Report Overview

UK Home Fragrance Market Highlights

UK Home Fragrance Market Size:

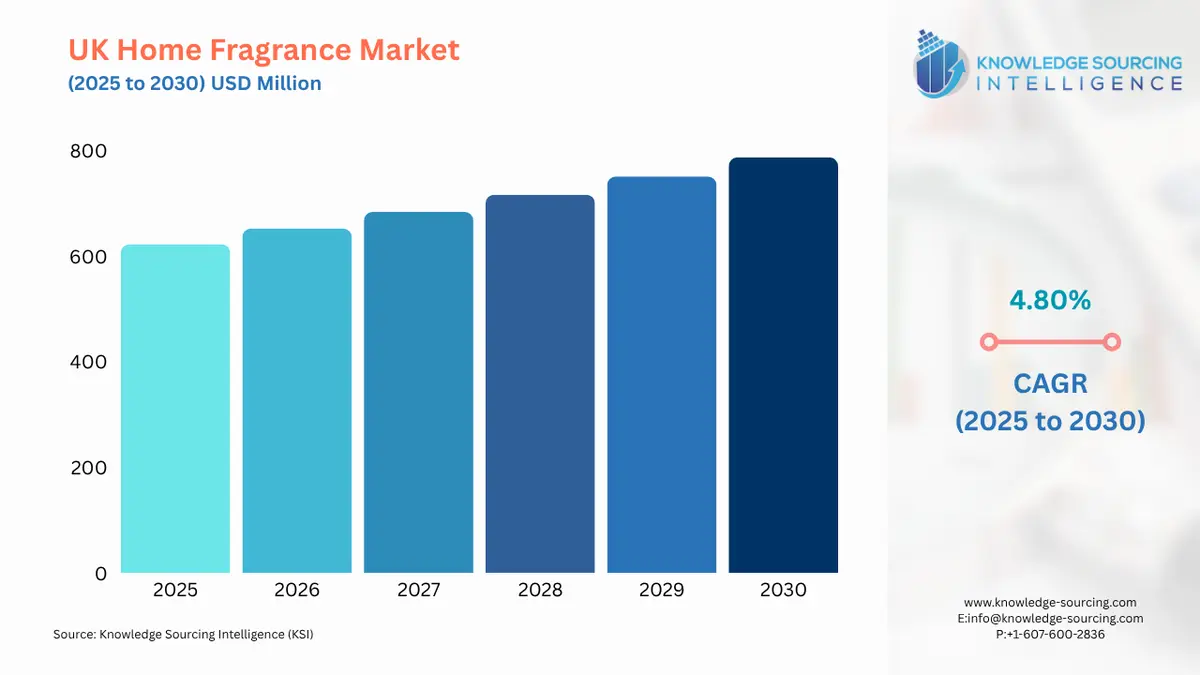

The UK Home Fragrance Market is set to register growth at a CAGR of 4.80%, climbing from USD 622.512 million in 2025 to USD 786.963 million by 2030.

Fragrances have cultural, historical, social, emotional, and economic importance. The fragrance market in the United Kingdom consists of body sprays, scented oils, colognes, perfumes, and a range of supplementary goods such as house fragrances and scented candles. It actively contributes to the broader beauty and personal care sector with the ability to enhance sensory experiences, self-expression, and personal grooming. Due to increased internet usage and the growth of social media platforms, users are propelling industry expansion. Customers can express themselves and discover their own identities through fragrances. They convey a person's personality and sense of style, arouse memories, and create moods. Customers now have more access to a wider variety of perfumes due to the simplicity of online buying and the availability of fragrances through e-commerce. Additionally, the in-store experience at specialty perfume counters and boutiques continues to be crucial to the scent industry.

UK Home Fragrance Market Overview & Scope:

The UK home fragrance market is segmented by:

Fragrance: The fresh and citrus segment is expected to lead the UK home fragrance market. This is primarily due to popular and easily available certain scents. A variety of citrus trees, including colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to make essential oils from their peels and fruits. In addition to their energizing qualities, these scents are well-liked for their many additional benefits, such as mood enhancement, aromatherapy applications, smell blending, and other uses that enhance overall wellbeing.

Product Type: Candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and other product types are among the several market categories. The candles category is expected to lead the home fragrances industry. This is primarily due to the growing popularity of scented candles. Because scented candles come in a wide range of fragrance possibilities, from fruity and floral to spicy and earthy, customers can select scents that correspond with their feelings. The increasing popularity of scented candles as a gift option is another factor supporting the market. These candles are growing in popularity over the Christmas season. They often serve as thoughtful housewarming gifts, hostess presents, or tokens of appreciation.

Distribution Channel: Depending on the distribution, the market is separated into hypermarkets, supermarkets, online retailers, specialty shops, and others. Supermarkets and hypermarkets are able to lead the market because a large variety of products are available on store shelves. This helps clients understand their options and choose a certain product or set of products according to their needs.

Top Trends Shaping the UK Home Fragrance Market

The Topography of Hyperlocal Scent

Scent preferences in UK cities reflect hyperlocal identity and lifestyle, creating their own olfactory subcultures. Scents that are specialized, experimental, or industrial like Le Labo, Aesop, or Beaufort London are preferred in East London. Manchester exhibits a greater preference for powerful, musky, and emotive scents, frequently containing pop culture or nostalgic overtones. Nowadays, fragrance companies are creating goods for certain micro demographics, focusing on postcodes rather than nations.

Scent Reclamation Across Generations

The older generation's fragrances are being purposefully reclaimed and reinvented by younger UK customers. Retro-futurist perspectives are being used to recontextualize fragrances such as Chanel No. 5, Brut, or Yardley lavender. In the same way that Crocs or Nokia phones gained popularity, this symbolizes a broader post-ironic Gen Z aesthetic. "Nan-perfumes" floral aldehydes, powdery musks, and crisp white florals are making a comeback.

UK Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

Sensory Reduction of Technology Fatigue: Social media, screens, and notifications are making British consumers more and more tired. The sensory cure of scent has gained popularity. Fragrances are becoming more and more popular as a luxury and as a way to escape the digital overload and detox. Using fragrance while reading, meditating, or taking screen breaks is becoming popular. In an over-digitized environment, there is a need for unmediated, purely sensuous sensations.

Scent-Collecting Culture and Scarcity: Similar to rare sneakers or vinyl, perfume is considered a collectible art form by a burgeoning community of fragrance enthusiasts in the UK. Rare samples, limited editions, and discontinued lines fuel a specialized secondary market. Collectors, dealers, and connoisseurs are gamifying the ownership of perfumes.

Challenges:

Environmental and Health Issues: The adoption of house fragrances is constrained by several issues, despite the quickly rising interest in these products. Some fragrances, especially those with potent odors and artificial ingredients, are linked to health issues. Overuse of several fragrances increases the chance of sensitivities or allergic responses. Several synthetic perfumes result in customers worrying about the environment. Furthermore, the cost of high-end home fragrance products, which are frequently created using better components, restricts the market's expansion. Changing laws governing the components of scent goods may have an impact on market dynamics and require manufacturers to comply.

UK Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Coty Inc, CHANEL, Jo Malone Limited, L'OREAL (UK) LIMITED, and Christian Dior UK Limited.

Entry in New Market: In May 2024, ScentAir®, a leading scent marketing and manufacturing company in the world with 30 years of experience providing creative consumer experiences, is extending its line of home fragrance goods in the UK.

UK Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 622.512 million |

| Total Market Size in 2030 | USD 786.963 million |

| Forecast Unit | Million |

| Growth Rate | 4.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Region |

| Geographical Segmentation | England, Scotland, Wales, Northern Ireland, Others |

| Companies |

|

UK Home Fragrance Market Segmentation:

By Fragrance

Floral

Fresh/Citrus

Woody

Oriental/Spicy

Herbal

Fruity

Sweet/Gourmand

Oceanic

Others

By Product Type

Candles

Sprays

Diffusers

Essential Oils

Incense Sticks

Plug-in Devices

Potpourri and Sachets

Wax Melts

Others

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Online Stores

Others

By Region

England

Scotland

Wales

Northern Ireland

Others