Report Overview

Infrastructure Monitoring Market - Highlights

Infrastructure Monitoring Market Size:

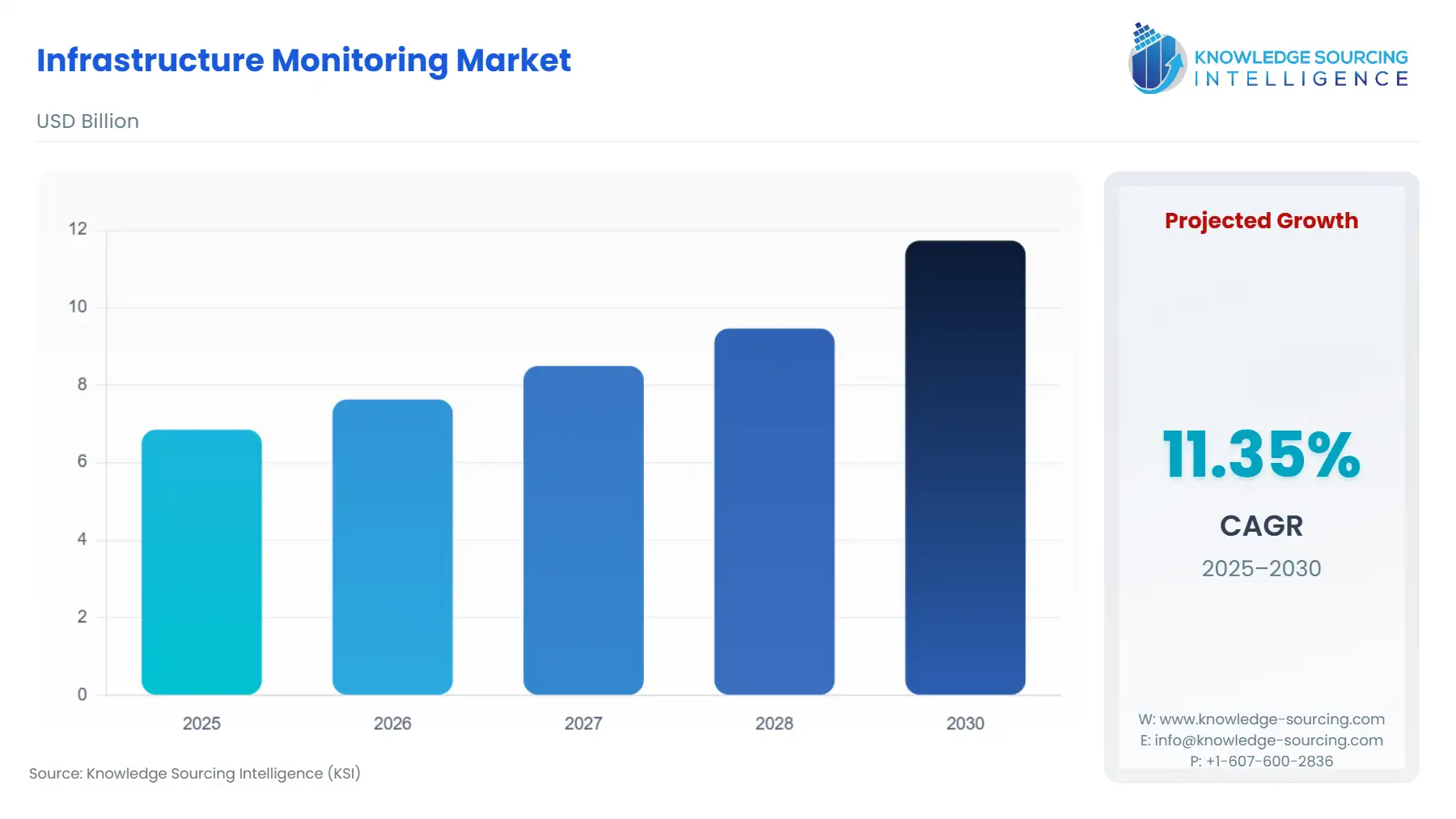

Infrastructure Monitoring Market is forecasted to rise at a 11.01% CAGR, increasing from USD 6.853 billion in 2025 to USD 12.825 billion in 2031.

Infrastructure Monitoring Market Trends:

Infrastructure monitoring is a crucial and multifaceted process involving the meticulous collection of health and performance data from various elements within a system. These elements encompass servers, virtual machines, containers, databases, and other backend components that together constitute the backbone of an organization's IT infrastructure. The overarching objective of infrastructure monitoring is to offer an invaluable vantage point into the well-being of these backend components, which are instrumental in supporting and sustaining applications. By doing so, it empowers teams to safeguard the availability of critical services and ensure that they function as intended. A paramount function of infrastructure monitoring is the preemptive detection and mitigation of issues to thwart their escalation into full-blown outages, thus averting substantial disruptions. In the event of an incident or outage, an infrastructure monitoring tool plays a pivotal role in identifying the precise hosts, containers, or other backend components that may have faltered or encountered latency. This invaluable insight allows engineers to promptly pinpoint the responsible culprits, facilitating swift issue resolution, support ticket handling, and amelioration of any customer-facing problems. However, for most organizations, infrastructure monitoring is merely one facet of a comprehensive monitoring solution. Effective troubleshooting frequently necessitates the parallel examination of infrastructure monitoring data alongside data emanating from applications, network infrastructure, and various other segments of the technology stack. A holistic monitoring solution provides a well-rounded contextual perspective, enabling a deeper understanding of the root causes of issues. Whether the culprit is an overburdened host, a flaw in the application code, connectivity glitches, or any other potential disruption, a comprehensive monitoring system unveils the intricate interplay of these factors and empowers organizations to maintain the seamless operation of their critical services.

The infrastructure monitoring market is currently experiencing rapid growth and is expected to maintain this trajectory in the foreseeable future. This expansion can be attributed to the critical role that infrastructure monitoring plays in the contemporary tech landscape. Infrastructure monitoring encompasses the systematic collection of vital health and performance data from various components within a tech stack, including servers, virtual machines, containers, databases, and other backend elements. Several factors are propelling the growth of the infrastructure monitoring market. First and foremost, there is a surging demand for cloud-based infrastructure monitoring solutions, driven by the increasing reliance on cloud services and the need for efficient management of these resources. Furthermore, real-time monitoring and data analysis have become imperative for businesses, given the ever-increasing complexity and scale of digital operations. The growth of the Internet of Things (IoT) has also contributed significantly, as more connected devices require robust infrastructure monitoring to ensure seamless operations. The data derived from infrastructure monitoring serves as a valuable resource for businesses. It aids in strategic planning to meet client demands and adhere to Service-Level Agreement (SLA) requirements, ultimately enhancing customer satisfaction and loyalty. Additionally, the benefits of infrastructure monitoring are substantial, including cost savings through efficient resource allocation, improved system reliability, and the invaluable capability to detect and address issues proactively, preventing them from adversely affecting end-users. As the tech landscape continues to evolve, infrastructure monitoring will remain a cornerstone of effective and reliable digital operations.

Infrastructure Monitoring Market Growth Drivers:

Increasing demand for cloud-based infrastructure monitoring solutions: The surge in demand for cloud-based infrastructure monitoring solutions is a direct consequence of the escalating prominence of cloud computing in the modern technological landscape. As organizations increasingly migrate their operations and data to the cloud, the need for robust and adaptable infrastructure monitoring tools becomes paramount. These solutions are designed to keep a vigilant eye on the intricate web of resources, services, and applications that comprise cloud-based infrastructure. The advantages they bring to the table are multifaceted and impactful. One of the pivotal strengths lies in its scalability, allowing businesses to effortlessly adapt to changing workloads and resource requirements without incurring the complexities associated with traditional on-premises solutions. The flexibility offered by cloud-based infrastructure monitoring solutions further empowers organizations to tailor their monitoring strategies according to their specific needs, whether it be optimizing performance, ensuring security, or meeting compliance standards.

Need for real-time data monitoring: Real-time monitoring and analysis of data play a pivotal role in today's fast-paced technological landscape, serving as a critical linchpin for identifying and resolving issues before they can adversely affect end-users. In this age of heightened digital dependence, the swift detection and mitigation of potential problems are paramount. Infrastructure monitoring tools, a cornerstone of modern IT and software management, are invaluable in this regard. These tools continuously gather and provide real-time data on the health and performance of critical backend components, such as servers, databases, and networking infrastructure. Armed with this invaluable insight, agile and responsive teams can promptly take proactive measures to preemptively address any anomalies or weaknesses, thereby mitigating the risk of incidents snowballing into full-blown outages.

Growing adoption of IoT: The increasing adoption of the Internet of Things (IoT) has become a significant catalyst for the demand for robust infrastructure monitoring solutions. With the IoT's rapid expansion, there is an ever-growing multitude of connected devices across various sectors and industries. This proliferation necessitates the implementation of comprehensive infrastructure monitoring tools to oversee and control this burgeoning ecosystem. These tools serve as a crucial means for organizations to uphold the functionality and security of their IoT devices. By constantly and proactively monitoring the network and its connected endpoints, organizations can ensure that their IoT devices are operating as intended, identify potential issues in real time, and take preventive measures to safeguard these devices from vulnerabilities and security threats. The IoT's remarkable growth is thus pushing organizations to embrace infrastructure monitoring as an indispensable strategy to optimize their operations and protect their IoT investments.

Increasing demand for preventive maintenance: The escalating demand for preventive maintenance is a direct consequence of the ever-increasing utilization of cutting-edge sensor technologies and the concurrent reduction in sensor costs. This trend is propelling organizations to prioritize proactive maintenance strategies. These strategies primarily involve the deployment of sophisticated infrastructure monitoring solutions, which can swiftly detect and pinpoint potential issues before they have a chance to adversely affect end-users. By taking a pre-emptive approach, organizations can significantly mitigate downtime, thus ensuring the consistent and reliable performance of their systems. This shift towards preventive maintenance marks a pivotal transformation in the way businesses and institutions manage their assets, and it underscores the critical role that technology plays in enhancing operational efficiency and overall reliability.

Rising Capital Investments: The escalation of capital investments in critical infrastructure underscores a fundamental shift in the mindset of industries spanning diverse sectors. Businesses and organizations are increasingly acknowledging the paramount significance of upholding the seamless functionality and long-term durability of their essential infrastructure. This rising awareness has led to a surge in the quest for innovative solutions aimed at not only bolstering safety standards but also fine-tuning maintenance procedures and ultimately elevating overall operational efficiency. As a result, companies are channelling resources into transformative initiatives that transcend traditional maintenance practices, embracing cutting-edge technologies and strategies that promise to fortify the bedrock of their operations, enhance reliability, and pave the way for sustained success.

List of Top Infrastructure Monitoring Companies:

Parker offers a variety of sensors to monitor a wide range of parameters, including vibration, temperature, pressure, and humidity. It also offers data acquisition and processing systems to collect and analyze data from sensors, software to help users visualize and analyze condition monitoring data, and to generate alerts and reports, and a variety of services, such as condition monitoring consulting, installation, and training.

Siemens offers SiMON which is a cloud-based platform that provides remote monitoring and analytics for railway infrastructure. SiMON collects data from a variety of sensors on railway assets, such as tracks, switches, and signals. This data is then analyzed to identify potential problems and to optimize the maintenance of railway assets.

Infrastructure Monitoring Market Segmentation Analysis:

Prominent growth in the vibration monitoring segment within the infrastructure monitoring market:

The vibration monitoring segment is a notable growth area in the infrastructure monitoring market, with several key factors contributing to its expansion. Vibration monitoring, a subset of machine condition monitoring, involves the continuous or periodic tracking of various parameters like temperature, vibration, pressure, electrical signals, and other relevant metrics. This approach facilitates the assessment of structural dynamics, the identification of potential stability-related issues, and the evaluation of vibrations' impact on overall infrastructure performance. The increasing adoption of vibration monitoring is pivotal in providing insights into detecting faults at their nascent stages, thus preventing more substantial infrastructure issues. Vibration monitoring solutions have also seen an uptick in usage due to their effectiveness in minimizing maintenance efforts, facilitating integration, and streamlining operational complexities. Industry players have responded by increasing their investments in the continuous monitoring of critical equipment, including cooling tower gearboxes, boiler feed pumps, steam turbines, and gas machinery. End-users are expected to integrate vibration monitoring into their systems to enhance reliability and safeguard data, further propelling the segment's growth. Moreover, the segment's expansion is driven by the growing reliance on renewable energy sources, which necessitates advanced monitoring solutions and the adoption of predictive maintenance strategies to optimize costs and uptime.

Infrastructure Monitoring Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share of the infrastructure monitoring market:

The Asia Pacific region is poised to exhibit the highest growth in the infrastructure monitoring market during the forecasted period, primarily attributed to a confluence of factors driving its robust growth. Among these factors are the proliferation of smart city initiatives and the surge in projects designed to enhance urban living, such as the noteworthy examples of Smart Wellington in New Zealand and the Intelligent Disease Prediction Project in China. Moreover, the region is experiencing a surge in cloud spending, further accelerating its technological advancement and fostering innovation. In addition to these technological advancements, the Asia Pacific region is witnessing a remarkable increase in the adoption of Internet of Things (IoT) devices. This trend is largely rooted in the growing necessity for real-time data monitoring and analysis across various sectors, including healthcare, transportation, energy, and utilities. These developments have been catalyzed by the region's extensive population, particularly its burgeoning middle-class demographic. This demographic's demand for improved infrastructure, spanning transportation networks, energy grids, and utilities, is steering substantial investments into the sector. Notably, emerging economies within the Asia Pacific region, notably China and India, are taking the lead in making substantial investments in infrastructure development. This financial commitment is directed toward modernizing and expanding critical infrastructure elements. As a result, governments in the region are increasingly focusing on implementing infrastructure monitoring solutions to enhance the reliability and safety of vital structures such as bridges, tunnels, and power plants. Furthermore, the Asia Pacific region is set to experience remarkable growth in the vibration monitoring segment. This growth is driven by the ever-increasing use of renewable energy sources and adoption of predictive maintenance strategies, aimed at optimizing operational costs and maximizing uptime. These strategies are not only environmentally responsible but also economically sound.

Infrastructure Monitoring Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Infrastructure Monitoring Market Size in 2025 | USD 6.853 billion |

Infrastructure Monitoring Market Size in 2030 | USD 11.730 billion |

Growth Rate | CAGR of 11.35% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Infrastructure Monitoring Market |

|

Customization Scope | Free report customization with purchase |

Infrastructure Monitoring Market Segmentation

By Component

Hardware

Software

Services

By Technology

Wired

Wireless

By Deployment

Cloud

On-Premise

By Application

Corrosion Monitoring

Crack & Damage Detection

Vibration Monitoring

Strain Monitoring

Others

By End-User

Manufacturing

Construction

Energy & Utilities

Aerospace & Defense

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others