Report Overview

Long-Duration Energy Storage Market Highlights

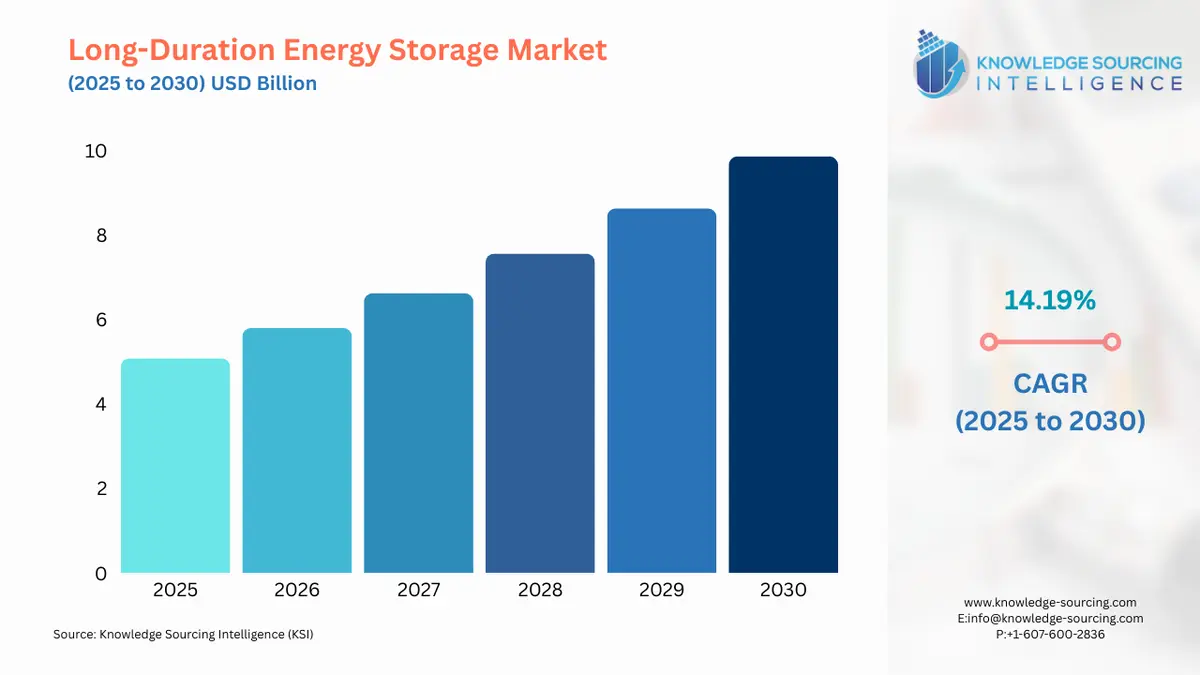

Long-Duration Energy Storage Market Size:

The long-duration energy storage market, with a 13.76% CAGR, is expected to grow to USD 11.009 billion in 2031 from USD 5.078 billion in 2025.

Large-duration energy storage systems play a pivotal role in the storage of renewable energy until its demand arises, offering a critical solution for ensuring grid reliability and decarbonization. These storage systems come with varying durations of energy storage capacity. They can provide energy storage for up to 8 hours or even extend beyond 10 hours. The surge in the long-duration energy storage industry growth is primarily driven by the expansion of electric vehicle (EV) charging infrastructures and the increasing adoption of renewable energy.

Long-Duration Energy Storage Market Drivers:

Increasing EV charging infrastructures drives the long-duration energy storage market expansion.

Charging stations often draw heavy loads from the power grid, especially during peak usage times, which can lead to grid instability. Long-duration energy storage can store excess power during periods of low demand and dispense it during peak times, facilitating the smooth, uninterrupted operation of EV charging stations. This ability to manage demand loads and mitigate the intermittency of renewable energy sources underpins the importance of long-duration energy storage in the EV charging infrastructure and as such infrastructure expand, the demand for long-duration energy storage is also set to increase. According to International Energy Agency, in 2022, the global landscape witnessed the installation of over 600,000 public slow charging points, making a significant expansion of electric vehicle infrastructure.

Booming renewable energy bolsters the long-duration energy storage market growth.

Long-duration energy storage plays an essential role in the renewable energy sector due to its ability to store power generated from renewable sources and release it when needed, addressing the intermittent nature of resources like solar and wind. Due to increasing global energy demands rise and intensifying environmental concerns, there has been an accelerated shift towards renewable energy. This growing reliance on renewables, in turn, necessitates efficient energy storage systems that can ensure, a reliable supply of power even during periods of low renewable energy production. According to the International Energy Agency, in 2023, global renewable capacity is projected to witness a remarkable surge, with a record-breaking absolute increase of 107 gigawatts (GW), reaching a total capacity of over 440 GW.

Government investments drive long-duration storage market growth.

Government initiatives and investments play a crucial role in accelerating the growth of the long-duration energy storage market. Targeted funding for research and development activities promotes technological advancements, driving cost reductions and efficiency improvements in long-duration energy storage systems. For instance, in September 2021, the U.S. Department of Energy (DOE) declared the allocation of $17.9 million in funds to support four research and development initiatives aimed at boosting U.S. production of long-duration storage systems and flow batteries. This financial backing is intended to facilitate the availability of requisite materials for grid expansion with new, environmentally-friendly energy sources, and achieve the target of net-zero carbon emissions by 2050.

Long-Duration Energy Storage Market Geographical Outlook:

North America is predicted to dominate the long-duration energy storage market.

North America will hold a substantial share of the long-duration energy storage industry due to the significant government investments by leading economies within the region namely the United States and Canada. For instance, in November 2022, The U.S. government launched a US$350 million funding program aimed at advancing long-duration energy storage technologies. Also, in April 2021, the Canadian Minister of Natural Resources announced a notable $500,000 investment in the advancement of Hydrostor Inc.'s Advanced Compressed Air Energy Storage (A-CAES) technology. This innovative solution offers a scalable and emissions-free long-duration energy storage system, reflecting Canada's commitment to sustainable energy development and grid stability.

Long-Duration Energy Storage Market Restraints:

Availability of alternatives may restrain the long-duration energy storage market.

The long-duration energy storage industry faces stiff competition from established energy storage technologies like pumped hydro storage, lithium-ion batteries, and hydrogen storage. These alternative solutions have been in the market for a longer time, with more familiarity among industry stakeholders, robust performance records, and often, a more mature supply chain. Consequently, these entrenched technologies pose a significant challenge to the proliferation of long-duration energy storage solutions, as they may be perceived as safer or more reliable options by potential adopters. Therefore, this competitive landscape acts as a notable restraint on the expansion of the long-duration energy storage market.

Long-Duration Energy Storage Market Key Developments:

September 2022: Sacramento Municipal Utility District (SMUD) and ESS announced a partnership agreement to supply up to 200 megawatts (MW)/2 gigawatt-hours (GWh) of long-duration energy storage. As part of this agreement, ESS is set to provide a combination of its long-duration energy storage technologies, which will be integrated into SMUD's electric grid. The commencement of this significant energy storage deployment was planned to begin in 2023, marking a substantial commitment to enhancing grid reliability and renewable energy integration.

August 2022: Global power technology frontrunner, Cummins Inc. announced a substantial investment of $24 million in VoltStorage, a premier tech firm specializing in energy storage systems. This strategic investment represents Cummins' commitment to furthering solutions aimed at enhancing grid stability and energy storage. By supporting VoltStorage, Cummins is contributing to the advancement of sustainable, efficient, and reliable power technologies.

June 2022: Italy's Energy Dome unveiled a ground-breaking long-duration energy storage technology plant located in Sardinia. This development represents the world's first grid-connected battery storage technology based on CO2. This innovative approach to long-duration energy storage is poised to contribute significantly to creating a dependable substitute for fossil fuels when it comes to globally dispatchable baseload electricity. In essence, it marks a significant stride towards a sustainable and reliable energy future.

January 2022: Stryten Energy made a strategic acquisition of Vanadium Redox Flow Battery (VRFB) Technology of Storion Energy. Storion's VRFB technology stands out as an optimal solution for applications necessitating more than four hours of storage capacity. This allows for the efficient deployment of clean energy derived from renewable sources such as solar and wind, whenever demand arises, thereby reinforcing Stryten Energy's commitment to sustainable energy solutions.

Long-Duration Energy Storage Market Company Products:

LDES solution: Energy Vault's LDES solutions employ a unique, proprietary gravity-based energy technology, which is ideally suited for scenarios necessitating four or more hours of storage capacity. Their EVx platform makes use of a mechanical system that raises and lowers composite blocks, effectively storing and dispensing electrical energy. This innovative approach leverages the basic principles of gravity and potential energy, offering a practical and efficient means of managing energy storage and distribution.

List of Top Long-Duration Energy Storage Companies:

Energy Vault Inc.

ESS Tech Inc.

Highview Power

Antora Energy

Ambri Inc.

Long-Duration Energy Storage Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Long-Duration Energy Storage Market Size in 2025 | USD 5.078 billion |

Long-Duration Energy Storage Market Size in 2030 | USD 9.858 billion |

Growth Rate | CAGR of 14.19% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Long-Duration Energy Storage Market |

|

Customization Scope | Free report customization with purchase |

Long-Duration Energy Storage Market Segmentation

By Technology Type

Thermal

Mechanical

Chemical & Electrochemical

By Energy Type

Solar

Wind

Others

By Capacity

Up to 100 MW

100 to 500 MW

Greater than 500 MW

By Duration

Up to 10 Hours

10 to 20 Hours

Greater than 20 Hours

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others