Report Overview

Laser Photomask Market - Highlights

Laser Photomask Market Size:

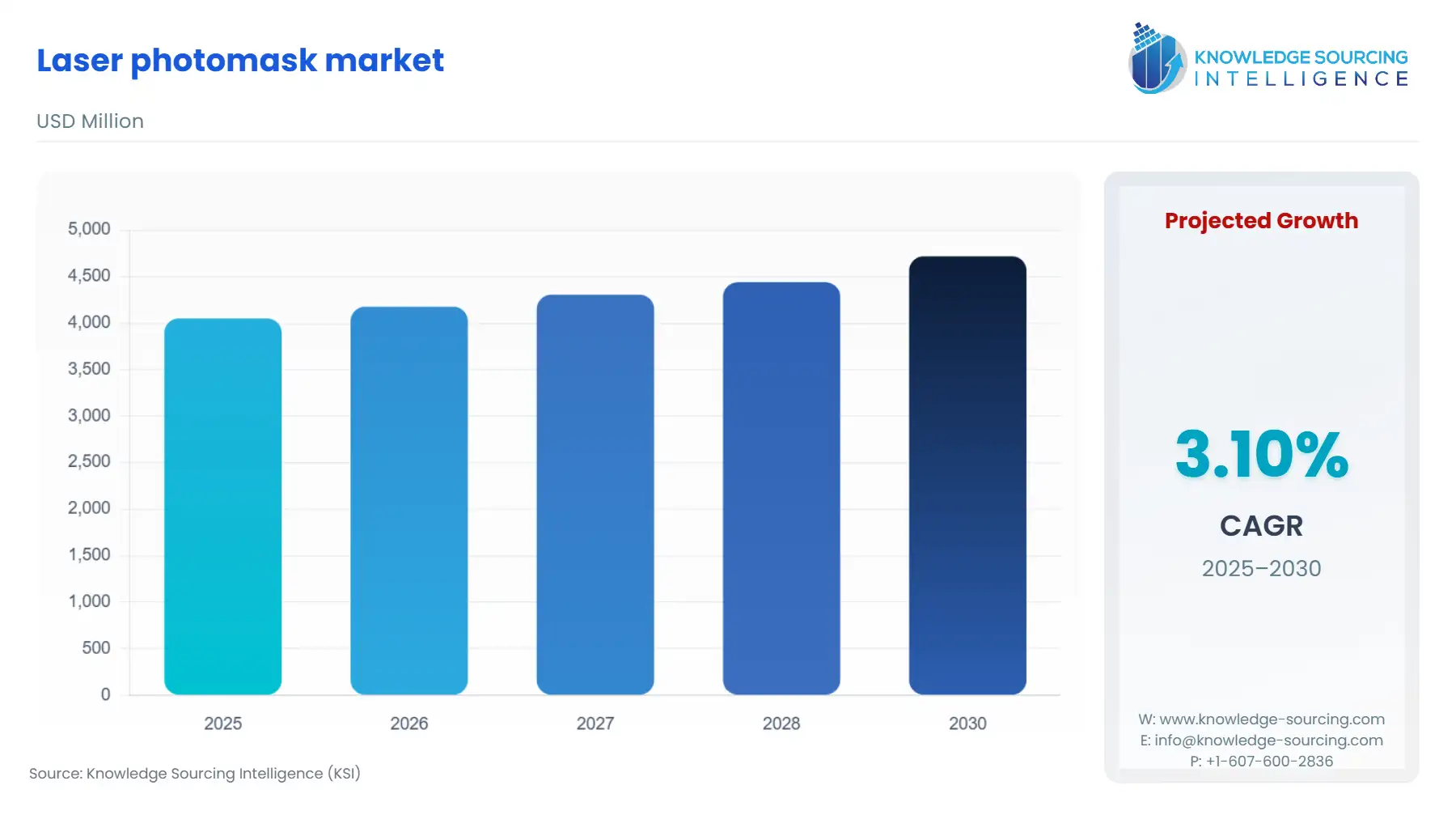

The laser photomask market is forecasted to expand at a 3.10% CAGR, reaching USD 4.719 billion by 2030 from USD 4.051 billion in 2025.

A high-precision, photographic-grade mask known as a laser photomask is used to transfer circuit designs onto a wafer when making integrated circuits (ICs). Materials such as quartz, chrome, molybdenum, or tungsten are used to make laser photomasks as they are UV-opaque in nature. For the production of high-quality ICs, the precision and clarity of laser photomasks are essential. The market for laser photomasks is being driven by ongoing technological advancements in goods like advanced computing devices. In the current conditions, the growth of the laser photomask market is being driven by the expansion of the robotic semiconductor sector.

Laser Photomask Market Driver:

- Demand for electronic devices will boost the laser photomask market growth

The main factor driving the market's expansion is the growing demand for highly integrated, miniature electronic devices and expanding semiconductor and electronics sector. On the basis of type, the laser photomask is categorized as reticles and masters. Reticles laser photomask is majorly used to fabricate microchips by the semiconductor industry which are found in a wide range of electronic products like computers, mobile phones, and televisions. Annual growth in consumer electronics sales has greatly increased demand for laser photomasks. According to National Retail Federation (NRF) in 2021, it was predicted that retail sales of consumer electronics in the US would rise 7.5% to $461 billion Miniaturization of the products is needed due to the rising demand for smartphones, tablets, and smart wearable technology, because of which demand of miniature semiconductor devices is increasing and parallelly boosting laser photomasks market. According to Consumer Technology Association (CTA), the consumer technology sector is predicted to grow to $63 billion, and smart home technology is anticipated to be a key driver of laser photomasks development.

- The automobile sector is expected to boost the panel-level packaging market growth

A laser photomask is frequently used in the automotive industry to create printed circuit boards (PCBs) for electronic control units (ECUs) and other electronic parts found in cars. It is anticipated that as the automotive industry expands, the demand for the laser photomasks market increases parallelly. The demand for semiconductor devices is anticipated to rise as the automotive industry continues to adopt modern technologies like autonomous driving systems, electric powertrains, and connected vehicle features and as a result, the demand for laser photomasks increases as its crucial part in semiconductor manufacturing. According to the International Organization of Motor Vehicle Manufacturers (OICA), the production of passenger vehicles has grown globally by more than 26%. According to the European Automobile Manufacturers Association (ACEA), with a total of 16.9 million vehicles produced, European auto production grew by 4.4% from 2020. The development of the laser photomask market may be influenced by the automotive industry's move towards new technology.

Laser Photomask Market Geographical Outlook:

- During the forecast period, the Asia Pacific region is expected to hold a significant market share.

The largest markets for laser photomasks are Taiwan, South Korea, and China as the majority of the manufacturers of laser photomasks are based in these nations. The Chinese government has also made a few modifications to its policies to support the growth of the semiconductor market. Semiconductor Industry Association (SIA) estimates that East Asia, which includes Taiwan, China, South Korea, and Japan has 75% of the world's potential for semiconductor manufacturing. According to the Executive Yuan of the Republic of China, Taiwan was the world's second-largest market for semiconductor manufacturing equipment in 2020 and the global sales of semiconductors reached US$71.2 billion. As the demand for semiconductors increases, on the other hand, the market for laser photomasks also increases. These factors all add to the market growth of laser photomasks in the Asia Pacific region.

Laser Photomask Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.051 billion |

| Total Market Size in 2031 | USD 4.719 billion |

| Growth Rate | 3.10% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Laser Photomask Market Segmentation:

- LASER PHOTOMASK MARKET BY TYPE

- Masters

- Reticles

- LASER PHOTOMASK MARKET BY APPLICATION

- Displays

- Integrated Circuits (ICs)

- MEMS

- LASER PHOTOMASK MANAGEMENT MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America