Report Overview

Global Wood Pellet Market Highlights

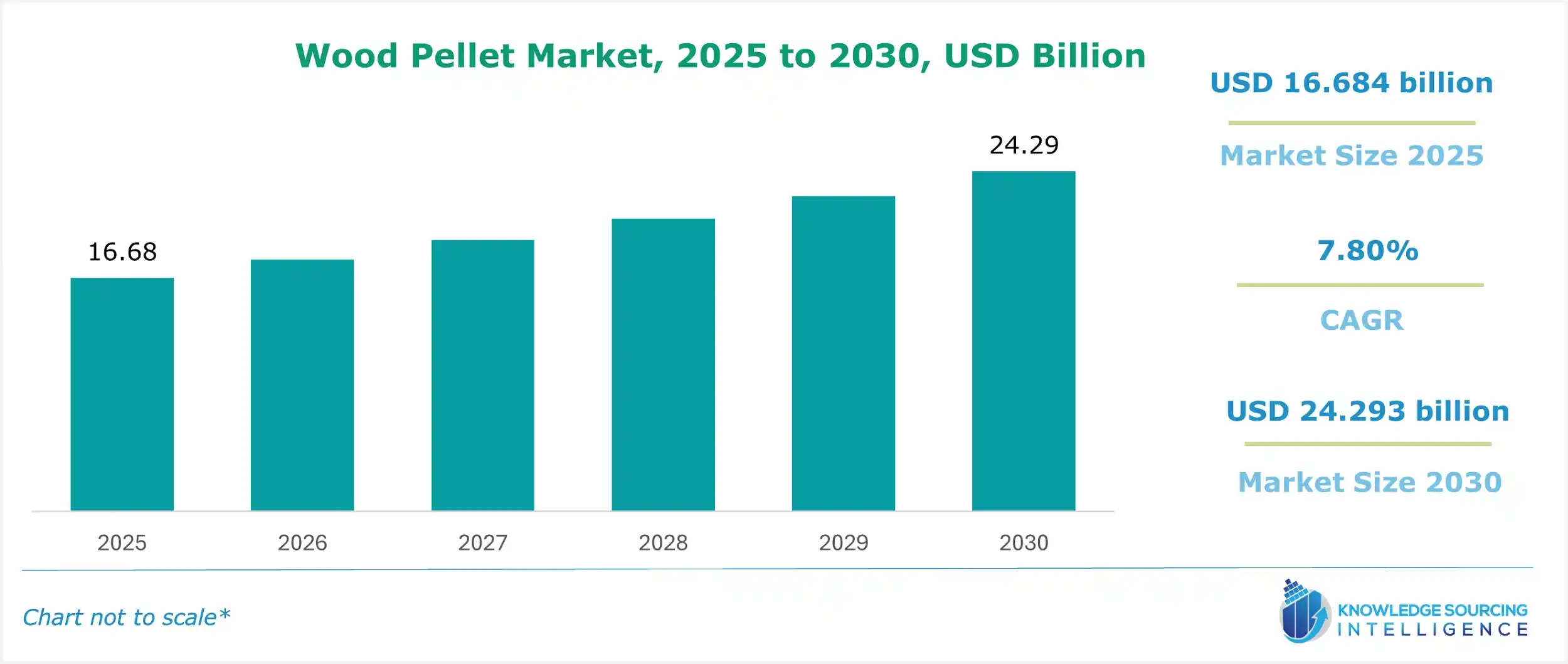

Wood Pellet Market Size:

The Global Wood Pellet Market is expected to grow at a compound annual growth rate (CAGR) of 7.80%, from US$16.684 billion in 2025 to US$24.293 billion in 2030.

Wood Pellet Market Trends

Wood pellets have emerged as a viable and promising renewable energy source, replacing coal, especially in Europe and North America. The pellet market has witnessed significant growth worldwide over the past few years, with increasing demand for industrial applications in large-scale power plants and small-scale applications in residential heating systems. Government policies and incentives for renewable energy, along with technological advancements in pellet production, have led to market growth.

Wood Pellet Market Growth Drivers:

Rising environmental concerns and growing regulations to reduce GHG emissions: The market for wood pellets is gaining remarkable traction since they have low carbon footprints. Concerns about environmental sustainability worldwide are driving the rising demand for wood pellets, fueling market growth. Governments from various countries and global organizations are constantly taking the necessary steps and measures to achieve their target of reducing carbon footprints or greenhouse gas (GHG) emissions. The limited availability of non-renewable resources and their adverse impact on the environment have made it necessary for the world economy to switch to alternative power sources without harming the environment.

Governments worldwide have set their targets aimed at moving towards different renewable energy sources. Austria, for example, has set a goal of achieving 100 percent renewable electricity by 2030. France has committed to cutting its GHG emissions and going ‘carbon-neutral’ by 2050, aligning with the 2015 Paris Climate Agreement. The Philippines has pledged to reduce carbon emissions from the transportation, energy, waste, forestry, and industry sectors by 70% by 2030. The escalating environmental concerns about GHG emissions in different countries have made biomass fuels popular. In recent years, significant progress has been made in logistics and advancements in combustion technology, further boosting the global wood pellet market growth.

Rising investment in research and development: The global wood pellet market players are actively engaged in R&D activities to increase the efficiency of the wood pellet manufacturing process and gain a competitive edge over their rivals. As such, new and advanced designs for pellet mills are being developed to obtain a high yield with optimum fuel input. Furthermore, extensive research is being conducted to produce wood pellets with a high-calorific value from the available feedstock. All these factors are anticipated to fuel the global wood pellet market growth during the forecast years.

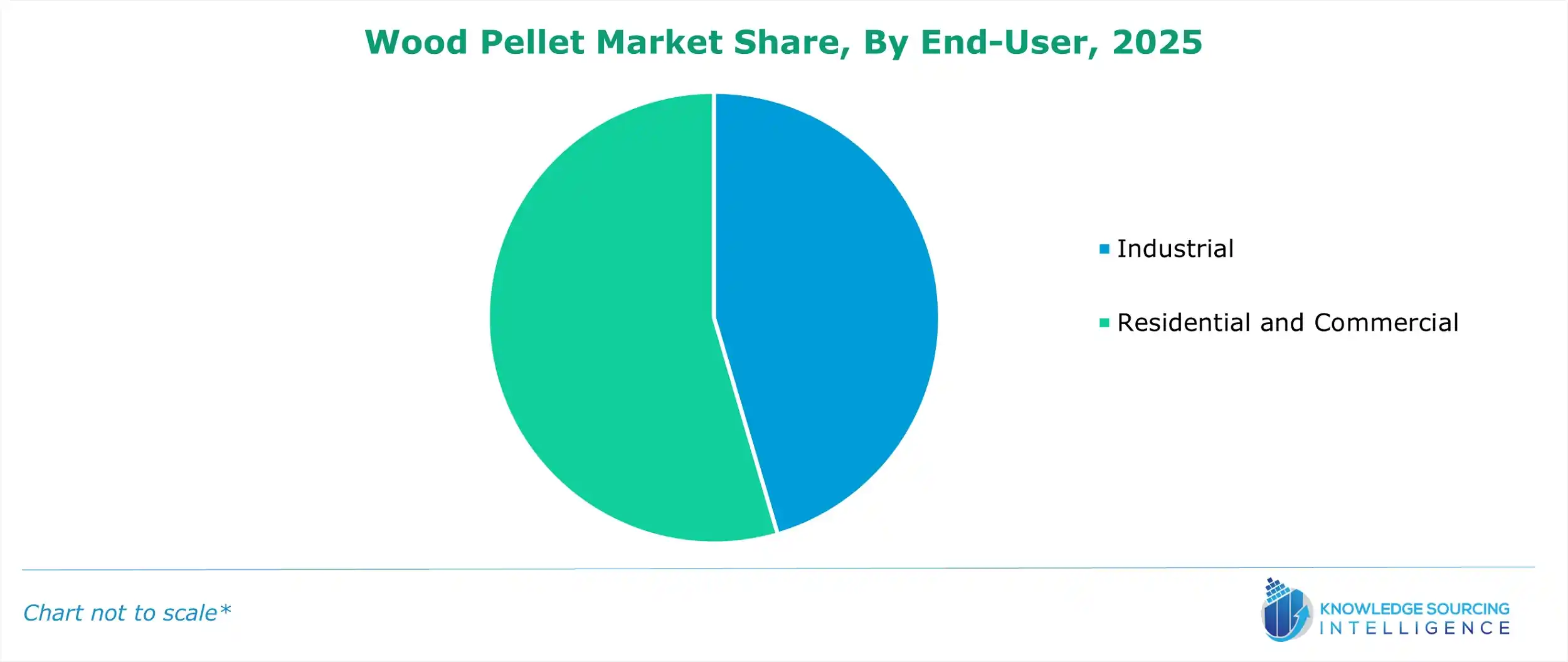

Wood Pellet Market Segmentation Analysis by End-User

Industrial: The industrial sector accounts for a significant share of the wood pellet market. In the industrial segment, wood pellets are used for power generation for various industrial heating processes, and they have applications across multiple industries. The growing governmental regulations for reducing carbon emissions by adopting renewable energy sources are driving its demand in this sector. The Wood Pellet Annual on European Union report by the USDA shows that approx. 50% of the wood pellets are used for large-scale industrial uses.

Residential and Commercial: The residential and commercial segment is estimated to have a growing trajectory during the forecast period. The residential sector uses wood pellets for heating and cooking purposes, while in the commercial sector, such as in hotels, restaurants, offices, and others, they are used for heating. In the EU, the largest market of wood pellets, Italy, Germany, France, Austria, Sweden, and Spain hold significant market share for its residential use. The German law requiring that buildings constructed after 2009 use a specific percentage of renewable energy has increased demand for wood pellets in residential and commercial markets. As a result, the number of wood pellet-based heating units in Germany rose to 722,000 in 2023.

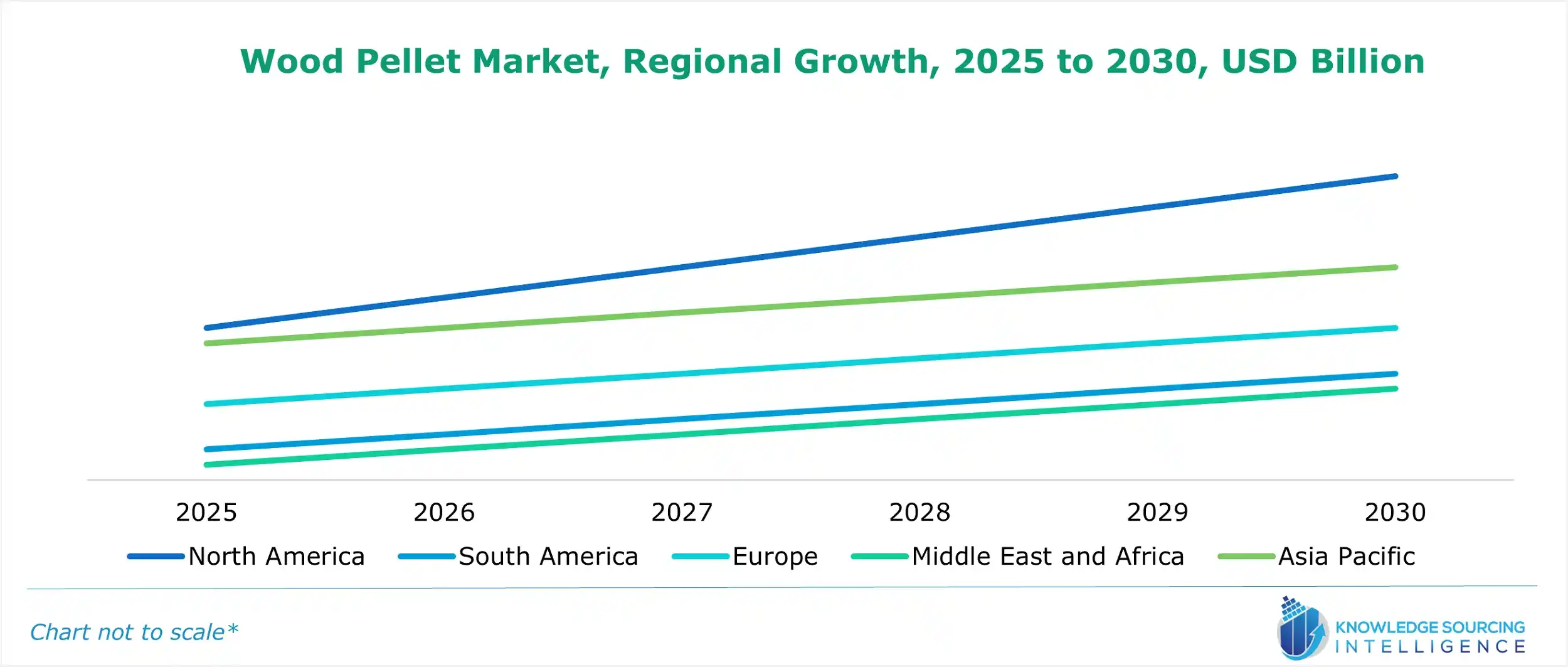

Wood Pellet Market Geographical Outlook:

Europe will continue to dominate the market.

North America: North America is also increasing its wood pellet consumption owing to the regional price competitiveness with propane and residential heating oil. Rapid replacement of traditional burners for improved feed-in is also spurring the demand for wood pellets.

Europe: Europe accounted for the major share of the global wood pellets market. EU Biomall policies such as EU’s Renewable Energy Directive, Renewable Energy Directive II, and others are contributing to its dominance in the wood pellet market. According to the USDA Foreign Agricultural Service, the EU consumed an estimated 24.5 million metric tons of wood pellets in 2023. It is estimated to consume 25.5 million metric tonnes in 2024. As per the same report, the EU had 774 wood pellet plants in 2021, increasing from 630 in 2016.

Additionally, stringent regulations regarding environmental sustainability and continuous efforts to achieve their emission targets within the specified period contribute significantly to the dominance of the European region in this market. Supportive government initiatives and the incentives offered by the EU member states also drive this market expansion.

Asia: The Asia Pacific (APAC) wood pellet market is projected to witness a noteworthy compound annual growth rate (CAGR) during the forecast period. Favorable government policies to ramp up the use of wood pellets for power generation and the increasing number of power plants are fuelling the demand for wood pellets in APAC countries, especially in Japan, South Korea, and China. The rising focus on the renewable energy sector in APAC countries is further propelling regional market growth. Samsung C&T has been continuously expanding its role in importing wood pellets to South Korea, which lacks natural energy resources. The country is also aggressively subsidizing the biomass sector so heavily that it is hindering the adoption of other renewable energy sources like wind and solar.

South America: South America is also expected to witness a considerable CAGR during the forecast period. The region consists of over one-fourth of the world’s forests. As such, rising investments in the forestry sector will continue to drive the availability of raw materials, thus positively impacting the market growth by aiding the production of wood pellets.

Middle East and Africa: The Middle East and Africa will also grow at a considerable CAGR due to the rising demand for wood pellets for residential cooking purposes in South Africa. Furthermore, the continuous efforts of governments in countries to reduce their reliance on coal-fired plants will further accelerate the demand for wood pellets in this region.

Wood Pellet Market – Competitive Landscape:

Drax Group

Enviva

German Pellets

Graanul Invest

These companies are the major market players in the global wood pellet market. They are anticipated to continue dominating the market as they are the leading companies with large production capacity, allowing them to meet the customer's demand. Their focus on sustainability and investment in research and development are leading them in the market.

Wood Pellet Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 16.684 billion |

| Total Market Size in 2030 | USD 24.293 billion |

| Forecast Unit | Billion |

| Growth Rate | 7.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Wood Pellet Market Segmentation:

By Application

Heat

CHP

Power

By End-User

Industrial

Residential and Commercial

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others