Report Overview

Thailand Home Fragrance Market Highlights

Thailand Home Fragrance Market Size:

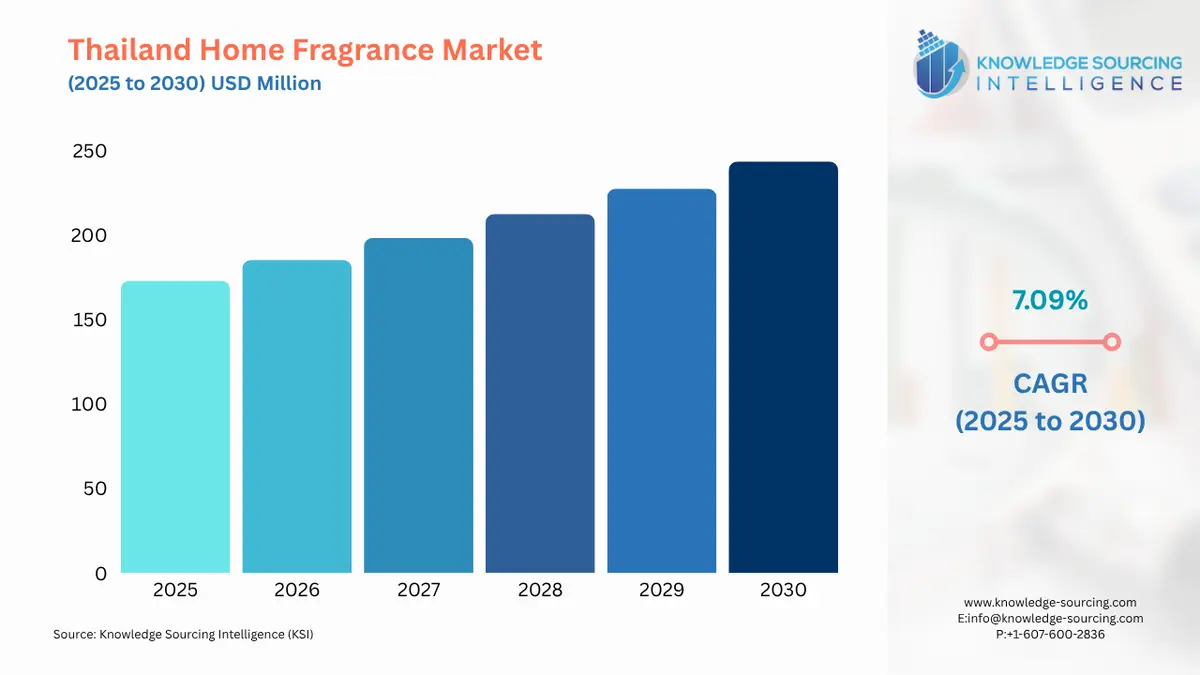

The Thailand Home Fragrance Market is expected to grow at a CAGR of 7.09%, reaching USD 243.563 million in 2030 from USD 172.920 million in 2025.

The Thai fragrance market is undergoing a major transformation due to shifting customer preferences and an increase in the country's disposable income. The growing middle class and urbanization have increased demand for a variety of fragrances, including niche and high-end brands. Natural and organic fragrances have gained popularity recently, reflecting a global trend toward healthier and more sustainable lifestyles. Thai consumers are more conscious of the ingredients in their fragrances and select products that align with their values of environmental impact and personal well-being. Local fragrance businesses that use traditional Thai ingredients and scents are becoming more and more well-liked by both domestic and international consumers seeking authenticity and unique sensory experiences.

Thailand Home Fragrance Market Overview & Scope:

The Thailand home fragrance market is segmented by:

- Fragrance: The Thailand home fragrance market is anticipated to be led by the fresh/citrus sector. This is mostly because these fragrances are so widely accessible and well-liked. Essential oils made from the peels and fruits of different citrus trees, such as colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, create fresh and citrusy scents. These fragrances are popular not only for their revitalizing properties but also for their many advantages, which include mood-boosting, aromatherapy applications, smell blending, and other uses that promote general well-being.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the candles category. This is mostly because scented candles are becoming more and more popular. Customers can choose fragrances that suit their emotions due to the wide variety of fragrance options available in scented candles, which range from fruity and floral to spicy and earthy. The segment is also supported by the growing appeal of scented candles as a gift option. During the holiday season, these candles are becoming more and more popular. They frequently function as considerate hostess presents, housewarming gifts, or expressions of gratitude. Additionally, these candles are used for a variety of festivities.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their requirements.

Top Trends Shaping the Thailand Home Fragrance Market:

- Multi-Product Combination

The distinctions between fragrance, skincare, and household care items are becoming smaller due to new product advancements. For example, hybridized products like linen sprays with antibacterial qualities, multi-surface cleaners with aromatherapeutic smells, and fabric softeners that also operate as room perfumes meet Thai consumers' need for multipurpose functionality.

- The Influence of International Travel on Domestic Fragrance Preferences

The expectations of international tourists are influencing local brands as Thailand's tourism industry flourishes. Signature smells are used by boutique hotels and upscale spas to set themselves apart from the competition. These carefully chosen fragrances frequently end up in domestic retail products.

Thailand Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Growth in the Region Outside of Bangkok: Home fragrance adoption is currently expanding to various locations, with Bangkok continuing to be the largest user. This trend is being driven by regional pride, digital penetration, and better infrastructure. Scents that are natural and inspired by forests and fit with the environmental identity of northern cities like Chiang Mai and Chiang Rai are attracting a lot of interest. Fresh scents with a marine theme suggest the seaside lifestyle is going well in coastal communities.

- Scent's Growing Significance in Thai Cultural Events: Thai religious and spiritual life has traditionally included fragrance, but its incorporation into modern festivities and social gifts is fuelling rising demand. Fragrances are now common presents for weddings, birthday celebrations, housewarming parties, and Songkran. Given its symbolic connotations of purity, prosperity, and serenity, fragrance is a perfect gift that complements Thai traditional values.

Challenges:

- Restricted Shelf Life and Product Degradation Due to Climate: Thailand's hot and humid tropical climate presents special difficulties for fragrance product consumption and storage. In-store displays or while being stored at home, candles may bend or melt. Scent performance and shelf life are impacted by the rapid degradation of natural essential oils in hot and humid environments. Diffusers in non-climate-controlled situations may dissipate too quickly or unevenly.

- Few Opportunities for Sensory Trials in E-Commerce: Online purchasing has taken over the fragrance market, especially through sites like Shopee and Lazada, yet a basic problem still exists—one can't detect the scent on a screen. Online customers are frequently compelled to rely on descriptions or the opinions of influencers because fragrance is an intrinsically sensory category. This makes it harder for new clients to convert online and raises the possibility of low retention, return requests, or discontent.

Thailand Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Iberchem Thailand, Ogawa Flavors & Fragrances (Thailand) Co., Ltd., Scent & Sense Co., Ltd., TCFF Thailand, and Prosper (Thailand) Co., Ltd.

- Collaboration: In December 2024, as a major move in its worldwide expansion strategy, cosmetics giant Kosé Corporation announced on Tuesday that it had acquired Pañpuri, a Thai premium holistic wellness brand. The transaction's financial details were not made public.

Thailand Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 172.920 million |

| Total Market Size in 2031 | USD 243.563 million |

| Growth Rate | 7.09% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Region |

| Geographical Segmentation | Bangkok, Nakhon Ratchasima, Chiang Mai, Udon Thani, Khon Kaen, Others |

| Companies |

|

Thailand Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Bangkok

- Nakhon Ratchasima

- Chiang Mai

- Udon Thani

- Khon Kaen

- Others