Report Overview

Global Ursolic Acid Market Highlights

Ursolic Acid Market Size:

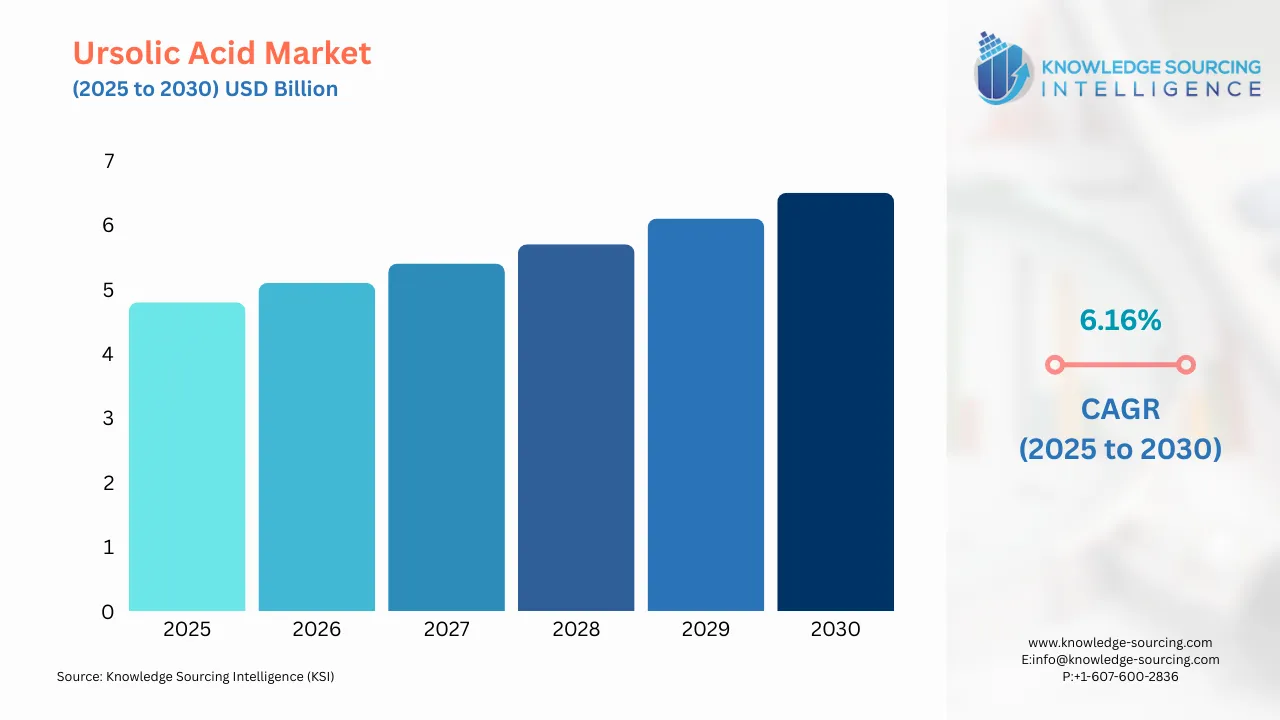

The global ursolic acid market is anticipated to reach US$6.452 billion by 2030. It is valued at US$4.785 billion in 2025, growing at a compound annual growth rate of 6.16%.

Ursolic Acid Market Key Highlights:

- The global ursolic acid market is growing steadily, driven by rising health consciousness.

- Research is advancing ursolic acid applications in food and pharmaceutical products.

- Nanotechnology is enhancing ursolic acid delivery for cancer treatment innovations.

- Companies are utilizing apple pomace to extract valuable ursolic acid compounds.

Ursolic Acid is a compound of triterpene acid found in various plants, such as prunes, hawthorn, thyme, oregano, lavender, cranberries, apples, and many others. This generic acid has many nutritious health-enhancing properties, such as antioxidant, anti-fungal, anti-bacterial, and anti-inflammatory properties, among others.

Various research and studies have been conducted to develop Ursolic acid extracts and incorporate these extracts into different food products and for pharmaceutical purposes. Thus, it could be rationally predicted that the inclusion of ursolic acid would be a well-warranted and effective nutrient provision to alleviate age-related dysregulation and changes in body composition. It is also an anti-depressant and can stimulate the synthesis of tortuous structures in humans' skin.

Ursolic Acid Market Growth Drivers:

- The growing adoption of healthy lifestyles is anticipated to expand the global ursolic acid market.

Ursolic acid is highly valued for its wide range of health benefits, particularly in addressing cardiovascular diseases, diabetes, obesity, and cancer. It reduces blood and serum cholesterol levels, decreases the incidence of stroke and heart attack, and lowers blood pressure. As of December 2023, Death Statistics reported that mortality due to cardiovascular disease was 12.4 million in 1990 and increased to 19.8 million in 2022. It is predicted that over time, mainly due to the increase in population aging and modifiable risk factors, the death rate could increase.

These factors will also lead to increased consumption of ursolic acid globally during the forecasted period. Furthermore, it can enhance the action of insulin and help in better diabetic management by improving glucose metabolism while helping to reduce weight. It even fights against tumors and their spread in the body. The increasing prevalence of lifestyle ailments worldwide and rising consumer interest in natural products are expected to stimulate the ursolic acid market’s growth.

Furthermore, it is expected that by 2030, the global diabetes-afflicted population will be 643 million, according to the IDF figures. It is estimated to rise to 783 million by 2045. The increase in diabetic diseases is also a factor driving the global ursolic acid market’s growth. This acid can potentially treat diabetes by enhancing insulin resistance and lowering blood sugar levels. As a rising number of people tend to go for natural cures and medicinal plants, ursolic acid is becoming common over time, attributed to its therapeutic effects.

- Growing R&D expenditure on various formulations of ursolic acid is anticipated to expand the market.

The active property of Ursolic Acid is also known for encouraging healthy body mass. This development has resulted in the quick expansion of resistant starch-bearing capsules and muscular development and weight reduction supplements. As a result, health-conscious and fitness-enthusiastic individuals are buying supplements and products enriched with ursolic acid. Moreover, the potential for this market among athletes and sportspersons appears significant, as there will likely be high demand in the coming years. So, the manufacturers and producers have been expanding their product lines and distribution channels to this market. There has been an increase in the income generated from the online and e-commerce earned income sectors, which will be dominant in the years to come.

Consequently, an increasing amount of ursolic capsules are being sold since they offer several health advantages. For instance, cardiovascular diseases are prevalent in many people, which has led to an increased demand for ursolic acid capsules. Growing numbers of firms have been investing in their capabilities to manufacture and produce such capsules without limiting themselves to any particular functions. The nutrition and health industries have several sectors aligning with the pharmaceutical industry, which is one of the determining factors in the global ursolic acid market’s expansion.

- The emergence of nanotechnology-based ursolic acid nanoparticles is one of the major factors contributing to the market growth.

The global requirement for products and services based on ursolic acid nanoparticles possesses a relatively high growth potential. This is due to technological advancement; nanoparticles have been changing the market in all sectors and industries. Nanoparticles are used in aviation, medicine, pharmaceuticals, and other sectors. Nanoparticles of ursolic acid drugs are also pivotal in changing the landscape of the pharmaceutical sector.

Using nanocapsules composed of the ursolic acid guard to treat cancerous cells is a new approach. This is being researched by major facilitation and research centers using the compound to address cancer and related issues. It has been observed that nanoparticles of ursolic acid are capable of killing melanoma cell population, and their efficacy is very much time dependent. The findings from the research carried out by Frontiers in July 2024 on the efficacy of treating the risk of gastrointestinal cancer with ursolic acid indicate the need for more effective approaches, such as molecular profiling and drug delivery using nanoparticles for the management of GI cancers.

Those tentative studies will be the new advance in drug-making processes and perhaps the new treatment focus in the next few years. The medical market is expected to play a significant factor in the ursolic acid market's overall expansion, as the anti-diabetic and anti-inflammatory effects of this compound. It is also a potential anticancer drug that will promote the demand for its research during the forecasted period. With advancements and technical innovations in the pharmaceutical field, ursolic acid nanoparticles will register major growth in the coming years.

- Apple pomace generated during its production offers a valuable resource for extracting and utilizing this beneficial ursolic acid.

Juice Industrial Waste is being used to develop bioactive compounds. Apple juice has numerous health-promoting properties, and the apple pomace generated during production is a valuable source of ursolic acid. It is used to support hydration, contains beneficial plant compounds such as polyphenols, supports heart health, and helps in enhancing brain-related properties. Apples peels contain a significant amount of ursolic acid, and their waste is used to develop bioactive compounds. Apple waste is also known as a by-product of the beverage industry. The raw materials are comparatively cheaper, and the major drawback is that there is no proper or robust industrial use of raw materials and waste products. The waste products contain a high nutrient source that is beneficial for the human body.

Therefore, major companies in the ursolic acid market have been working and trying to capitalize on the opportunity to use huge amounts of apple waste to develop various types of bioactive compounds. Other fruits such as rosemary, cranberry, and orange peels are also rich in ursolic acid. Fruit is an essential commodity, and its consumption will also surge with the growing population globally. For this reason, there is a need to develop proper extraction mechanisms and techniques to utilize industrial and agricultural waste in the form of orange peels and apple pomace.

List of Top Ursolic Acid Companies:

Ursolic Acid Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ursolic Acid Market Size in 2025 | US$4.785 billion |

| Ursolic Acid Market Size in 2030 | US$6.452 billion |

| Growth Rate | CAGR of 6.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

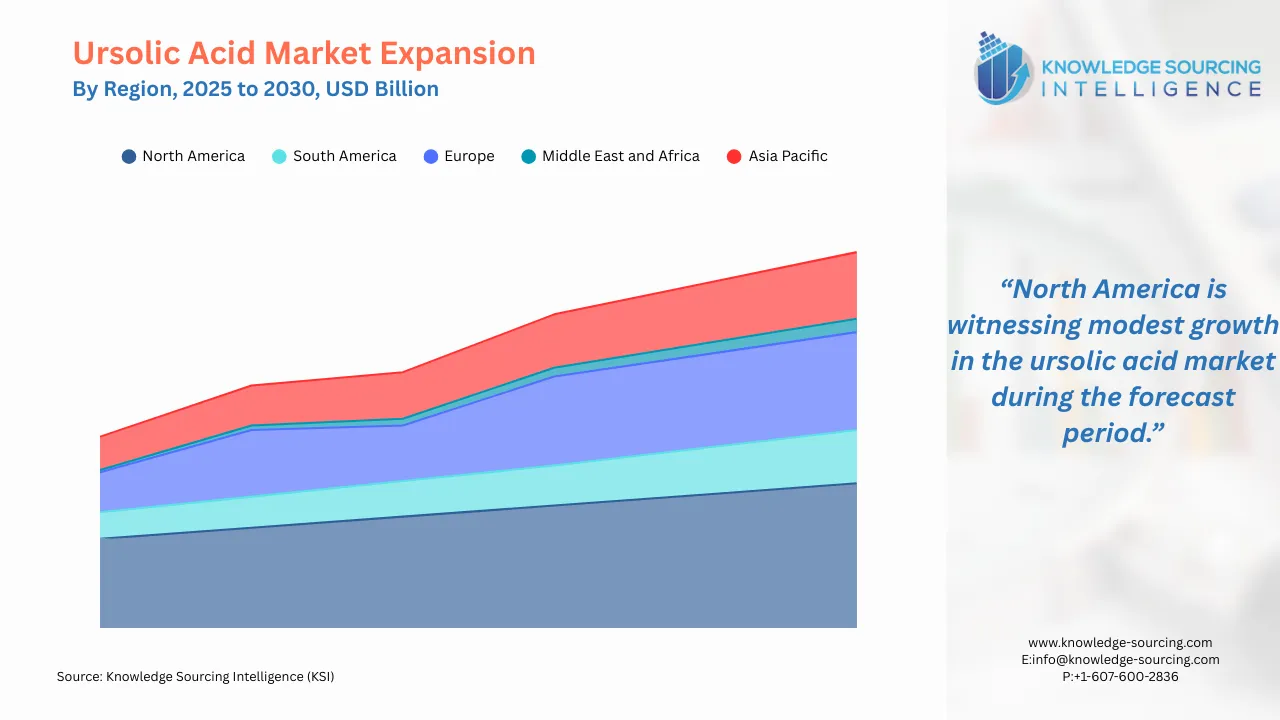

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Ursolic Acid Market |

|

| Customization Scope | Free report customization with purchase |

The Global Ursolic Acid Market is analyzed into the following segments:

- By Form

- Liquid Extract

- Powdered Extract

- By Product Type

- 25% Ursolic Acid

- 50% Ursolic Acid

- 90% Ursolic Acid

- 98% Ursolic Acid

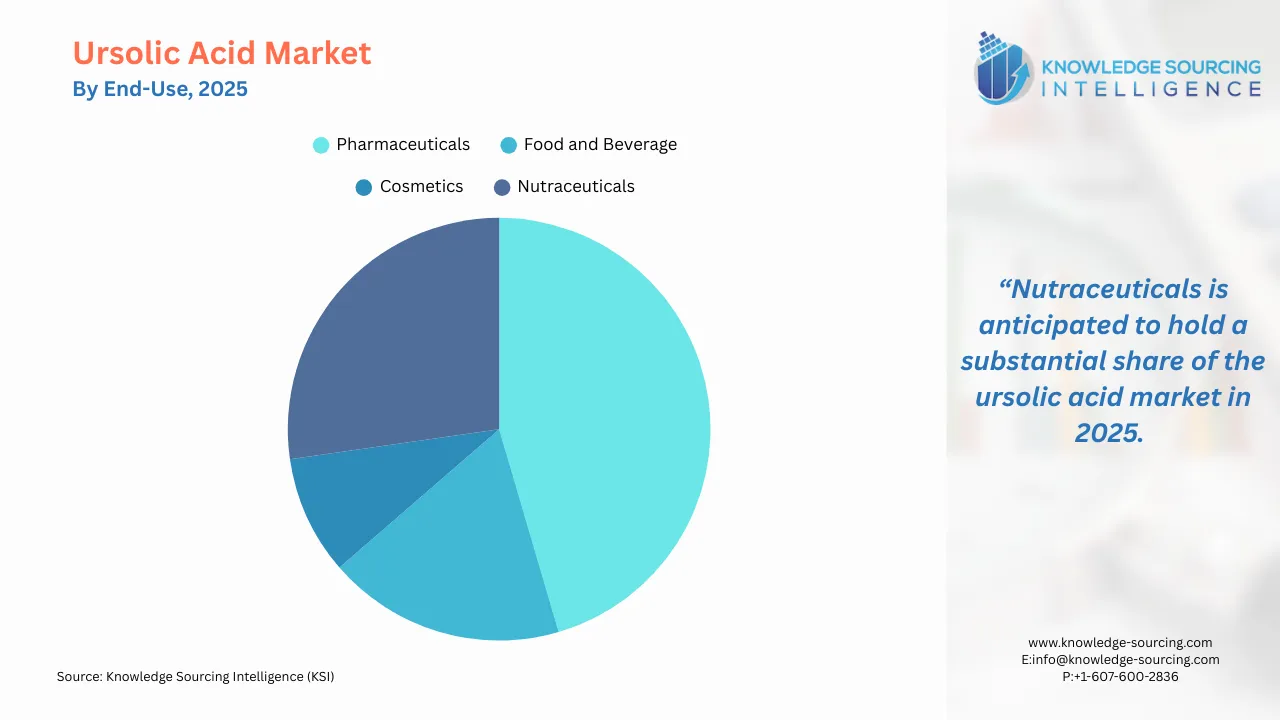

- By End-Use

- Pharmaceuticals

- Food and Beverage

- Cosmetics

- Nutraceuticals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- France

- Others

- Middle East and Africa

- Saudi Arabia

- South Africa

- Others

- Asia Pacific

- China

- Japan

- Australia

- India

- South Korea

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

Page last updated on: