Report Overview

Head Mounted Display Market Highlights

Head Mounted Display Market Size:

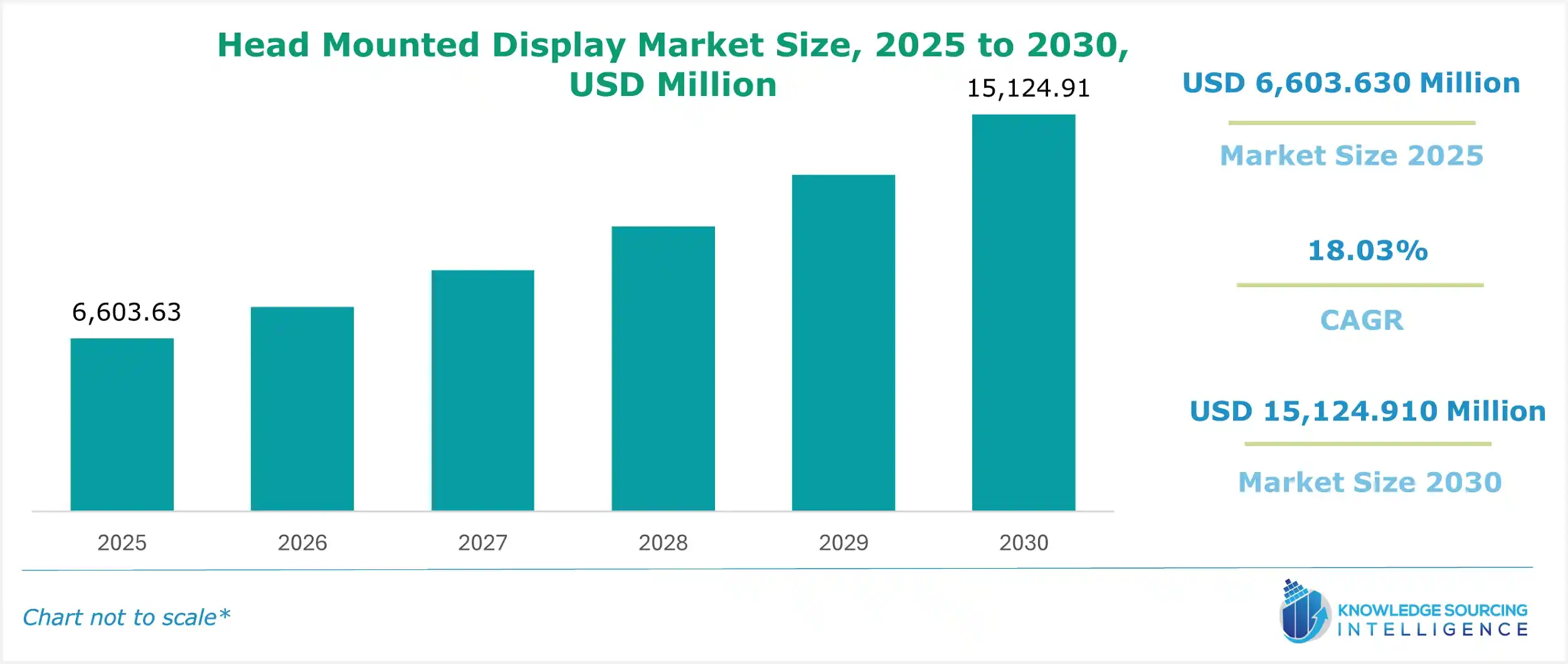

The head-mounted display market is predicted to grow at a CAGR of 18.03% from USD 6,603.630 million in 2025 to USD 15,124.910 million by 2030.

Head Mounted Display Market Trends:

The head-mounted display (HMD) market is a rapidly evolving segment of the wearable technology landscape. The increasing demand for immersive virtual reality (VR) and augmented reality (AR) experiences drives the market growth. HMDs, often integrated into eyeglasses or headsets, project digital content directly into the user’s field of view. This technology enables applications in gaming, entertainment, healthcare, education, and industrial training, among others. These devices have transformed from bulky, niche products into sleek, user-friendly systems prioritizing comfort, functionality, and seamless integration with other technologies. As companies continue to innovate, the HMD market is set for significant growth, driven by advancements in display technology, sensor capabilities, and software ecosystems, although it faces challenges that could limit its expansion.

HMDs have evolved significantly since their introduction. Early models, such as the Oculus Rift, released in 2016, introduced consumers to VR gaming. Presently, modern HMDs from companies like Meta, Sony, and Apple feature advanced optics, high-resolution displays, and lightweight materials, designed to enhance the user experience. The development of micro-LED and OLED displays has led to sharper visuals, wider fields of view, and lower power consumption, effectively overcoming some of the limitations of earlier LCD-based systems. Moreover, ergonomic designs, including adjustable head straps and balanced weight distribution, have made HMDs more comfortable for prolonged use. This comfort is a crucial factor for their adoption in both consumer and enterprise settings.

One notable example is Google’s Glass AR, launched in February 2020, integrating augmented reality into lightweight eyeglasses. This device provides contextual information about objects in the user's environment, such as product details or navigation prompts, showcasing the potential of augmented reality (AR) in everyday situations. Unlike traditional VR headsets that completely immerse users in virtual environments, AR-enabled HMDs like Google Glass integrate digital content with the real world. This blending opens up new applications in retail, logistics, and remote assistance sectors. Similarly, devices like Microsoft’s HoloLens 2 have gained traction in industrial settings, enabling workers to access real-time data, such as schematics or instructions, without diverting their attention from physical tasks.

The HMD market is poised for further transformation as companies invest in next-generation technologies. One promising area is the development of brain-computer interfaces (BCIs), which could allow users to control HMDs using neural signals, reducing reliance on physical controllers. Moreover, advancements in haptic feedback are improving immersion by simulating touch and texture, especially in VR gaming and training simulations.

Sustainability is also emerging as a focus area, with manufacturers exploring eco-friendly materials and energy-efficient components to address environmental concerns. For instance, some companies are experimenting with recyclable plastics and low-power displays to reduce the ecological footprint of HMDs.

Head Mounted Display Market Drivers:

- Increasing adoption of HMD in gaming applications

The availability of affordable HMD devices and the need for a better gaming experience will lead to a rise in the use of head-mounted displays in gaming applications. The helmet-mounted display encourages improving user experience by enhancing game playability. As a result, the number of VR game releases has increased over time, propelling the HMD industry to rise.

Affordable HMDs can be utilized for 3D gaming and other leisure pursuits. A cutting-edge monitor can be created by coupling modern video and DSLR cameras to several video glasses. Filmmakers and photographers can view presentations of their live photos in enhanced clarity due to the glasses' ability to filter out ambient light. For instance, Sony launched a new generation of PlayStation VR for its PlayStation 5 platform in February 2021. This headset had upgrades such as a higher-resolution screen, a new head-mounted display, a new controller, and a single wire in place of the original cable box, among others. Further, these advancements have increased the revenue for the online gaming industry. For instance, as per the FICCI, the revenue of online gaming in India increased from INR 101 billion in 2021 to INR 119 billion in 2022.

- Expanding VR/AR Applications

The versatility of HMDs has driven their adoption across various sectors. In gaming, devices such as Sony's PlayStation VR2 (2023) provide high-fidelity visuals and responsive controllers, creating immersive experiences for players. In healthcare, AR headsets assist surgeons by displaying critical data, such as 3D models of organs, during procedures. Similarly, VR HMDs enable virtual field trips and interactive simulations, enhancing learning outcomes in the education sector. Industrial applications, such as remote maintenance and training, are also growing, with companies like Boeing using AR headsets to guide technicians through complex assembly processes.

- Technological Advancements

Continuous improvements in display technologies, such as micro-LED, OLED, and waveguide optics, have enhanced the visual quality and compactness of HMDs. For example, waveguide displays allow for thinner, lighter AR glasses, as seen in products like Xreal Air, resembling traditional sunglasses while delivering immersive AR experiences. Furthermore, advancements in sensors, including eye-tracking and spatial mapping, allow for more intuitive interactions like gaze-based controls and accurate hand tracking, thus enhancing user engagement.

- Integration with Emerging Technologies

The integration of HMDs with technologies such as 5G, AI, and the Internet of Things (IoT) is creating new opportunities. For instance, the low latency of 5G enables cloud-based rendering for VR and AR, reducing the need for powerful onboard processors and making devices more affordable. AI-driven features like voice recognition and real-time translation improve usability, as demonstrated by Google Glass AR's contextual information display. IoT integration enables HMDs to interact with smart home devices, fostering seamless user experiences.

Head Mounted Display Market Restraints:

- High Costs

Advanced HMDs are expensive, particularly those with cutting-edge features like high-resolution displays and advanced sensors. For example, high-end devices like Apple’s Vision Pro (2024) are priced in a way that might discourage mainstream consumers, limiting their market expansion. Although more affordable options are available, such as standalone VR headsets like the Meta Quest 3, these often involve compromises in features or performance.

- Health and Comfort Issues

Prolonged use of HMDs can cause physical discomfort, including eye strain, headaches, and motion sickness, particularly in VR applications with high latency or low refresh rates. Although ergonomic enhancements have addressed some concerns, user feedback indicates that prolonged sessions, typical in gaming or professional contexts, can still pose challenges. Ensuring comfort without sacrificing performance remains a key challenge for manufacturers.

- Privacy and Data Security Concerns

AR-HMDs, such as Google Glass, collect real-time environmental data, including images and location information, raising significant privacy concerns. The potential for unauthorized data collection or hacking could undermine consumer trust. Regulatory scrutiny, particularly in regions with strict data protection laws like the EU, may impose additional compliance costs on manufacturers.

Head Mounted Display Market Segmentation Analysis:

- By technology, the VR segment is expected to grow significantly

VR HMDs create fully immersive digital environments, isolating users from the physical world to deliver experiences like gaming, simulations, and virtual tours. Unlike augmented reality, which adds digital content to the real world, VR HMDs utilize high-resolution displays, motion-tracking sensors, and spatial audio to create immersive 3D environments. Devices such as Sony’s PlayStation VR2 (2023) and Meta Quest 3 demonstrate the advancements in VR technology, offering 4K OLED displays and precise controllers for seamless interaction.

VR’s popularity stems from its ability to provide unparalleled immersion, particularly in gaming and entertainment. For instance, VR gaming allows players to enter virtual worlds and interact with characters and environments in real-time, as seen in Half-Life: Alyx.

VR is also used in training simulations, such as flight simulators for pilots or virtual labs for students, offering safe, controlled environments to practice complex tasks. The integration of 5G and cloud rendering has improved VR by reducing latency and allowing standalone devices that do not require external PCs or consoles, making them more accessible.

- By product type, the head-mounted segment is rising considerably

Head-mounted product type refers to standalone HMDs that operate independently, integrating all necessary components, such as processors, batteries, and displays, within the headset itself. Unlike tethered head-mounted displays, which rely on external devices such as PCs or consoles, head-mounted systems like the Meta Quest 3 provide a wireless, all-in-one solution. These devices use onboard processors, like Qualcomm Snapdragon XR2, and built-in sensors for tracking, providing portability and ease of use.

The head-mounted HMDs are ideal due to their accessibility and versatility. Users can create VR or AR experiences without complex wiring or external hardware, making them suitable for home use, travel, or corporate applications like remote training. For example, in industrial settings, head-mounted displays allow technicians to access virtual manuals or collaborate remotely without being tethered to a workstation. The integration of Wi-Fi 6 and 5G significantly improves performance by facilitating cloud-based content streaming and minimizing the need for high-end onboard hardware.

- By Display type, the integrated HMDs will witness robust market expansion

Integrated HMDs combine the display, processing unit, and sensors into a single, self-contained device, distinguishing them from slide-on HMDs (which use smartphones as displays) and discrete HMDs (which rely on external devices). Integrated HMDs, such as the Apple Vision Pro (2024), offer high-resolution displays (e.g., micro-OLED with 4K per eye) and advanced features like eye-tracking and gesture control, creating seamless VR and AR experiences. These devices are designed for consumer and professional use, blending aesthetics with functionality.

The strength of integrated HMDs lies in their capacity to deliver high-performance experiences independently. For instance, Apple Vision Pro supports spatial computing, allowing users to interact with digital content in 3D space using hand gestures and voice commands. Integrated head-mounted displays (HMDs) are perfect for applications such as virtual meetings, where users can interact with 3D models. They are also beneficial in creative industries, allowing designers to visualize prototypes in real-time. Additionally, their compact design improves portability, making them attractive to professionals who require AR solutions while on the move.

- By industry vertical, the healthcare segment is experiencing substantial growth

In the healthcare sector, HMDs are transforming medical training, diagnostics, and patient care by providing immersive and interactive solutions. AR-enabled HMDs, such as Microsoft’s HoloLens 2, allow surgeons to overlay 3D anatomical models during procedures, improving precision and reducing errors. For instance, during complex surgeries, HMDs can show real-time data, such as MRI scans or vital signs, directly within the surgeon’s line of sight. This eliminates the need for the surgeon to glance at external monitors, ultimately enhancing focus and efficiency in high-stakes situations.

HMDs are also used in medical training, enabling students to practice procedures in virtual environments. VR simulations allow trainees to perform virtual surgeries, such as heart or brain operations, without risking patient safety. AR HMDs enhance telemedicine by allowing remote specialists to guide on-site staff through procedures with real-time annotations. For example, a doctor wearing an AR headset can project instructions directly into a nurse's field of view, even if they are in different locations. This technology improves access to expert guidance in underserved areas.

Head Mounted Display Market Geographical Outlook:

- The United States is anticipated to be the fastest-growing country in the North American region

The increasing adoption of augmented reality and virtual reality (AR/VR) is expanding the head-mounted display market in the country. Further, the increased demand for these displays in the healthcare sector for surgeries and treatments is providing an edge for market growth. Critical patient data, such as MRI and CT scans, can be easily seen through these displays.

HMDs are used for defense and military purposes. Many companies are launching products with this feature in mind. For instance, in October 2022, Honeywell launched the Honeywell 360 Display, a head-mounted display designed to offer improved situational awareness to operators of military vehicles, particularly in challenging and low-visibility conditions. This advanced display system replicates natural vision, providing a high-resolution, real-time view of the vehicle's surroundings with minimal delay.

The increasing use of head-mounted displays can be attributed to the increasing gaming industry in the United States. According to the Entertainment Software Association (ESA), the number of people who play video games increased to 226.6 million in 2021 compared to 214.4 million in 2020. The rising penetration of video games among the people of the United States is aiding the head-mounted display market to propel in the projected period.

List of Top Head-Mounted Display Companies:

- Kopin Corporation

- Vuzix

- Alphabet Inc.

- Sony Group Corporation

- Meta

Head Mounted Display Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Head Mounted Display Market Size in 2025 | USD 6,603.630 million |

| Head Mounted Display Market Size in 2030 | USD 15,124.910 million |

| Growth Rate | CAGR of 18.03% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Head Mounted Display Market |

|

| Customization Scope | Free report customization with purchase |

Head Mounted Display Market Segmentation:

- By Display Type

- Slide-On HMDs

- Discrete HMDs

- Integrated HMDs

- By Technology

- Virtual Reality

- Augmented Reality

- By Connectivity

- Wired

- Wireless

- By End-user

- Aerospace and Defense

- Media and Entertainment

- Manufacturing

- Healthcare

- Education

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America