Report Overview

ESG Advisory Services Market Highlights

ESG Advisory Services Market Size:

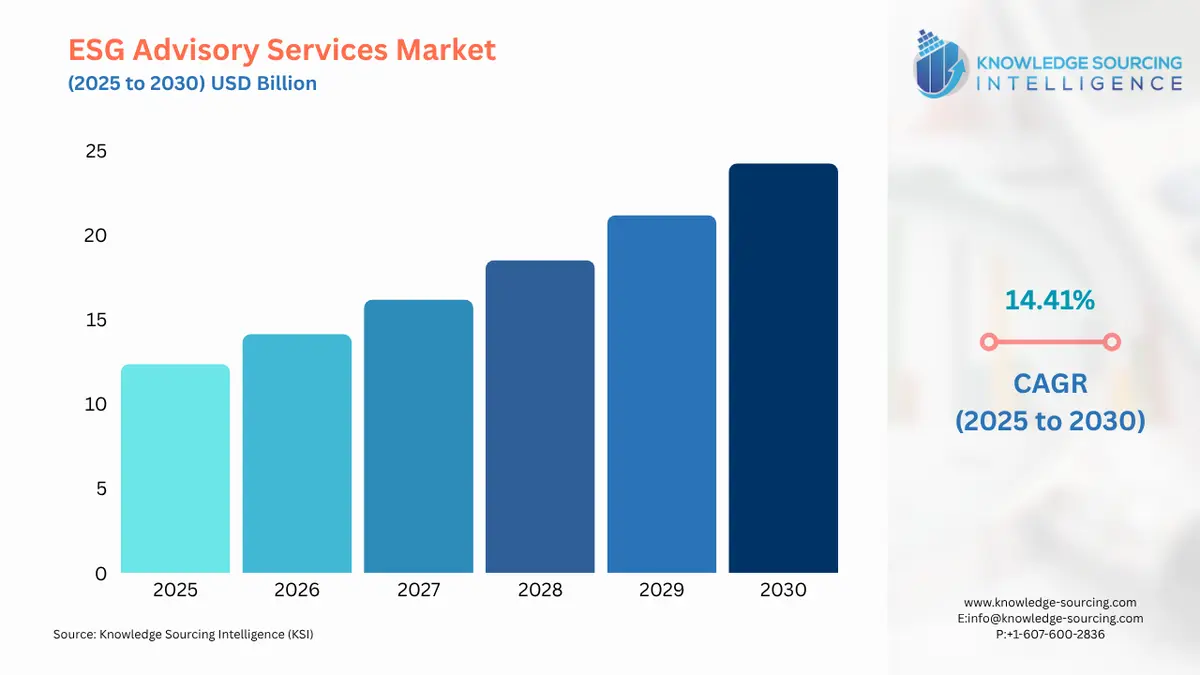

The ESG Advisory Services Market is foreseen to grow at a CAGR of 14.41%, climbing to USD 24.236 billion in 2030 from USD 12.361 billion in 2025.

The ESG advisory services market refers to consulting and professional services that help other organizations to integrate their Environmental, Social, and Governance (ESG) principles into their business strategies, operations, and investments. With the growth of ESG and other regulations such as EU CSRD, ISSD, and SEC climate disclosures across countries, organizations are increasingly demanding consultation for navigating regulatory compliance, improving sustainability performance, and also aligning with the stakeholders' expectations.

With increasing government regulations on ESG, and stakeholder pressure along with organizations business strategies to get the ESG benefits such as better financing access, resilience, and competitive advantage, is driving the market.

ESG Advisory Services Market Overview & Scope

The ESG Advisory Services Market is segmented by:

- Component: The market is segmented by type into full-spectrum advisory services, ESG reporting and disclosure services, climate and carbon advisory services, ESG ratings & investment advisory, and supply chain & social impact services.

- Deployment Mode: The market is segmented by delivery mode into on-site consulting, remote/virtual advisory, and hybrid models.

- Application: The market is segmented by client type into corporates, institutional investors, private equity & venture capital firms, government & regulatory bodies, and NGOs & development organizations.

- End-User: The market is segmented by end-user into financial institutions, industrial and energy sectors, technology and services, consumer-facing industries, and public and regulatory bodies.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific.

Top Trends Shaping the ESG Advisory Services Market

- Integration of ESG into Business Strategy and Risk Management

The market is experiencing a major shift into a demand driver. It is moving from just a regulatory compliance requirement to a broader market strategy. Organizations are demanding advisory services to identify ESG risks and opportunities and integrate sustainability into operations and investment decisions. - Shift Towards Standardization of ESG Reporting

There is a global push towards standardization of ESG frameworks, which is driving market consolidation. The growth towards ESG consolidation is helping advisory firms to align companies' reporting with these standards.

ESG Advisory Services Market Growth Drivers vs. Challenges

Opportunities:

- Increasing Regulatory Pressure for ESG Compliance: One of the key factors driving the market is the growing regulatory pressure from the government bodies for aligning with ESG norms. They are making ESG disclosures mandatory, pressurizing companies to comply with these, and driving the demand for these ESG platforms. For instance, the EU’s Corporate Sustainability Reporting Directive mandates that companies above a certain size (those with more than 1000 employees) disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment. Similarly, the USA’s SEC Climate Disclosure Rule and India’s BRSR are forcing firms to adapt to these norms, driving the market growth. Since making these compliance errors can cause very heavy damage to the companies, both in economic terms and market, such as a company may lose access to green financing, ESG funds, or favorable lending terms and reputational damage, organizations demand advisory services.

- Rising Demand Driven by ESG as a Business Strategy: Organizations are increasingly demanding ESG advisory services from consulting firms and specialized ESG providers because they are not viewing ESG compliance only as a regulatory requirement, but rather their business strategies. They see it as long-term growth and operational efficiency factors, driving the demand for ESG advisory services.

Challenges:

- High Advisory fee: One of the key challenges that is limiting the market growth and potential is cost. ESG compliance itself requires substantial cost, and the advisory fee taken by the ESG advisory firm increases their cost substantially. As ESG advisory firms offer their specialized expertise, data analytics, and regulatory knowledge, their charges are higher, which becomes a key limitation for the adoption, especially for small and mid-sized companies.

ESG Advisory Services Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific is experiencing rapid growth in ESG advisory services demand, driven by growing regulatory mandates as well as growing demand. They have a key demand, driven by their large addressable market due to the presence of multinational corporations, emerging startups, and state-owned enterprises who are seeking ESG compliance and strategy advisory. These MNCs are also seeking advisory for business strategy, again driving the demand.

ESG Advisory Services Market Competitive Landscape

The market is fragmented, having the presence of some major consulting giants such as Deloitte, Accenture, PwC, EY, KPMG, BCG, Bain and Company and McKinsey and Company. It also has some major specialized ESG research and rating firms, such as MSCI ESG and Sustainalytics, with the presence of some major niche sustainability consultants.

- Product Launch: In August 2025, Green Co, an ESG Consulting firm, launched a new digital product, ESG Action Toolkit+ AI App. It offers AI-driven technology, toolkit functions, sustainability checklists, a knowledge sharing hub and other features.

- Market Expansion: In May 2025, Re Sustainability Limited (ReSL) launched Integrated Sustainability Solutions for helping businesses to fully integrate across operations, infrastructure, and investment strategies in India. It will offer sustainability and ESG advisory, permitting and regulatory compliance, environmental due diligence and remediation services, environmental infrastructure, operations and maintenance, and decarbonisation and climate action services.

- Market Entry: In February 2023, UL Solutions launched its environmental, social and governance (ESG) advisory and assurance practice, to offer companies with ESG services. It started operations in more than 100 countries.

ESG Advisory Services Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 12.361 billion |

| Total Market Size in 2031 | USD 24.236 billion |

| Growth Rate | 14.41% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Delivery Mode, Client Type, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

ESG Advisory Services Market Segmentation:

- By Type

- Full-Spectrum Advisory Services

- ESG Reporting and Disclosure Services

- Climate and Carbon Advisory Services

- ESG Ratings & Investment Advisory

- Supply Chain & Social Impact Services

- By Delivery Mode

- On-Site Consulting

- Remote/Virtual Advisory

- Hybrid

- By Client Type

- Corporates

- Institutional Investors

- Private Equity & Venture Capital Firms

- Government & Regulatory Bodies

- NGOs & Development Organizations

- By End-User

- Financial Institutions

- Industrial and Energy Sectors

- Technology and Services

- Consumer-Facing Industries

- Public and Regulatory Bodies

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America