Report Overview

Coated Paper Market Report, Highlights

Coated Paper Market Size:

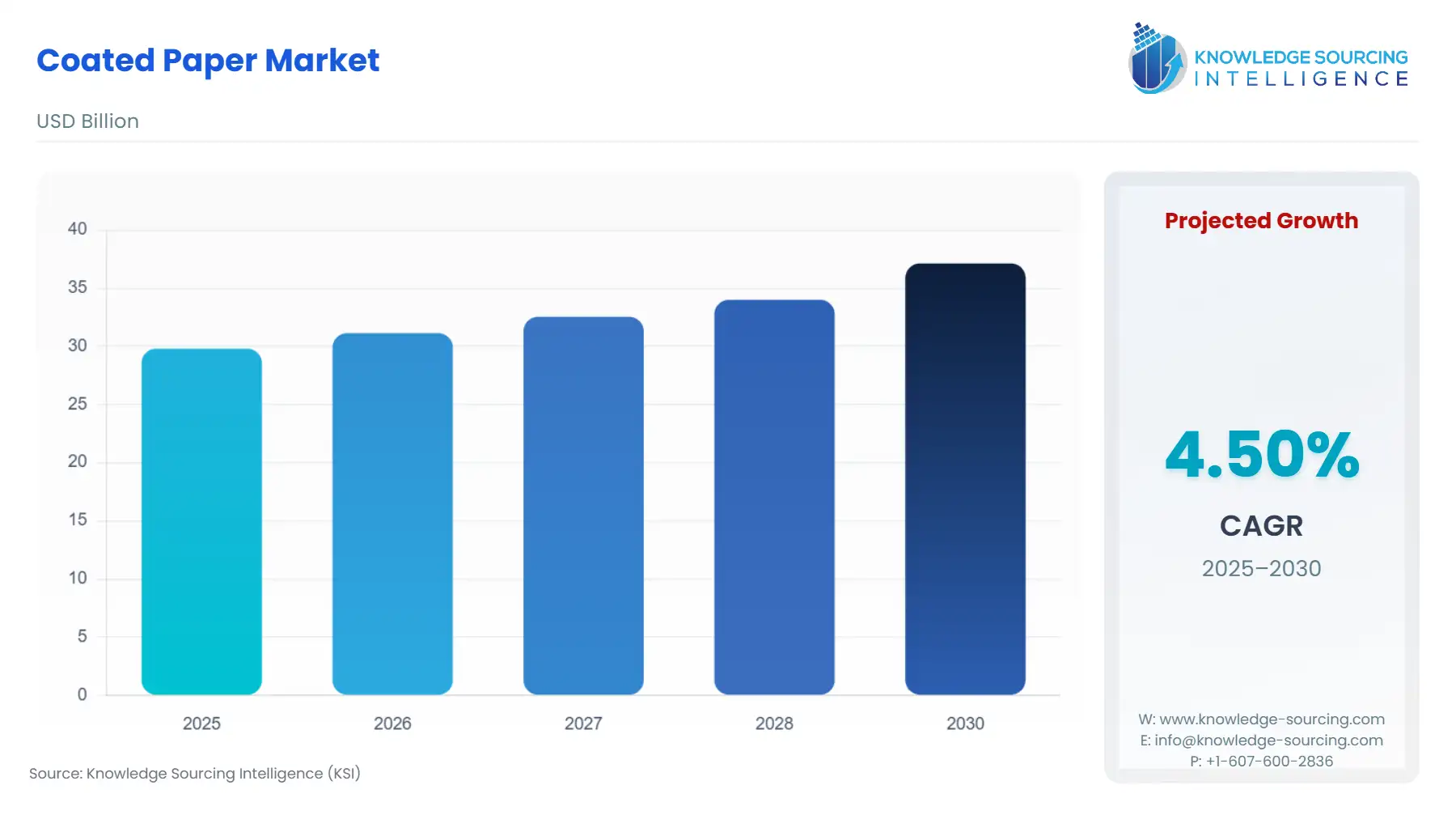

The Coated Paper Market is expected to grow from USD 29.804 billion in 2025 to USD 37.141 billion in 2030, at a CAGR of 4.50%.

The Coated Paper Market is navigating a profound structural bifurcation, characterized by a fundamental decline in traditional Graphic Paper consumption—driven by media digitization—concurrently offset by vigorous growth in specialty and packaging applications. This dynamic environment compels major producers to undertake strategic capacity conversion, shifting capital expenditure from commodity printing grades to high-value, functional coated substrates. Coated paper, defined by its surface application of mineral pigments like clay or calcium carbonate, remains indispensable for applications requiring superior print quality, gloss, opacity, and barrier properties. Its renewed relevance stems directly from the global imperative to replace fossil-fuel-derived plastics in packaging, transforming the product from a print medium staple into a high-performance material for the circular economy.

Coated Paper Market Analysis:

- Growth Drivers

The primary catalyst for market expansion is the Packaging sector, where e-commerce growth mandates high-strength, visually appealing coated substrates for consumer packaging and mailing boxes, driving demand for High-gloss UV and specialty finishes. Concurrently, the proliferation of global bans and taxes on single-use plastics has created mandatory demand for functional Polymer Coated barrier papers in food contact applications as brands search for fiber-based, recyclable alternatives. The final driver is the persistent need for superior aesthetics in luxury goods and high-end catalogs, which maintains a niche, but profitable, demand for Art Paper to achieve unparalleled color reproduction and tactile quality.

- Challenges and Opportunities

The central challenge remains the structural decline of the print media sector, particularly magazines and commercial print, which reduces the total market volume for commodity Coated Groundwood Paper. This necessitates significant and costly capacity conversion, increasing short-term capital constraints. The key opportunity, however, is the functional coating innovation required to replace plastic barriers in food and non-food packaging. Developing water-based and bio-polymer coatings that deliver moisture, grease, and oxygen barriers while maintaining recyclability under municipal standards unlocks vast, high-margin demand across the global fast-moving consumer goods (FMCG) sector.

- Raw Material and Pricing Analysis

The cost structure of coated paper is dominated by wood pulp (Bleached Softwood/Hardwood Kraft Pulp) and coating pigments (Kaolin Clay, Calcium Carbonate). Wood pulp prices demonstrate significant cyclical volatility, driven by global capacity additions and fluctuating logistics costs, directly influencing the final product price and impacting converter margins. Conversely, coating pigments, predominantly supplied from geographically concentrated regions (e.g., Kaolin from the US/Brazil), offer comparative stability but are subject to energy and freight cost escalations. Manufacturers mitigate this instability through backward integration into pulp production and by substituting costly, high-brightness pulps with lower-cost filler materials like calcium carbonate in the coating layer.

- Supply Chain Analysis

The coated paper global supply chain is characterized by geographical consolidation and high capital barriers to entry. Production hubs are concentrated in North America, Europe (especially Scandinavia), and Asia Pacific (China and Indonesia) due to access to integrated pulp mills, necessary for scale and cost efficiency. Logistical complexities arise from the product's high-volume, low-density nature, which necessitates efficient, often intermodal, transportation (sea freight and rail) to move paper reels from major mills to dispersed converting and printing houses globally. The key dependency is the reliable flow of market pulp and the specialized mineral pigments used in the coating process, which are vulnerable to geopolitical and energy-related disruptions.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Single-Use Plastics Directive (SUPD) |

Directly reduces demand for plastic-laminated food service packaging (cups, trays), compelling manufacturers to transition to fiber-based, Polymer Coated papers that meet mandated recyclability thresholds, thereby increasing demand for specialized barrier grades. |

|

United States |

Environmental Protection Agency (EPA) / State-Level Recycling Mandates |

State-level legislation, particularly concerning minimum post-consumer recycled content in packaging, drives demand for coated papers with high recycled fiber inclusion, forcing producers to invest in advanced de-inking and coating technologies for recycled pulp-based paper. |

|

China |

Solid Waste Prevention and Control Law / Plastic Ban Policy |

The nationwide restriction on specific non-degradable plastics directly incentivizes domestic and international packaging manufacturers operating in the Chinese market to adopt coated paper and paperboard for product boxes and flexible packaging, significantly stimulating demand in the Asia Pacific region. |

Coated Paper Market Segment Analysis:

- Packaging Application Segment Analysis

The Packaging application segment has become the pivotal demand center, fundamentally reshaping the market structure. This growth is driven by the synergistic effect of e-commerce penetration and the sustainability imperative. E-commerce necessitates high-performance coated substrates—primarily coated board—that provide structural integrity for shipping and a premium print surface for branding and consumer unboxing experiences. This mandates the use of materials like Coated Fine Paper for cartons and High-gloss UV finishes for luxury consumer goods packaging, directly increasing demand for these quality tiers. Furthermore, stringent regulatory movements against single-use plastics create non-discretionary demand for polymer or bio-polymer coated papers to serve as moisture and grease barriers in food-contact packaging, effectively substituting non-recyclable materials and opening a new, high-growth revenue stream.

- Clay Coated Material Segment Analysis

The Clay Coated material segment remains foundational due to Kaolin clay's superior optical and print characteristics combined with its cost-effectiveness. The need for clay-coated paper is primarily driven by the need for exceptional print fidelity and surface uniformity in high-end commercial printing and premium packaging. Clay particles are platelet-shaped, which allows them to align parallel to the paper surface, creating an exceptionally smooth finish that minimizes ink absorption and maximizes light reflection, crucial for vibrant color reproduction on Glossy Finish and Silk Finish products. Recent demand has been augmented by environmental pressures, as clay-based coatings are often deemed more easily recyclable than traditional polymer or wax coatings, aligning the segment with the increasing regulatory and consumer preference for fiber-recyclable packaging and marketing materials.

Coated Paper Market Geographical Analysis:

- USA Market Analysis

The US market for coated paper is characterized by a strong, but mature, commercial printing base and rapidly expanding packaging demand. The key local growth driver is the decentralization of e-commerce packaging logistics, which increases demand for specialized Coated Fine Paper and coated board for fulfillment and brand-specific packaging. While magazine and catalog volumes continue a long-term decline, high-value demand for Art Paper remains resilient in the luxury goods and pharmaceutical sectors. Moreover, state-level mandates concerning minimum post-consumer content in packaging directly stimulate the need for domestically produced, recyclable coated substrates that meet regional compliance standards.

- Brazil Market Analysis

Brazil's coated paper market is primarily propelled by its strong, domestically focused publishing and consumer goods sectors. The key local driver is the rising middle class and increasing literacy rates, which create consistent, high-volume demand for textbooks, educational materials, and commercial brochures, predominantly utilizing Coated Groundwood Paper. The large and complex food and beverage sector drives secondary demand for coated paperboard used in folding cartons and liquid packaging. Logistical challenges associated with internal distribution often compel a preference for local production capacity from companies with robust internal supply chains.

- Germany Market Analysis

The German market exhibits highly discerning demand, heavily influenced by its robust industrial and export-focused sectors. Local demand is critically impacted by the European Union’s Single-Use Plastics Directive (SUPD), which accelerates the adoption of bio-polymer coated barrier papers to replace plastic linings in takeaway food containers and cups. This regulatory push creates mandatory demand for high-quality, recyclable Specialty Papers with functional coatings. The country's strong commitment to sustainability means demand is highly sensitive to FSC/PEFC certification and demonstrable end-of-life recyclability claims.

- Saudi Arabia Market Analysis

The Saudi Arabian market’s demand for coated paper is closely correlated with large-scale governmental investment in retail infrastructure, tourism, and national diversification projects (Vision 2030). The primary driver is the burgeoning luxury and premium consumer goods market, which requires high-quality, High-gloss UV finished coated paper for high-impact promotional materials, brochures, and luxury packaging. As domestic manufacturing capacity is limited, demand is heavily reliant on imports, making the local pricing structure highly sensitive to global logistics costs and international trade agreements.

- China Market Analysis

China is the largest volume consumer in the Asia-Pacific region, driven by its massive manufacturing output and unparalleled e-commerce ecosystem. The key driver is the sheer scale of the Packaging and Labelling application segments. Rapidly increasing domestic consumption, coupled with the national plastic-reduction policy, generates colossal demand for Calcium Carbonate Coated board for folding cartons, particularly for electronics and consumer durables. Domestic capacity expansion, as exemplified by the ramp-up of new pulp and paper integrated mills, is focused on securing raw material supply and meeting this escalating internal demand for coated packaging grades.

Coated Paper Market Competitive Environment and Analysis:

The Coated Paper Market operates under intense competition, characterized by major global integrated pulp and paper manufacturers who compete primarily on production efficiency, cost leadership, and the ability to convert declining graphic paper capacity to high-growth packaging and specialty grades. Strategic differentiation is now centered on sustainability—specifically, the development of functional, fiber-recyclable barrier coatings—and geographic capacity rationalization to serve regional market needs efficiently. Price volatility in input materials (pulp, energy) amplifies the advantage held by vertically integrated players.

- Stora Enso Oyj

Stora Enso’s strategy is a decisive pivot towards renewable packaging, biomaterials, and wood products, positioning the company away from commodity graphic papers. Their competitive edge is built on high-quality Coated Fine Paper and cartonboard, supported by significant, recent capacity additions aimed at the packaging sector. The 2025 inauguration of Europe's most modern consumer board production line in Oulu, Finland, highlights their commitment to increasing capacity for renewable, high-performance Packaging board, directly targeting the plastic substitution trend in food service and liquid packaging.

- Sappi Limited

Sappi maintains a strong global footprint with a core competency in both graphic papers and specialty packaging. The company’s strategic positioning focuses on high-end graphic papers and a rapidly growing portfolio of functional papers. In July 2025, Sappi North America announced the completion of its $500M Project Elevate, converting and expanding Paper Machine No. 2 (PM2) at its Somerset Mill, significantly boosting production capacity for high-performance Solid Bleached Sulfate (SBS) paperboard for folding carton and food service applications. This move demonstrates a clear focus on the premium packaging and specialty paper segments.

- Asia Pulp and Paper Group

Asia Pulp and Paper Group (APP) is characterized by its massive scale and cost leadership, predominantly leveraging integrated mill operations in the Asia Pacific region, specifically Indonesia and China. APP’s strategy is geared towards meeting the burgeoning domestic and export demand for coated paper and board from the rapidly growing Chinese manufacturing and e-commerce sectors. Their strength lies in providing high-volume, cost-competitive Coated Groundwood Paper and coated board grades, supported by the continuous addition of integrated pulp and paper capacity in the region, ensuring a stable, cost-effective raw material base.

Coated Paper Market Developments:

- November 2025: Stora Enso held a Capital Markets Day to outline a new strategic direction with a strong focus on renewable packaging, indicating a planned demerger of its Swedish forest assets. This highlights the industry-wide strategic shift from traditional paper to packaging-led capacity.

- September 2025: Stora Enso launched Ensovelvet, a new premium uncoated Solid Bleached Sulfate (SBS) board with a velvet-like smoothness designed for luxury packaging applications, particularly cosmetics and perfumes. This represents product launch innovation targeting the high-margin, aesthetic-driven segment.

- July 2025: Sappi North America announced the commercial readiness of its converted Paper Machine No. 2 (PM2) at the Somerset Mill in Maine, adding approximately 470,000 metric tons of annual capacity for high-performance Solid Bleached Sulfate (SBS) paperboard. This is a major capacity addition focused on sustainable packaging.

Coated Paper Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29.804 billion |

| Total Market Size in 2031 | USD 37.141 billion |

| Growth Rate | 4.50% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Paper Type, Coating Material, Finish Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Coated Paper Market Segmentation:

- By Paper Type

- Coated Fine Paper

- Coated Groundwood Paper

- Art Paper

- Cast-coated and Specialty Papers

- By Coating Material

- Clay Coated

- Calcium Carbonate Coated

- Titanium Dioxide Coated

- Polymer Coated

- Others

- By Finish Type

- Glossy Finish

- Matte Finish

- Silk Finish

- Dull Finish

- High-gloss UV

- Others

- By Application

- Printing

- Packaging

- Labelling

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America