Report Overview

Electromagnetic Flow Meter Market Highlights

The Electromagnetic Flow Meter Market

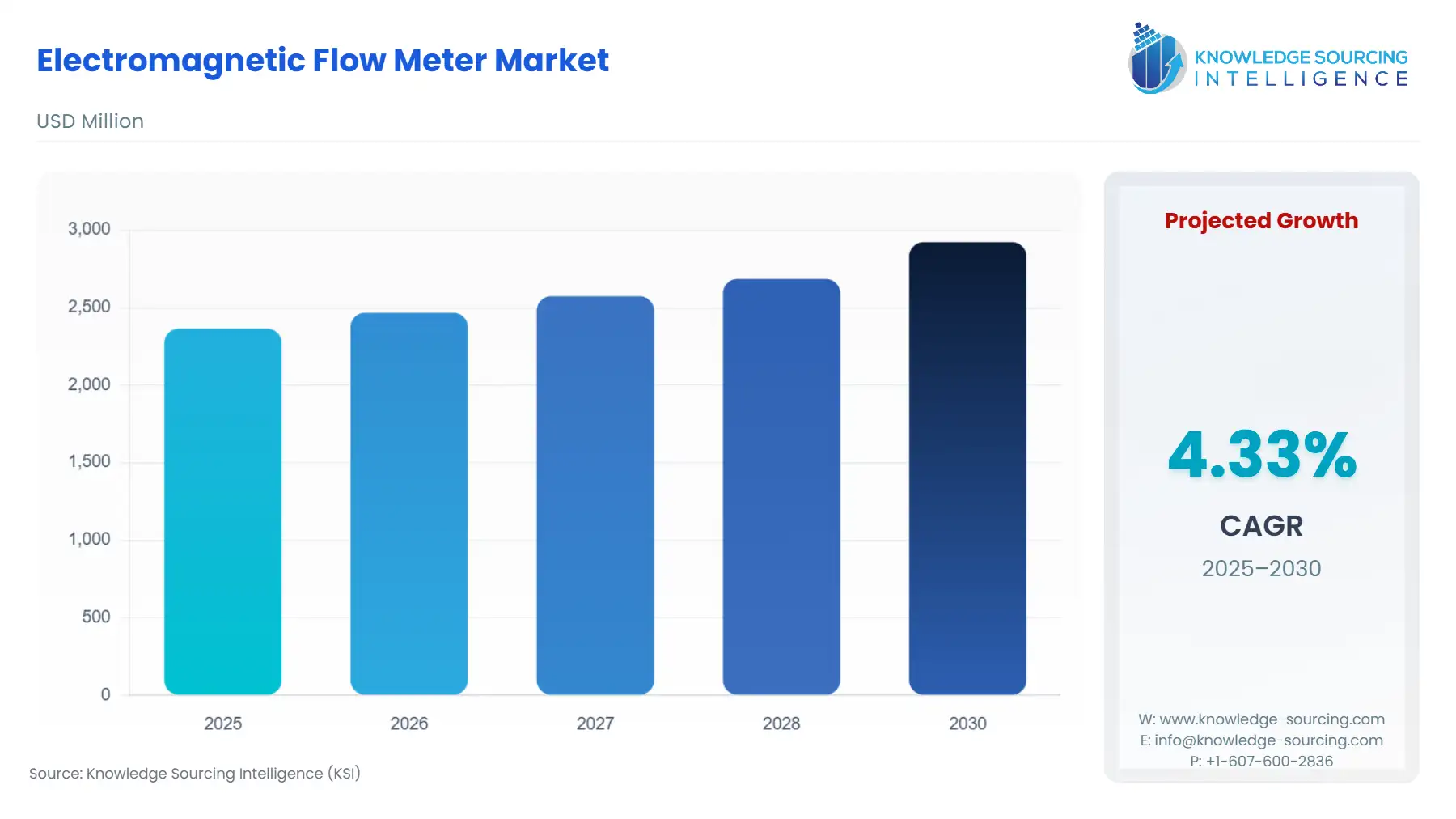

The Electromagnetic Flow Meter Market will reach US$2,922.600 million in 2030 from US$2,364.866 million in 2025 at a CAGR of 4.33% during the forecast period.

Electromagnetic Flow Meter Market Introduction:

Electromagnetic flow meters, also known as magmeters, are precision instruments used to measure the flow rate of electrically conductive liquids in various industrial applications. These devices operate on Faraday’s Law of Electromagnetic Induction, which states that a voltage is induced when a conductive fluid flows through a magnetic field. This voltage is proportional to the fluid’s velocity, enabling accurate flow measurement without moving parts, thus reducing wear and maintenance. Their non-intrusive design and ability to handle a wide range of fluids, from water to corrosive chemicals, make electromagnetic flow meters indispensable in industries such as water and wastewater management, chemical processing, food and beverage production, pharmaceuticals, and power generation. As industries increasingly prioritize efficiency, accuracy, and sustainability, the electromagnetic flow meter market is experiencing significant growth, driven by technological advancements and evolving industrial needs.

The electromagnetic flow meter market is a critical segment of the global flow measurement industry, which supports process optimization and regulatory compliance across multiple sectors. These devices are particularly valued for their ability to measure flow in challenging conditions, such as slurries, viscous fluids, or liquids with suspended solids, where other flow measurement technologies, like turbine or ultrasonic meters, may falter. Their versatility has positioned them as a preferred choice in industries requiring precise flow data to ensure operational efficiency, product quality, and environmental compliance.

In the water and wastewater sector, electromagnetic flow meters are widely used for monitoring water distribution, sewage treatment, and industrial effluent management. For instance, municipalities rely on these devices to measure water usage accurately, supporting billing systems and leak detection efforts. In the chemical industry, magmeters handle aggressive fluids, ensuring safe and efficient process control. The food and beverage industry uses them for hygienic applications, such as measuring liquid ingredients in dairy or beverage production, where sanitary standards are paramount. Similarly, in pharmaceuticals, their non-invasive design ensures compliance with stringent cleanliness requirements. The power generation sector employs magmeters for cooling water and process fluid management, contributing to energy efficiency.

Recent advancements in electromagnetic flow meter technology have bolstered their adoption. One notable development is the integration of digital technologies, such as Internet of Things (IoT) connectivity and smart diagnostics. Modern magmeters now feature real-time data transmission, enabling remote monitoring and predictive maintenance. For example, in 2024, Siemens introduced an upgraded version of its SITRANS FM magmeter series with enhanced IoT capabilities, allowing seamless integration with industrial automation systems. This development aligns with the broader trend of Industry 4.0, where data-driven decision-making is transforming manufacturing and process industries.

Another significant trend is the development of battery-powered electromagnetic flow meters, which cater to remote or off-grid applications, such as agricultural irrigation or remote water monitoring. In 2025, ABB launched a new battery-operated magmeter designed for harsh environments, offering up to 10 years of battery life and compatibility with solar-powered systems. This innovation addresses the growing demand for sustainable and energy-efficient solutions in water management.

Additionally, advancements in sensor technology have improved the accuracy and reliability of magmeters, even in low-conductivity fluids. Yokogawa, for instance, released a high-precision magmeter in 2024 capable of measuring fluids with conductivity as low as 1 µS/cm, expanding applications in industries like pharmaceuticals and ultrapure water production.

Electromagnetic Flow Meter Market Trends

The electromagnetic flow meter market is witnessing transformative growth, driven by technological advancements and increasing demand for efficient fluid management across industries like water and wastewater, pharmaceuticals, and chemical processing. A prominent trend is the adoption of sustainable flow measurement solutions, which optimize resource usage and support environmental compliance, particularly in water management systems. For instance, ABB’s AquaMaster4 Mobile Comms flow meter, designed for remote water distribution monitoring, enhances sustainability by minimizing water loss.

The integration of Industry 4.0 flow meters is reshaping the market, with systems incorporating IoT and AI for real-time data analytics. This enables remote monitoring flow, allowing operators to track flow rates and system performance from anywhere, reducing operational downtime. Additionally, predictive maintenance flow meters are gaining traction, using advanced diagnostics to anticipate maintenance needs, as seen in Siemens’ SITRANS FM MAG 8000 series. The rise of wireless flow meters further supports this trend, offering flexible installation and connectivity, especially in remote or hazardous environments. These innovations align with global sustainability goals and regulatory demands, positioning electromagnetic flow meters as critical tools for modern industrial applications.

Electromagnetic Flow Meter Market Dynamics:

Market Drivers

Rising Demand for Water and Wastewater Management

Global population growth and urbanization are intensifying the need for efficient water and wastewater management systems. Electromagnetic flow meters are critical for monitoring water distribution, sewage treatment, and industrial effluent management, ensuring accurate measurement and compliance with environmental standards. The United Nations projects that by 2030, 68% of the global population will reside in urban areas, increasing pressure on water infrastructure to support growing urban centers. This trend is particularly evident in emerging economies, where investments in smart water grids are rising. For example, in 2024, the Asian Development Bank announced funding for advanced water management systems in Southeast Asia, emphasizing the role of precise flow measurement technologies like magmeters in optimizing water distribution. Additionally, the growing focus on water conservation and leak detection in municipal systems further drives demand for electromagnetic flow meters, which offer high accuracy and reliability in measuring water flow.Industrial Automation and Industry 4.0

The global shift toward Industry 4.0 and smart manufacturing is a significant driver for the electromagnetic flow meter market. Modern magmeters are increasingly equipped with Internet of Things (IoT) connectivity, enabling real-time data transmission, remote monitoring, and predictive maintenance. These features align with the automation needs of industries such as chemical processing, food and beverage, and pharmaceuticals. For instance, Siemens’ SITRANS FM magmeter series, upgraded in 2024, integrates seamlessly with industrial automation systems, providing data analytics for process optimization. The International Data Corporation (IDC) forecasts that global spending on Industry 4.0 technologies will continue to grow, with a focus on IoT-enabled devices driving operational efficiency. Electromagnetic flow meters with digital communication protocols, such as Modbus or Profibus, are becoming essential for industries seeking to reduce downtime and enhance productivity through data-driven decision-making.Stringent Regulatory Standards

Governments and international organizations are implementing stricter regulations on water usage, emissions, and industrial processes, necessitating accurate flow measurement to ensure compliance. Electromagnetic flow meters are widely used to monitor and report flow data in regulated industries like water treatment, chemical manufacturing, and power generation. In the United States, the Environmental Protection Agency (EPA) enforces standards for wastewater discharge, requiring precise measurement of effluent flows. Similarly, the European Environment Agency (EEA) sets guidelines for water resource management, pushing industries to adopt reliable measurement technologies. In 2025, the European Union introduced updated directives on industrial emissions, further emphasizing the need for accurate flow monitoring in the chemical and manufacturing sectors. These regulations drive the adoption of electromagnetic flow meters due to their high accuracy and ability to handle diverse fluid types.Technological Advancements

Innovations in electromagnetic flow meter technology are expanding their application scope and improving performance. Developments such as battery-powered magmeters, enhanced sensor accuracy, and compatibility with low-conductivity fluids are attracting new end-users. For example, ABB’s 2025 launch of a battery-operated magmeter with up to 10 years of battery life caters to remote applications like agricultural irrigation and off-grid water monitoring. Additionally, Yokogawa’s 2024 release of a high-precision magmeter capable of measuring fluids with conductivity as low as 1 µS/cm has opened new opportunities in pharmaceuticals and ultrapure water production. These advancements address specific industry challenges, such as energy efficiency and measurement accuracy, driving market growth by making magmeters more versatile and cost-effective over time.

Market Restraints:

High Initial Costs

The upfront cost of electromagnetic flow meters, particularly advanced models with IoT or digital features, remains a significant barrier, especially for small and medium-sized enterprises (SMEs). These devices often require specialized installation and calibration, which add to the total cost of ownership. For instance, high-end magmeters with advanced diagnostics can cost significantly more than traditional flow measurement devices like turbine meters. While the long-term benefits of low maintenance and durability offset initial costs, budget constraints in smaller operations hinder widespread adoption.Limited Application for Non-Conductive Fluids

Electromagnetic flow meters rely on the conductivity of fluids to function, making them unsuitable for measuring non-conductive liquids such as oils, hydrocarbons, or certain gases. This limitation restricts their use in industries like oil and gas, where alternative technologies like ultrasonic or Coriolis flow meters are preferred. For example, in upstream oil and gas applications, the inability to measure crude oil or refined petroleum products limits magmeter adoption. This constraint confines the market to industries dealing with conductive fluids, reducing its overall addressable market size.Complex Installation Requirements

While electromagnetic flow meters are low-maintenance once installed, their setup requires precise alignment, grounding, and calibration to ensure accurate measurements. In retrofit applications or complex piping systems, installation can be challenging and time-consuming, increasing project costs. A 2025 article on industrial flow measurement highlighted that improper installation is a common cause of measurement errors in magmeters, necessitating skilled technicians and careful planning. This complexity can deter adoption in facilities with limited technical expertise or resources, particularly in older industrial setups.

Electromagnetic Flow Meter Market Segmentation Analysis:

By Type, the Flange Type flow meters are expected to lead the market

Flange-type electromagnetic flow meters are the most prominent segment in the market due to their versatility, reliability, and widespread use in industrial applications. These meters are designed with flanged connections that allow easy integration into existing piping systems, making them ideal for high-pressure and large-diameter pipelines. Their robust construction ensures durability in harsh environments, such as chemical plants, water treatment facilities, and heavy industries. Flange-type magmeters are preferred for their high accuracy, ability to handle a wide range of conductive fluids, and compatibility with automated systems. According to a 2023 industry analysis, the Flange Type segment accounted for a significant share of the global electromagnetic flow meter market due to its adaptability across industries like wastewater, chemical, and food processing. Flange-type magmeters are extensively used in applications requiring precise flow measurement of conductive liquids, such as water, slurries, and corrosive chemicals. In the wastewater industry, they monitor sewage and effluent flows, ensuring compliance with environmental regulations. In the chemical sector, their ability to handle aggressive fluids with appropriate lining materials (e.g., PTFE or rubber) makes them indispensable. Recent advancements, such as Yokogawa’s ADMAG AXG series, enhance Flange Type magmeters with dual-frequency excitation, improving accuracy for complex fluids. The growth of this segment is driven by increasing demand for reliable flow measurement in industrial automation and the global push for efficient water management. The United Nations’ projection of 68% urbanization by 2030 underscores the need for advanced water infrastructure, boosting demand for Flange Type magmeters in municipal applications.By Components, detectors are gaining significant growth

Detectors are the core component of electromagnetic flow meters, responsible for generating the magnetic field and measuring the induced voltage to determine flow rate. They consist of coils to create the magnetic field and electrodes to detect the voltage, making them critical to the meter’s functionality. Detectors dominate the components segment due to their essential role in ensuring measurement accuracy and reliability. Advances in detector technology, such as improved electrode materials and lining technologies, have enhanced performance in challenging applications, such as low-conductivity fluids or abrasive slurries. A 2024 article highlighted that innovations in detector design are key to expanding magmeter applications in industries like pharmaceuticals and ultrapure water production. Detectors are integral to all electromagnetic flow meter types, from flange to insertion, and are used across industries like wastewater, chemical, and food processing. For instance, in wastewater treatment, detectors with corrosion-resistant linings (e.g., ceramic or PTFE) ensure accurate measurement of sewage flows. The push for Industry 4.0 has led to the development of smart detectors with IoT capabilities, enabling real-time data transmission and diagnostics. Siemens’ SITRANS FM series, upgraded in 2024, incorporates advanced detectors with digital signal processing for enhanced accuracy and integration with automation systems. The growth of this segment is driven by the need for high-precision measurement in regulated industries and the integration of smart technologies in industrial processes, as noted in IDC’s forecast of increased Industry 4.0 spending.By End-User, the wastewater segment is rising rapidly

The wastewater industry is the largest end-user segment for electromagnetic flow meters, driven by the global need for efficient water management and regulatory compliance. Magmeters are ideal for wastewater applications due to their ability to measure flows of conductive liquids, including sewage, sludge, and industrial effluents, without obstruction or wear. Their non-intrusive design minimizes maintenance, making them cost-effective for municipal and industrial wastewater treatment plants. The segment’s dominance is underscored by the increasing focus on environmental sustainability and water conservation, with governments enforcing stricter regulations on wastewater discharge. The U.S. EPA mandates precise flow monitoring for compliance, driving magmeter adoption. In wastewater treatment, electromagnetic flow meters are used for monitoring influent and effluent flows, sludge processing, and leak detection in water distribution systems. Their ability to handle abrasive and corrosive fluids makes them suitable for challenging wastewater environments. For example, ABB’s battery-operated magmeters, launched in 2025, cater to remote wastewater monitoring, supporting sustainable water management in off-grid areas. The segment’s growth is fueled by urbanization and investments in water infrastructure, particularly in emerging economies. The Asian Development Bank’s 2024 initiative to fund smart water management systems in Southeast Asia highlights the role of magmeters in addressing water scarcity.

Electromagnetic Flow Meter Market Geographical Outlook:

The Asia Pacific market is expanding significantly

The Asia Pacific region dominates the electromagnetic flow meter market due to rapid industrialization, urbanization, and significant investments in water and wastewater infrastructure. Countries like China, India, Japan, and South Korea are key contributors, driven by large-scale industrial activities and government initiatives to improve water management. The region’s dominance is further supported by its manufacturing base for flow measurement technologies and the adoption of Industry 4.0 practices. In the Asia Pacific, electromagnetic flow meters are widely used in wastewater treatment, chemical manufacturing, and food processing. China’s focus on environmental protection, including its 2025 water pollution prevention policies, has increased demand for magmeters in municipal and industrial applications. India’s Smart Cities Mission, aimed at improving urban infrastructure, drives the adoption of magmeters for water distribution and sewage management. Additionally, the region’s chemical and pharmaceutical industries rely on magmeters for precise process control. Technological advancements, such as Yokogawa’s high-precision magmeters for low-conductivity fluids, cater to the Asia Pacific’s growing pharmaceutical sector. The region’s growth is propelled by population growth, industrial expansion, and regulatory pressures, making it a key market for electromagnetic flow meters.

List of key companies profiled:

ABB Ltd.

Siemens AG

Endress+Hauser AG

Yokogawa Electric Corporation

Emerson Electric Co.

Honeywell International Inc.

Electromagnetic Flow Meter Market Key Developments:

ABB Battery-Operated Magmeter for Remote Applications (2025): ABB launched a new battery-operated electromagnetic flow meter designed for harsh and remote environments, such as agricultural irrigation and off-grid water monitoring. This magmeter offers a battery life of up to 10 years and compatibility with solar-powered systems, aligning with the global push for sustainable and energy-efficient solutions.

Siemens SITRANS FM Magmeter Series Upgrade with IoT Integration (2024): Siemens introduced an upgraded SITRANS FM electromagnetic flow meter series, incorporating advanced IoT connectivity and smart diagnostics. This development enhances real-time data transmission and predictive maintenance capabilities, allowing seamless integration with Industry 4.0 automation systems.

Electromagnetic Flow Meter Market Segmentations:

The market is analyzed by type into the following:

By Type:

Flange Type

Insertion Type

The report analyzes the market by components as below:

By Components:

Detectors

Convertors

Others

The report analyzes the market by end-user segment as below:

By End-User Segment:

Wastewater

Food and Beverage

Chemical

Mining

Others

The study also analyzed the Electromagnetic Flow Meter Market into the following regions, with country-level forecasts and analysis as below:

By regions:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)