Report Overview

Home Infusion Therapy Market Highlights

Home Infusion Therapy Market Size:

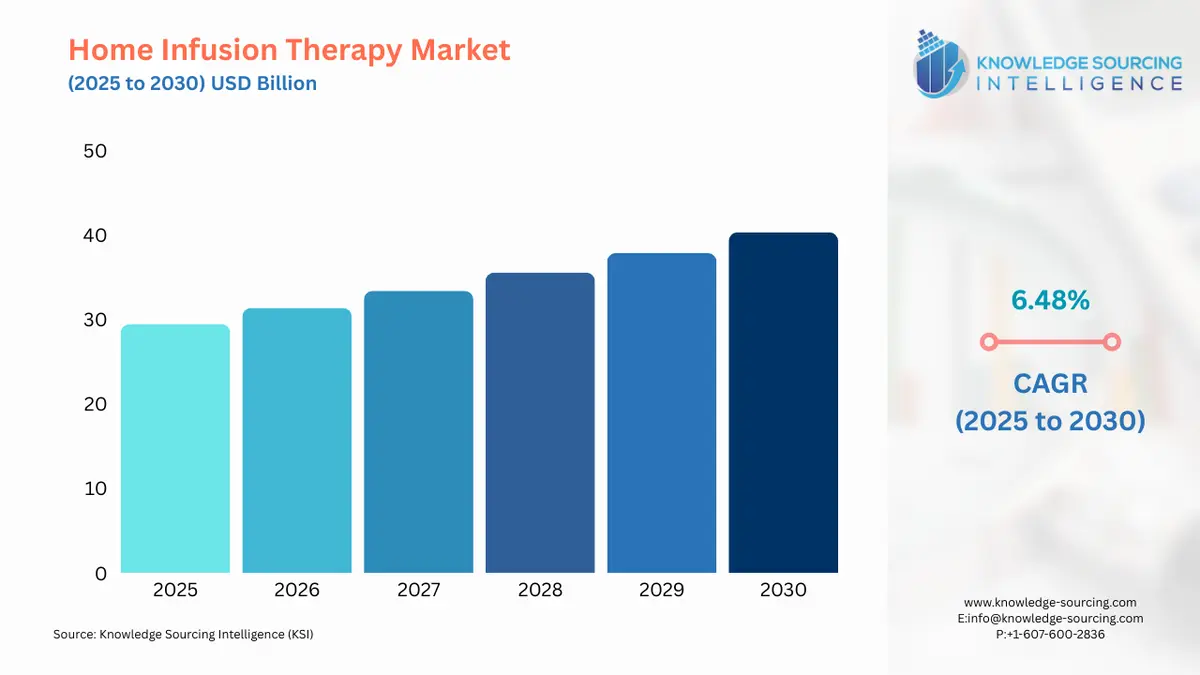

Home Infusion Therapy Market, with a 6.29% CAGR, is projected to increase from USD 29.450 billion in 2025 to USD 42.455 billion in 2031.

Home Infusion Therapy Market Trends:

The home infusion therapy market is anticipated to grow at a steady pace throughout the forecast period. Home infusion is just one of the many pharmaceutical treatments that are generally offered to patients in their homes as outpatient care. The bulk of these medications must be provided via a needle or catheter, a process known as an infusion; however, some can also be given intramuscularly, epidurally, or using self-injectable devices. Multiple associated benefits of home infusion therapy coupled with the increasing immobility disorders are major growth drivers in the home infusion therapy market. Moreover, the higher rate of hospital-acquired infections and government regulation to encourage home therapy are further contemplated to boost the home infusion therapy market.

Home Infusion Therapy Market Growth Drivers:

Multiple Associated Benefits of Home Infusion Therapy

Home infusion therapy offers a wider range of benefits to patients that encourage its adoption and thereby boost the home infusion therapy market. Studies demonstrate that patients are highly satisfied with home infusion therapy and that clinical results are more positive at home than in inpatient hospital settings. Depending on an individual’s healthcare plan, it can be less expensive than receiving the same service at a hospital or clinic. Moreover, with 78% of customers indicating they would be very or somewhat inclined to employ alternative types of treatment, such as a clinician visiting the home, according to EverNorth Health Services, there has been an increase in the demand for more flexibility and choice in how care is given in recent years. The patients’ inclination towards home care coupled with associated benefits is contemplated to propel the home infusion therapy market.

Increasing Immobility Disorders

The increasing cases of immobility disorders restraining physical movement indicate the growing demand for home infusion therapy. For instance, there are 1.3 billion persons who are severely disabled. This equates to 1 in 6 of us, or 16% of the world's population as per WHO updates in March 2023. According to the WHO, Accessible and inexpensive transit is 15 times more difficult to find for people with disabilities than it is for people without impairments. Therefore, these immobility disorders are expected to positively impact the home infusion therapy market as it offers a convenient at-home setting to the patients.

Need for Reducing Stays at Hospital

Numerous infections occur when a person stays longer at the hospital and home infusion therapy helps to reduce the infections acquired from the hospitals. According to the WHO, Seven patients in high-income nations and 15 patients in low- and middle-income countries are expected to contract at least one healthcare-associated infection (HAI) during their hospital stay per 100 patients in acute-care hospitals. Every ten people who are impacted will die as a result of their HAI, on average. Newborns and those in critical care are particularly vulnerable and the WHO 2022 study finds that over half of all instances of sepsis with organ failure are treated in adult intensive-care units and about one in four hospital-treated sepsis cases are related to medical care. These hospital-acquired infections pose a problem and therefore encourage the adoption of the home infusion therapy market.

Home Infusion Therapy Market Opportunities:

The growth drivers mentioned above indicate an immense opportunity for the home infusion therapy market. Moreover, government regulations are also providing a growth opportunity in the home infusion therapy market. For instance, in 2021, the Centres for Medicare & Medicaid Services (CMS) passed new regulations that increased the coverage of home infusion therapy to cover a variety of related nursing and monitoring services in addition to the treatment itself. Moreover, Eitan Medical launched a new cutting-edge connected infusion multi-therapy ambulatory infusion system named Avoset™ to transform post-acute care and speciality infusion therapy. Additionally, the approvals of home infusion therapy by the authorities further propel the home infusion therapy market thereby providing an entrance opportunity. For instance, home infusion of anticancer therapy was approved by the ASCO board of directors in June 2020.

Home Infusion Therapy Market Restraints:

There are a few complexities that are supposed to restrain the home infusion therapy market. For example, home infusion pharmacies, patients, doctors, hospital discharge planners, health insurance, and other parties must work closely together to complete the procedure because it can be a complex ecology. Disconnected data poses a significant problem because there are so many parties involved and it can lead to a variety of prescribing, administering, and/or coding problems. For instance, the physician normally submits prior authorization requests and prescription claims, but they go through the plan separately.

Home Infusion Therapy Market Geographical Outlook:

North America is projected to Grow Significantly

The North American region is anticipated to hold a significant share of the home infusion therapy market during the forecasted period. Various factors attributed to such a share are increasing immobility disorders, chronic diseases such as cancer, and the aging population along with the favorable government regulations to encourage home infusion therapy. For instance, 12.1 percent of adult U.S. citizens have a mobility impairment that makes walking and climbing stairs extremely difficult and 12.8 percent of adults in the United States struggle greatly with concentration, memory, and decision-making as per the recent CDC data. Moreover, the market players such as Baxter, and Braun Melsungen AG are further expected to propel the home infusion therapy market in the region.

List of Top Home Infusion Therapy Companies:

Baxter International is a US-based healthcare company with a portfolio including acute, nutritional, renal, hospital, and surgical care products. The company provides a portfolio of intravenous premixed medication and injectable drugs that are ready to fill patients’ needs.

Ambulatory surgery centers, employed physician networks, two HMOs, and 15 hospitals are all part of McLaren Health Care. The Joint Commission (JCAHO) and the Community Health Accreditation Programme (CHAP) have both granted accreditation to McLaren's home infusion service.

Home Infusion Therapy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Home Infusion Therapy Market Size in 2025 | USD 29.450 billion |

Home Infusion Therapy Market Size in 2030 | USD 40.311 billion |

Growth Rate | CAGR of 6.48% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Home Infusion Therapy Market |

|

Customization Scope | Free report customization with purchase |

Home Infusion Therapy Market Segmentation

By Product Type

Infusion Pumps

Infusion Catheters

Intravenous IV Sets

Others

By Route of Administration

Intravenous

Subcutaneous

By Application

Anti-Infective Therapy

Parenteral Nutrition

Chemotherapy

Pain Management Drugs

Hydration Therapy

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others

Our Best-Performing Industry Reports:

Navigation:

Page last updated on: September 19, 2025