Report Overview

Liquid Hydrogen Market - Highlights

Liquid Hydrogen Market Size

The global liquid hydrogen market is forecast to grow at a CAGR of 7.5%, reaching USD 49.2 billion in 2031 from USD 34.3 billion in 2026.

Liquid Hydrogen Market Introduction:

Liquid hydrogen (LH2) is hydrogen in its liquid state, achieved by cooling hydrogen gas to extremely low temperatures. Multiple factors have driven the market for liquid hydrogen. It is used primarily as a fuel in aerospace, transportation, and industrial processes. With the growing demand for green transportation, the need for innovative technologies like liquid hydrogen used in vehicles would rise.

Collaborations between key players, energy companies, technology providers, and industrial users are accelerating the development and adoption of liquid hydrogen technologies. The adaptation of hydrogen technologies and global hydrogen supply chains has also been increasing due to government support and policies.

The EU adopted a strategy on hydrogen (COM/2020/301) in 2020 and policy action points in 5 areas: investment support, support production and demand, creating a hydrogen market and infrastructure, research and cooperation, and international cooperation. The EU planned to develop renewable hydrogen to produce 10 million tonnes and import 10 million tonnes by 2030.

Liquid Hydrogen Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

Companies

- Air Liquide

- Linde plc

- Cryolor

- Plug Power

- Air Products

- Iwatani

- Messer

- Nippon Sanso Holdings Corporation

- INOX India

:

- Air Liquide

- Linde plc

- Cryolor

- Plug Power

- Air Products

- Iwatani

- Messer

- Nippon Sanso Holdings Corporation

- INOX India

The global liquid hydrogen market is continuing to develop across various applications, including aerospace, energy, industry, transportation, and infrastructure. Major projects, policy support, and system-scale investments are shaping the LH? market. Aerospace has its major project. NASA completed a new 1.4 million gallon (? 5,300 m³) LH? storage tank at Kennedy Space Centre (the world's largest LH? tank) in early 2023 to support increasing launch cadence under the Artemis program.

Infrastructure projects are accelerating as well. Hydrogen pipeline projects in Europe went live in 2024, which expanded the continent's hydrogen network. The system was already over 40% longer than it was in March 2024. Spain is fast-tracking a national network of 2,600 km as part of the longer H2Med corridor, expected to begin operations by 2030. Hy2Infra aims to develop 2,700 km of pipelines and 3.2 GW of electrolysers across Europe by 2027-2028. The German regulator has plans for a core hydrogen grid of 9,700 km by 2037, reusing approximately 60% of existing gas lines, supported by investment mechanisms, and a €20 billion budget.

In terms of production, it was noted that global hydrogen demand was almost 100 Mt in 2024, with low-carbon hydrogen production being less than 1%. Europe aims to achieve 100 GW of electrolysers capacity by 2030, with a growth rate of 150% annually between 2025-2030.

Liquid hydrogen is starting to be adopted by the industrial and transport sectors in a more meaningful manner. There are projects and liquid hydrogen pipeline-based transportation infrastructure, as well as initiatives such as the H2Med corridor that aims to transport 2 Mt of hydrogen (approx. 10% of the EU's forecasted hydrogen demand in 2030). The aviation sector is also progressing with the Climate Impulse project, which is developing a demonstration flight using green hydrogen by 2028.

These developments represent a simultaneous acceleration in several areas, including very large storage capacity (multi-million gallon tanks), further development of hydrogen pipeline infrastructure, deployment of larger numbers of electrolysers, and linking hydrogen into multiple industries. Liquid hydrogen, previously considered a niche fuel for aerospace, is now being incorporated into mainstream energy and transport infrastructure, enabled by specific projects, measurable targets, and alignment across government and industry.

This graph represents the current and future liquid hydrogen liquefaction capacity in the United States. As of May 2024, the U.S. liquefaction capacity is 304 metric tons per day and will have an additional 490 mtpd in construction or planning. The increase in total capacity raises the anticipated total to 794 mtpd, an important growth.

This is significant because cryogenic liquefied hydrogen is useful for high-volume hydrogen applications, including transport, aerospace, and grid-storage applications, which must be cryogenic to transport and use effectively. The increase in the number of cryogenic hydrogen liquefaction facilities represents a shift from pilot project organisations to actual, scalable deployment of liquid hydrogen technology. Therefore, both hydrogen fuel cell vehicle networks, launch service organisations, and industrial companies will now be able to plan more in advance for their LH? demand and use cases.

Liquid Hydrogen Market Growth Drivers:

Growing demand for liquid hydrogen for space exploration

Liquid hydrogen (LH?) has become a critical fuel in the aerospace industry, helping to facilitate the continued modern growth of space and launch capabilities. One of the key events of 2024 was NASA's upgrade of its 1.4-million-gallon cryogenic tank at Kennedy Space Centre. Originally intended for Artemis missions, the newly modified tank now allows for a heavier cadence of launches, both government and commercial. This reduces boil-off losses from storage and supports improved logistics of fuel and cryogenics for heavy-lift capabilities.

As this has progressed, Blue Origin has continued to move forward on its BE-7 lunar lander engine, which uses liquid hydrogen. The engine was successfully tested in a vacuum cell at the Air Force Research Laboratory in Edwards, California, in mid-2024. As these tests simulate the space-like environment used to validate performance characteristics before actual deployment on the moon, tests like these are important for development and validating reliability. The BE-7 is expected to be part of Blue Origin's lunar lander, with Blue Origin investing extensively in engine production and upgrades of its test facilities in Huntsville and Edwards AFB.

These aerospace developments are not only technical advances; they are market drivers. First, increased LH? storage and delivery capability at launch sites provides economies of scale to use LH? in a wider range of missions. Second, further newsworthy cryogenic-engine tests create confidence with both investors and start-ups that the entire LH? supply chain from production to transport to storage can meet the longer timescales and safety criteria for commercial scale-up. Third, every demonstration starts the chain of knock-on effects: insulation suppliers, cryogenic tank suppliers, pumping system suppliers, and logistics service suppliers all have to increase their capabilities, leading to further innovation and lower prices across the sector.

The aerospace industry is paving the way for more widespread adoption of LH? after a period of maturation in the market. NASA-sponsored retrofitting projects will study on how to safely incorporate LH? into aircraft, and conceptual future technologies (e.g., hypersonic transports) will help push those boundaries. As these aerospace launch programs are not just about the space market, they are serving as live case studies to validate the entire LH? supply chain. The infrastructure being constructed for launch storage systems, fueling logistics, and cryogenic transport will apply directly to aviation, heavy-duty transport, and industrial applications. Aerospace is taking LH? from a niche application to a commercially viable and infrastructure-ready fuel. The aerospace sector is signaling a demand to further develop the global LH? market by proving its safety, performance, and reliability at scale for launches. By investing in large storage solutions, validating the engine, and increasing supply networks, it is reaching a pivotal tipping point that positions liquid hydrogen as an important energy carrier in a broader transition to clean energy. The growing space programs from different nations like India, China, UAE, Saudi Arabia, etc., are leading to the demand for space fuel in large quantities, like liquid hydrogen.

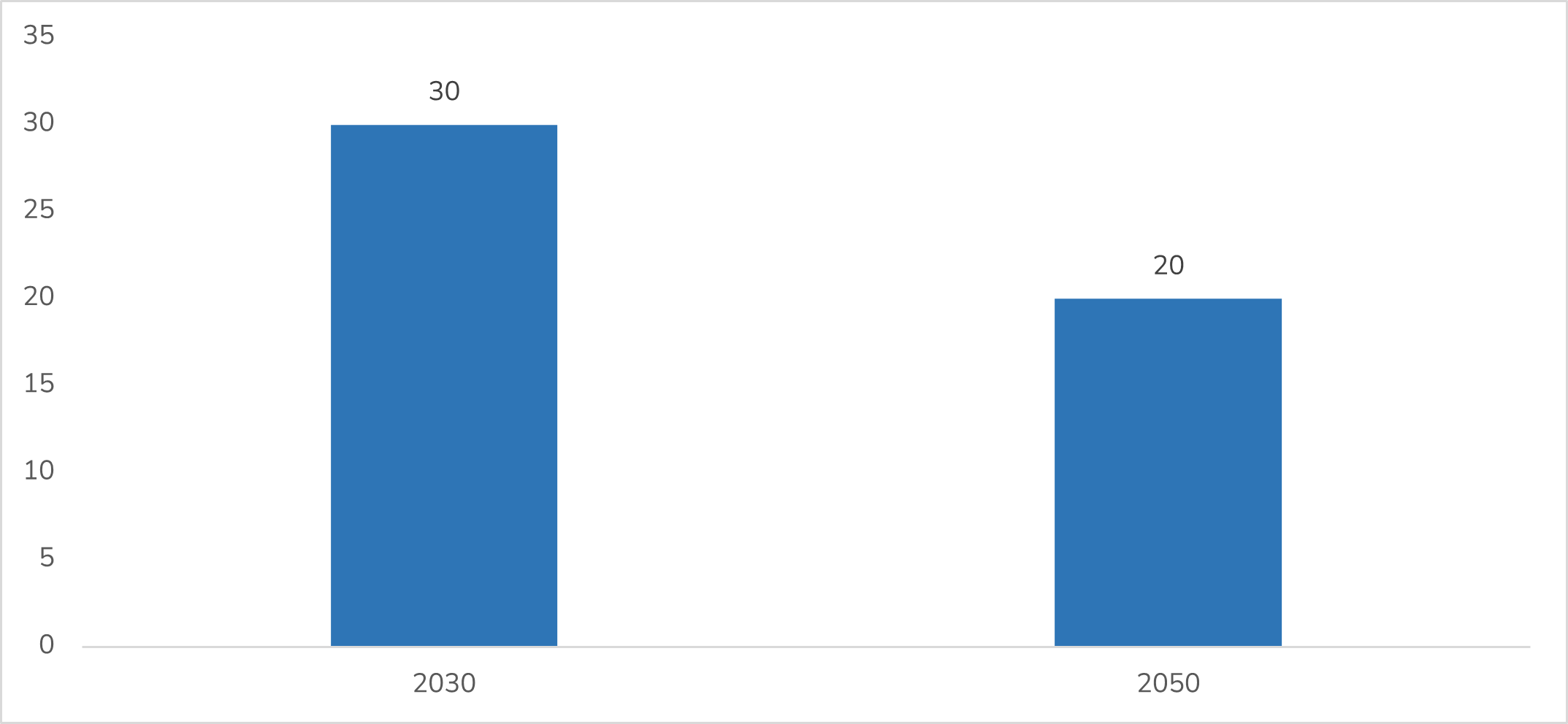

Japan’s Hydrogen Supply Cost Targets (Yen/Nm³)

Source: METI, Large-scale Hydrogen Supply Chain for Liquid Hydrogen and MCH, January 2023[1]

This bar chart shows Japan’s aim to reduce supply costs from 30?yen/Nm³ in 2030 to 20?yen/Nm³ in 2050, a 33% reduction, which is supported by government investment. This cost trajectory is important for the liquid hydrogen market, which will be critical for aerospace and launch applications, where large quantities of high-purity LH? are required. Lower supply costs for LH? provide economic feasibility, allowing increased frequency of rocket launches and aerospace testing with LH?, which will encourage private sector actors involved to engage in new projects and investment in infrastructure to scale up. As costs trend downward, LH? moves from a niche fuel to a feasible long-term fuel option to support additional aerospace traffic and fuel logistics. This reinforces the growth driver by enabling launch operations to scale, while fuel logistics improves the economic sustainability of supplying fuel.

Increasing adoption of hydrogen fuel cells in commercial vehicles

The development of long-haul and heavy-duty transportation within the hydrogen ecosystem is the key end-use of liquid hydrogen. The energy carrier has a far higher energy density per volume than gaseous hydrogen. Thus, the tanks of a fuel-cell truck using liquid hydrogen are more cost-efficient compared to the carbon tanks used for gaseous hydrogen. Due to the lower pressure, they are also significantly lighter.

In August 2023, Hyzon Motors Inc. and Performance Food Group, Inc. announced the successful completion of Hyzon's first commercial run with a liquid hydrogen fuel cell electric vehicle (LH2 FCEV). TX, the truck completed deliveries to eight PFG customers near Dallas, TX, traveling over 540 miles on a 16-hour continuous run, including over 100-degree Fahrenheit temperatures. This showcased the increased range and no added weight in comparison to gaseous hydrogen trucks.

Further, in July 2024, Daimler Truck and Linde Engineering presented sLH2, a jointly developed refueling technology for subcooled liquid hydrogen. Daimler Truck and Linde Engineering tried to establish sLH2 as a common refueling standard for hydrogen-powered trucks and make the technology available to all interested parties via an ISO standard. The first public sLH2 fuel station was inaugurated in Wörth am Rhein, Germany. Logistics would also use this for initial customer trials with the Mercedes-Benz GenH2 Truck from mid-2024.

These innovative technologies in subcooled liquid hydrogen considerably increase the efficiency of hydrogen refueling systems. These would pave the way for the development of a robust liquid hydrogen refueling network, which is essential to keep vehicles moving and supply chains intact.

Liquid Hydrogen Market Segmentation Analysis:

The automotive and transportation segment is expected to grow significantly

By end-user industry, the global liquid hydrogen market is segmented into aerospace, automotive and transportation, energy and power, industrial sector, and others. The liquid hydrogen market for automotive and transportation is gaining momentum as the global mobility sector shifts towards zero-emission solutions. Liquid hydrogen is attracting interest due to its high energy density and suitability for long-range applications. It is especially relevant in areas where battery-electric vehicles (BEVs) have limitations, such as heavy-duty transport, aviation, rail, and maritime sectors. Compared to gaseous hydrogen, its lower volume at cryogenic temperatures allows for more hydrogen to be stored onboard. This feature makes it ideal for applications where space and weight are important.

In the automotive sector, liquid hydrogen is mainly being investigated for use in fuel cell electric vehicles (FCEVs), particularly for commercial fleets, trucks, and buses. Many automotive manufacturers and transportation companies are running pilot projects and developing vehicles designed for liquid hydrogen. These vehicles offer faster refueling times and longer driving ranges than BEVs, making them suitable for long-haul and high-utilization routes.

In line with this, the data published by the Society of Indian Automobile Manufacturers (SIAM) indicate that the production of automobiles, including passenger vehicles, CVs, 3-wheelers, 2-wheelers, and quadricycles in India during 2021-22 was 2,30,40,066, which increased to 2,59,40,344 during 2022-23. Nonetheless, in 2023-24, the total number of all these vehicle productions reached 2,84,34,742.

Rail and marine transportation are also important areas for liquid hydrogen. Hydrogen-powered trains are being tested and rolled out in Europe and Asia, providing a cleaner alternative to diesel locomotives, especially on non-electrified tracks.

Moreover, to help freight customers see how much carbon emissions they have saved by choosing rail transport over road, Indian Railways gives them Rail Green Points (RGPs). The carbon savings are measured in tonnes of CO2 and credited to the customer as RGPs. Each freight customer has an RGP account on their dashboard. When a Railway Receipt (RR) is issued, the RGPs earned are added to the customer’s RGP account.

Apart from this, the global liquid hydrogen sector is witnessing rapid advancements driven by technological innovation, strategic collaborations, and large-scale infrastructure initiatives across mobility and energy applications.

Comprehensively, the expansion of the liquid hydrogen market in transportation will significantly depend on coordinated investments in production, storage, and distribution infrastructure. Government policies, incentives for clean transport, and public-private partnerships will be crucial in overcoming current economic and technical challenges. As the need for decarbonization becomes more urgent, liquid hydrogen will be key in enabling low-emission transportation in sectors where electrification is less practical or cost-effective.

Liquid Hydrogen Market Geographical Outlook:

The global liquid hydrogen market is segmented into five regions worldwide

By geography, the global liquid hydrogen market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the global liquid hydrogen market due to increasing applications in various industrial processes, from refining metals to producing ammonia for fertilizers. North America is expected to have a significant global liquid hydrogen market share due to hydrogen-powered vehicles becoming more common.

Liquid Hydrogen Market Major Products:

New York Green Hydrogen Facility – New York Green Hydrogen Facility by Air Products operates a 35-metric-ton-per-day facility to produce green liquid hydrogen. This is also a liquid hydrogen distribution and dispensing operation. This was an investment of $500 million.

Hydrogen Liquefaction - Air Liquide Engineering & Construction offers several proprietary technologies, including expansion turbines, heat exchangers, advanced insulation cold boxes, and a range of standard H2 liquefiers. An increase in hydrogen liquefaction would support the transition to a low-carbon future. The company has experience in designing, engineering, and operating ultra-low-temperature liquefaction plants. The company is working on the next generation of H2 liquefiers, which are larger than 100 tpd, for large liquid hydrogen export projects.

Liquid Hydrogen Market Key Developments:

The global liquid hydrogen market leaders are Air Liquide, Air Products and Chemicals, Inc., Iwatani Corporation, Linde PLC, Messer Group GMBH, Nippon Sanso Holdings Corporation, and Cryolor. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

In June 2025, ZeroAvia announced the UK Government had awarded the company and consortium partners a grant towards a £10.8m project to develop a novel liquid hydrogen management system. The project, co-funded through the ATI Programme, culminates in the integration of the lightweight fuel system into a Dornier 228 before a series of flight tests.

As of May 2025, Mitsubishi Fuso Truck and Bus Corporation and Iwatani Corporation have signed a Memorandum of Understanding (MoU) on the study of liquid hydrogen refueling technology for hydrogen-fueled commercial vehicles.

In May 2025, Air Products, a global leader in industrial gases and the largest hydrogen supplier worldwide, successfully delivered liquid hydrogen for the world’s first hydrogen-powered fuel cell superyacht, "Breakthrough." This milestone underscores a major advancement in sustainable marine technology, demonstrating the viability of hydrogen as a clean energy solution for maritime transportation and signaling its growing role in the industry's decarbonized future.

In May 2024, Airbus launched an innovative aviation hydrogen handling and refueling project with academic partners, airport operators, and leading hydrogen industry companies. The company demonstrates small-scale liquid hydrogen aircraft ground operations at three European airports. The project is named GOLIAT (Ground Operations of LIquid Hydrogen AircrafT). It would receive €10.8 million in funding from the EU’s Horizon Europe Framework Programme via CINEA, the European Climate, Infrastructure and Environment Executive Agency. The duration of the project is four years. This would demonstrate high-flow liquid hydrogen (LH2) handling and refueling technologies for airport operations. The group would support the aviation industry’s adoption of LH2 transportation and energy storage solutions by developing the standardization and certification framework for future LH2 operations and assessing the sizing and economics of the hydrogen value chains for airports.

In March 2024, the Federal Institute for Materials Research and Testing (BAM) worked on a pioneering storage concept for liquid hydrogen. The aim was to increase the capacity of suitable tanks by a factor of forty and simultaneously reduce costs by 80 percent.

In February 2024, Plug Power Inc. started operating its hydrogen plant in Charleston, Tennessee. This would add about ten tons per day (TPD) of liquid hydrogen supply back onto the U.S. market. The company implemented design improvements to enhance overall plant efficiency. Plug Power Inc. is a key player in comprehensive hydrogen solutions for the green hydrogen economy. Plug’s cryogenic trailer fleet would deliver liquid hydrogen from the Tennessee plant to customers throughout North America. This liquid hydrogen would be used in material handling operations, fuel cell electric vehicle fleets, and stationary power applications. The company expected its joint venture plant in Louisiana to be operational in the third quarter of 2024, adding another 15 TPD of liquid hydrogen capacity to the market.

In February 2024, Universal Hydrogen Co. successfully ran a megawatt-class fuel cell powertrain using its proprietary liquid hydrogen module to supply the fuel. This is the largest fuel cell powertrain to run on liquid hydrogen. The liquid hydrogen module powered the company’s “iron bird” ground test rig for over 1 hour and 40 minutes. It holds fuel to power the iron bird for over three hours at full power with two such modules. The iron bird is a functional analog of the powertrain that Universal Hydrogen has been flight testing. It is developed at Universal Hydrogen’s engineering and design center in Toulouse, France. The module contains ~200 kilograms of liquid hydrogen and is capable of storing it for long durations.

List of Top Liquid Hydrogen Companies:

Air Liquide

Linde plc

Cryolor

Plug Power

Air Products

Liquid Hydrogen Market Scope:

The global liquid hydrogen market is segmented and analyzed as follows:

By Production Method

Coal Gasification

SMR

By Distribution

Pipelines

Cryogenic Tanks

Others

By End Use Industry

Aerospace

Automotive and Transportation

Energy and Power

Industrial Sector

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Rest of South America

Europe

United Kingdom

Germany

France

Italy

Spain

Rest of Europe

Middle East and Africa

Saudi Arabia

UAE

Rest of the Middle East and Africa

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Indonesia

Rest of Asia-Pacific