Report Overview

UAE Home Fragrance Market Highlights

UAE Home Fragrance Market Size:

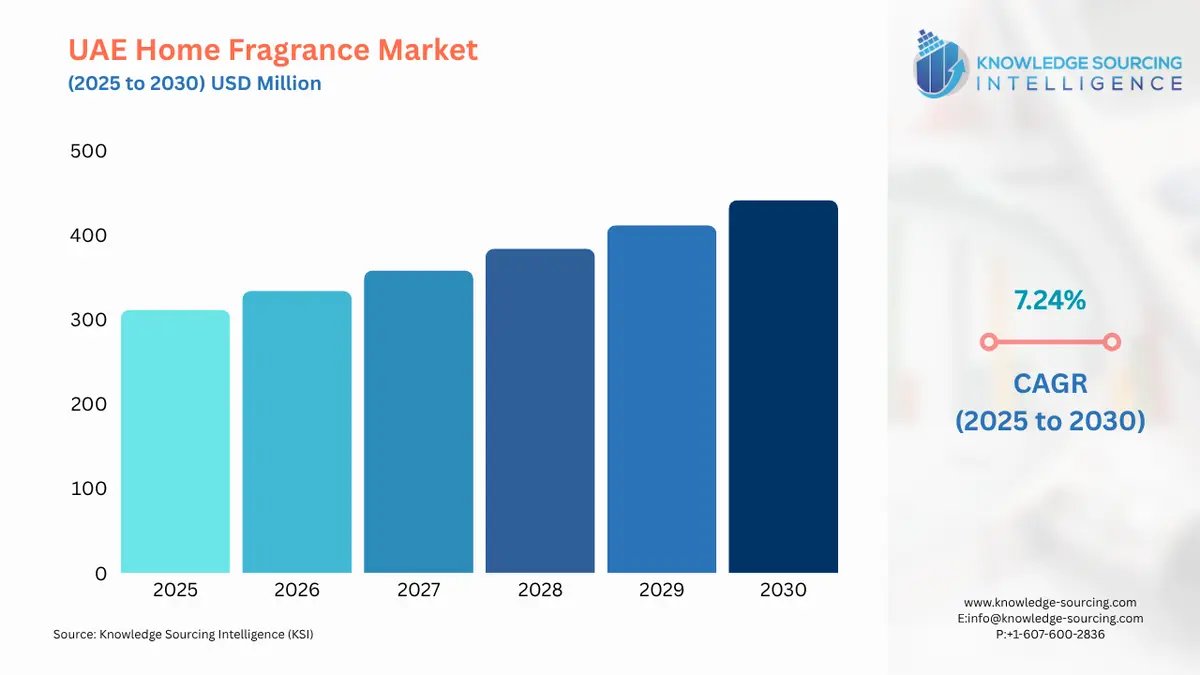

The UAE Home Fragrance Market is likely to reach USD 441.384 million in 2030, up from USD 311.256 million in 2025, growing at a CAGR of 7.24%.

In UAE, people are looking for products that smell good and help them to relax and feel better. The expansion of high-end local producers and the entry of foreign companies have increased competition. It has resulted in more creative products and a wider range of online and physical retail channels. Consumer awareness has also increased because of events like the Dubai Shopping Festival and the expanding e-commerce industry. A noticeable trend toward natural and eco-friendly scent items is emerging as sustainability becomes a more important factor, which is in line with the UAE's larger environmental objectives. The home fragrance industry in the United Arab Emirates is anticipated to continue its robust growth trajectory.

UAE Home Fragrance Market Overview & Scope

The UAE home fragrance market is segmented by:

- Fragrance: The UAE home fragrance market is anticipated to be led by the fresh/citrus sector. This is mostly because these fragrances are so widely accessible and well-liked. Essential oils made from the peels and fruits of different citrus trees, such as colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to create fresh and citrusy scents. These fragrances are popular not only for their revitalizing properties but also for their many advantages, which include mood-boosting, aromatherapy applications, smell blending, and other uses that promote general well-being.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the candles category. This is mostly because scented candles are becoming more and more popular. Customers can choose fragrances that suit their emotions due to the wide variety of fragrance options available in scented candles, which range from fruity and floral to spicy and earthy. The segment is also supported by the growing appeal of scented candles as a gift option. During the holiday season, these candles are becoming more and more popular. They frequently function as considerate hostess presents, housewarming gifts, or expressions of gratitude. Additionally, these candles are used for a variety of festivities.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

Top Trends Shaping the UAE Home Fragrance Market

- Smart and Networked Fragrance Instruments

Smart home fragrance solutions are in high demand due to growth in young consumers. App-controlled diffusers and programmable aroma emitters are among the increasingly popular products that let users adjust timing, strength, and even blend combinations from a distance. In the UAE, these new inventions are making home fragrances part of the smart lifestyle.

- Promotions by Celebrity and Influencer

The impact of local celebrities and social media influencers cannot be understated. Instagram and TikTok are used to market a lot of home fragrance items, with influencers creating home scent aesthetics. Increased consumer participation, especially among Gen Z and millennials, has led to the introduction of limited-edition or co-branded scent collections by brands.

UAE Home Fragrance Market Growth Drivers vs. Challenges

Opportunities:

- Demand in the Travel and Hospitality Sector: The demand for home fragrance goods is increased by the UAE's flourishing tourism and hospitality industries. The demand is particularly high in luxury hotels, resorts, and spas. Signature smells are used by many high-end venues to create unforgettable visitor experiences, which in turn affect consumer preferences and boost sales at retail stores. There is an extra demand for these goods since travelers frequently want to replicate the aromas of their trips in their own homes.

- High disposable income and a luxurious lifestyle: Premium home fragrance products are growing in popularity due to the UAE's affluent consumer base. People are willing to spend money on high-end, designer, or artisanal scents as part of their home décor and lifestyle choices, especially in urban areas like Dubai and Abu Dhabi. Home perfumes have changed from daily-use products to products that frequently express the wealth, taste, and artistic sensitivity of the homeowner.

Challenges:

- Interruptions and Variable Raw Material Costs: Essential oils, flowers, and woods are among the natural elements that are used extensively in the fragrance industry; many of these are imported from foreign countries. Production cost spikes may result from changes in global demand, political unrest in supply nations, or climate change.

- Short Life Cycles of Products and Dependency on Trends: Consumer preferences are always changing toward new smells, fashions, or wellness purposes, making home fragrance trends extremely dynamic. Brands must constantly innovate due to this short product lifecycle, which raises R&D expenses and the possibility of unsold inventory. In a market like the UAE where consumers are concerned about wellness and style, businesses that don't keep up with the latest trends risk having their products become obsolete very soon.

UAE Home Fragrance Market Competitive Landscape

The market is moderately fragmented, with many key players including Ajmal Perfumes, Al Haramain Perfumes, Swiss Arabian, and Khadlaj Perfumes.

- Product launch: In June 2024, the seven-decade-old perfume expert and top luxury fragrance brand Ajmal Perfumes announced "Qasida Dahabia," a brand-new scent that epitomizes luxury and mystery.

UAE Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 311.256 million |

| Total Market Size in 2031 | USD 441.384 million |

| Growth Rate | 7.24% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Region |

| Geographical Segmentation | Abu Dhabi, Dubai, Sharjah, Ajman, Fujairah, Others |

| Companies |

|

UAE Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Fujairah

- Others