Report Overview

Hydrogen Fuelling Station Market Highlights

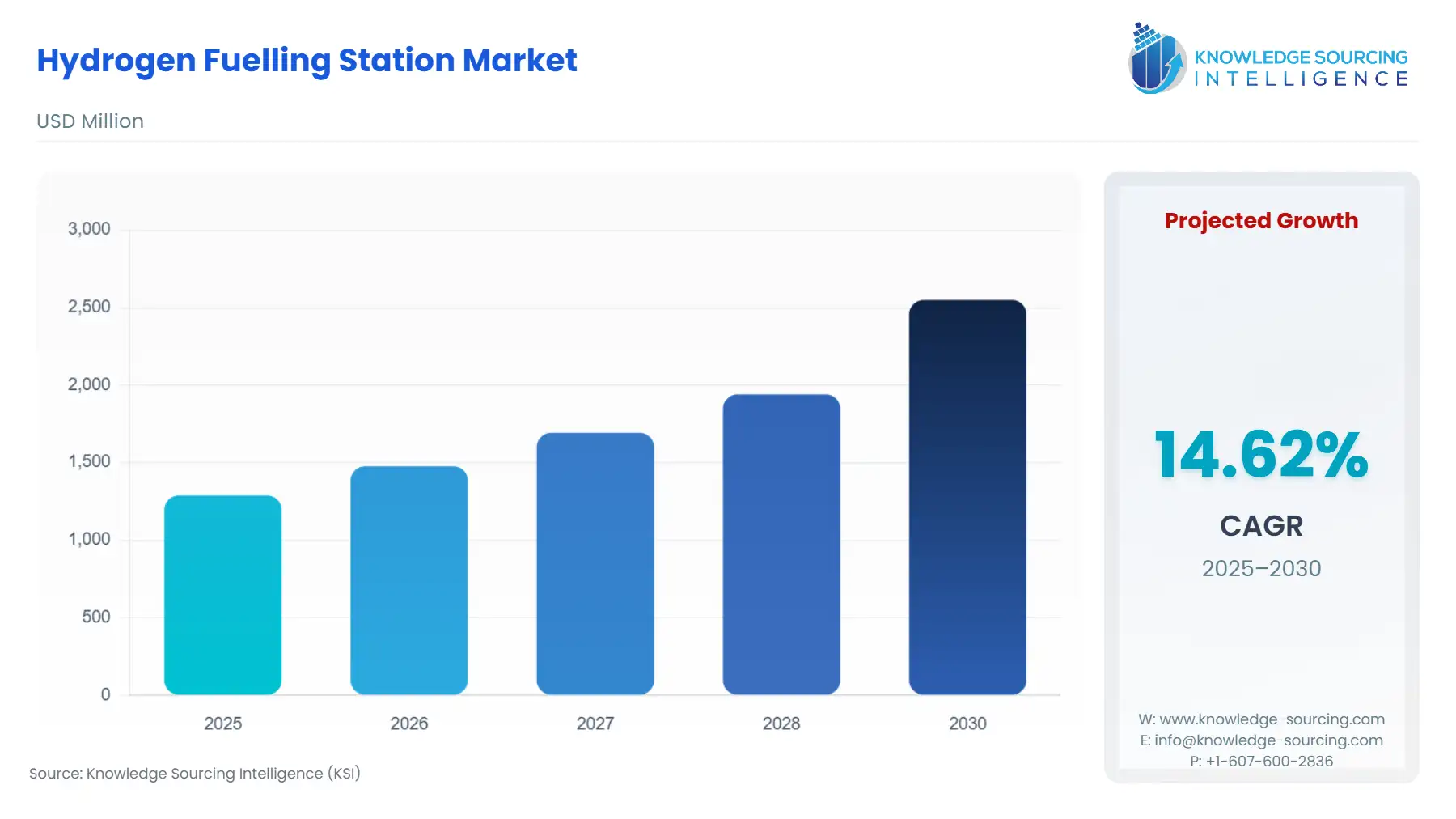

Hydrogen Fuelling Station Market Size:

The Hydrogen Fuelling Station Market is expected to grow at a CAGR of 14.62%, reaching a market size of US$2,549.399 million in 2030 from US$ 1,288.650 million in 2025

The compressing, storing, and manufacturing of hydrogen gas are the functions served by hydrogen refueling stations. These are crucial infrastructure support for hydrogen as a source of clean fuel, specifically for fuel-cell electric vehicles (FCEVs). These power stations offer hydrogen quickly and efficiently, enabling FCEVs to refuel easily. Establishing such stations is key in setting up a sustainable hydrogen infrastructure in the economy to promote the transition to cleaner transportation and energy solutions.

The hydrogen fueling station market is rapidly expanding, driven by clean energy trends and the rising popularity of FCEVs.

With support from governments and innovative companies like Linde and Air Liquide, advancements in smart technologies promise sustainable growth and diverse applications across mobile, fixed, and urban infrastructures.

Hydrogen Fuelling Station Market Growth Drivers:

- The growing popularity of FCEVs driving growth in the hydrogen fuelling market

Fuel cell electric vehicles are gradually gaining popularity, making noticeable impacts on the transport sector because of the increasing need for hydrogen refueling infrastructure. The engines of these cars run on hydrogen and will provide an environment-friendly, efficient, and sustainable alternative to the engines conventionally using internal combustion. Emissions are the leading concern for industries and consumers and FCEVs are considered climate- and zero-emission solutions.

According to the California Air Resources Board, in April 2024, California FCEV registrations steadily rose, which is noted as a slow growth rate with 14,429 registrations. This is because 1,436 new registrations were recorded from April 2023 to April 2024, compared to 1,859 the previous year.

- Government initiatives and policies are propelling the hydrogen fuelling station market growth

Government initiatives and policies have played a key role in driving the growth of hydrogen infrastructure. Governments worldwide are offering financial incentives, subsidies, and grants to promote the adoption of hydrogen as a clean energy source. These measures eliminate one of the biggest obstacles in creating hydrogen refueling stations and fuel cell technologies: their high upfront costs. Most global governments will also have ambitious targets to be carbon neutral, those that would be supported with hydrogen infrastructure for fuel cell electric vehicle use and industry.

Nikkiso Clean Energy & Industrial Gases Group secured a contract for nearly 24 liquid hydrogen (LH2) fueling stations to be installed and serviced in South Korea. Some stations have already become operational as they are now helping buses be efficiently fueled, while the rest are expected in around 12 months. This will help establish and support a transition to hydrogen as a means of sustainable energy solution in the South Korean powerhouse.

Hydrogen Fuelling Station Market Segment Analysis:

- By type, fixed stations are anticipated to grow during the forecast period

The fixed hydrogen fueling stations segment will grow significantly, driven by the increasing uptake of fuel cell electric vehicles, investments in hydrogen infrastructure by the government, and progress in smart technologies that assure reliable, scalable, and sustainable energy solutions for urban and industrial applications.

Japan Hydrogen Fund is the first collaboration by JH2A and Advantage Partners with a focus on advancing a hydrogen society. Its first closing was on August 27, 2024, with more than $400 million in capital committed by prominent investors, including Toyota and Total Energies.

Hydrogen Fuelling Station Market Geographical Outlook:

- Asia-Pacific will be the fastest-growing region during the forecast period

The Asia Pacific region is emerging as a significant region in the hydrogen fueling stations market, displaying promising trends in growth, driven highly by initiatives and the use of hydrogen FCEVs. With the ratio of construction relating to the overall market size, China is set to dominate the market, planning over 1,000 hydrogen stations by 2030 as part of its decarbonization efforts. Japan is expected to add 900 stations by 2030 and is emphasizing the integration of renewables in the future; in South Korea, 310 hydrogen stations have emerged. This number may seem relatively small for a country with a population of 50 million, but it reflects its commitment to its hydrogen economy roadmap leading up to 2025.

In June 2023, Japan elevated the Basic Hydrogen Strategy, necessitating over JPY 15 trillion ($98.8 billion) into 2040 to invigorate that sector of hydrogen technologies, including fuel cells and water electrolysis. Japan has advanced fuel cell technology and earmarked JPY 20.3 billion ($134 million) for hydrogen in FY 2024. This is expected to expand the market for commercial fuel cell vehicles, which may also include trucks and buses, propelling hydrogen adoption.

Hydrogen Fuelling Station Market Recent Developments:

- In May 2024, Air Liquide finished the construction of the Motomiya Interchange hydrogen Station in Fukushima. The station is designed for round-the-clock operation and will provide hydrogen fuel to 60 fuel cell trucks running on the roadway. Hydrogen supply from different channels includes sourcing from renewable sources. The project was carried out in collaboration with Air Liquide, ITOCHU Corporation, and ITOCHU ENEX, with the support of METI and the Fukushima Prefecture.

- In May 2024, Nel ASA secured a €3.8 million order from Alperia Greenpower SRL for building its first H2Station in Italy. The station is scheduled to be operational by the end of 2025, with service to vehicles during the 2026 Winter Olympics and two years of a maintenance contract.

Hydrogen Fuelling Station Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hydrogen Fuelling Station Market Size in 2025 | US$ 1,288.650 million |

| Hydrogen Fuelling Station Market Size in 2030 | US$2,549.399 million |

| Growth Rate | CAGR of 14.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Hydrogen Fuelling Station Market |

|

| Customization Scope | Free report customization with purchase |

The Hydrogen Fuelling market is analyzed into the following segments:

- By Type

- Mobile Hydrogen Fuelling Stations

- Fixed Hydrogen Fueling Stations

- By Fuel Type

- Liquid Hydrogen

- Gaseous Hydrogen

- By End User

- Automotive

- Energy & Power

- Aerospace

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America