Report Overview

Hybrid Cloud Market - Highlights

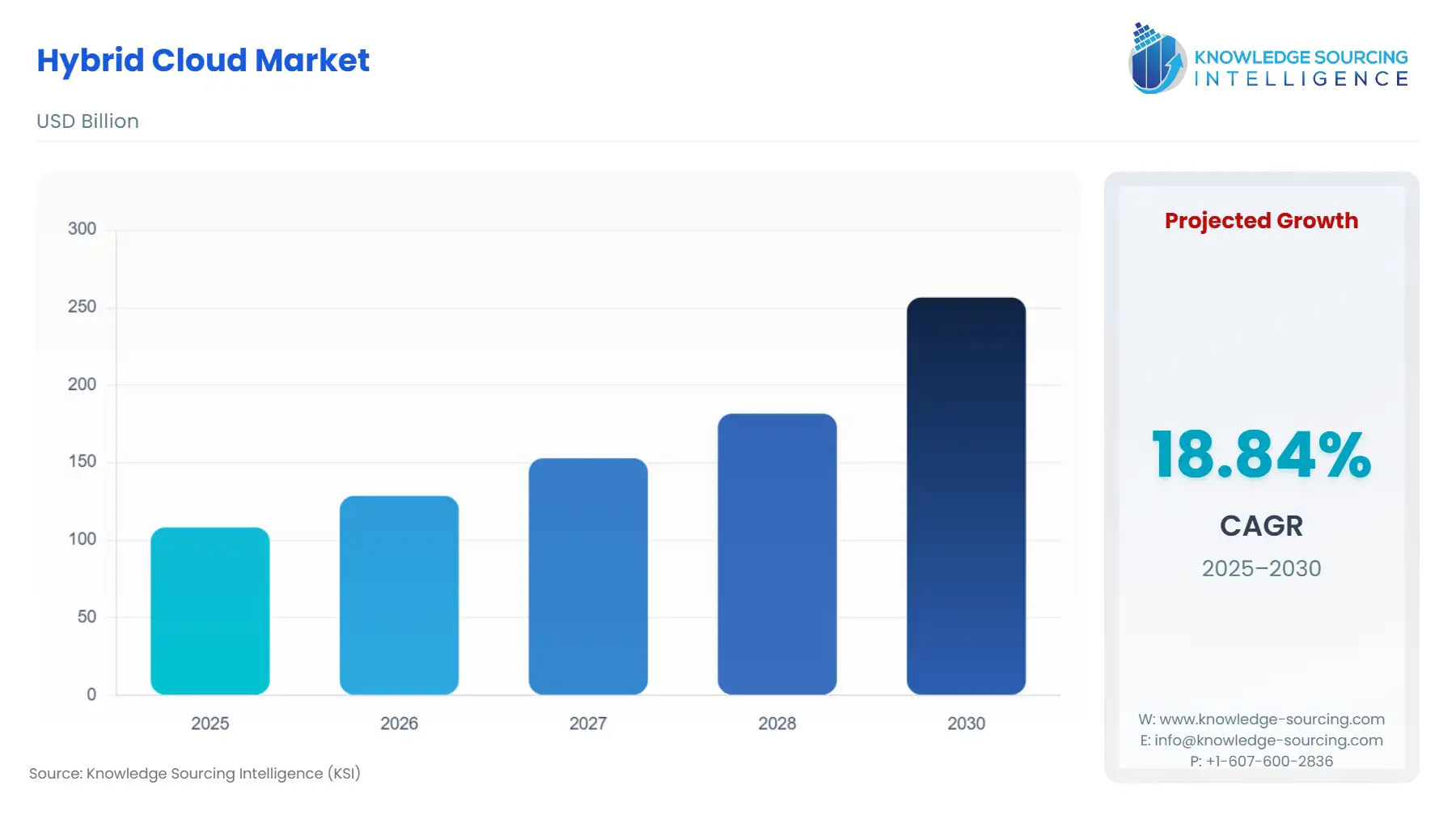

Hybrid Cloud Market Size:

The Hybrid Cloud Market is expected to grow from USD 108.243 billion in 2025 to USD 256.557 billion in 2030, at a CAGR of 18.84%.

A hybrid cloud is an IT infrastructure design that combines an organization's private IT resources with the infrastructure and services of external cloud providers. This industry is anticipated to be driven by the rise of cloud-based services and applications, as well as the rising demand for cloud computing. A hybrid data center combines on-premises and cloud-based equipment to enable network-based sharing of data and applications. According to a report by the United States International Trade Commission, in 2021, some of the major European countries, like the United Kingdom, held 6%. Germany holds 5%, France 3%, and Italy 2% of the total data center share globally.

Hybrid Cloud Market Growth Drivers:

- Growing adoption of cloud computing

The hybrid cloud market is expanding due to the rising popularity of cloud computing, which encourages businesses to use both public and private cloud infrastructure. Organizations are given the scalability they require to swiftly and easily scale up or down to meet changing demands through public cloud services. According to the 2021 American Community Survey (ACS) one-year estimates released by the U.S. Census Bureau, the percentage of people who predominantly work from home quadrupled between 2019 and 2021, rising from 5.7% (approximately 9 million people) to 17.9% (27.6 million people). In 2021, the District of Columbia had the greatest proportion of home-based employees (48.3%) among all the states and state equivalents. This growth has surged the demand for cloud computing, positively impacting the hybrid cloud market growth.

- Rising demand for cloud services

Big enterprises are embracing cloud services. For instance, in April 2023, the consumer goods firm Unilever's business processes successfully migrated to the cloud. Additionally, Canada-based SmartSimple Software Inc., a developer of cloud-based software, introduced SmartSimple Cloud + AI in March 2023. Each process can be enhanced with AI due to the SmartSimple Cloud + AI, and end users can modify workflows to suit their particular requirements. To decrease the barrier to commercializing company innovation, Alibaba Cloud introduced the ModelScope open-source Model-as-a-Service (MaaS) new solution platform in November 2022. Over the past years, the company's worldwide research initiative, the Alibaba DAMO Academy ("DAMO"), has produced over 300 ready-to-deploy AI models.

- Government investments in cloud computing services

Governments in various developing nations are investing in cloud computing delivery strategies because they may simplify technical procedures and boost administrative effectiveness, which is anticipated to propel the hybrid cloud market growth. For instance, the Ministry of Economy (MoE) of the UAE and Amazon Web Services, Inc., a provider of cloud computing platforms, partnered to launch the AWS Connected Community program, which supports the digitalization of small and medium businesses (SMEs) in the UAE, in June 2023. A government cloud cluster platform powered by artificial intelligence was introduced in June 2023 by Smart Nation Singapore and the Digital Government Office. Government agencies have collaborated with Google Cloud to increase the adoption of artificial intelligence technologies in Singapore's public sector.

Product Innovation And Collaboration by Major Manufacturers:

Major businesses are collaborating with other organizations and investing in new initiatives to expand their customer base and better satisfy demands across diverse applications. According to DXC Technology, a hybrid cloud-optimized complete data center platform called DXC Secure Network Fabric was released in April 2023. This is a complete software-defined data center solution that automates, modernizes, streamlines, and protects data center networks at a lower cost. It was created in collaboration with Hewlett-Packard Enterprise and AMD. Additionally, in October 2021, Google Cloud and Citrix Systems, a multinational American cloud computing and virtualization technology business, established a partnership to give Google Cloud access to Citrix's virtualization and workspace technologies.

Hybrid Cloud Market Geographical Outlook:

- The North American hybrid cloud is projected to propel the market

The bolstering growth of the hybrid cloud industry in the North American region is fueled by its versatility and ability to provide a seamless blend of on-premises and cloud resources, catering to diverse business needs. The region is further segmented into the USA, Canada, and Mexico. The Asia Pacific hybrid cloud market is anticipated to be driven by the increasing need for businesses to achieve operational agility, cost-efficiency, and scalability in a highly competitive and dynamic business environment, whereas the Middle East and Africa are projected to be propelled by rapid urbanization, expanding digitalization efforts, and the adoption of cloud-based technologies across diverse sectors.

- The United States is anticipated to be the fastest-growing country in the North American region

The USA's dominance in data center share in 2021, at 33%, reflects the country's strong and well-established IT infrastructure, which is driving growth in the hybrid cloud market. This solid foundation has been instrumental in the nation’s hybrid cloud market growth, as a dependable and extensive data center network is crucial for supporting hybrid cloud solutions. The presence of advanced data centers can facilitate the seamless integration of on-premises and cloud resources, making hybrid cloud adoption more attractive to businesses. Additionally, the USA's leadership in data centers may also indicate a higher level of cloud readiness and maturity among enterprises, further driving the hybrid cloud market forward as companies seek to modernize their IT systems and leverage the benefits of hybrid cloud solutions for their digital transformation efforts.

Hybrid Cloud Market Key Developments:

- Nov 2025: Google Cloud launched its first Sovereign Cloud Hub in Munich, providing a regionally-controlled environment for data residency, proof-of-concept development, and sovereign AI in Europe.

- Jun 2025: Microsoft announced the general availability of its Azure Arc Workload Orchestration, enabling enterprises to centrally deploy and manage Kubernetes-based applications across edge, cloud, and on-premises environments.

- May 2025: Kyndryl and Microsoft expanded their partnership to deliver “adaptive cloud services” using Azure Arc, enabling unified operations across hybrid, multicloud, edge, and IoT environments.

Hybrid Cloud Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 108.243 billion |

| Total Market Size in 2031 | USD 256.557 billion |

| Growth Rate | 18.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Service Type, Enterprise Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Hybrid Cloud Market Segmentation:

- By Type

- Solutions

- Services

- By Service Type

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- By Enterprise Size

- Small and Medium

- Large

- By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT and Telecom

- Manufacturing

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Others