Report Overview

Coal Mining Market - Highlights

Coal Mining Market Size:

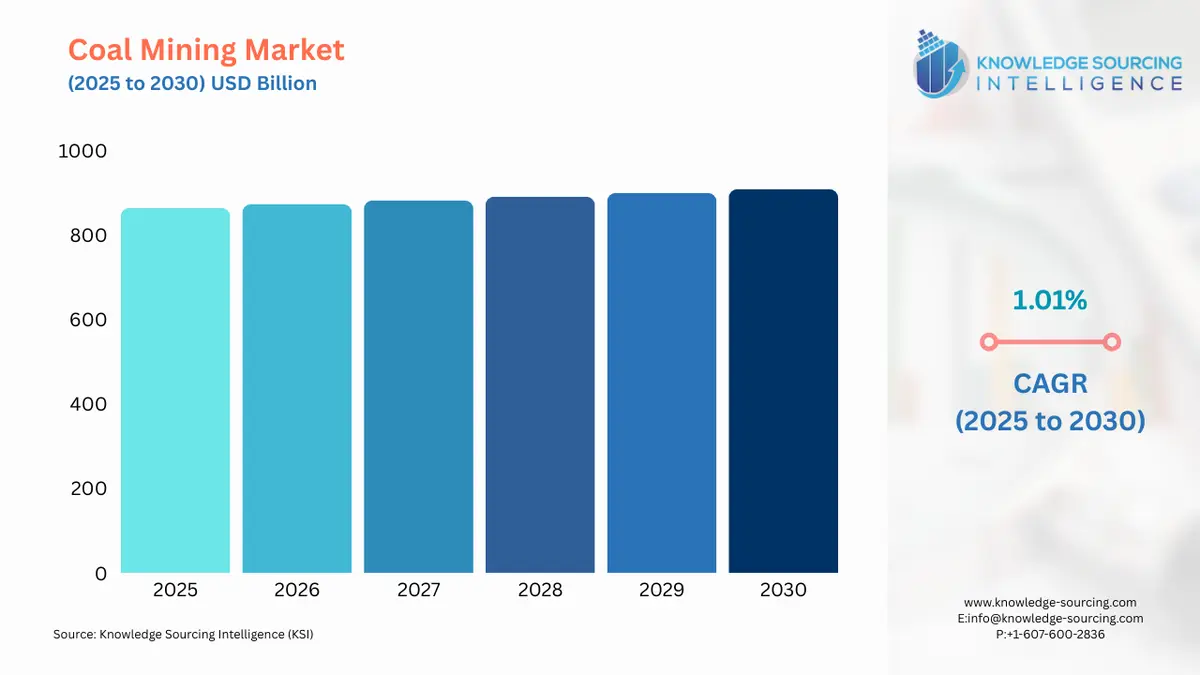

The Coal Mining Market is expected to grow at a CAGR of 1.01%, reaching USD 908.650 billion in 2030 from USD 864.222 billion in 2025.

The global coal mining market is a critical, yet highly contested, component of the international energy and industrial landscape. Its historical dominance as a primary fuel for power generation and industrial processes continues, but the industry operates within an environment of profound transformation. The market's trajectory is defined by a dichotomy: robust demand from developing economies seeking to power industrialization and urbanization, contrasted with a rapid decline in consumption in developed nations pursuing decarbonization. The necessity for coal is not uniform and is segmented by type, quality, and end-use application, each subject to unique economic and regulatory pressures.

Coal Mining Market Analysis:

- Growth Drivers

The primary drivers in the coal mining market are directly linked to fundamental economic and demographic trends in emerging and developing economies. The most significant catalyst is the sustained demand for electricity, particularly in Asia. The International Energy Agency (IEA) reports that coal use for power generation reached a record level in 2024, accounting for a new high of 10,766 TWh. In countries like China and India, which together constitute a majority of global coal consumption, electricity demand is growing alongside industrial expansion and urbanization. The expansion of industrial sectors and the construction of new infrastructure in these regions directly drives demand for thermal coal to power manufacturing facilities and for coking coal in the steel and iron industries.

The steel and cement industries are also foundational growth drivers. The production of steel, an indispensable material for construction and manufacturing, relies on metallurgical (coking) coal. The growth of construction and infrastructure projects, particularly in Asia, propels demand for both steel and cement, which in turn creates a direct and persistent need for the specific types of coal required for these processes. While the power sector receives considerable attention, the stable demand from these industrial applications provides a critical and less volatile base for the market. Finally, the intermittency of renewable energy sources, such as solar and wind, has led some regions to maintain and, in some cases, increase their reliance on coal as a reliable baseload power source to ensure energy security. This dynamic provides a temporary but significant demand driver in a market otherwise facing long-term decline in certain geographies.

- Challenges and Opportunities

The coal mining market faces significant headwinds, primarily driven by global decarbonization efforts and the rapid deployment of renewable energy technologies. The most pressing challenge is the widespread implementation of climate policies and carbon pricing mechanisms, which directly increase the operational costs for coal-fired power plants. In advanced economies, these policies, combined with the declining cost of natural gas and renewable energy, have led to the retirement of numerous coal plants, resulting in a structural decline in demand. The IEA reports that in 2024, coal requirement declined significantly in the European Union and the United States. This trend directly erodes the market for thermal coal in these regions. Furthermore, the increasing public and political focus on environmental, social, and governance (ESG) factors makes it more difficult for coal companies to secure financing and insurance, thereby constraining capital investment and long-term viability.

Despite these challenges, opportunities exist, particularly in the realm of operational efficiency and market diversification. The primary opportunity is for companies that can efficiently and cost-effectively supply the remaining high-demand markets. As coal consumption shifts to Asia, companies with mines in countries like Indonesia and Australia, which are major exporters, are well-positioned. There is also an opportunity to capture value from the demand for higher-quality, lower-ash coal, which is more efficient and can help meet stricter environmental regulations in importing countries. In some regions, a specific opportunity lies in supplying metallurgical coal to the steel industry, a sector that lacks a readily available, scalable alternative to coal in the steelmaking process. Companies that can specialize in this segment of the market may find a more resilient demand profile. Another emerging opportunity involves carbon capture, utilization, and storage (CCUS) technologies. While still nascent, the development of these technologies could potentially allow coal to remain a part of the energy mix in the long term by mitigating its carbon footprint.

- Raw Material and Pricing Analysis

In the context of the coal mining market, the raw material is the coal itself. Its pricing dynamics are a function of a complex global market that is influenced by both supply and demand fundamentals and logistical constraints. The price of thermal coal is primarily determined by its energy content (measured in calorific value) and its sulfur and ash content. Higher-quality coal with greater energy content commands a premium. The pricing of metallurgical coal, used in steelmaking, is similarly based on its coking properties.

Recent pricing trends have been impacted by an oversupply from major producing countries. The IEA reports that in the first half of 2025, thermal coal prices dropped to their lowest since 2021. This downward pressure is a direct result of production in China and India outpacing demand in those countries, leading to a surplus that is being absorbed by global markets. This has also reduced the price of seaborne coal, making it more competitive and thereby reducing the import dependence of some major consumers. The pricing environment is also sensitive to geopolitical events, which can disrupt trade flows and create price volatility.

- Supply Chain Analysis

The global coal supply chain is a complex logistical network that connects mining operations to end-user industries. It can be broadly segmented into two primary components: the production of coal and its subsequent transport. Production hubs are concentrated in a few key geographies, most notably China, India, Indonesia, Australia, and the United States, which together produce the majority of the world's coal. Once mined, coal is prepared and processed to meet quality specifications and then transported to consumers via a variety of methods, including rail, barges, and maritime shipping.

Logistical complexities are a defining feature of the supply chain. The sheer volume and weight of coal require robust and efficient rail and port infrastructure. Bottlenecks at these transport hubs can cause significant delays and increase costs, thereby impacting the final delivered price and, in turn, the demand for coal. The supply chain for seaborne coal, which is critical for markets like Japan and South Korea, is particularly vulnerable to disruptions. Furthermore, the dependence of major consumers on a few key exporters creates geopolitical dependencies. The supply chain is a critical determinant of market dynamics, as a breakdown in any part of the chain can have immediate and dramatic effects on supply and pricing in distant markets.

- Government Regulations

Government regulations are a principal force shaping the coal mining market, directly influencing production, consumption, and trade. Policies are increasingly focused on reducing carbon emissions and transitioning to cleaner energy sources. These regulations create direct market impacts by raising the costs of coal-based power generation and incentivizing alternative energy investments.

- European Union: Emissions Trading System (ETS) and European Green Deal

The EU ETS places a cap on carbon emissions and requires companies to purchase allowances for each tonne of CO2 emitted. This directly increases the operational costs for coal-fired power plants, making them less economically competitive compared to natural gas and renewables. The European Green Deal further solidifies this trend by setting ambitious climate targets and policies that accelerate the phase-out of coal-fired generation, thereby reducing demand for thermal coal across the bloc. - China: National Energy Administration (NEA) and policies on domestic production capacity

China, while the largest consumer of coal, is actively managing its domestic market. Its policies focus on ensuring energy security by increasing domestic production to reduce import dependence. This drives demand for domestically produced coal while simultaneously impacting international seaborne coal prices. The government also promotes efficiency and safety standards, leading to the closure of smaller, less efficient mines and consolidating production among larger, more technologically advanced operations. - India: Ministry of Coal, commercial coal mining auctions

The Indian government, through the Ministry of Coal, has implemented a series of reforms aimed at augmenting domestic production and reducing import reliance. The introduction of commercial coal mine auctions has opened the sector to private participation, increasing competition and incentivizing capacity additions. This policy directly increases domestic supply, thereby reducing the country's import demand and strengthening India's energy self-sufficiency. - United States: Environmental Protection Agency (EPA) regulations and state-level policies

While the US has seen a significant decline in coal use, federal and state-level regulations continue to play a role. EPA regulations on air and water emissions from power plants increase compliance costs for coal-fired generators. At the same time, state-level renewable portfolio standards and commitments to carbon reduction create a powerful market signal that favors renewable energy over coal, leading to the closure of coal plants and a corresponding drop in thermal coal demand.

Coal Mining Market Segment Analysis:

- By Application: Power Generation

The power generation segment is the single largest consumer of coal globally, and its demand profile is the most critical determinant of the overall market's health. The need for reliable, baseload electricity generation fundamentally drives the demand for coal in this segment. In countries with rapidly growing economies and populations, like China and India, the expansion of the industrial sector and household electricity consumption creates an insatiable demand for power. Coal-fired power plants provide a stable and consistent supply of electricity, which complements the intermittent nature of renewable energy sources. This reliance on coal for energy security is a key growth catalyst, especially in regions with limited access to natural gas or other fuels. However, this requirement is under immense pressure from climate policies and the falling costs of wind and solar power, which are increasingly displacing coal in the energy mix. The future demand for thermal coal in power generation is therefore directly tied to the pace of the global energy transition and the ability of a country's power grid to integrate large-scale renewable generation.

- By End-User Industry: Steel & Iron

The steel and iron industry is a foundational consumer of metallurgical coal, and its demand profile is distinct from that of the power sector. Metallurgical coal is an indispensable component of the blast furnace process used to produce steel. Its unique coking properties, which transform it into a porous, high-carbon fuel, are essential for both providing heat and acting as a reducing agent in the steelmaking process. The necessity for this type of coal is therefore directly linked to global steel production. The sustained demand for steel, driven by urban development, infrastructure projects, and the automotive industry, ensures a continuous and less volatile market for metallurgical coal. While alternative steelmaking methods exist, such as electric arc furnaces (EAFs), which use scrap metal and do not require coal, the global reliance on traditional blast furnaces ensures that metallurgical coal retains its importance. The need for coking coal is less susceptible to the same regulatory pressures as thermal coal, as the steel industry has yet to identify a commercially viable, large-scale substitute that can replace coal's function in the blast furnace.

Coal Mining Market Geographical Analysis

- US Market Analysis: The US coal market is defined by a consistent, long-term decline in demand, primarily due to intense competition from low-cost natural gas and a rapid increase in renewable energy generation. The US Energy Information Administration (EIA) reports that in the first quarter of 2025, US coal consumption increased compared to the same period in 2024, driven by strong electricity demand and higher natural gas prices. This increase, however, is a short-term trend within a broader context of coal plant closures. The market's structural shift is driven by a combination of market forces and regulatory pressures. The availability of low-cost shale gas has made natural gas the preferred fuel for power generation, directly displacing coal. State-level policies mandating renewable energy targets and federal environmental regulations on air emissions from power plants have further accelerated this transition. While the US possesses the world's largest coal reserves, production is declining, and the market's focus has shifted towards exports, particularly for metallurgical coal, which finds a market in international steelmaking.

- Brazilian Market Analysis: Brazil's coal mining market is relatively small compared to other global players, but it serves a vital role in the country's energy mix. The market for coal is primarily driven by the steel industry and a few thermal power plants. The country's necessity for metallurgical coal is directly linked to its domestic steel production. The Brazilian government's energy policy is heavily reliant on hydropower, which can be vulnerable to droughts. During periods of low rainfall, thermal power plants, including those that use coal, are brought online to ensure grid stability. This intermittent need for coal creates a volatile but critical demand driver. The country's coal resources are predominantly lower-quality, sub-bituminous coal, and it remains a net importer of higher-quality metallurgical and thermal coal to meet industrial and power sector needs.

- German Market Analysis: Germany’s coal market is a clear case study of a nation's deliberate policy-driven phase-out of a fossil fuel. The country's coal market has been in a steep and steady decline, driven by its national policy commitment to phase out coal-fired power generation. The European Union's Emissions Trading System (ETS) has made coal power increasingly uneconomical, and Germany's national energy transition, the Energiewende, has prioritized a shift to renewable energy and natural gas. The closure of coal-fired power plants directly erodes demand for both lignite, a soft coal mined domestically, and imported thermal coal. Despite this, some of Germany's industrial sectors, particularly steel and cement, continue to rely on coal, though there is a growing push for decarbonization in these sectors as well. The German market is therefore a leading indicator of the long-term headwinds facing the coal industry in advanced economies.

- South African Market Analysis: South Africa’s coal market is a cornerstone of its national economy and energy supply. The country is a major global producer and exporter of thermal coal, and demand is driven by its own significant power generation needs, which are almost entirely met by coal-fired power plants operated by the state-owned utility, Eskom. The need for coal is therefore directly tied to the country's industrial and domestic electricity consumption. The South African market is also a major global supplier of high-quality thermal coal for export, primarily to India and China. While the government has expressed a long-term commitment to a cleaner energy transition, the country's immediate and persistent energy security needs ensure a stable and robust domestic demand for coal. The market's health is highly dependent on Eskom's operational efficiency and the government's ability to maintain a stable export infrastructure.

- Australian Market Analysis: Australia's coal market is one of the most significant globally, with its demand profile heavily skewed toward exports. The country is the world's largest exporter of metallurgical coal and a major thermal coal exporter. Domestic demand for coal is a fraction of its total production, with the country’s primary growth driver being its export partners, particularly in Asia. The market’s health is therefore a direct reflection of global, particularly Asian, steel production and energy demand. The country's production is dominated by large-scale, low-cost surface mining operations. While the country is facing increasing pressure from global climate policies, its position as a reliable supplier of high-quality coal to major consumers like Japan, South Korea, and India ensures a resilient demand stream. The Australian market is a clear example of a coal-producing nation whose demand is a function of global, rather than domestic, consumption patterns.

List of Top Coal Mining Companies:

The global coal mining market is characterized by a mix of state-owned enterprises, particularly in Asia, and large, publicly-traded international corporations. Competition is based on production scale, cost efficiency, and access to key export markets. Companies with high-quality reserves and well-established logistical networks are best positioned to navigate the market's volatility.

- Peabody Energy: A major US-based coal company with a diversified portfolio of thermal and metallurgical coal operations. The company's strategic positioning is focused on maximizing value from its large, low-cost mines in the US and Australia. Its strategy involves optimizing its US thermal operations to serve domestic power demand while also leveraging its Australian operations to access higher-growth seaborne markets, particularly in Asia. Peabody’s portfolio re-weighting towards greater seaborne thermal and metallurgical coal access is a direct response to declining demand in its home market.

- Glencore: A global commodities giant with a significant and diversified coal portfolio. Glencore's competitive advantage lies in its extensive global footprint, which includes mines in Australia, South Africa, and Colombia, and its integrated marketing and trading network. The company is strategically positioned to navigate shifting demand by leveraging its logistical capabilities to serve multiple markets. Glencore’s recent acquisition of the majority of Teck Resources' metallurgical coal business strengthens its position as a major supplier to the global steel industry, a segment with more resilient demand.

- Coal India Limited (CIL): A state-owned, monolithic coal producer in India that dominates the domestic market. CIL's strategic positioning is directly aligned with the Indian government's imperative to ensure national energy security and reduce coal imports. Its primary focus is on expanding domestic production to meet the country's massive and growing demand for electricity and industrial use. CIL’s competitive advantage is its near-monopoly status and the government's support, which insulates it from some of the international competitive pressures faced by other global players. Its mission is to increase domestic supply and reduce India's reliance on foreign coal, a trend that directly impacts global trade flows.

Coal Mining Market Developments

- January 2025: Arch Resources and CONSOL Energy completed an all-stock merger of equals to create a new entity, Core Natural Resources. The merger combines two major North American coal producers with a world-class portfolio of high-quality, low-cost longwall coal mining assets and strong distribution networks. This strategic consolidation is a response to market pressures and is intended to create a more resilient and efficient company capable of competing in global markets.

- December 2024: The Indian Ministry of Coal signed Coal Mine Development and Production Agreements for seven new mines under its commercial coal mine auction policy. The signing of these agreements, which included private sector participation for the first time, signals a clear policy shift aimed at boosting domestic production and reducing import dependency, thereby directly influencing the country's demand for foreign coal.

Coal Mining Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Coal Mining Market Size in 2025 | USD 864.222 billion |

| Coal Mining Market Size in 2030 | USD 908.650 billion |

| Growth Rate | CAGR of 1.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Coal Mining Market |

|

| Customization Scope | Free report customization with purchase |

Coal Mining Market Segmentation:

- By Type

- Lignite

- Sub-bituminous

- Bituminous

- Anthracite

- By Application

- Power Generation

- Industrial

- Others

- By End-User Industry

- Cement

- Steel & Iron

- Power

- Others

- By Mining Method

- Underground Mining

- Surface Mining

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa