Report Overview

Iron Ore Mining Market Highlights

Iron Ore Mining Market Size:

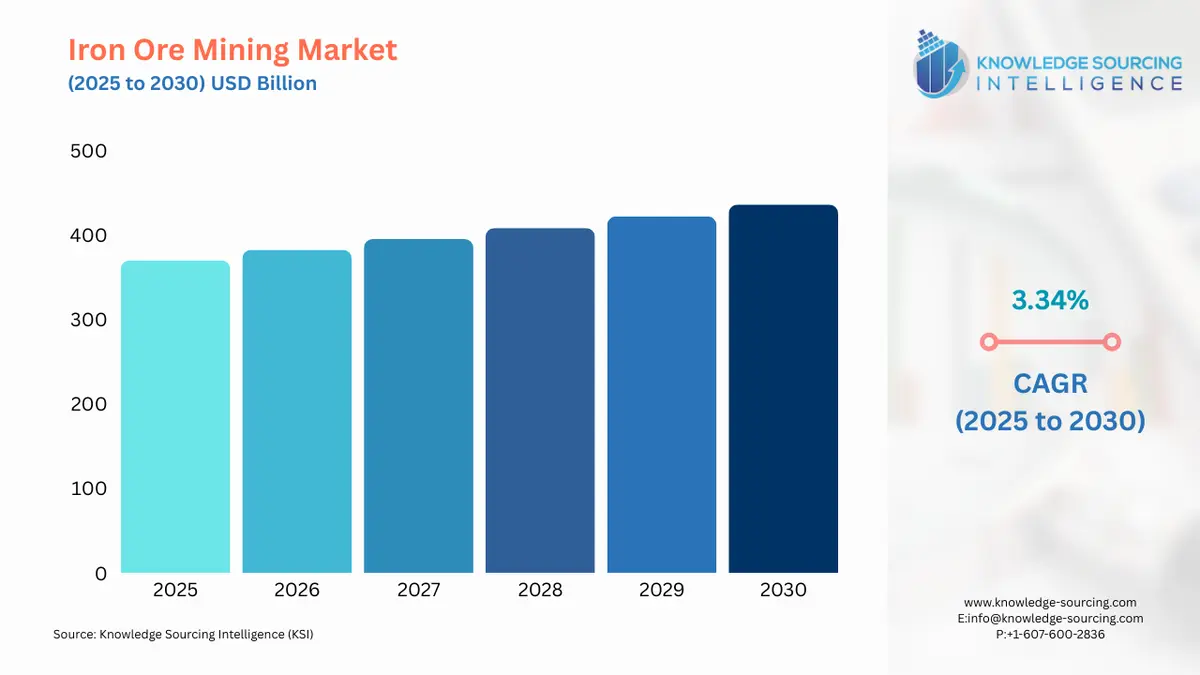

The Iron Ore Mining Market is expected to grow at a CAGR of 3.34%, reaching USD 436 billion in 2030 from USD 370 billion in 2025.

The global iron ore market is a foundational component of the industrial economy, with its dynamics inextricably linked to the global steel industry. As the principal raw material for steel, iron ore demand is a direct reflection of activity in the construction, automotive, and heavy machinery sectors. The market is defined by a dichotomy of short-term cost pressures and long-term strategic shifts. While cyclical fluctuations in steel prices and an oversupply of lower-grade ore have presented near-term challenges for miners and steelmakers, the industry is simultaneously navigating a profound transformation driven by the imperative of decarbonization. This transition is influencing investment patterns, shaping demand for specific ore types, and reconfiguring the competitive landscape.

Iron Ore Mining Market Analysis

- Growth Drivers

Demand for iron ore is fundamentally propelled by the escalating need for steel, which is the cornerstone of modern infrastructure and industrial development. The primary catalyst is rapid urbanization and industrialization in emerging economies, particularly in the Asia-Pacific region. As nations like India embark on extensive government-funded infrastructure projects—including railways, bridges, and housing—the demand for construction-grade steel surges. This directly translates into a heightened requirement for iron ore, which constitutes approximately 98% of the raw material for steel production. This relationship is direct: a new bridge or high-rise building project is an immediate and substantial demand signal for steel, which in turn pulls a specific volume of iron ore through the supply chain.

Another significant driver is the global transition to cleaner energy systems. The construction of renewable energy infrastructure, such as wind turbines and solar panel arrays, is steel-intensive. The manufacturing of wind turbines alone requires large quantities of high-grade steel for their towers and foundations. Similarly, the automotive industry's pivot toward electric vehicles (EVs) is driving demand for specific steel grades, as automakers seek lighter, stronger materials for vehicle chassis and battery components. This technological shift does not simply create generic demand; it specifically incentivizes the use of high-quality iron ore inputs to produce advanced steels.

- Challenges and Opportunities

The iron ore mining market faces significant headwinds, primarily from a structural slowdown in steel consumption in major markets. The deceleration of China’s property sector, a long-standing pillar of global steel demand, poses a substantial challenge. Weakness in new home starts and a focus on managing existing housing inventory have directly curtailed the need for construction steel, which has a ripple effect on iron ore demand and has contributed to price volatility. Furthermore, a broader economic slowdown and rising geopolitical tensions have introduced unpredictability into global trade flows and steel demand.

Conversely, significant opportunities are emerging from the very challenges of decarbonization. The global imperative to reduce carbon emissions from the steel industry is creating a new demand segment for high-grade iron ore and pelletized feed. Traditional blast furnaces require coking coal, but the nascent green steel production using hydrogen-based Direct Reduced Iron (DRI) technologies is highly dependent on high-quality, pure iron ore. Europe is at the forefront of this shift, with investments in DRI plants creating a premium market for specific iron ore products. This trend presents a long-term opportunity for miners who can supply the high-purity ore required for these cleaner processes, allowing them to differentiate their product and command higher prices.

- Raw Material and Pricing Analysis

Iron ore is the singular raw material for the iron ore mining market. Pricing is a complex dynamic influenced by both supply and demand fundamentals, as well as the specific grade of the ore. The market has traditionally been dominated by a handful of major producers, who historically set annual benchmark prices. However, in recent years, the market has shifted toward a more dynamic, spot-based pricing system. The price is highly sensitive to fluctuations in Chinese steel production, as China is the world's largest consumer and importer of seaborne iron ore. A key trend is the widening price spread between high-grade (62%+ Fe content) and lower-grade ores. As steelmakers focus on improving efficiency and reducing emissions, they favor high-purity ore that requires less energy and coking coal for processing, making it more cost-effective in the long run. This preference has created a two-tiered market where high-grade ore commands a significant premium, while lower-grade material faces downward price pressure and oversupply challenges.

- Supply Chain Analysis

The global iron ore supply chain is characterized by a high degree of geographical and corporate concentration. Production is heavily centralized in a few key nations, with Australia and Brazil dominating seaborne exports. From the mine, the iron ore is typically processed—crushed, screened, and sometimes pelletized or sintered—before being transported via rail to large, dedicated ports. The logistical infrastructure, including extensive rail networks and massive bulk-loading terminals, is a critical component of the supply chain. This infrastructure represents a significant barrier to entry, as the capital expenditure required is immense. From the ports, the ore is shipped in large vessels to major steel-producing centers, primarily in Asia. The supply chain's dependency on a few key choke points—from a handful of mines to a small number of ports—makes it vulnerable to disruptions from adverse weather events, labor strikes, or logistical bottlenecks, which can cause significant price volatility and supply shocks.

- Government Regulations

Government regulations are a critical factor influencing the iron ore mining market. Jurisdictions worldwide are implementing stricter environmental and operational standards, which have a direct impact on both production and cost.

- Australia: Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act)

The EPBC Act mandates rigorous environmental assessments for new mining projects. This lengthens the approval process and increases pre-production costs. The regulatory burden and potential for project delays can limit new supply additions and influence investment decisions. - India: Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act)

The MMDR Act, along with subsequent amendments, governs mineral concession and leasing. The policy changes, such as the auction of mining leases, have introduced greater transparency but also heightened competition for resources. This can impact the long-term operational costs for miners and influence domestic supply dynamics. - China: Environmental Protection Law of the People’s Republic of China

China's strict environmental policies, which include production curbs on steel mills during periods of high pollution, directly reduce the country's demand for iron ore. These intermittent demand shocks create price volatility and require major miners to maintain flexible supply strategies. - Brazil: National Mining Agency (ANM)

Regulations from the ANM, particularly those related to dam safety following major tailings dam failures, have led to production cuts and stricter operational requirements. These measures have increased compliance costs for companies like Vale and have directly constrained supply, influencing global prices. - European Union: European Green Deal

The EU’s policy framework, including a focus on a circular economy and the push for green steel, is creating a demand signal for high-grade iron ore and pellets. These regulations are not constraining supply but are fundamentally altering the demand profile, favoring producers who can supply the high-quality inputs required for low-carbon steel production.

Iron Ore Mining Market Segment Analysis

- Steel Production

The steel production segment is the dominant application for iron ore, consuming over 98% of all globally mined ore. The demand drivers within this segment are multifaceted and tightly linked to global economic cycles. The construction and infrastructure sectors are the most significant consumers of steel, and their activity directly dictates the volume of iron ore required. In recent years, public and private infrastructure spending in developing nations has been the primary engine of demand. This is not a uniform or static demand; it is characterized by specific requirements for different grades of steel. For instance, the construction of a new bridge or skyscraper necessitates structural steel, which is produced from iron ore with specific quality parameters. The demand for iron ore is thus a derived demand, intrinsically tied to the project pipelines of major construction firms and government infrastructure programs. A key factor influencing demand within this segment is the technological shift in steelmaking. The traditional blast furnace method, which utilizes a blend of iron ore fines and lump ore, remains dominant. However, the emerging use of electric arc furnaces (EAFs) and Direct Reduced Iron (DRI) technologies is creating a growing demand for high-grade iron ore pellets, which are purer and more suitable for these processes. This is shifting demand not just in volume but in quality, compelling miners to invest in processing facilities that can produce these premium products.

- By Form: Pellets

Iron ore pellets represent a high-value, processed form of iron ore, and their demand is driven by their superior properties in steel production. Pellets are small, spherical balls of iron ore fines that have been agglomerated and hardened. Their uniform size, high iron content (typically 62-65% Fe), and low impurities make them an ideal feed for both blast furnaces and Direct Reduced Iron (DRI) plants. The demand for pellets is a direct result of steelmakers' pursuit of greater operational efficiency and lower emissions. In a blast furnace, the use of pellets improves gas permeability, which leads to reduced coke consumption and higher productivity. In the context of decarbonization, the demand for pellets is growing rapidly in regions, particularly Europe, that are investing in hydrogen-based DRI technologies. These processes require a very pure iron ore feed, and pellets are the preferred choice. The demand for pellets is therefore not a substitute for traditional ore but an evolution of it, driven by the technological and environmental imperatives of the steel industry. This segment's growth is directly tied to the capital investments and strategic shifts of major steel companies toward cleaner, more efficient production methods.

Iron Ore Mining Market Geographical Analysis

- US Market Analysis: The United States is a significant consumer and producer of iron ore, with a market defined by its maturity and specific end-user demands. The US market is characterized by a strong and steady demand from its domestic steel industry, which is a major supplier to the automotive and construction sectors. Unlike emerging markets, the US does not have the same rapid urbanization-driven demand, but instead, its consumption is tied to industrial output and infrastructure renewal projects. The market is also increasingly influenced by technological advancements, as US steelmakers focus on improving efficiency and reducing emissions. Domestic iron ore production, concentrated primarily in the Great Lakes region, serves a large portion of this demand, particularly through the production of high-quality iron ore pellets that are tailored for use in US blast furnaces.

- Brazil Market Analysis: Brazil is a global powerhouse in the iron ore market, primarily as a massive supplier to the world. The country’s market is defined by its vast reserves and the dominance of a few major mining corporations. The primary demand driver for the Brazilian market is not domestic consumption but rather the insatiable export market, particularly to China. The Brazilian mining sector is heavily dependent on logistical infrastructure, including rail and ports, to move millions of tonnes of ore from inland mines to the coast. The demand for Brazilian ore is closely tied to its high quality and competitive pricing, which makes it a preferred option for steel mills worldwide. However, the market is also subject to regulatory and environmental risks, as government oversight on tailings dams and mining practices directly impacts production capacity and cost.

- UK Market Analysis: The United Kingdom's iron ore market is a small but historically significant component of the global landscape. The country is a net importer of iron ore, with its domestic demand driven by its smaller-scale, specialized steel industry. The market is primarily driven by the manufacturing and construction sectors, with a notable portion of steel being produced for high-value applications. The UK market's profile is not driven by the same large-scale, raw tonnage requirements as in China or India. Instead, it is more focused on securing a stable supply of specific iron ore grades to meet the needs of its niche steel production. Regulatory frameworks in the UK, particularly those related to environmental protection and emissions, also play a role in influencing the types of iron ore that are in demand.

- South Africa Market Analysis: South Africa holds a crucial position in the global iron ore market, possessing substantial reserves and operating as a key supplier to both the Atlantic and Asian markets. The demand for South African iron ore is driven by its high-quality hematite reserves, which are well-regarded by international steelmakers. Domestically, the market is linked to the country’s own infrastructure and manufacturing sectors. The market dynamics in South Africa are heavily influenced by the efficiency of its rail and port infrastructure. Logistical challenges, including rail capacity constraints and port congestion, have often limited the country's ability to capitalize fully on global demand. Therefore, while international demand exists, the local factors of infrastructure and labor relations are major determinants of the market's performance.

- China Market Analysis: China is the single most dominant force in the global iron ore market, both as a consumer and as an importer. Its market is characterized by an immense, almost insatiable demand for iron ore, which is the direct result of decades of rapid urbanization, industrialization, and infrastructure development. The Chinese demand for iron ore is a direct reflection of its position as the world's largest steel producer. The market is not only defined by the sheer volume of consumption but also by the regulatory and policy environment. Government-mandated production cuts at steel mills, often in response to pollution concerns, create a unique and highly volatile demand curve. The demand for iron ore in China is driven by a complex interplay of infrastructure spending, the health of the property sector, and government-led industrial policy. The vast majority of this demand is met through seaborne imports, making China the most critical destination for global iron ore producers.

Iron Ore Mining Market Competitive Analysis

The competitive landscape of the iron ore mining market is dominated by a small number of global giants, with a larger pool of mid-tier and regional players. The market is highly concentrated, with the top three producers controlling a significant share of the seaborne trade. Competitive advantage is derived not only from the scale of operations but also from the quality of reserves, the efficiency of the supply chain, and the ability to adapt to changing demand profiles, such as the shift toward higher-grade ores.

- Vale S.A.: Vale is a Brazilian multinational corporation and one of the world's largest producers of iron ore and iron ore pellets. The company's strategic positioning is anchored by its vast, high-quality iron ore reserves in Brazil, particularly in the Carajás region, which produces high-grade ore with low impurities. This positions Vale as a key supplier for steelmakers seeking to improve efficiency and reduce emissions. Vale's operations are vertically integrated, with its own railway and port logistics, which provide a competitive edge in controlling the supply chain from mine to market. The company has focused on developing its portfolio of high-grade products, including pellet feed, to meet the growing demand from green steel initiatives.

- BHP: BHP is one of the largest mining companies in the world, with its iron ore operations concentrated in the Pilbara region of Western Australia. The company's strategy is centered on high-volume, low-cost production. Its extensive, automated rail and port infrastructure allows it to move enormous quantities of iron ore to key Asian markets with high efficiency. BHP's competitive advantage lies in its scale, low production costs, and its ability to act as a reliable, large-volume supplier to the world's biggest steel producers. The company's product portfolio includes a range of fines and lump ores, which are a staple for traditional blast furnace steelmaking.

- Rio Tinto: Rio Tinto, also with significant iron ore operations in the Pilbara, is another key player in the oligopolistic iron ore market. Rio Tinto's strategy is similar to BHP's, focusing on large-scale, efficient production. The company has invested heavily in automation, including autonomous haul trucks and trains, to optimize its operations and reduce costs. Rio Tinto's product is known for its consistency and quality, which has made it a preferred supplier for many steel mills. The company's strategic positioning is also influenced by its commitment to sustainability and its efforts to develop technologies and products that support the decarbonization of the steel industry.

Iron Ore Mining Market Developments

- September 2025: Mitsui & Co., Ltd. has agreed with BHP to acquire an indirect 7% interest in the Ministers North iron ore deposit, located in the Pilbara region of Western Australia. The deal also involves Itochu Corporation acquiring an 8% interest, aligning the ownership with their existing Western Australia iron ore joint venture. This acquisition is significant as the Ministers North deposit is located near existing mines and infrastructure, which is expected to create synergistic benefits and lead to highly cost-competitive operations for the joint venture partners.

- February 2025: Mitsui & Co. agreed to acquire a 40% stake in the Rhodes Ridge iron ore project in Australia, operated by Rio Tinto, for $5.34 billion. This acquisition is one of the largest in the sector for the period and is of major importance due to the project's scale. With an estimated 6.8 billion tons of untapped resources, Rhodes Ridge is one of the world's largest undeveloped iron ore deposits, and this investment signifies Mitsui's long-term strategy to secure supply and diversify its revenue streams.

- December 2024: BHP and Rio Tinto Announce Collaborative Study on Low-Carbon Steel Production - In a joint press release, BHP and Rio Tinto announced a new collaboration to study the use of iron ore from Western Australia's Pilbara region for low-carbon steel production. The initiative, focused on the potential for hydrogen-based DRI, signals a strategic shift by these major miners to align their product offerings with the long-term decarbonization goals of their key customers in Asia. This is a direct response to the changing demand profile driven by new steelmaking technologies.

Iron Ore Mining Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Iron Ore Mining Market Size in 2025 | USD 370 billion |

| Iron Ore Mining Market Size in 2030 | USD 436 billion |

| Growth Rate | CAGR of 3.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Iron Ore Mining Market |

|

| Customization Scope | Free report customization with purchase |

Iron Ore Mining Market Segmentation:

- By Product Type

- Fines

- Lumps

- Pellets

- Sinter

- By Application

- Steel Production

- Infrastructure & Construction

- Automotive

- Machinery & Equipment

- Others

- By End-User

- Steel Manufacturers

- Construction Companies

- Automotive Industry

- Foundries

- By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

- North America

Our Best-Performing Industry Reports:

Navigation:

- Iron Ore Mining Market Size:

- Iron Ore Mining Market Key Highlights:

- Iron Ore Mining Market Analysis

- Iron Ore Mining Market Segment Analysis

- Iron Ore Mining Market Geographical Analysis

- Iron Ore Mining Market Competitive Analysis

- Iron Ore Mining Market Developments

- Iron Ore Mining Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 22, 2025