Report Overview

Global Gene Therapy Market Highlights

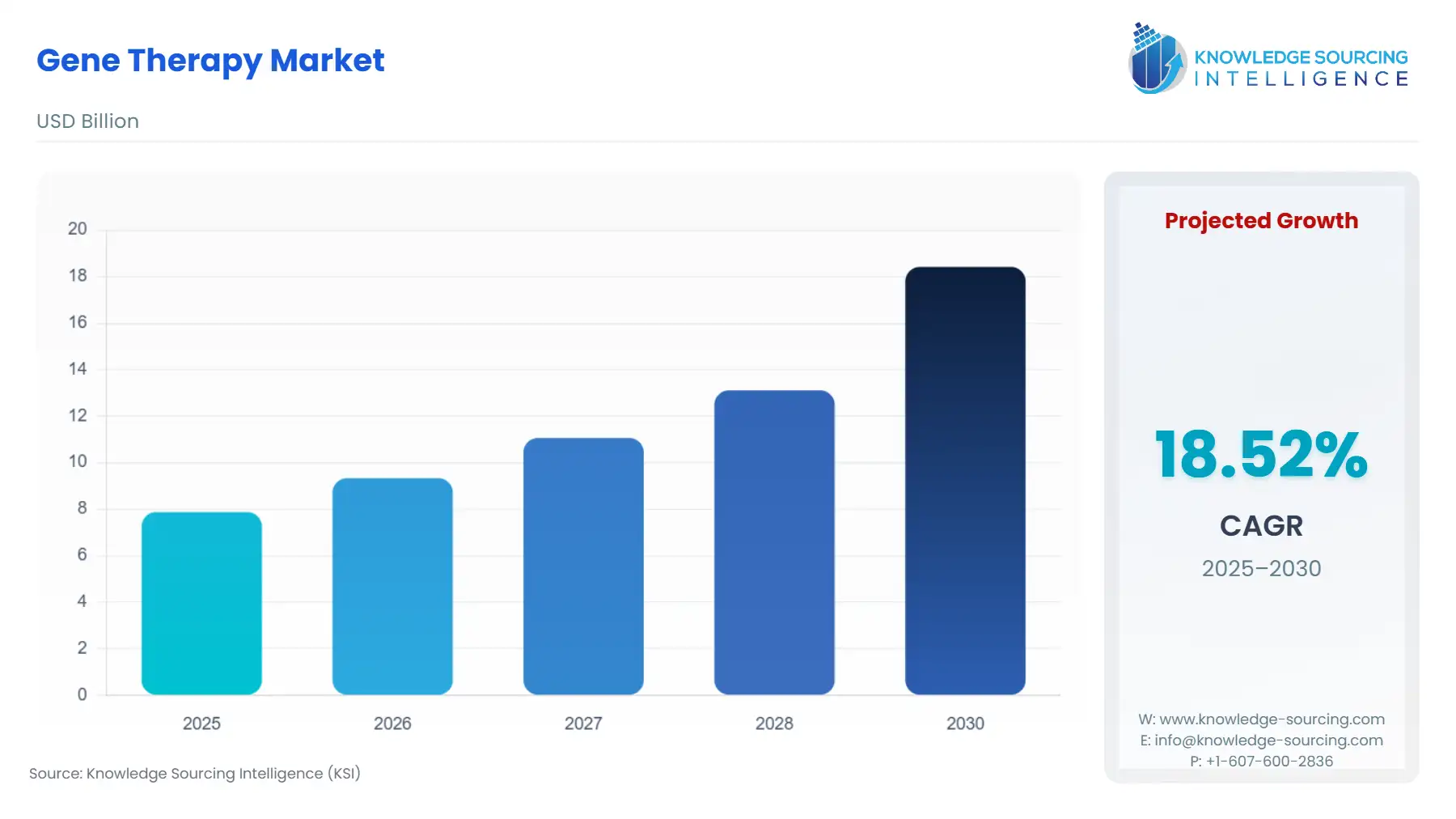

Gene Therapy Market Size:

The global gene therapy market is expected to grow from US$7.876 billion in 2025 to US$18.419 billion in 2030, at a CAGR of 18.52%.

Gene Therapy Market Trends:

The rise in investment in gene therapy research and development, together with the growing incidence of diseases such as cancer, are the main drivers of the global gene therapy market's expansion. According to data published by the Open Government Data (OGD) Platform India, cancer cases have prevailed in recent years. In the year 2019, people suffering from cancer were 13,58,415 in India, which rose to 14,61,427 cancer cases in 2022. A considerable need for innovative therapeutic medications that could be useful for cancer therapy is predicted due to the rising incidence of cancer patients.

Conventional gene treatments target the immune system to improve remissions for patients with advanced-stage tumours due to the rising importance of immunotherapy in cancer treatment.

The FDA authorized Vyjuvek in May 2023 for the treatment of wounds in patients 6 months and older with dystrophic epidermolysis bullosa (DEB) and mutations in the collagen type VII alpha 1 chain (COLTA1) gene. Vyjuvek is a herpes simplex virus type 1 (HSV-1) vector-based gene therapy. Additionally, in April 2023, REGENXBIO Inc. stated that the FDA had awarded RGX-202, a potential one-time gene therapy for the treatment of Duchenne muscular dystrophy.

Gene Therapy Market Growth Drivers:

- Increasing Research And Development Activities ‘

Top market players are concentrating on R&D and regional growth tactics for greater market penetration. As per the WHO data published in April 2023, the total gross domestic spending on research and development for healthcare as % of GDP was 0.07% for Western specific, which is leading the market, America was 0.03% and for Eastern Mediterranean, it was just 0.01% of the total GDP.

Further, in August 2022, the FDA approved Bluebird Bio's BLUE.O gene therapy for use in the treatment of patients with a rare condition that needs routine blood transfusions. Each unit of the medication costs USD 2.8 million.

Oncolytic virotherapy research is supported by several highly attractive grants. For instance, the National Institutes of Health awarded the researchers at the Centre for Nuclear Receptors and Cell Signalling at the University of Houston a USD 1.8 million grant in July 2022 to study oncolytic virotherapy. Additionally, in June 2022, the phase 1 clinical trials for ImmunoAct's CAR-T (chimeric antigen receptor) therapy, which is used to treat certain forms of cancer, were completed.

Elicera Therapeutics AB, a cell and gene therapy firm in clinical development, received financing from the European Innovation Council (EIC) Accelerator Programme in June 2022 for $2.67 million (€2.5 million). The market for cancer gene therapy is predicted to benefit significantly from rising medical funding. In December 2022, researchers in the UK treated a young kid with relapsed T-cell leukaemia using a novel sort of gene therapy. The use of this novel gene therapy has sparked expectations that it can treat major illnesses.

Gene Therapy Market Geographical Outlook:

- The United States in North America is an Expected Dominant Market

Cancer is one of the leading causes of death in the United States. In 2022, an estimated 1.9 million new cancer cases will be diagnosed in the United States, and 609,000 people will die from cancer. The increasing incidence of cancer is driving the demand for new and innovative cancer treatments, such as gene therapy.

Consequently, there have been significant advances in gene therapy technology in recent years. These advances have made it possible to develop gene therapy treatments for a wider range of cancers. For example, in 2022, the FDA granted approval for Adstiladrin (nadofaragene firadenovec-vncg), an adenoviral vector-mediated gene therapy. It is intended for adults experiencing high-risk Bacillus Calmette-Guérin (BCG)-unresponsive non-muscle-invasive bladder cancer (NMIBC) presenting with carcinoma in situ (CIS), with or without accompanying papillary tumours.

Moreover, there is a growing investment in gene therapy research in the United States. This investment is being driven by the potential of gene therapy to cure cancer and other diseases. In 2022, the National Institutes of Health (NIH) awarded over $1 billion in funding for gene therapy research. Further driving this momentum is the favourable regulatory environment. The regulatory environment for gene therapy is generally favourable in the United States. The FDA has approved several gene therapy treatments for cancer, and it is expected to approve more in the coming years.

The escalating figures of new cancer cases in the USA from 2020 to 2022—18,06,590 to 18,98,160 to 19,18,030—underscore the persistent and concerning prevalence of cancer. This trend accentuates the significance of advancements in cancer treatments, including gene therapy. The mounting need for innovative therapeutic interventions aligns with the potential growth of the gene therapy market in the USA. As the patient pool expands, there is a concurrent opportunity for the development and adoption of gene therapies targeting various types of diseases, potentially reshaping the landscape of treatment strategies in the coming years.

Gene Therapy Market Key Developments:

- In an agreement signed in October 2022, Xcell Biosciences and aCGT Vector agreed to work together to manufacture and test cell and gene treatments for cancer patients. In June 2021, Tata Memorial Centre and Indian Institute of Technology researchers worked together to create "Chimeric Antigen Receptor T-cell," a cutting-edge kind of gene therapy for the treatment of cancer.

- In December 2022, Adstiladrin, a non-replicating adenoviral vector-based gene therapy, received FDA approval. It is indicated for treating adult patients with high-risk, Bacillus Calmette-Guérin (BCG)-refractory, non-muscle-invasive bladder cancer (NMIBC), with carcinoma in situ (CIS), with or without papillary tumours.

List of Top Gene Therapy Companies:

- Shanghai Sunway Biotech Co. Ltd

- Pfizer In

- Astellas Gene Therapies, Inc.

- Novartis Gene Therapies

- MeiraGTx

Gene Therapy Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.876 billion |

| Total Market Size in 2031 | USD 18.419 billion |

| Growth Rate | 18.52% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Therapy Type, Vector Type, Technique Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Gene Therapy Market Segmentation:

- By Therapy Type

- Ex Vivo

- In Vivo

- In Situ

- By Vector Type

- Viral

- Non-Viral

- By Technique Type

- Gene Augmentation

- Gene Inhibition

- Specific Cell Kill

- By Disease Type

- Cancer

- Heart Disease

- Diabetes

- HIV

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others