Report Overview

Kaolin Market Size, Share, Highlights

Kaolin Market Size:

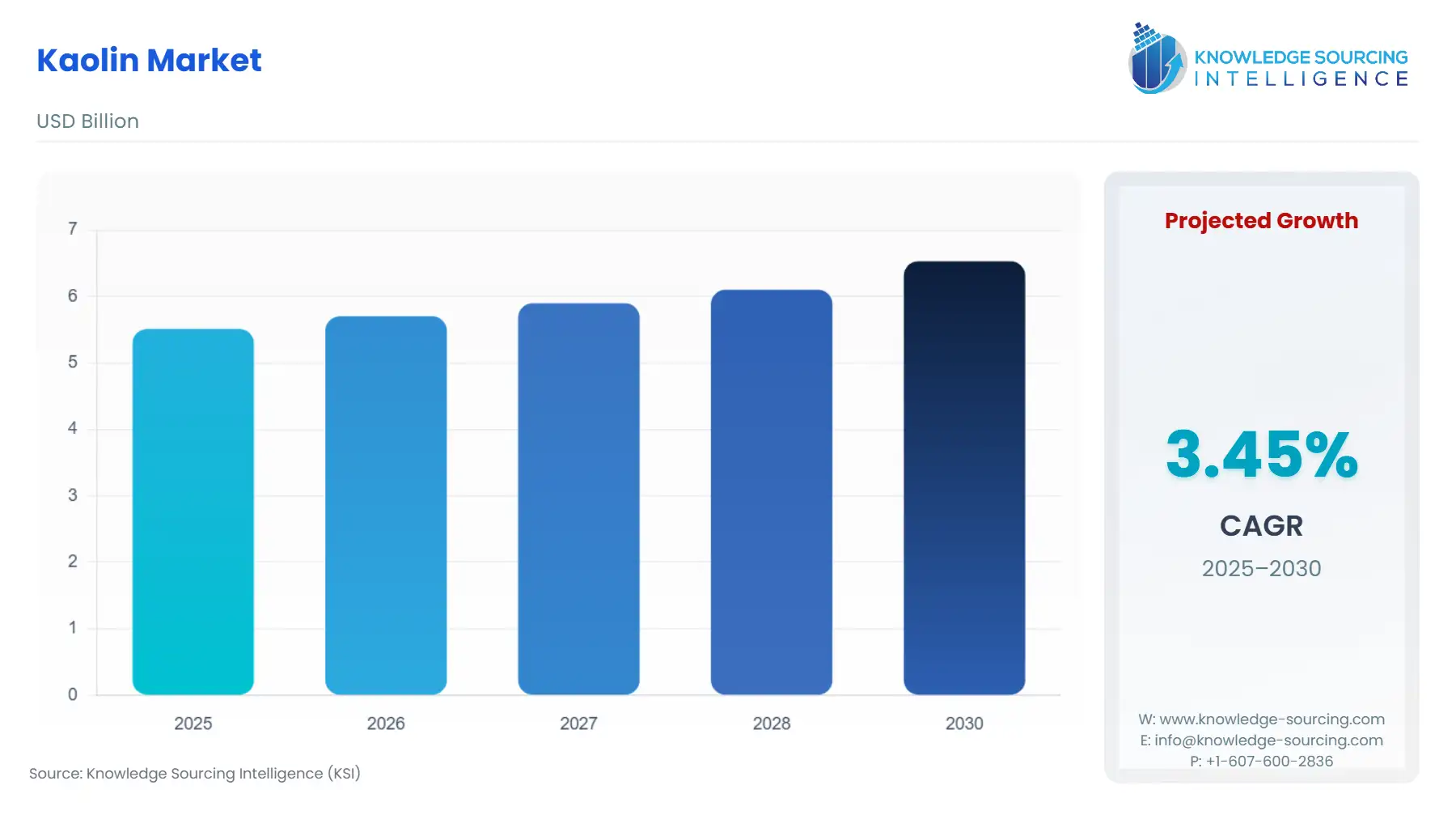

The Kaolin Market is expected to grow from US$5.513 billion in 2025 to US$6.532 billion in 2030, at a CAGR of 3.45%.

Kaolin Market Trends:

Kaolin serves as a coating that increases the smoothness, brightness, and gloss of paper, ceramics, paints, and other products. The market is expected to grow due to rising demand for ceramic products and increased use of kaolin in the cement industry. However, the mining of kaolin is acknowledged to have a negative impact on the environment, which is expected to hinder the growth of the market during the forecast period.

Kaolin Market Growth Drivers:

- Increasing construction activity is driving the demand for kaolin

Rapid industrialization in developing economies is expected to fuel the demand for kaolin in construction and other industries. Kaolin is considered an important raw material used in the manufacturing of ceramic tiles, and with the increasing construction activities, the market is anticipated to grow at a significant rate during the forecast period. Investment in the development of infrastructure is expected to increase, more specifically, in emerging and developing countries like India, China, and Vietnam, among others. For instance, India and China have been growing at above 6% per annum for the last couple of years, which is an indication of the development of infrastructure and growing urbanization. Moreover, in the United States, construction spending has increased from US$1,627,985 million in June 2021 to US$1,762,317 million in June 2022 (source: United States Census Bureau), while a similar trend has been noticed in Europe. Thus, the growing investment in the development of infrastructure is expected to continue to drive the growth of the kaolin market in the coming years.

- Increasing application in paper, ceramics, and paint and coatings, among others, is expected to drive the market

By application, the global kaolin market has been segmented into paper, ceramics, rubber, plastic, and paint & coatings, among others. Paper holds a significant share in the market and is expected to grow at a substantial rate owing to the rising demand for kaolin in the paper packaging industry. Kaolin is used as a component to provide paper with a smooth surface and enhance paper qualities such as brightness, opacity, and printability. The ceramic segment is anticipated to witness exponential growth over the forecast period. Increasing construction activities and rising investment by big market players is driving the market for the ceramics segment in the coming years. Furthermore, expanding the automotive industry also propels the demand for paints, coatings, and rubber, which are widely used in the manufacturing of automobiles, which drives the demand for kaolin in the automotive industry. For instance, according to the International Organization of Motor Vehicle Manufacturers, automotive production in India has increased from 3,394,446 units in 2020 to 4,399,112 thousand in 2021, showing a growth of more than thirty percent.

Kaolin Market Geographical Outlook:

- The Asia-Pacific region is estimated to hold a significant share of the market

By geography, the global kaolin market has been segmented as North America, South America, Europe, the Middle East and Africa, and Asia Pacific (APAC) regions. The Asia Pacific accounts for a significant share of the global kaolin market and is projected to remain at its position throughout the forecast period. This growth is attributed to the strong presence of key players in the region and established the paper industry. Also, the region is experiencing a significant increase in construction activity, which is further driving the growth of the market over the forecast period. Also, the increasing number of construction projects in the countries like China especially megaprojects like Beijing Daxing International Airport is one of the largest infrastructure projects initiated by the country with an aim to process 72 million passengers a year, which is expected to have four runways by 2025, is expected to drive the scope of demand for kaolin during the forecast period. Besides, increasing population density in urban areas coupled with rising investment in residential projects has been increasing the demand for kaolin over the last few years and this trend is expected to continue in the coming years. Due to growing ceramic production and consumption in Europe, the market is growing at a substantial rate. Similar trends have been noticed in the North American region, which is witnessing exponential growth on account of the expanding paper packaging industry coupled with increasing investment by market players.

Kaolin Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Kaolin Market Size in 2025 | US$5.513 billion |

| Kaolin Market Size in 2030 | US$6.532 billion |

| Growth Rate | CAGR of 3.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Kaolin Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Process

- Dry Processing

- Wet Processing

- By Application

- Paper

- Paints & Coatings

- Ceramics

- Rubber

- Plastic

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Malaysia

- Others

- North America