Report Overview

Italy Home Fragrance Market Highlights

Italy Home Fragrance Market Size:

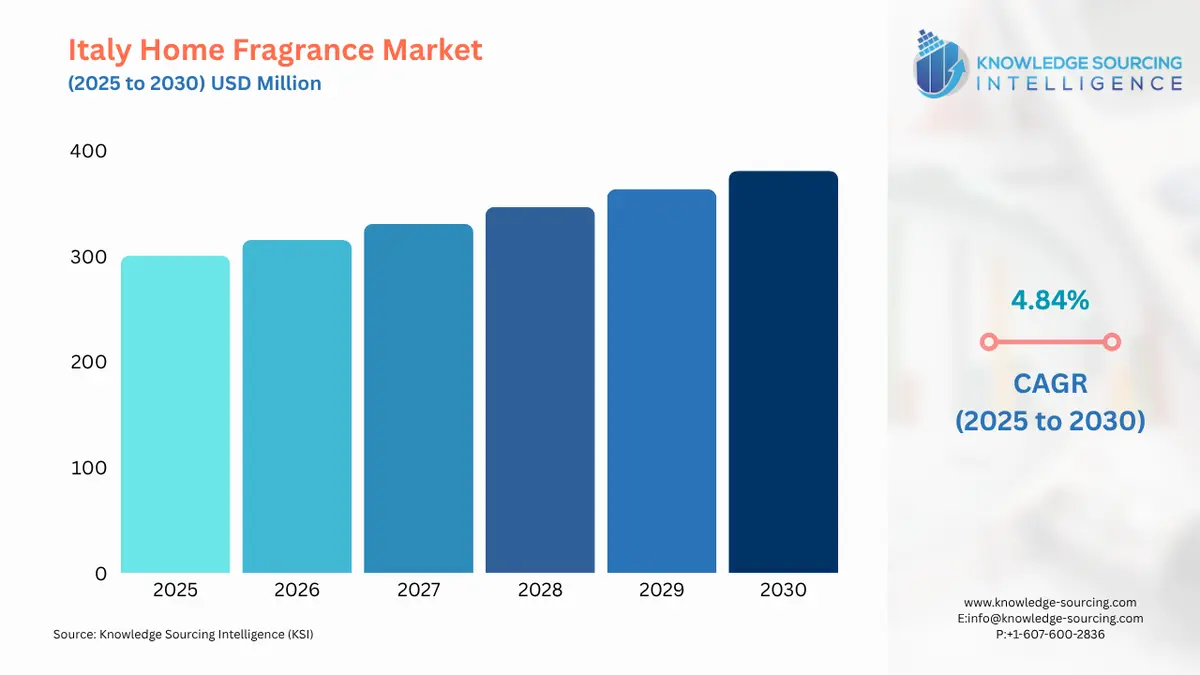

The Italy Home Fragrance Market is forecasted to increase at a CAGR of 4.84%, climbing from USD 300.687 million in 2025 to USD 380.900 million in 2030.

The market for house fragrances in Italy has grown significantly in recent years due to shifting customer tastes and a greater emphasis on wellness and lifestyle. Demand for home fragrance items, including scented candles, reed diffusers, essential oils, and room sprays, has increased because of Italian consumer's rising interest in designing unique and comfortable living spaces. A growing trend toward natural and environmentally friendly components is also impacting the market; many consumers prefer goods that are packed sustainably and don't include artificial chemicals. Overall, it is anticipated that the Italian home fragrance market will keep growing due to innovation, and a strong cultural focus on home aesthetics and experiences.

Italy Home Fragrance Market Overview & Scope:

The Italy home fragrance market is segmented by:

- Fragrance: The Italy home fragrance market is anticipated to be led by the fresh/citrus sector. This is mostly because these fragrances are so widely accessible and well-liked. Essential oils made from the peels and fruits of different citrus trees, such as colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to create fresh and citrusy scents. These fragrances are popular not only for their revitalizing properties but also for their many advantages, which include mood-boosting, aromatherapy applications, smell blending, and other uses that promote general well-being.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the candles category. This is mostly because scented candles are becoming more and more popular. Customers can choose fragrances that suit their emotions due to the wide variety of fragrance options available in scented candles, which range from fruity and floral to spicy and earthy. The segment is also supported by the growing appeal of scented candles as a gift option. During the holiday season, these candles are becoming more and more popular. They frequently function as considerate hostess presents, housewarming gifts, or expressions of gratitude. Additionally, these candles are used for a variety of festivities.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

Top Trends Shaping the Italy Home Fragrance Market:

- Cultural and Regional Factors

Fragrances that represent different regions and cultures are highly valued by Italian customers. Companies are experimenting with fragrances influenced by regional plants, customs, and historical accounts to produce goods that evoke feelings of nostalgia and patriotism. This strategy not only helps firms stand out in a crowded market but also improves the emotional bond between customers and brands.

- Experiences with Multiple Sensations

Creative companies are integrating fragrance with lighting, music, or even seasonal décor to create multisensory experiences. As an example, certain diffusers are now made to emit fragrance in sync with soundscapes or ambient lighting, creating a more immersive setting. The Italian heritage of multimodal storytelling and immersive art is in line with this.

Italy Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Growing Gifting Trend and Seasonality: The Italian culture has a tradition of giving gifts. Home fragrance products, particularly high-end candles, carefully chosen diffuser sets, and customized aroma collections are becoming more and more popular as classy, considerate presents. Holidays like Christmas, Easter, and weddings result in seasonal demand rising, which spurs innovation and limited-edition product releases. Companies usually take advantage of this by showcasing seasonal fragrances and Italian customs in their themed collections.

- Tourism and Export Demand for Italian Scent: The market for home fragrances is indirectly boosted by Italy's growing tourism sector. Travelers frequently look for mementos items that can capture the experience of Italy. Fragrances derived from Roman flowers, Sicilian citrus, or Tuscan botanicals are quite popular and are bought as mementos. Since Italian scents are associated with elegance and authenticity, this not only boosts home sales but also increases demand abroad.

Challenges:

- Complicated Regulatory Framework: As a member of the EU, Italy is bound by strict laws governing the environmental impact, safety, and labeling of fragrance goods. Production becomes more complicated and expensive when local Italian consumer protection rules and the EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) legislation are followed. The requirement to declare the usage of specific synthetic components or allergies, may discourage innovation and restrict the use of some common scent compounds.

- Oversaturation of the Luxury Market: Premium home fragrance brands have grown in the Italian market, many of which cater to the same client base. This adds to market saturation even though it also represents the nation's appreciation for luxury and fine craftsmanship. Differentiation becomes more challenging when there are many comparable products available, which increases competition. Pricing strategies and innovations are strained by this saturation, particularly for smaller or mid-tier firms that are attempting to differentiate themselves.

Italy Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Paglieri S.p.A., GEA Profumi S.r.l., Culti Milano, and Dr. Vranjes Firenze.

- Product Launch: In July 2024, The Italian luxury fashion brand Max Mara and Shiseido announced their plan to form a long-term fragrance cooperation. As part of this partnership, Shiseido will have the sole global license to create, manufacture, sell, and distribute perfumes under the Max Mara name.

- Collaboration: In January 2024, the L'OCCITANE Group announced that it had acquired Dr. Vranjes Firenze, an Italian premium home fragrance brand. This is the next phase in the Group's plan to develop a portfolio of powerful, high-end beauty and fragrance brands that are geographically balanced.

Italy Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 300.687 million |

| Total Market Size in 2031 | USD 380.900 million |

| Growth Rate | 4.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | Lombardy, Lazio, Campania, Sicily, Veneto, Others |

| Companies |

|

Italy Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Lombardy

- Lazio

- Campania

- Sicily

- Veneto

- Others