Report Overview

Leakage Current Clamp Meter Highlights

Leakage Current Clamp Meter Market Size:

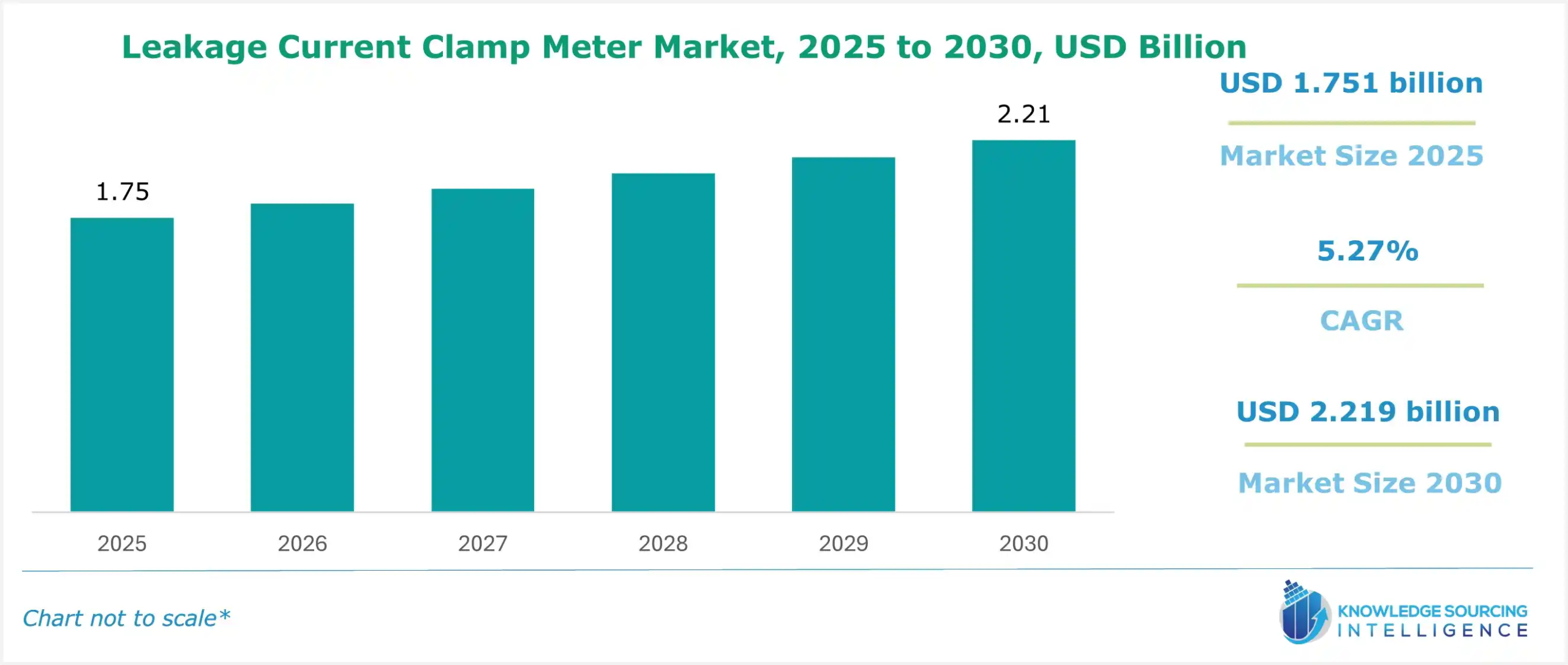

The leakage current clamp meter market is projected to grow at a CAGR of 5.27% over the forecast period, increasing from US$1.751 billion in 2025 to US$2.219 billion by 2030.

The leakage current clamp meter market is experiencing notable growth driven by several factors such as increasing demand for electrical safety, stringent regulations, growing adoption of renewable energy sources, rising complexity in electrical systems applications, and rising industrial applications.

The renewable energy sector growth has a significant boost to the demand for the leakage current clamp meter. According to the International Energy Agency, annual renewable capacity additions are expected to rise from 666 GW in 2024 to almost 935 GW in 2030.

Further, the expansion of the electricity supplies in the developing regions of the world, such as Africa, has a significant boost to the growth of the leakage current clamp meter market. In January 2025, the World Bank Group (WBG) and the African Development Bank (AfDB) announced their commitment to deliver electricity to 300 million Africans by 2030.

Leakage Current Clamp Meter Market Growth Drivers:

- Rising demand in the automotive sector is bolstering market growth

The automotive industry is increasingly focused on ensuring safety in vehicles. Leakage current meters play a crucial role in detecting potentially hazardous leakage currents that can lead to electrical failures or fires. This is propelling the demand for measurement tools like leakage current clamp meters. The growth of electric vehicles increases the necessity for testing and monitoring of electrical systems, including charging stations. Leakage current meters play a crucial role in expanding the electrical vehicle infrastructure. Moreover, the increased demand for automobiles will boost the usage of leakage current clamp meters and their market growth. According to the OICA (International Organization of Motor Vehicle Manufacturers), in 2023 increased by 10% from the previous, the total number of vehicles produced in year. The total number of vehicles produced was 93,546,599, comprising 67,133,570 cars and 26,413,029 commercial vehicles.

- Strict electrical safety regulations are anticipated to increase the market demand

Regulatory and government bodies around the world have been busy enhancing safety standards to minimize electric hazards. Leakage current measurement helps, on a very strong note, in ascertaining whether or not a certain electrical connection is safe to use. Currently, the clamour for clamp meters has increased significantly because of the large requirement for such meters that can accurately detect and subsequently measure leakage currents in industrial domains like construction and manufacturing, apart from energy-oriented industries and places.

Moreover, the development of renewable energy installations, such as solar and wind power, has created new markets in the area of leakage-current clamp meters. Hence, there is a demand for precise observation of the electric current in renewable energy systems. This is because efficient and safety-conscious use of various renewable energy installations can be ensured by using the clamp meter.

Leakage Current Clamp Meter Market Segment Analysis:

- By leakage type, the AC leakage segment is anticipated to grow during the forecast period

The AC Leakage Clamp Meter Market refers to the production, distribution, and use of clamp meters for measuring the leakage in alternating currents in electrical systems or electronics. It is widely used in residential, construction, industrial, power distribution, and electrical appliance systems.

Moreover, the market for AC Leakage will be driven by the increasing application of AC leakage meters in various end-users, such as in residential, industrial, construction, utilities & power sectors, among others. The growing adoption of safety standards across industries is offering a major boost to the AC leakage market. Further, the growing electrical complexity due to the increased adoption of smart grids and the expansion of electrical systems will be the major factors driving the market.

- By end-user, electricals and electronics are anticipated to grow during the forecast period

In the electrical and electronics segment, a leakage current clamp meter is used for measuring the leakage of current from electrical systems to detect faults in power lines, transformers, etc., and in electronic appliances such as washing machines, refrigerators, ovens, televisions, computers, laptops, electric cookers, and many others. The growing electronic market is driving the market growth of AC Leakage Clamp meters.

Further, the electronics sector is rapidly growing, driving the demand for electronics products such as washing machines, ovens, microwaves, refrigerators, televisions, computers, and laptops, among many others. The growth in the electronics sector is driving the demand for measuring current leakages, also due to growing safety concerns. Thus, the demand for clamp meters for detecting and measuring the leakage of currents is growing.

Leakage Current Clamp Meter Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The major factor propelling the growth of the global leakage current clamp meter market in the USA is the increasing demand for electrical safety across residential and commercial infrastructures. The leakage current clamp meter helps in detecting possible short circuits. Similarly, the increasing utilization of leakage current clamp meters across multiple industries is also among the key factors that are expected to boost the growth of the market during the forecasted timeline. The leakage current clamp meter offers its application across multiple industries, which include automotives, manufacturing, construction, and electronics.

Similarly, the increasing demand for electrical safety in the nation is also expected to propel the growth of the leakage current clamp meter. The demand for electrical safety across residential, commercial, or industrial infrastructure witnessed a major increase, mainly with the increasing cases of infrastructure fire related to electrical malfunction.

Leakage Current Clamp Meter Market Key Launches:

- In September 2023, Fluke Corporation acquired Solmetric, the leader in solar test and measurement tools. Solmetric's PV Analyzer is the feature-rich number one I-V curve tracer that includes perfect conductance and troubleshooting of solar installations, especially in utility-scale projects. This acquisition will make Fluke committed to raising excellent global electrification through its high-quality products for solar installers.

List of Top Leakage Current Clamp Meter Companies:

- Metravi Instruments Pvt Ltd.

- Hioki E.E Corporation

- Fluke Corporation

- Kyuritsu Electrical Instruments Works Ltd.

- Testo & Company Co. KGaA

Leakage Current Clamp Meter Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Leakage Current Clamp Meter Market Size in 2025 | US$1.7515 billion |

| Leakage Current Clamp Meter Market Size in 2030 | US$2.219 billion |

| Growth Rate | CAGR of 5.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Leakage Current Clamp Meter Market |

|

| Customization Scope | Free report customization with purchase |

The leakage current clamp meter market is analyzed into the following segments:

- By Leakage Type

- AC Leakage

- DC Leakage

- By End-User

- Construction

- Electrical & Electronics

- Medical & Healthcare

- Automotive

- Others

- By Geography