Market

1. Rising demand from biomedical imaging and healthcare

- One of the key trends shaping the ultrafast laser market is the growing demand for ultrafast lasers in biomedical applications, such as imaging, and in healthcare applications.

- The growth is driven by the increasing use of innovative ultrafast lasers, such as femtosecond and picosecond lasers, in advanced medical procedures, such as laser eye surgeries and tissue ablation. Ultrafast lasers are superior in format and convenience, thus being adopted for high efficiency, good compactness, low cost, and being free of maintenance.

- It also acts as a powerful tool for modification of the surface of medical implants at the micro- and nanoscale by improving or limiting the living tissues' adhesion ability.

- For instance, Edmund Optics has launched Chromacity 1040 ultrafast laser, which is designed for multi-photon microscopy, life sciences, and imaging applications, which are core areas in biomedical research.

2. Expanding applications of ultrafast fiber lasers across nonlinear microscopy, environmental sensing, and quantum technologies

- There is an emerging trend of expansion of ultrafast lasers in high-growth applications like nonlinear optical imaging, such as 2PEF and SHG microscopy, real-time environmental gas sensing, and quantum technologies.

- As fiber lasers are increasingly getting technologically advanced in terms of being more compact, energy-efficient, and cost-effective, there are emerging applications. There is a growing demand for fixed-wavelength femtosecond lasers at 920 nm, 1040 nm, and 780 nm in nonlinear microscopy.

- Also, ultrafast lasers are becoming central to quantum optics experiments and next-gen computing for applications in quantum cryptography, spectroscopy, and entanglement.

Global Ultrafast Lasers Market Growth Drivers vs. Challenges:

Opportunities:

- Growing demand for precision due to the booming consumer electronics industry: As the consumer electronics market is growing rapidly, there is an increasing demand for high-accuracy laser processing. The data from the International Data Corporation (IDC), indicating a 2.4% year-over-year (YoY) increase in global smartphone shipments to 331.7 million units in Q4 2024, with a full-year growth of 6.4% and 1.24 billion shipments in 2024, provides strong evidence of growth in the consumer electronics sector. Since ultrafast lasers are crucial for glass cutting and the fabrication of delicate components, their demand is growing at a robust rate due to the boom in the consumer electronics market.

- Rise in demand for precision manufacturing: The core use of ultrafast lasers is helping in precision manufacturing by drilling, cutting, and ablating materials across various industries. With micron-level precision along with minimal thermal damage, it is crucial in semiconductor manufacturing, display fabrication, medical device production, and other applications, and with the growth in these sectors, ultrafast lasers are promising. The Semiconductor Industry Association reports global semiconductor sales hit $627.6 billion in 2024, which is a 19.1% growth compared to the 2023 total of $526.8 billion. Also, there is growing automation in industries in the backdrop of revolutionary Industry 4.0, driving demand for ultrafast lasers for laser surface texturing and 3D printing.

Challenges:

- High initial cost: One of the key challenges the market faces is the high initial cost due to specialized components and advanced cooling and power systems. Also, it has high maintenance costs due to the demand for highly skilled operators and technical staff. The cost factor limits its adoption across smaller labs or startups and also has limited adoption in cost-sensitive regions such as Latin America, Africa, and parts of Asia.

Global Ultrafast Lasers Market Regional Analysis:

- North America: The North American region is the leading market in the global ultrafast lasers market, dominated by the USA and followed by Canada and Mexico. The higher adoption or demand for ultrafast lasers in advanced manufacturing and healthcare drives its market. The market is growing at a moderate rate due to a mature market of ultrafast lasers.

- Asia-Pacific: The Asia-Pacific will be growing at the fastest rate during the forecast period, driven by industrialization and a growing manufacturing base due to the booming semiconductor and electronics market. Additionally, the increasing investment in research and development in photonics and quantum technologies, with universities and state-backed labs adopting ultrafast lasers for spectroscopy and environmental sensing, is driving the market.

Global Ultrafast Lasers Market Competitive Landscape:

The market is moderately consolidated, with some important key players such as Amplitude Systèmes, Coherent Corp., EKSPLA UAB, Kapteyn-Murnane Laboratories, Inc., Thorlabs, Inc., JENOPTIK AG, Maxphotonics Co., Ltd., Wuhan Huaray Precision Laser Co., Ltd., Han’s Laser Technology Industry Group Co., Ltd., Lumentum Operations LLC, IPG Photonics Corporation, NKT Photonics A/S, TRUMPF GmbH + Co. KG, Clark-MXR, Inc., and Laser Quantum Ltd.

- Research and Description: In February 2025, Laser Photonics Corporation (NASDAQ: LASE), along with its subsidiary CMS Laser, is advancing a laser marking technology for stainless steel medical wires. This R&D initiative supports high-speed, precision marking, which is crucial for medical device identification and traceability. The system includes features like on-the-fly wire marking, rotary wire handling and delivers up to 550% throughput gains for medical device manufacturing lines.

- Expanding application: In December 2024, Focused Energy and Amplitude entered into a $40 million agreement to co-develop ultrafast, high-energy laser systems. The system will be deployed at Focused Energy’s $65M Laser Development Facility in the San Francisco Bay Area. This demonstrates continued investment and innovation in ultrafast lasers beyond industrial and biomedical use, aimed at fusion fuel compression, extending ultrafast lasers into the clean energy and fusion power sector.

Ultrafast Lasers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ultrafast Lasers Market Size in 2025 | US$3,841.726 million |

| Ultrafast Lasers Market Size in 2030 | US$6,401.22 million |

| Growth Rate | CAGR of 10.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Ultrafast Lasers Market |

|

| Customization Scope | Free report customization with purchase |

Global Ultrafast Lasers Market Segmentation:

By Type

- Titanium- Sapphire Lasers

- Nd: YAG Lasers

- Yb-Doped Lasers

- Fiber Lasers

- Diode-Pumped Lasers

- Others (Thin Disk Lasers, OPOs, CO2 Ultrafast lasers etc.)

By Pulse Duration

- Femtosecond Lasers

- Picosecond Lasers

By Applications

- Research

- Spectroscopy and Imaging

- Material Processing

- Telecommunications

- Biomedical Processing

- Others

By End-User Industry

- Electronics and Semiconductors

- Automotive

- Healthcare

- Academic and Research Institutes

- Aerospace and Defense

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

Our Best-Performing Industry Reports:

Navigation:

- Ultrafast Lasers Market Size:

- Ultrafast Lasers Market Key Highlights:

- Ultrafast Lasers Market Trends:

- Global Ultrafast Lasers Market Overview & Scope:

- Top Trends Shaping the Global Ultrafast Lasers Market

- Global Ultrafast Lasers Market Growth Drivers vs. Challenges:

- Global Ultrafast Lasers Market Regional Analysis:

- Global Ultrafast Lasers Market Competitive Landscape:

- Ultrafast Lasers Market Scope:

- Our Best-Performing Industry Reports: