Report Overview

Low VOC Paints Market Highlights

Low VOC Paints Market Size:

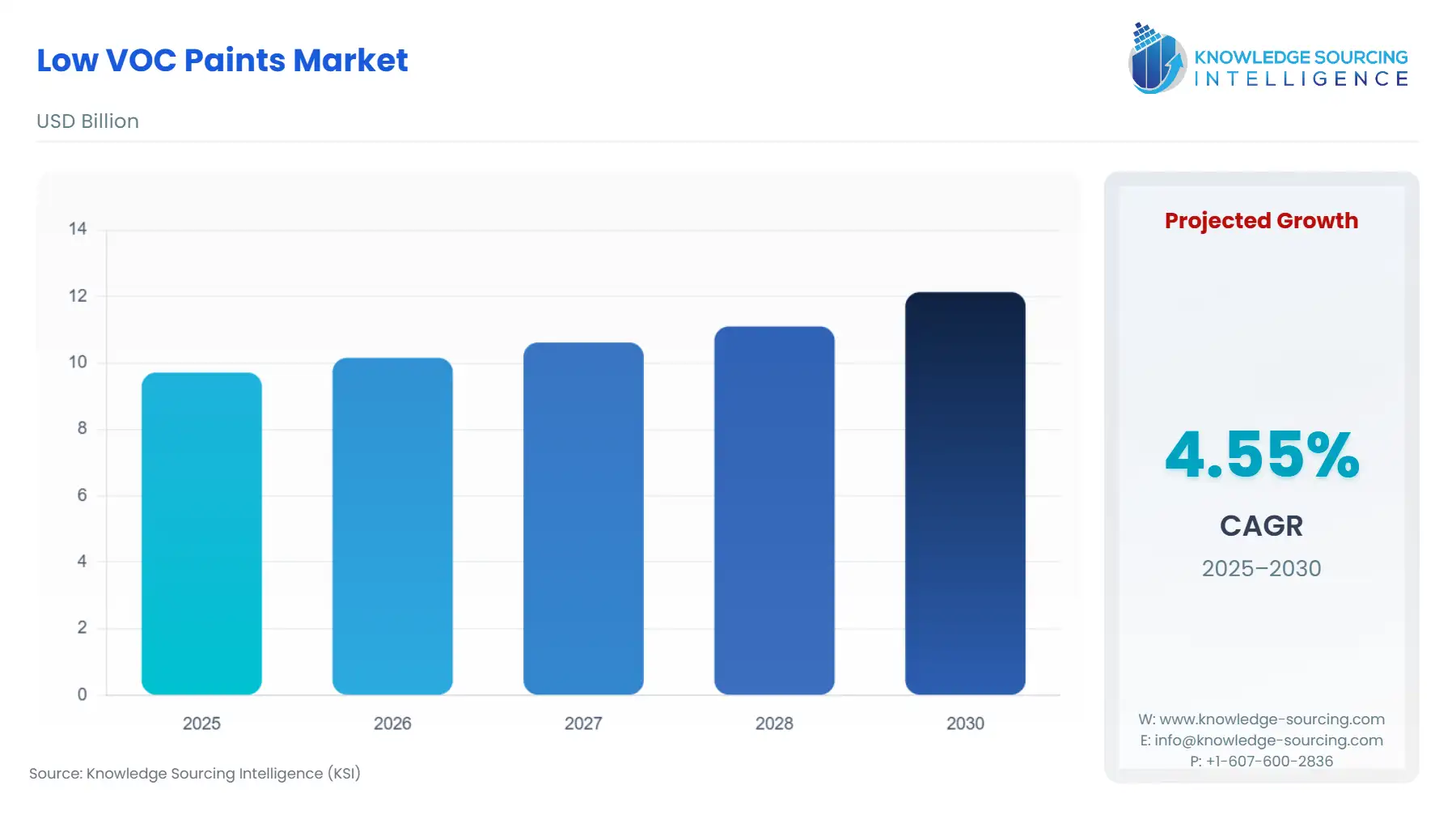

The Low VOC Paints Market will reach US$12.135 billion in 2030 from US$9.715 billion in 2025, growing at a CAGR of 4.55%.

The low VOC paints market has emerged as a pivotal segment within the global coatings industry, driven by increasing environmental awareness, stringent regulations, and a shift toward sustainable practices. Low VOC coatings, defined as paints with volatile organic compound (VOC) content typically below 50 grams per liter, and zero VOC paints, with negligible VOC emissions, offer eco-friendly alternatives to traditional solvent-based paints. These products reduce harmful emissions that contribute to air pollution and health issues, aligning with the growing eco-friendly paint market and the paint industry’s trends toward sustainability.

The market caters to diverse applications, including architectural, automotive, and industrial sectors, with a strong emphasis on green building materials. The low VOC paints market is reshaping the coatings industry as consumers, builders, and regulators prioritize environmental and health concerns. VOCs, organic chemicals that evaporate at room temperature, are found in traditional paints and contribute to indoor air pollution, smog, and health issues like respiratory irritation and headaches. Low VOC coatings and zero VOC paints mitigate these risks by using water-based or bio-based formulations, making them ideal for residential, commercial, and industrial applications. The eco-friendly paint market is fueled by rising demand for sustainable paint that meets VOC emission standards, such as those set by the U.S. Environmental Protection Agency (EPA) and the European Union’s REACH regulations. These standards limit VOC content in paints to reduce environmental impact and improve indoor air quality. The market is also driven by the global push for green building materials, as certifications like LEED (Leadership in Energy and Environmental Design) and WELL prioritize low-emission products. In 2023, Crown Paints Limited launched Crown Trade Clean Air, an ultra-low VOC air-purifying paint that removes up to 45% of formaldehyde, showcasing innovation in sustainable paint. Similarly, in August 2022, Arkema introduced SYNAQUA 9511, a waterborne binder for low VOC industrial paints, highlighting advancements in formulation technology. These developments reflect the industry’s commitment to balancing performance with environmental responsibility, positioning low VOC coatings as a cornerstone of modern construction and design. Several factors propel the low VOC paints market:

Stringent VOC Emission Standards: Global regulations, such as the EPA’s National Volatile Organic Compound Emission Standards for Architectural Coatings and the EU’s Decorative Paints Directive, enforce strict VOC limits, driving adoption of low VOC coatings and zero VOC paints. These regulations encourage manufacturers to innovate eco-friendly formulations.

Growing Demand for Green Building Materials: The rise of green building materials in sustainable construction, supported by certifications like LEED, boosts demand for sustainable paint. The U.S. Green Building Council reported increased adoption of low VOC paints in certified projects, reflecting market alignment with eco-conscious building practices.

Consumer Awareness and Health Concerns: Rising awareness of VOC-related health risks, such as asthma and allergies, fuels demand for eco-friendly paint market products. Consumers, particularly in North America and Europe, prioritize paints that enhance indoor air quality, driving sales of zero VOC paints.

Technological Advancements: Innovations in waterborne and bio-based formulations improve the performance of low VOC coatings, making them competitive with traditional paints in durability and finish. Arkema’s SYNAQUA 9511 launch exemplifies this trend.

Despite growth, the market faces challenges:

Higher Costs: Low VOC coatings and zero VOC paints often have higher production costs due to advanced formulations and eco-friendly raw materials, making them pricier than traditional paints. This can deter cost-sensitive consumers in emerging markets.

Performance Perceptions: Some industry professionals and consumers perceive low VOC coatings as less durable or harder to apply than traditional paints, though recent innovations have narrowed this gap. Educating stakeholders remains a challenge.

Safety: Sleeping in a Room After Painting with Low VOC Paint

A common question is, “Can I sleep in a room right after painting with low VOC paint?” Low VOC paints significantly reduce harmful emissions compared to traditional paints, making them safer for indoor use. The EPA notes that low VOC coatings emit fewer harmful chemicals, improving indoor air quality. For zero VOC paints, emissions are minimal, often allowing safe occupancy shortly after painting, provided the room is well-ventilated. However, even with low VOC coatings, trace odors or minor VOCs may linger during drying. Industry experts recommend waiting at least 2–3 hours with proper ventilation (open windows or fans) before sleeping in a freshly painted room, especially for sensitive groups like children or those with respiratory conditions. Always follow manufacturer guidelines, as drying times and VOC content vary.

Performance and Cost Comparison with Traditional Paints

Performance: Modern low VOC coatings and zero VOC paints have closed the performance gap with traditional paints. Advances in waterborne and bio-based technologies ensure comparable adhesion, durability, and finish quality. For instance, Crown Paints’ Clean Air product offers excellent coverage and air-purifying benefits, matching traditional paints in aesthetic appeal. Low VOC coatings excel in architectural applications, providing weather resistance and color retention, though some industrial applications may still favor solvent-based paints for specific durability needs. Application ease has also improved, with sustainable paint offering smooth finishes and faster drying times.

Cost: Low VOC coatings and zero VOC paints are typically 10–20% more expensive than traditional paints due to premium raw materials and complex manufacturing processes. Traditional solvent-based paints benefit from economies of scale and cheaper petrochemical solvents, keeping costs lower. However, the long-term benefits of low VOC coatings, such as reduced health risks and compliance with VOC emission standards, often justify the cost for commercial and residential projects prioritizing sustainability.

Low VOC Paints Market Overview & Scope

The market for low-VOC (volatile organic compounds) paints is driven by growing consumer awareness about the harmful impact of VOCs on health and the environment and rising government regulations. Typically, low VOC paints have less than 50 grams per liter of VOC solvents, significantly reducing the amount of off-gassing, and are considered safe to use, propelling its market expansion. The market is driven to a great extent by the demand for indoor air quality. Growing recognition of the health and environmental risks posed by high VOC levels, particularly in oil-based paints, is accelerating the shift to safer alternatives. Stricter government regulations, such as the U.S. EPA's National Volatile Organic Compound Emission Standards and the EU Paints Directive, are limiting VOC content, boosting the market for water-based and low-VOC paints. The market is increasingly favoring bio-based and waterborne coatings due to their significantly lower VOC levels compared to solvent-based paints, driving growth in the low-VOC paint sector. North America is expected to capture a significant share of the low-VOC paint market, fueled by robust environmental regulations from the U.S. EPA and state-level laws like California's SCAQMD. High consumer awareness and demand for green building solutions further support market growth. The Asia-Pacific region, particularly China, India, and Southeast Asia, is poised for substantial growth in the low-VOC paint market. Government initiatives promoting green building codes, rapid urbanization, and increased construction activities are key drivers. However, price sensitivity and limited awareness of VOC-related health risks may hinder market expansion. Some of the major players covered in this report include Asian Paints Limited, Sherwin-Williams Company, Akzo Nobel N.V., and Axalta Coatings System LLC, among others. Some niche players are also emerging due to their innovative solutions, such as Farrow and Ball Ltd., Nanotech Coatings Inc., and Dunn-Edwards Corporation, among others.

Low VOC Paints Market Trends

Integration of Multi-Modal Natural Language Processing

The low VOC paints market is evolving rapidly, driven by environmental regulations and consumer demand for sustainable solutions. A key trend is the rise of waterborne paints, which dominate due to their low VOC content and ease of application. In August 2022, Arkema launched SYNAQUA 9511, a waterborne paint binder for industrial coatings, enhancing durability with minimal emissions. Similarly, bio-based paints, derived from renewable sources like plant oils, are gaining traction for their eco-friendly profiles. Powder coatings, another low-VOC option, are expanding in industrial applications due to their solvent-free application and durability. Acrylic latex paints, known for their versatility and low emissions, are increasingly popular in architectural settings, offering excellent adhesion and weather resistance. Meanwhile, alkyd paint alternatives, such as water-based alkyds, provide high-performance options with reduced environmental impact. The integration of nanotechnology in paint enhances properties like scratch resistance and UV protection, as seen in recent innovations by companies like Sheboygan Paint Company, which recently expanded its low VOC portfolio. These trends underscore the market’s shift toward sustainability and advanced performance.

Low VOC Paints Market Growth Drivers vs. Challenges

Drivers:

Stringent Environmental Regulations: The low VOC paints market is significantly driven by stringent global VOC emission standards, which aim to reduce air pollution and health risks associated with volatile organic compounds. Regulatory bodies like the U.S. EPA and the European Union’s REACH framework enforce strict VOC limits for architectural and industrial coatings, pushing manufacturers toward waterborne paints and zero VOC paints. For instance, the EPA’s National Volatile Organic Compound Emission Standards for Architectural Coatings mandate low VOC formulations, encouraging innovation in sustainable paints. In 2023, Crown Paints launched Crown Trade Clean Air, an ultra-low VOC paint with air-purifying technology, aligning with these regulations. Compliance with such standards drives demand for low VOC coatings, as manufacturers reformulate products to meet environmental requirements, fostering market growth in residential and commercial applications.

Further, The global push for sustainable construction has increased demand for green building materials, positioning low-VOC paints as a cornerstone of eco-conscious projects. Certifications like LEED and WELL prioritize sustainable paint to improve indoor air quality and reduce environmental impact. The U.S. Green Building Council highlighted the increased adoption of low-VOC coatings in LEED-certified buildings, reflecting their role in sustainable design. Bio-based paints and acrylic latex paints, which offer low emissions and durability, are particularly favored in green construction. This trend is evident in products like Arkema’s SYNAQUA 9511, a waterborne binder for low-VOC industrial paints launched in August 2022, which supports sustainable building practices. The emphasis on eco-friendly construction drives market expansion, as architects and builders prioritize low-VOC paints. Additionally, growing consumer awareness of the health risks posed by VOCs, such as respiratory issues and allergies, fuels demand for low-VOC coatings and zero-VOC paints. The eco-friendly paint market benefits from consumers seeking products that enhance indoor air quality and align with paint industry trends toward sustainability. Waterborne paints and bio-based paints are popular for their minimal emissions, appealing to health-conscious households and businesses. In July 2024, Sheboygan Paint Company’s acquisition of Bradley Coatings Group expanded its portfolio of low-VOC coatings, catering to this demand. Marketing campaigns by companies like Benjamin Moore emphasize the health benefits of sustainable paint, further driving consumer preference. This awareness, particularly in North America and Europe, propels market growth as end-users prioritize environmentally responsible and health-safe paint options for residential and commercial spaces.

Challenges:

Higher Production Costs: The low VOC paints market faces challenges due to the higher production costs of low VOC coatings and zero VOC paints compared to traditional solvent-based paints. Formulating waterborne paints, bio-based paints, or powder coatings requires advanced technologies and premium raw materials, such as bio-based resins or low-emission additives, which increase manufacturing expenses. These costs are often passed on to consumers, making low VOC coatings less competitive in price-sensitive markets, particularly in developing regions. For example, while innovations like Arkema’s SYNAQUA 9511 enhance performance, their complex production processes elevate costs. This restraint limits market penetration among budget-conscious consumers and small-scale contractors, slowing adoption despite the environmental and health benefits of sustainable paint.

Perceived Performance Limitations: Despite advancements, some industry professionals and consumers perceive low VOC coatings as inferior to traditional paints in terms of durability, application ease, and finish quality. While acrylic latex paints and alkyd paint alternatives have improved significantly, misconceptions persist, particularly in industrial applications where solvent-based paints are favored for their robustness. This perception hinders market growth, as contractors may hesitate to adopt low VOC paints for demanding projects. Although products like Crown Paints’ Clean Air demonstrate comparable performance with added air-purifying benefits, overcoming these perceptions requires ongoing education and demonstration of nanotechnology in paint and other innovations that enhance durability and aesthetics. This restraint challenges market expansion, particularly in sectors prioritizing performance over sustainability.

Low VOC Paints Market Segmentation Analysis

By Product Type, Water-based Paints are growing considerably

Water-based paints dominate the low-VOC paints market due to their low volatile organic compound (VOC) emissions, ease of application, and alignment with VOC emission standards. These paints, primarily acrylic latex paints, use water as a solvent, significantly reducing harmful emissions compared to traditional solvent-based paints. Their versatility makes them ideal for residential, commercial, and industrial applications, offering excellent adhesion, durability, and color retention. For instance, Arkema launched SYNAQUA 9511, a water-based paint binder for low VOC industrial coatings, enhancing performance while meeting environmental regulations. The popularity of water-based paints is further driven by consumer demand for eco-friendly paint market solutions and their compatibility with green building materials, making them a preferred choice in sustainable construction projects across North America and Europe.

The Architectural segment is expected to raise the demand for low-VOC paint significantly

The architectural segment leads the low VOC paints market, driven by widespread use in residential and commercial buildings. Low VOC coatings, particularly water-based paints and bio-based paints, are favored for their minimal emissions, enhancing indoor air quality in homes, offices, and public spaces. This segment benefits from the global push for green building materials, with certifications like LEED prioritizing sustainable paint. In 2023, Crown Paints introduced Crown Trade Clean Air, an ultra-low VOC paint with air-purifying technology, tailored for architectural applications. The rise in eco-conscious construction and renovation projects, especially in urban areas, fuels demand for low VOC coatings that meet aesthetic and environmental standards, solidifying the architectural segment’s dominance in the market.

North America is predicted to dominate the market share

North America is the leading region in the low VOC paints market, driven by stringent VOC emission standards, high consumer awareness, and robust demand for sustainable paint. The United States, in particular, sees strong adoption of water-based paints and zero VOC paints in architectural and industrial applications, supported by regulations like the EPA’s National Volatile Organic Compound Emission Standards. In July 2024, Sheboygan Paint Company’s acquisition of Bradley Coatings Group expanded its low VOC coatings portfolio, reinforcing market growth. Canada and Mexico also contribute, with increasing use of green building materials in sustainable construction. North America’s focus on health, environmental compliance, and innovation in nanotechnology in paint positions it as the market’s dominant region.

Low VOC Paints Market Key Developments

In July 2024, Birla Opus, a new player in the Indian paints industry, introduced its product line, including the "One Pure Elegance" interior paint. This product is a premium, low-VOC paint that also boasts germ protection technology. The launch of Birla Opus's entire portfolio, with a strong emphasis on eco-friendly and health-conscious formulations like this one, signals a significant shift in the market, with new companies entering to compete directly based on advanced, low-VOC technology and additional benefits like air purification.

In July 2024, Sheboygan Paint Company, a U.S.-based industrial coatings company, acquired Bradley Coatings Group. This strategic acquisition was made to enhance Sheboygan's offerings and customer service within the industrial coatings sector, which includes a focus on low VOC formulations to meet increasing regulatory and environmental demands.

Low VOC Paints Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 9.715 billion |

| Total Market Size in 2030 | USD 12.135 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.55% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Application, End-Use Industry, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Low VOC Paints Market Segmentation:

By Product Type

Water-based Paints

Solvent-based Low VOC Paints

Powder Coatings & Hybrid Coatings

Bio-based Paints

Smart & Functional Coatings

By Application

Architectural

Industrial Coatings

Automotive & Transportation

Wood Finishes & Furniture

Others (schools, data centers, cleanrooms, etc.)

By End-Use Industry

Construction

Automotive and Aerospace

Industrial and Manufacturing

Hospitality, Retail, and Offices

By Region

North America

South America

Europe

Middle East & Africa

Asia Pacific