Report Overview

Lifting Stations Market Size, Highlights

Lifting Stations Market Size:

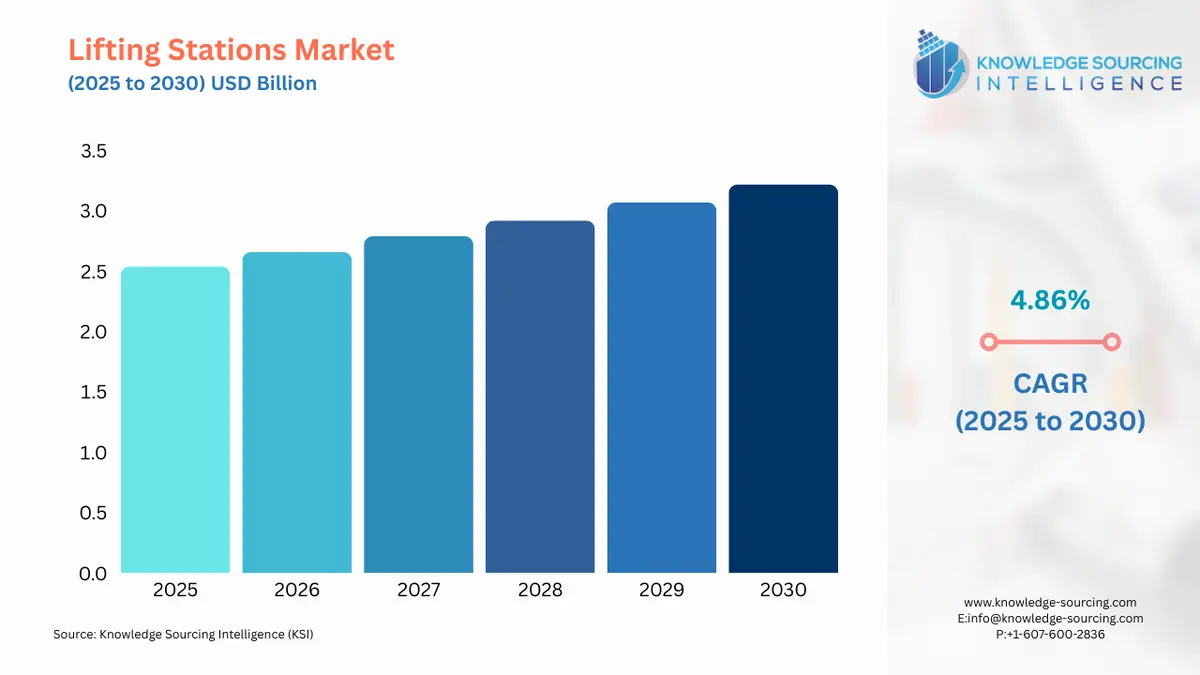

The lifting stations market is estimated to attain a market size of US$3.215 billion by 2030, growing at a 4.86% CAGR from a valuation of US$2.536 billion in 2025.

Lifting Stations Market Introduction:

The lifting stations market is predicted to expand steadily during the forecast period. A lift station is a facility designed to transport wastewater from a lower level to a higher level by utilizing pumps. Dynamic pumps and positive displacement pumps are two types of pumps commonly utilized in lifting stations. Favorable investments to improve the wastewater management system, and a lack of drinking water availability have increased the wastewater treatment activities, thereby driving the expansion of the lifting station market size.

Growing urbanisation and stringent environmental regulations have driven an increasing demand for lifting stations. As cities grow, impacting sewer networks typically requires pump systems to carry waste to treatment works, or when topography does not allow for the use of deep gravity tunnels, which promotes the requirement for lift stations. Similarly, many modern industrial, commercial, or multi-family residential developments require compact lift stations that conform to municipal regulations for the movement of wastewater, stormwater, or process effluent, particularly in basement or flood-prone applications.

Recent advances in pump technology, such as solids-handling submersibles, grinder pumps, variable-speed drives, among others, improve the system’s efficiency, minimise clogging, and energy consumption. Control systems are also evolving, combining sensors, floats, alarms, and remote monitoring to create resilient lifting station operations.

Station design is focused on smarter, more robust technology. Pumping units today are equipped with improvements such as submersible solids-handling and grinder pumps to mitigate clogging, and guide-rail hoists for mechanical assistance, control systems are now more robust than ever with a control system that utilizes float switches, pressure sensors, variable speed drives, and remote monitoring which reduces energy consumption and provides the pump station operator with assurance.

Additionally, according to the World Bank data, the urban population was 4.54 billion in 2022, which increased to account for 4.61 billion in 2023. Further, as per the data from the United Nations Population Fund (UNFPA), over 50 percent of the global population is expected to reside in cities by 2030, with an estimated value of approximately 5 billion. This will contribute to a rise in industrialization and infrastructure development, which will contribute to the construction of a sewage and wastewater management system, which will fuel the market during the projected period.

Supporting communities for their daily operations and developing infrastructure, institutions, and modes of Isla dws under the umbrella of managing soft urban growth dependency millennium. Lifting stations are a constant fixture in the growing urban, commercial, or industrial development. All aided by growing amounts of rehabilitation infrastructure, trades, libraries packing and moving in the community context.

Lifting Stations Market Drivers:

- Improving wastewater management systems bolsters the lifting station market.

Lifting stations facilitate the transportation of wastewater from lower to higher elevations, ensuring proper drainage and preventing flooding. These systems not only promote environmental sustainability by reducing the risk of contamination but also enable the efficient collection and treatment of wastewater. In 2022, the European Investment Bank made a significant investment of €2.17 billion in the wastewater management sector, which improved sanitation facilities for approximately 10.8 million individuals, ensuring healthier living conditions. Additionally, the investment provided better access to safe drinking water for around 25.4 million people and also contributed to minimizing the risk of flooding for 234,000 individuals.

- Emerging water scarcity drives the lifting station market expansion.

The rising concerns regarding water scarcity in different regions have highlighted the importance of effective water management. Lifting stations have emerged as critical components in the process of wastewater reuse and recycling, playing a pivotal role in promoting sustainable water management practices. As a result, the lifting stations market demand is witnessing positive growth. According to a report issued by UNESCO in the “UN 2023 Water Conference,” approximately 2 billion people worldwide, which accounts for 26% of the global population, still lack access to safe drinking water. Furthermore, an alarming 3.6 billion people, equivalent to 46% of the population, are deprived of safely managed sanitation facilities

- Favorable government initiatives drive the lifting station market growth.

Government initiatives aimed at the establishment of water treatment and sewage treatment plants play a crucial role in boosting the growth of the lifting stations industry. These initiatives involve the construction and modernization of water and sewage infrastructure, creating a demand for lifting stations to efficiently manage the transportation of water, wastewater, and sludge. For instance, in January 2023, the Government of India initiated a ceremony to inaugurate seven sewage treatment plants (STPs) in Mumbai. These plants collectively can treat 2,464 million liters of sewage per day. This significant undertaking is part of the 'Mumbai Sewage Disposal Project — II,' an initiative led by the Brihanmumbai Municipal Corporation (BMC) to address sewage disposal challenges in the city.

- Technological innovation & Smart integration:

Technological innovation, especially in the form of variable-frequency drives (VFDs), SCADA systems, and intelligent pump controls, is proving to be a massive leverage point for growth in the lifting stations marketplace. It will be noted that, unlike previous generations of fixed-speed pumps, many of today's lift stations can utilise VFDs to vary pump speed based on actual demand, generating a considerable degree of energy savings. Reducing pump speed by 20% will reduce power consumption by almost 50% because power consumption is related to speed cubed.

The benefit of SCADA (Supervisory Control and Data Acquisition) systems significantly adds to the gains. SCADA provides continuous real-time monitoring of pump operation, flow, energy use, and the capability for operators to adjust any of these operations from a distance. Some saving estimates concluded potential reductions of 10–20% through reconfiguration of the normal operational control settings to maximise savings using SCADA data. SCADA assists these savings not only in enhancing energy savings, but also plays a role in conducting preventive maintenance and predictive analytics to reduce downtime and extend service life.

Another dazzling advancement in technology is the intelligent anti-clog routines, which automatically execute brief reverse-rotation pumping sequences to remove debris, including fats, oils, greases, and rags (which account for over 40% of lift-station failures). Working as self-cleaners, intelligent anti-clogging routines significantly reduce the required time to perform maintenance, reduce the number of emergency call-outs and associated labour costs.

In addition, the technological innovation and advancement in lifting solutions are also attributed to increased investment in new development and diversification of product portfolios by major market players. The major market players, such as Sulzer, offer a diverse range of advanced lifting solution products and provide the pumping solutions under its flow division, which is a major segment of the company. The sales of the flow division were CHF 1,444.3 million in 2024, with an order intake of CHF 1,603.3 billion.

Furthermore, the provincial Ministry's Water & Energy Conservation Guidance Manual for Ontario indicates that variable-speed controls (VFDs) are now required for sewage works, as it's possible to save somewhere in the range of 65% of energy use through reducing the pump speed by 30%. According to the Clean Water State Revolving Fund (CWSRF) Green Project Reserve from the U.S. EPA, lift station retrofits with a minimum energy efficiency increase of 20% qualify for green funding, indicating a strong preference for VFDs. Going forward, these rules, which are required as of 2024, actively incentivize the market acceptance of smart pump technologies in the wastewater sector and therefore create obligations for VFDs and automated controls, as less than a sound operational performance objective, but a compliance requirement.

Lifting Stations Market Restraints:

- Technological advancements restrain the lifting station market growth.

The lifting stations industry's growth faces significant challenges due to the rapid advancement of alternative wastewater management technologies. Emerging solutions like decentralized treatment systems and innovative sewer designs offer attractive alternatives that are often more cost-effective, efficient, and environmentally friendly. Decentralized treatment systems, for example, can eliminate the need for extensive pumping infrastructure by treating wastewater at the source. Innovative sewer designs, such as low-pressure systems or gravity-based solutions, reduce the reliance on pumping stations altogether. As a result, stakeholders are increasingly exploring these alternatives, leading to a shift in focus and investment away from traditional lifting stations.

Lifting Stations Market Geographical Outlooks:

- The Asia-Pacific region is anticipated to dominate the lifting station market.

Asia Pacific is expected to account for a significant market share. The favorable sustainable water management practices and investments to boost water treatment capacities in the region to address water scarcity concerns have propelled the lifting station market in the Asia-Pacific. According to the Bureau of Meteorology, Australia faced dry conditions throughout most of the country. As of 30 June 2020, the combined water storage across Australia reached 46% of its total capacity, the same as the previous year. The total amount of water consumed in Australia for various purposes amounted to 14,270 gigalitres (GL), reflecting a 6% decrease compared to the previous year. Additionally, according to the International Trade Organization, in 2023, China's government established ambitious targets, aiming to achieve a 95% wastewater treatment rate in all county-level cities and a 25% water reuse rate in water-scarce regions.

Lifting Stations Market Geographical Outlook:

- North America is also expected to grow significantly in the market

The rise in the urban population is leading to an increase in the large-scale infrastructure development in the USA, which is expected to bolster the demand for lifting stations, which are focused on providing solutions for wastewater and water management in the country.

The country population in mid-2024 was reported to be 336.6 million as per the ‘2024 World Population Data Sheet’ of the Population Reference Bureau (PRB), of this, about 83 percent is the urban population. This trend will necessities an upgrade in the public sanitation infrastructure, which demands lifting stations.

In addition, the United States Census Bureau data report of June 2025 reported monthly spending in sewage and waste disposal construction was USD 45,232 million in April 2024, which grew by 8.9 percent to constitute USD 49,260 million in April 2025. In addition, the water supply total construction spending was USD 34,323 million in April 2025 from 32,104 million in April 2024, which is an increase of 6.9 percent. This trend is expected to promote the demand for advanced lifting stations in the country during the forecasted period.

Moreover, the government's stringent regulations and policies at the federal and state levels mandate efficient waste management along with environmental protection. For instance, the Clean Water Act (CWA) by the US Environmental Protection Agency (EPA) is a regulation for the discharge of pollutants into the water and quality standards for surface water. The EPA also proposed a new CWA method update in April 2024 in the rules for lab analytics methods utilized by municipalities and industries. This will contribute to the adoption of the advanced lifting stations in the country for compliance with wastewater treatment standards and achieving sustainability goals with reduced environmental footprints.

Lifting Stations Market Key Developments:

- August 2022: Wilo, a renowned company in the field of water and wastewater management, completed two significant acquisitions in Germany. The first acquisition involves FSM Frankenberger GmbH & Co KG, located in Pohlheim, and the second acquisition includes WSM Walower Stahl- und Maschinenbau GmbH, situated in Walow. These strategic acquisitions demonstrate Wilo's commitment to expanding its capabilities and enhancing its presence in the wastewater treatment sector.

- January 2022: Industrial Flow Solutions, a prominent company in the industrial solutions sector, had recently acquired Dreno Pompe, a reputable company specializing in the design and manufacturing of electrical submersible pumps specifically for wastewater applications. Through this strategic acquisition, Industrial Flow Solutions aims to strengthen its product portfolio and expand its capabilities in the wastewater industry.

- January 2022: Holland Pump Co. had recently completed the acquisition of Pump Service & Supply of Troy (PSS). This strategic move further strengthens Holland Pump Co.'s market position and expands its reach in providing comprehensive pump solutions.

- January 2022: The management team of Enaqua had recently completed the acquisition of a UV water treatment company. This strategic acquisition reaffirms Enaqua's commitment to providing its customers with the most advanced and cutting-edge technology for their water treatment applications. By integrating the UV water treatment company into its operations, Enaqua strengthens its ability to offer the best available technology to its customers.

Lifting Stations Market Company Products:

- LIFTING STATION LIFT C: AZU Water's LIFT C is an efficient wastewater-lifting plant designed to address the needs of various buildings and sites, including houses, offices, and industrial facilities. This innovative solution plays a crucial role in overcoming challenges related to altitude, distance, and maintenance in wastewater management.

- ABS Piranhamat 100 and 120: Sulzer's Piranhamat 100 and 120 models are innovative and compact fecal pumping units specifically designed for convenient and direct connection to a single toilet. These units are ready-to-use and can be easily plugged in, offering a hassle-free solution for handling fecal waste. The Piranhamat units feature a robust polyethylene tank that ensures a gas- and odor-tight environment, maintaining a hygienic and pleasant atmosphere.

Lifting Stations Market Segmentations:

- By Type

- Dry Well Lifting Station

- Submersible Wet Well Lifting Station

- By Pump Type

- Grinder

- Vortex

- Others

- By Component

- Housing

- Pump

- Pressure Sensors

- Control System

- By Application

- Residential

- Commercial

- Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Other

- North America