Report Overview

Picosecond Lasers Market - Highlights

Picosecond Lasers Market Size:

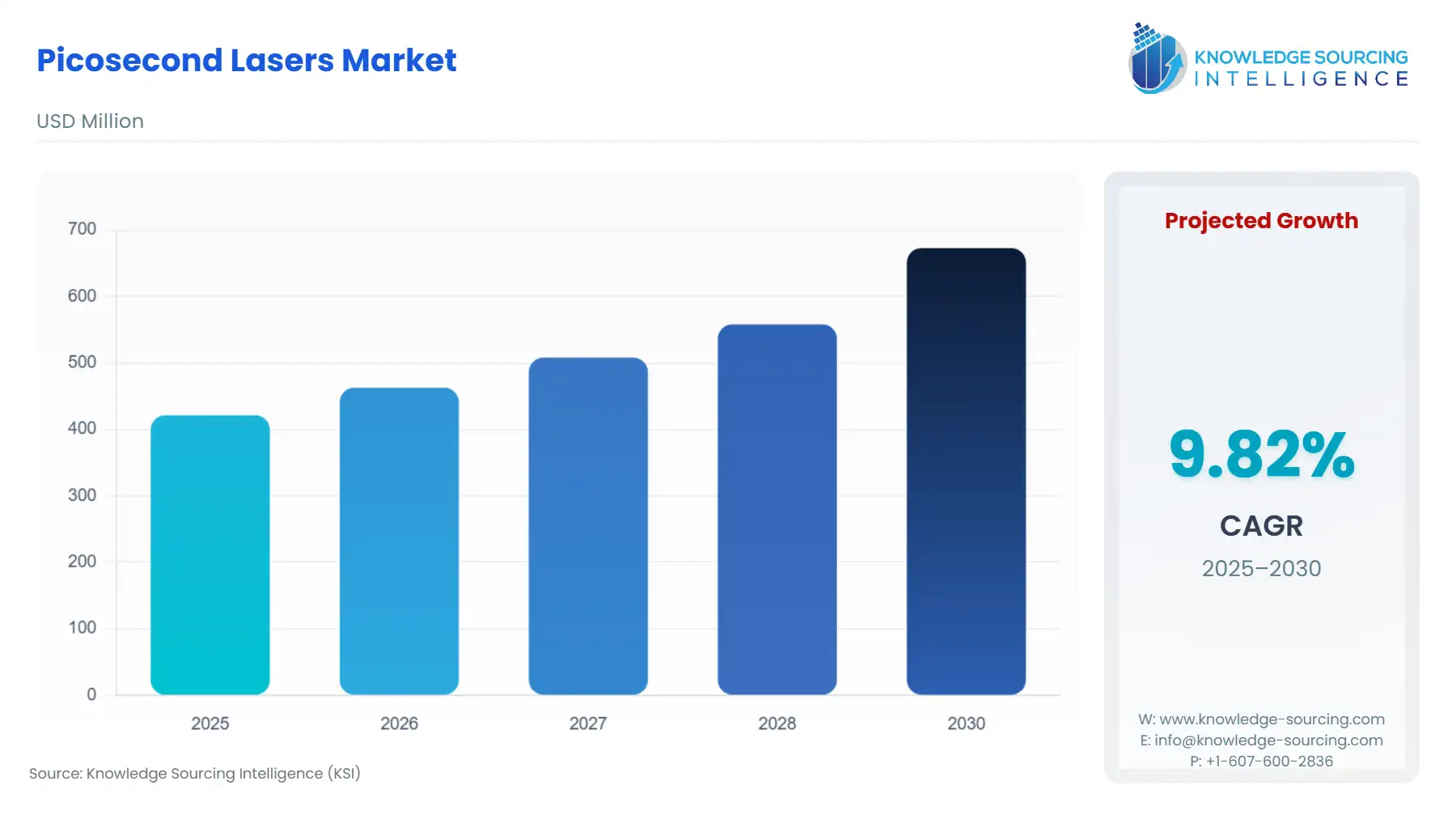

Picosecond Lasers Market is projected to expand at a 9.53% CAGR, attaining USD 727.409 million in 2031 from USD 421.395 million in 2025.

Picosecond Lasers Market Trends:

Picosecond lasers are a type of ultrafast laser technology that emits extremely short pulses of light, typically in the picosecond (ps) range. A picosecond is one trillionth of a second, or 10^-12 seconds, making these lasers capable of delivering extremely high peak powers in a very short duration. Multiple associated benefits and the growing prevalence of acne is the major growth driver of the picoseconds lasers market. Moreover, the emerging application in numerous industries and growing demand for minimally invasive surgeries coupled with enhanced product launches are further expected to propel the picoseconds lasers market.

Picosecond Lasers Market Growth Drivers:

Multiple Associated Benefits

Picosecond lasers offer several benefits in medical applications, making them valuable tools in various treatments and procedures as compared to other traditional lasers thereby propelling the picoseconds lasers market. The short pulse duration of picosecond lasers limits the amount of heat transferred to the surrounding tissue, minimizing the risk of thermal damage. Consequently, patients experience reduced side effects like scarring and hyperpigmentation. Moreover, the precise and minimally invasive nature of picosecond laser treatments often reduces the need for extensive anesthesia during procedures, making them more comfortable for patients. Additionally, picosecond lasers offer precise tissue ablation with minimal collateral damage. They are used in ophthalmology for precise corneal surgery, as well as in other surgical procedures requiring high precision.

Growing Prevalence of Acne and Other Dermatological Conditions

Picosecond lasers can be used to improve the appearance of acne scars by stimulating collagen remodeling and tissue repair. Picosecond lasers have shown promise in treating certain dermatological conditions like psoriasis and vitiligo, providing targeted treatment with reduced risk to unaffected areas. The rising cases of acne and other dermatological conditions are driving the picoseconds lasers market. According to the IHME, around 4.96 million people had acne vulgaris causing Disability-adjusted life year (DALY) in 2019 out of which, 3.52 million occurred in people aged between 15-49 years old. Moreover, 34 percent of individuals in the UK have experienced acne at some time in their lives according to the research by Click2Pharmacy.

Emerging Applications in Numerous Industry

Picosecond lasers can be used for skin rejuvenation treatments, targeting areas with pigmented lesions, age spots, and other skin imperfections. The number of laser skin resurfacing procedures in the USA increased by almost 483% between 2000 and 2020 according to the ASPS. Picosecond lasers are effective in treating various pigmented lesions, including freckles, birthmarks, and melasma. These can be used for hair removal, effectively targeting hair follicles with minimal damage to the surrounding skin. The rising demand for hair removals and pigmented lesions treatment is contemplated to bolster the picoseconds lasers market. For instance, hair removal was ranked among the top-five non-surgical cosmetic procedures in 2021 as per the ISAPS.

Increasing Demand for Minimally Invasive Surgeries

Many picosecond laser treatments are non-invasive or minimally invasive which reduces patient discomfort and downtime compared to more invasive aesthetic surgical procedures. The rising demand for minimally invasive surgeries is expected to boost the picosecond lasers market. For instance, there were 13.2 million minimally invasive cosmetic procedures conducted out of a total of 15.6 million cosmetic procedures in 2020 as per the American Society of Plastic Surgeons (ASPS). Further, the non-surgical cosmetic procedure increased by 19.9% in 2021 with a total of 54.1% increase in the last four years as per the ISAPS.

Picosecond Lasers Market Restraints:

The picoseconds lasers market has experienced growth and development however some restraints or challenges can impact its expansion. For example, picosecond laser technology involves complex and advanced components, which can result in a higher upfront investment compared to other laser systems with longer pulse durations. Additionally, the maintenance and service costs for picosecond lasers may be relatively higher due to the precision and sophistication of the components involved. Moreover, some picosecond laser systems may be limited to specific wavelengths, which could restrict their suitability for certain applications that require a broader range of wavelengths.

Picosecond Lasers Market Geographical Outlook:

North America is Expected to Grow Considerably

North America is expected to hold a significant share of the picoseconds lasers market during the forecast period. The factors attributed to such a share are the increasing dermatological conditions, technological advancements, increasing aesthetic cosmetic surgeries, and the presence of major market leaders such as Candela Medical, and Thorlabs. For instance, in the United States, acne is the most prevalent skin disorder, affecting up to 50 million people each year according to the American Academy of Dermatology Association. Moreover, the laser hair removal procedure in the USA increased from 735,996 in 2000 to 1,055,466 in 2019 as per the ASPS.

List of Top Picosecond Lasers Companies:

Candela Medical is a leading global medical aesthetics company that specializes in developing and manufacturing advanced laser-based devices for various cosmetic and medical treatments. PicoWay® picoseconds laser machine offered by the company is designed to improve acne scars through 15 to 20-minute treatments.

Alma Lasers offers a diverse range of cutting-edge technologies and platforms for different applications including hair removal, tattoo removal, skin rejuvenation, and others. The operating principle of PICO CLEAR designed by the company relies on the delivery of extremely short pulses of picosecond energy into the skin tissue.

PicoQuant, founded in 1996 is a leading company specializing in the development of high-quality instrumentation and solutions for time-resolved fluorescence spectroscopy, time-correlated single-photon counting (TCSPC), and photon counting applications. It offers LDH series Prima, and PLS as picosecond pulsed sources.

Picosecond Lasers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Picosecond Lasers Market Size in 2025 | USD 421.395 million |

Picosecond Lasers Market Size in 2030 | USD 673.070 million |

Growth Rate | CAGR of 9.82% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Picosecond Lasers Market |

|

Customization Scope | Free report customization with purchase |

Picosecond Laser Market Segmentation

By Type

Nd:YAG

Alexandrite

By Application

Material Processing

Medical Application

Skin Rejuvenation

Pigmented Lesions

Melasma

Tattoo Removal

Laser Microscopy

Others

By End-User

Medical & Healthcare

Electronics & Semiconductor

Research & Science

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others