Report Overview

Global Water Disinfection Market Highlights

Water Disinfection Market Scope:

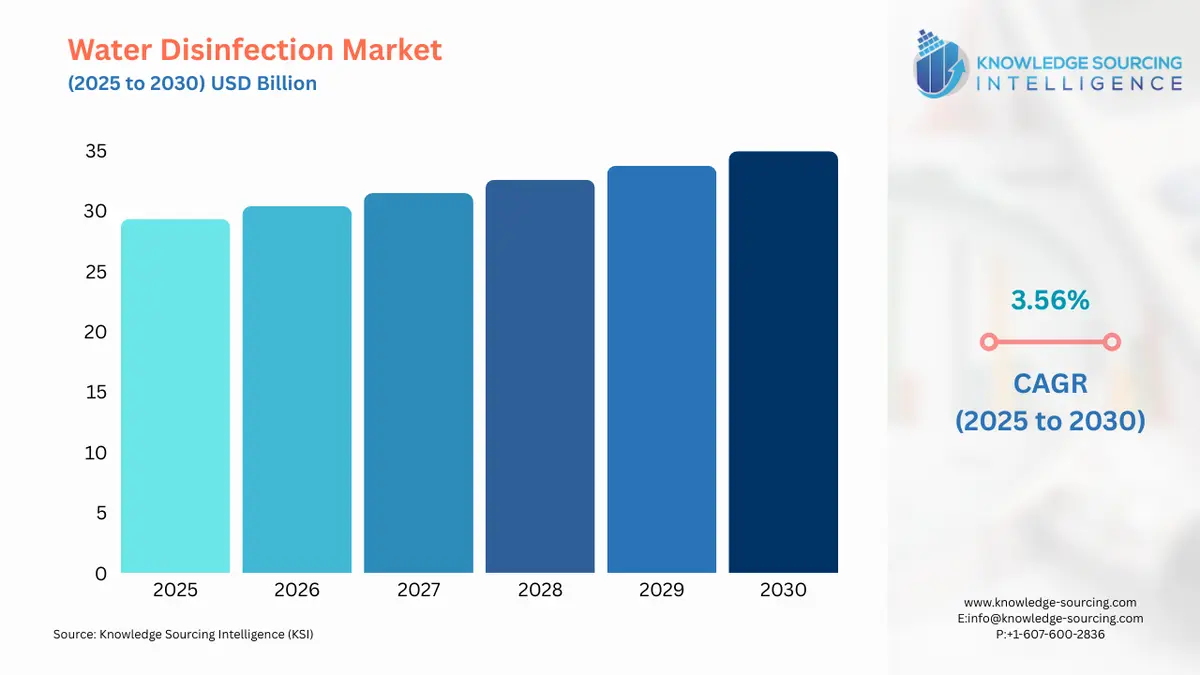

The global water disinfection market is expected to grow from US$29.342 billion in 2025 to US$34.952 billion in 2030, at a CAGR of 3.56%.

Water Disinfection Market Introduction:

The removal, deactivation, or extermination of harmful microorganisms in water is referred to as water disinfection. Disinfection can be accomplished using either physical or chemical disinfectants. Organic pollutants in water that act as nutrition or habitat for microbes are also removed by the agents. Disinfectants do more than just destroy germs. Disinfectants can also have a residual impact, meaning they stay active in the water after disinfection. After disinfection, a disinfectant prevents harmful bacteria from proliferating in the plumbing and re-contaminating the water.

Concerns regarding disinfection byproducts (DBPs), many of which are recognized or suspected carcinogens. Continuous outbreaks of waterborne disease due to chlorine-resistant organisms such as Cryptosporidium and Giardia lamblia occur in developed countries. Furthermore, the expanding global population, combined with rising urbanization, is one of the primary drivers of the water disinfection equipment market. Scarce freshwater resources, combined with a growing population, are driving governments all over the globe to develop new water treatment facilities and update old ones to supply safe drinking water to everybody. Strict laws and industry requirements for wastewater treatment across various sectors are another driving factor for the growth of the water disinfection equipment market.

Water Disinfection Market Overview:

The necessity for safe drinking water, increased government regulations on water treatment, and growing concerns about waterborne diseases are all driving the global water disinfection market's notable expansion. Significant water pollution has resulted from the rise in industrialization and urbanization in both developed and developing nations, increasing the need for effective water disinfection systems. The ability of technologies like ultraviolet (UV) disinfection, chlorination, ozonation, and sophisticated filtering systems to eradicate dangerous diseases and pollutants is allowing them to be widely adopted in the residential, commercial, and municipal sectors.

Investments in water treatment infrastructure and disinfection technologies are also being driven by the enormous strain that the growing global population and the ensuing increase in water consumption are imposing on the world's water resources. The use of eco-friendly and energy-efficient disinfection techniques has also increased due to greater awareness of the negative effects unclean water has on the environment and human health. Continuous technical developments that enhance operational efficiency and ensure regulatory compliance, such as the creation of automated disinfection systems, real-time water quality monitoring, and intelligent water management solutions, further boosts the industry’s growth.

Furthermore, new prospects for market expansion are being created by the building of desalination plants, especially in areas with limited water resources. Rapid industrial growth, rising urban populations, and increasing government efforts to provide safe drinking water are all propelling Asia-Pacific to become a prominent region in the global market. To satisfy the growing demand for dependable and environmentally friendly water disinfection solutions worldwide, major market participants are concentrating on strategic alliances, mergers, and acquisitions to increase their geographic footprint and fortify their product lines.

According to the United Nations Statistics Division, even with significant advancements, sanitation and water quality are still lacking. At the current rate, 3 billion people will lack properly managed sanitation, 1.4 billion will need basic hygiene facilities, and 2 billion people will still lack safe drinking water by 2030.

The market has low-to-moderate entry barriers, allowing local and specialized players to grow, particularly in high-growth segments like chemical disinfection and UV-based systems. The increasing demand for technologically advanced and sustainable disinfection solutions is creating significant opportunities for innovation-driven companies to gain a competitive edge.

The market is also experiencing consolidation trends, highlighted by SUEZ and Veolia or Xylem's acquisition of Evoqua in 2023. The overall growth of companies towards consolidation and the emergence of technology-focused players, sustainability trends, public health concerns, and technological disruption from UV-C LEDs, AI-driven monitoring, and smart disinfection systems is intensifying competition.

Water Disinfection Market Driver:

- Increase in applications of UV disinfection equipment.

UV disinfection equipment can eliminate any live microbe in the air, water, or on surfaces, therefore preventing disease transmission. When bacteria, viruses, and protozoa are exposed to germicidal UV light wavelengths, they lose their ability to reproduce and infect. UVC is a kind of radiation that has been shown to deactivate or eliminate a variety of infections, including the virus that causes COVID-19. A 254 nm mercury UV lamp, according to the International Ultraviolet Association (IUVA), killed 99% of SARS-CoV-2, also known as the coronavirus. When chlorine-based disinfectants take nearly 20 minutes to adequately treat the water tank, UV disinfection equipment uses UVC lamps to perform the same work in less than 10 seconds.

The UV disinfection equipment market is expected to be driven by high R&D investments by manufacturers to improve the performance of UV disinfection equipment for large volume applications such as municipal drinking water and industrial process water treatment. Supporting government programs for water and wastewater treatment has boosted technological development in growing nations such as India and China. The adoption of UV disinfection equipment is projected to benefit from increased demand for clean and safe drinking water as a result of the rising population and scarcity of freshwater resources.

- Growing urbanization and industrialization

The world's increasing industrialization and urbanization are major factors driving the global water disinfection market's growth. The concentration of people in urban areas is significantly raising the demand for basic utilities, particularly clean and safe water, as nations continue to experience rapid urban growth, especially in emerging economies. Strong and effective water disinfection solutions must be implemented as urbanization increases residential water consumption, wastewater production, and the strain on municipal water treatment facilities.

Concurrently, the fast industrialization of industries, including manufacturing, chemicals, food and drink, pharmaceuticals, power generation, and textiles, is using a large amount of water and releasing a large volume of industrial effluent that contains dangerous pollutants. To meet increasingly stringent environmental standards, these sectors need not just high-quality process water but also rigorous effluent disinfection before environmental release. Municipal governments and businesses are making significant investments in state-of-the-art water treatment facilities equipped with cutting-edge disinfection technologies, such as ultraviolet (UV) systems, ozonation, chlorination, and advanced oxidation processes, as a result of these urban and industrial dynamics.

According to OurWorldinData, 81 percent of people live in cities in the majority of high-income nations, including those in Western Europe, the Americas, Australia, Japan, and the Middle East. Meanwhile, about 69% of individuals in the majority of upper-middle-income nations, such as in South America, North and Southern Africa, East Asia, and Eastern Europe, lived in urban areas as of 2023.

Furthermore, opportunities for the integration of intelligent water management systems, such as automated disinfection controls and real-time water quality monitoring, are being created by the growing adoption of smart cities and sustainable infrastructure projects. This will guarantee a steady supply of safe. Because of the increased hazards of untreated or inadequately treated water in densely populated areas, including the potential for waterborne disease outbreaks, efficient water disinfection is not only required by law but also a top public health priority.

Water Disinfection Market Restraints:

- Higher investment costs

Although a majority of ozone systems do not need substantial maintenance. Some systems employ an air-drying substance that must be changed regularly. It is also important to clean the water storage tank regularly and to inspect pumps, fans, and valves for damage and wear. If UV radiation produces ozone, the lamp must be changed periodically. Any pre-treatment or post-treatment equipment might necessitate further upkeep. Ozone treatment can potentially result in the formation of toxic byproducts in drinking water. For example, if bromide is present in the raw water, ozone interacts with it to create bromate, which has been proven to cause cancer in rats.

Water Disinfection Market Segmentation Analysis

The market is divided by method, end-user, and geography.

- By method, the market is segmented into chlorination, UV radiation, ozonation, membrane filtration, and others. Chlorination is anticipated to remain dominant as it is one of the most widely used methods and is cost-effective as well. However, the formation of toxic byproducts like trihalomethanes raises health concerns, pushing industries toward eco-friendly alternatives like UV or ozonation. UV radiation is expected to experience a strong growth, driven by its eco-friendly nature and effectiveness across a broad range of microbes. Ozonation will also be growing, while membrane filtration is growing rapidly, driven by its high effectiveness, increasing adoption in municipal and industrial sectors, and significant investments in Asia-Pacific. Other methods will also be growing moderately.

- The products find key end-use in municipal, residential, and industrial applications. Industrial is further segmented into industry-specific, such as food & beverages, pulp & paper, metal & mining, oil & gas, pharmaceutical, power generation, and others. Municipal holds the largest segment, while residential also has a significant share and is growing due to rising concerns about tap water quality. Industrial applications are the fastest-growing, driven by the tightening of regulations and demand for high-quality water in industries like food & beverages and pharmaceuticals.

- The market is segmented into key regions such as North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America will hold a major market share, driven by strict regulations, high demand, and high investment, with increasing technological developments. Europe is also a key market, driven by strict regulations. While the Asia-Pacific is growing at the fastest rate, driven by rising industrialization, investments in wastewater infrastructure to address water pollution, particularly in China and India.

Water Disinfection Market Geographical Outlook:

- North America, particularly the US, is expected to lead the market expansion

North America has a substantial market share owing to the high awareness regarding water quality among the masses and the resulting enormous need for improved water treatment technologies. The USA holds the largest share of the North American water disinfection market. With stricter water safety regulations, such as U.S. EPA standards, and rising demand for water treatment from municipal utilities, industrial processing, and healthcare facilities, the water disinfection market is growing.

In addition, the ageing water infrastructure is driving funding from the government for modernization and upgradation, which drives the market. Additionally, states like California, Arizona, and Texas are adopting advanced disinfection for potable reuse, boosting market growth. Furthermore, the growing awareness of public health and safety is driving the demand for upgraded and innovative disinfection systems.

In recent years, regulatory pressure from the U.S. Environmental Protection Agency (EPA) due to growing goals towards circular economy is driving the demand for advanced water disinfection systems in the U.S. These regulations ensure water safety for both municipal and industrial use and directly impact technology adoption in the market. For instance, the USA, through the Safe Drinking Water Act, 1974, has set standards for drinking water quality. The National Primary Drinking Water Regulations are water quality standards and water treatment rules by limit the levels of more than 90 contaminants, which utilities must follow. Other regulations, like the Disinfection Byproducts Rule and Legionella & Healthcare Regulations, which require facilities such as hospitals and nursing homes to implement water disinfection plans to control Legionella, are driving the demand for water disinfection systems. In 2021, under the Bipartisan Infrastructure Law, the U.S. invested US$50 billion specifically for the upgradation of the nation’s water systems. It supports projects including wastewater treatment, giving a boost to the market.

A key driver for the U.S. water disinfection market is the increasing prevalence of waterborne diseases and stricter public health regulations. According to the CDC, waterborne diseases affect over 7 million people in the U.S. every year. Between 2015 and 2020, the U.S. reported 214 waterborne outbreaks, an overwhelming 87% of which were linked to biofilms, overall, 80% of outbreaks are linked with public water systems, resulting in over 2,140 illnesses, 563 hospitalizations, and 88 deaths, underscoring the rising threat of waterborne diseases and the urgent need for advanced disinfection solutions.

Thus, the modernization of aging infrastructure, increasing regulatory pressure, rising public awareness around safe drinking water, growing adoption of water treatment at both industrial and municipal levels, and continuous technological advancements are collectively driving the U.S. water disinfection market expansion.

Several key players are actively competing in the U.S. water disinfection market, such as Xylem Inc., Ecolab Inc., Veralto Corporation, 3M, and DuPont. They are leading the way in technologically advanced solutions like ultraviolet (UV) disinfection, chlorine dioxide systems, advanced filtration, and real-time water quality monitoring technologies, further accelerating market growth.

- The APAC region is also gaining a notable market share

During the forecast period, the Asia-Pacific region is anticipated to be the fastest-growing regional market for water disinfection equipment. This expansion can be attributed to an increase in the number of industrial facilities in sectors such as energy and power, food and beverages, chemicals, and pharmaceuticals. Strict legislation and rules governing drinking water quality, as well as increased government efforts and policies, would drive demand for water disinfection equipment in the area, favorably influencing the APAC water equipment market growth during the projected period.

Water Disinfection Market Key Developments:

- In 2025, Veolia constructed the Stanton Water Treatment Plant, which is one of the largest PFAS treatment systems in the US and the Northeast, to ensure high-quality drinking water for over 100,000 residents. It also meets the EPA PFAS regulations and establishes a replicable model for cost-effective PFAS treatment projects globally.

- The Aquaray S UV System is a cutting-edge horizontal UV disinfection technology, which is ideal for applications in small factories. It consists of 2, 4, or 6 vertical lamps for efficient treatment. It offers low-pressure, high output, and is ideal for small flow wastewater usage, providing up to 3 million gallons per day of water consumption.

Water Disinfection Companies:

- Xylem

- Ecolab Inc.

- Veralto Corporation

- 3M

- DuPont de Nemours, Inc.

Water Disinfection Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Water Disinfection Market Size in 2025 | US$29.342 billion |

| Water Disinfection Market Size in 2030 | US$34.952 billion |

| Growth Rate | CAGR of 3.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Water Disinfection Market |

|

| Customization Scope | Free report customization with purchase |

The water disinfection market is analyzed into the following segments:

- By Method

- Chlorination

- UV Radiation

- Ozonation

- Membrane Filtration

- Others

- By End-User

- Municipal

- Industrial

- Food & Beverages

- Pulp & Paper

- Metal & Mining

- Power

- Chemical & Pharma

- Oil & Gas

- Pharmaceutical

- Power Generation

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Ultraviolet Water Treatment System Market

- Solar Water Heater Market

- Industrial Water Treatment Market

Navigation:

- Water Disinfection Market Scope:

- Water Disinfection Market Highlights:

- Water Disinfection Market Introduction:

- Water Disinfection Market Overview:

- Water Disinfection Market Driver:

- Water Disinfection Market Restraints:

- Water Disinfection Market Segmentation Analysis

- Water Disinfection Market Geographical Outlook:

- Water Disinfection Market Key Developments:

- Water Disinfection Companies:

- Water Disinfection Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025