Report Overview

India Animal Feed Market Highlights

India Animal Feed Market Size:

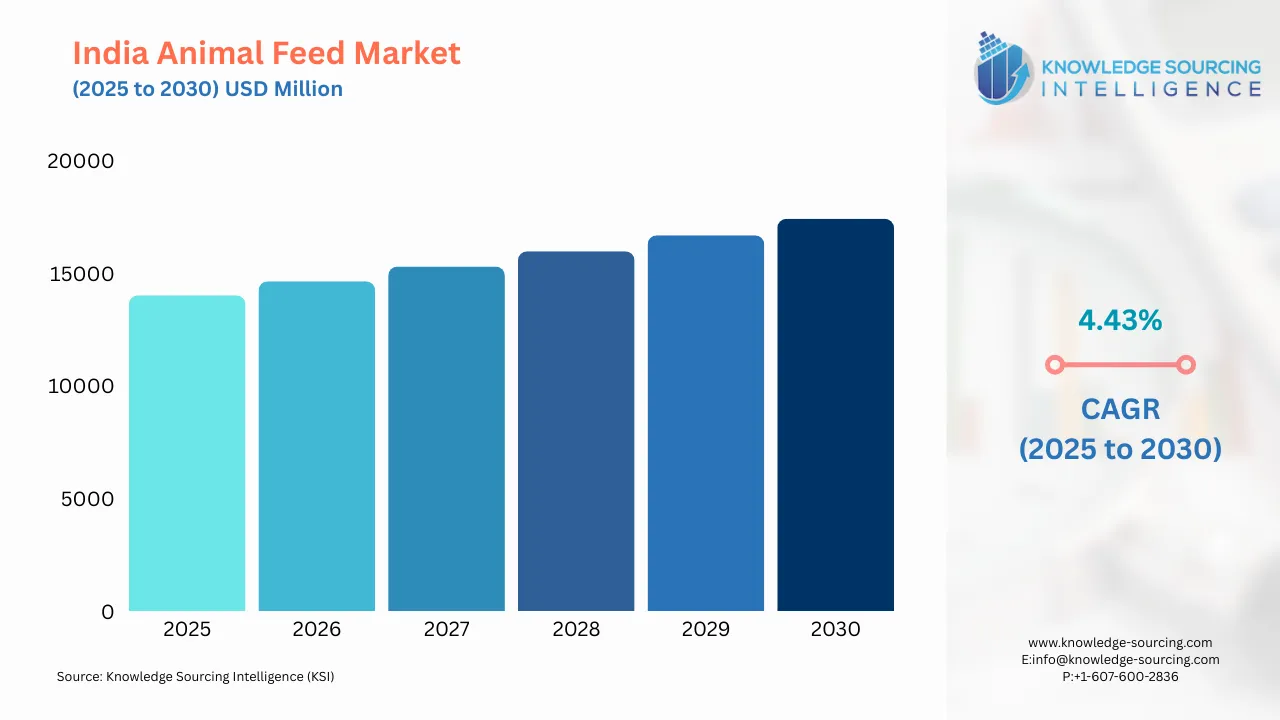

The India Animal Feed Market is projected to witness a compound annual growth rate of 4.43% to grow to USD 17,419.795 million by 2030 from USD 14,025.714 million in 2025.

The increasing poultry population and product launches are major growth drivers of the Indian animal feed market. The increasing purchasing power of the people, coupled with the favorable demographic in the country, from urban to rural areas, is further contributing largely to the increase in poultry consumption. Further, the growing incentives by the government, such as in fishing promotion, cattle per capita milk production, poultry farming, and others, are one of the key factors driving the market.

India Animal Feed Market Overview & Scope:

The Indian Animal Feed Market is segmented by:

Type: By type, the market is divided into fodder & forage and compound feed. Compound feed is growing rapidly, driven by the expansion of commercial poultry and dairy farming.

Livestock: By livestock, it is segmented into swine, aquatic animals, cattle, poultry, and others. Poultry feed is the largest and dominant segment, driven by growth in demand for eggs and meat. While the cattle feed segment is also growing, supported by India’s massive cattle population and growing emphasis on doubling the farmer income, including by increasing the per capita milk consumption. Aquaculture feed is the emerging segment, driven by various government fish farming initiatives.

Form: By form, the market is categorised into liquid and dry feed. The dry feed is the largest segment, driven by its commercial feed formulation standards.

Source: By source, the market is classified into organic and conventional feed. Conventional feed dominates the market, while the growing sustainability awareness is driving the demand for organic and eco-friendly feed ingredients; however, the market's price-sensitive nature is currently limiting its adoption.

Raw Material: By raw material, the market is segmented into corn, soy, rendered meal, and others.

India Animal Feed Market Drivers:

Increasing Poultry Population

The increasing poultry population is one of the major growth drivers of the Indian animal feed market. As per a report from the Department of Animal Husbandry and Dairying in India, poultry production in India has taken a huge leap in India in four decades. According to the 20th Livestock Census in the country, the total poultry population reached 851.81 million heads in 2019, registering a growth of 16.8% as compared to the previous census results. In addition, as per the 2021-22 Annual Report of DAHD, egg production in the country grew from 82.93 billion in 2015-16 to 122.05 billion in 2020-21. The cattle population increased by 9.8% from 2017 to 2022, and a similar trend is anticipated to be followed in the projected period as well. The growth in the poultry sector is significantly contributing to the growth of the feed market in India.

Total Egg Production in 22-23 (in Billion) | 138.38 |

Commercial Production | 118.16 |

Backyard Production | 20.20 |

Source: BAHS Statistics 2023, DAHD-Govt. of India

Increasing Consumption of Milk

The increasing consumption of milk in India is encouraging the farm owner to invest in good-quality feed to increase the production of milk. As per the India Livestock Census, the per capita consumption of milk in India was 427 grams/day in 2021, compared to the global consumption that stood at 305 grams/day in the same year. Moreover, the consumption of beef is also increasing in some parts of the country, such as in Assam, Kerala, and other southern parts. The growing milk consumption, coupled with the increasing demand for animal products in the country, is providing an edge to the market growth of India’s animal feed market.

Government Initiatives

The demand for animal products is also increasing in the country. For instance, the consumption of poultry meat in the country is also on the rise in the present times. For instance, according to OECD (Organization of Economic Co-operation and Development), the per capita consumption of poultry meat in India was 2.32 kg in 2017, which reached 2.58 kg in 2021. Poultry meat consumption is increasing year by year in the country, increasing demand for good-quality animal feed to feed the animals.

Government Initiatives/Projects | Investment/Growth Areas |

National Livestock Mission | Rs. 2,300 Crore Budget for 2021-26, Focus including on feed development |

Animal Husbandry Infrastructure Development Fund | Rs. 29,610.25 crore for another three years up to 2025-26. |

Rashtriya Gokul Mission | Launched in 2014, this mission aims to conserve and develop the country's indigenous bovine breeds. |

Growing Cattle Feed Market

Growing demand for higher-yield cattle in the dairy industry, coupled with the subsidies and schemes by the government, is anticipated to be the major driver of the animal feed market in India for cattle livestock. For instance, according to the April 2023 released Grain and Feed Annual -2023 by the United States Department of Agriculture (USDA), there is currently an ongoing trend of replacing low-yielding cattle with crossbred buffaloes and cows with higher yields, which has led to the per annum growth of 10-12 per cent in the commercial dairy feed sector of the country. Furthermore, as per the Dairy Development Department Annual Plan 2022-23 Report released by the Department of Dairy Development, Kerala State, a sum of INR 500 lakhs is benchmarked for the cattle feed distribution under a subsidy scheme, which will be based upon the quantity of milk produced in the dairy cooperatives. The report further stated that milk production in India has grown to 19.84 crore tons in the 2019-20 period, which is a 5.64% increase compared to the 18.78 crore tons of production in 2018-19.

India Animal Feed Market Competitive Landscape:

The Indian animal feed market is highly fragmented, with the presence of leading global and domestic companies such as Cargill, Godrej Agrovet, ADM, Alltech, BASF, and DSM Nutritional Products. In addition to these major players, several other key companies play an important role in shaping the industry, including Golden Feeds, Avitech, Suguna Foods Private Limited, SKM Animal Feeds and Foods (India) Pvt. Ltd., Avanti Feeds Limited, Japfa Comfeed India Private Limited, Amrit Feeds, and Venky’s (India) Limited. This diverse mix of international and local participants intensifies competition and drives continuous innovation within the market.

Product Launch and Expansion: In August 2024, Swiss-Indian agri-tech platform Innoterra announced the expansion of its subsidiary MilkLane’s Aayush cattle feed business, launching two new premium products and outlining plans for nationwide growth. It introduced Aayush Supreme and Aayush Vardhan, containing 22 per cent and 24 per cent crude protein, respectively, aimed at the premium segment of the cattle feed market.

Government Initiatives: In 2025, APEDA launched its new initiative BHARATI, Bharat’s Hub for Agritech, Resilience, Advancement, and Incubation for Export Enablement. The programme aims to empower 100 agri-food and agri-tech startups, accelerating innovation, creating export opportunities, and supporting APEDA’s vision of achieving Rs. 4,40,150 crore (US$ 50 billion) in agri-food exports of Scheduled Products by 2030.

India Animal Feed Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 14,025.714 million |

| Total Market Size in 2030 | USD 17,419.795 million |

| Forecast Unit | Million |

| Growth Rate | 4.43% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Livestock, Form, Production System |

| Companies |

|

India Animal Feed Market Segmentation:

By Type

Fodder & Forage

Compound Feed

By Livestock

Swine

Aquatic Animals

Cattle

Poultry

Others

By Form

Liquid

Dry

By Production System

Integrated

Commercial Mills

By Source

Organic

Conventional

By Raw Material

Corn

Soy

Rendered Meal

Others