Report Overview

Indonesia AI in Finance Highlights

Indonesia AI in Finance Market Size:

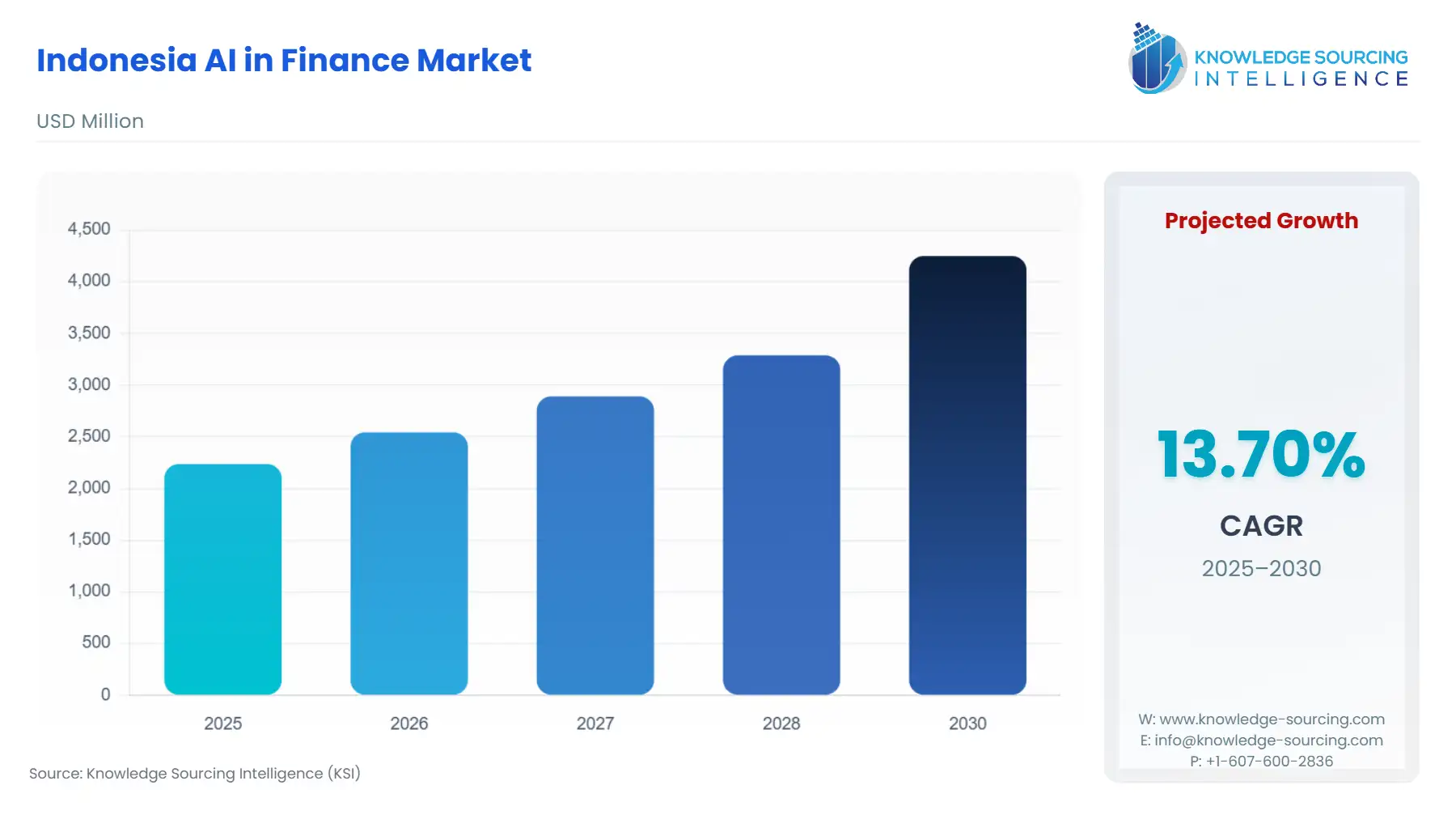

The Indonesia AI in Finance Market is expected to grow at a CAGR of 13.70%, rising from USD 2.237 billion in 2025 to USD 4.250 billion by 2030.

Indonesia's financial sector is undergoing a profound digital transformation, catalyzed by the convergence of high internet penetration—approaching 79%—and a strategically supportive regulatory environment. This evolution is transitioning the industry from a reliance on traditional, branch-based operations to a dynamic, technology-centric ecosystem.

The Indonesian government and the Financial Services Authority (OJK) have prioritized a digital economy, setting the stage for Artificial Intelligence to become an embedded operational necessity rather than a marginal technology. The imperative to manage risk across high-volume digital transactions, combined with the strategic goal of deepening financial inclusion, frames the core operational challenge that AI-driven tools are uniquely positioned to solve for both established commercial banks and emerging fintech institutions.

________________________________________

Indonesia AI in Finance Market Analysis:

Growth Drivers:

The accelerating pace of digital transactions fundamentally increases the demand for sophisticated AI tools. Indonesia recorded a significant rise in digital transactions in 2024, creating an immense data set that legacy systems cannot effectively process for real-time risk or customer segmentation. This sheer volume necessitates AI for fraud detection and instantaneous credit risk assessment, directly driving the adoption of Machine Learning and deep learning algorithms. Furthermore, the persistent drive for hyper-personalized customer experiences at scale, especially among the digitally native population, mandates the use of AI for product recommendation engines and customized service delivery, thereby increasing demand for Natural Language Processing (NLP) in customer-facing applications.

Challenges and Opportunities:

A critical challenge is the significant talent shortage of data scientists and AI specialists, a constraint that slows internal development and increases reliance on expensive, external AaaS vendors. This constraint, in turn, creates a demand opportunity for pre-packaged, domain-specific AI solutions and partnerships with global technology providers. Conversely, the opportunity lies in leveraging AI to bridge the financial inclusion gap. AI agents with local dialect capabilities can simplify the onboarding process and improve digital literacy for the unbanked, a demographic around 25% of the adult population. Successful deployment in these underserved markets directly expands the addressable market for financial products, boosting demand for AI-enabled operational platforms.

Supply Chain Analysis:

The Indonesian AI in Finance supply chain is primarily a service-oriented dependency chain, not a material-based one. The key production hubs are globally distributed hyperscale cloud providers and specialized AI development firms. Logistical complexities center on data sovereignty and secure cross-border data transfer, as many AI models are trained on platforms hosted outside Indonesia. The principal dependency is on the availability of high-quality, unified data within Indonesian financial institutions. Fragmented legacy systems present an internal logistical hurdle that must be overcome before third-party AI models can be effectively deployed, creating a direct dependency on robust domestic data integration platforms.

Government Regulations:

The regulatory landscape, driven by the OJK and Bank Indonesia (BI), directly shapes the market by imposing strict data security, consumer protection, and technology risk management requirements.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| OJK | POJK No. 11/POJK.03/2022 on the Application of Information Technology by Commercial Banks | Formally establishes the framework for banks to outsource IT activities, including AI development and hosting. This regulation reduces the friction for banks to adopt cloud-based AI solutions, driving external demand for specialized vendor services. |

| OJK | POJK No. 22/POJK.03/2023 on Consumer and Public Protection in the Financial Services Sector | Mandates stringent data privacy and fair treatment for consumers. This increases demand for Responsible AI frameworks and technologies that ensure non-discriminatory loan approvals and transparent decision-making, compelling AI vendors to build auditable models. |

| Ministry of Communications and Informatics (Kominfo) | Personal Data Protection Law (PDP Law) No. 27/2022 | Bolsters the legal framework for safeguarding user data. This creates a strong demand for AI solutions with advanced encryption, anonymization techniques, and on-premise or localized data processing capabilities to ensure compliance with data sovereignty principles. |

| Bank Indonesia (BI) | Payment System Blueprint (PSBI) 2025 | Encourages the digital payment system to promote financial inclusion and efficiency. This accelerates the adoption of AI for real-time payment fraud monitoring and transaction analysis, as the speed and volume of money movement increase dramatically. |

________________________________________

Indonesia AI in Finance Market Segment Analysis:

By Application: Back Office

The Back Office segment, encompassing core functions like risk management, compliance, and loan processing, is a primary demand center for AI in the Indonesian finance market. Its necessity is not driven by external customer convenience but by the internal imperative to manage systemic risk and operational efficiency at a national scale. For instance, large state-owned banks like BRI utilize AI-powered tools such as BRIBrain to execute immediate, risk-scored credit decisions for micro-loans. This use of Machine Learning transforms loan approval from a multi-day manual assessment into an instantaneous process, directly increasing loan volume and reducing non-performing loan risk. The regulatory pressure from OJK for robust risk management in the rapidly expanding fintech sector further fuels this demand, as institutions require AI to proactively identify transaction anomalies and meet stringent Anti-Money Laundering (AML) reporting obligations.

By User: Corporate Finance

The Corporate Finance segment, which includes services for Medium to Large Enterprises (MLEs) and major institutional clients, drives demand for sophisticated AI models focused on complex data analysis and forecasting. These institutions require AI for cash flow prediction, supply chain financing risk modeling, and complex trade finance compliance. The growth catalyst here is the need for speed and granularity in financial market analysis to maintain a competitive edge in capital markets and optimize treasury functions. AI-driven sentiment analysis, for example, is increasingly required by corporate finance desks to interpret macroeconomic news, trade reports, and regulatory announcements from sources like Bank Indonesia, allowing for real-time adjustment of investment and hedging strategies. This segment is less sensitive to the consumer-centric demand for simple user interfaces and more focused on the computational power and predictive accuracy of Large Language Models (LLMs) and predictive analytics.

________________________________________

Indonesia AI in Finance Market Competitive Environment and Analysis:

The competitive landscape is defined by the strategic rivalry between Indonesia's major incumbent banks and the well-funded, agile fintech platforms. Traditional banks are leveraging their large customer bases and regulatory trust to deploy AI, while fintechs use AI to disrupt traditional credit and payment processes. This dynamic ensures sustained investment and rapid AI adoption across the sector.

Bank Central Asia (BCA): BCA, one of Indonesia's largest private banks, maintains a strategic positioning focused on the digital experience of its mass affluent and corporate segments. BCA's key initiatives often center on integrating AI into its proprietary platforms. BCA's focus is on scaling digital services, evidenced by a sustained commitment to modernizing its core banking systems to accommodate AI-driven personalized offers and streamlined transaction processing for its extensive mobile user base.

Bank Rakyat Indonesia (BRI): BRI's strategic positioning is rooted in being the nation's largest microfinance lender, making its AI investment an extension of its core mission of financial inclusion. Its flagship proprietary AI model, BRIBrain, is a verifiable cornerstone of this strategy. BRIBrain is used to digitize the entire micro-lending value chain, specifically for credit scoring and fraud detection, allowing for the rapid disbursement of small-ticket loans. This focus enables BRI to service millions of unbanked customers in remote areas, a key strategic differentiator.

GoTo (GoPay/Gojek): GoTo, through its fintech arm GoPay, leverages its 'super app' ecosystem to integrate financial services deeply into the daily lives of millions of users. GoTo's strategic positioning is as an AI-driven ecosystem enabler, prioritizing the user experience through embedded finance. A verifiable key product is the launch of Dira by GoTo AI, an AI-enabled FinTech voice assistant in Bahasa Indonesia, which simplifies navigation and accessibility within the GoPay app. This move is specifically designed to broaden the user base by overcoming language and digital literacy barriers.

________________________________________

Indonesia AI in Finance Market Recent Developments:

July 2024: GoTo Launches Dira by GoTo AI Voice Assistant

GoTo Group officially introduced "Dira by GoTo AI," the first AI-enabled FinTech voice assistant in Bahasa Indonesia, accessible on the GoPay app. This product launch is aimed at enhancing user experience and accessibility. Dira enables users to perform various tasks and discover GoPay app features faster using natural voice commands, aiming to simplify the user journey for Indonesia's vast base of users, including the unbanked, and can be utilized on mobile phones with limited capacity, according to the official release.

________________________________________

Indonesia AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.237 billion |

| Total Market Size in 2031 | USD 4.250 billion |

| Growth Rate | 13.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Indonesia AI in Finance Market Segmentation

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office