Report Overview

Media Gateway Market Report, Highlights

Media Gateway Market Size:

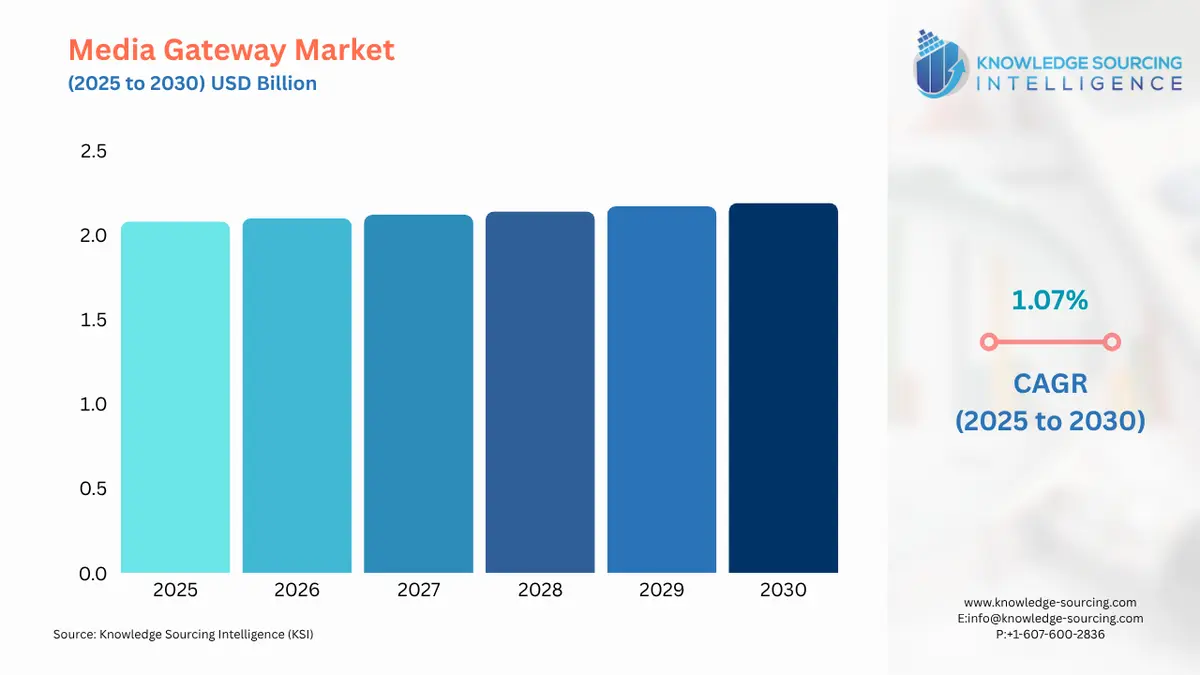

The Media Gateway Diode Market is expected to grow from USD 2.077 billion in 2025 to USD 2.190 billion in 2030, at a CAGR of 1.07%.

The media gateway market is a critical enabler of modern telecommunications, serving as the essential bridge between legacy, circuit-switched networks and the modern, packet-switched IP networks. These devices are fundamental to the operation of a converged network, translating various media streams—such as voice, video, and data—between different communication protocols and transport technologies. A media gateway’s function is not a simple conversion but a complex process that includes transcoding, signaling translation, and routing, all of which are essential for ensuring seamless, high-quality communication across a heterogeneous network. The market's expansion is a direct result of the telecom industry's long-term evolution and the ongoing need to manage hybrid network environments. The persistent deployment of media gateways is a clear indicator of the global transition toward all-IP networks, as they facilitate a gradual and cost-effective migration path for both service providers and enterprises.

Media Gateway Market Analysis

- Growth Drivers

The media gateways market is propelled by a singular, overarching trend: the global migration to IP-based communication. This transition is not a spontaneous event but a strategic imperative for telecommunication service providers and enterprises to enhance operational efficiency and reduce costs. The shift from outdated circuit-switched TDM (Time Division Multiplexing) systems to IP (Internet Protocol) networks enables the delivery of a wide array of high-quality multimedia services, including Voice over IP (VoIP), unified communications (UC), and video conferencing. Media gateways are indispensable components in this process, as they provide the necessary interoperability. They convert voice and data signals from legacy Public Switched Telephone Network (PSTN) lines into packets for transmission over an IP network and vice versa. This functionality directly creates demand, as it allows companies to adopt new technologies without a complete and costly overhaul of their existing infrastructure.

A second, powerful driver is the growing adoption of unified communications (UC) solutions and the pervasive need for network interoperability. Businesses and service providers are increasingly deploying UC platforms to integrate voice, video, and messaging services into a single, cohesive system to improve collaboration and productivity. Media gateways are crucial for connecting these modern, IP-based UC platforms to the vast, pre-existing legacy network infrastructure. They ensure that a call from a traditional landline can seamlessly connect to a VoIP-based softphone or a video conferencing system. Without the media gateway's translation function, this interoperability would be impossible. This creates a continuous demand as enterprises, particularly in the telecommunications and IT sectors, seek to leverage new technologies while preserving the functionality of their established communication systems.

- Challenges and Opportunities

The media gateway market faces a fundamental challenge from the long-term trend toward all-IP, software-defined networks. The ultimate goal of this migration is to create a fully packet-switched network that no longer requires the translation function of a physical media gateway. As service providers and large enterprises complete their network modernization projects and move toward virtualized, cloud-native communication solutions, demand for traditional, hardware-based media gateways may decelerate. This potential decline is a significant headwind for the market, as it signifies a shift from physical hardware to software-defined network functions (NFV) and virtualized gateways.

This challenge, however, presents a significant opportunity. The market is evolving with the development of virtual and cloud-native media gateways. Instead of being a dedicated physical appliance, the media gateway becomes a software function that runs on standard servers. This model provides superior scalability, flexibility, and cost-efficiency. It allows service providers and enterprises to deploy and scale gateway functions on demand without the need for new hardware. This technological shift enables new revenue streams and opportunities for market players who can offer these software-based solutions. Another opportunity lies in serving the vast installed base of legacy systems. The complete transition to all-IP networks is a multi-decade process, especially in developing regions. Media gateways will continue to be essential for managing hybrid network environments for the foreseeable future, ensuring a long-tail of demand for both new and replacement hardware.

- Supply Chain Analysis

The supply chain for media gateways is a global, technology-intensive ecosystem. It is centered around the manufacturing of complex electronic components and the assembly of highly specialized telecommunications hardware. Key components include digital signal processors (DSPs), microprocessors, various memory modules, and specialized telecommunications interface cards. Production hubs are heavily concentrated in East Asia, particularly in China, Taiwan, and South Korea, where a robust electronics manufacturing infrastructure exists. Final product assembly, testing, and quality control are often distributed globally, with major manufacturers operating facilities in North America, Europe, and Asia.

Logistical complexities include managing the sourcing of highly specialized chips and a diverse range of electronic components. The reliance on a concentrated number of semiconductor manufacturers in Asia creates a vulnerability to supply chain shocks. Disruptions to this supply, whether from geopolitical events or manufacturing bottlenecks, can directly impact the production and lead times of media gateways. The supply chain is further complicated by the need for stringent quality control and certification processes, as media gateways are mission-critical components in a communication network. The global nature of this supply chain necessitates careful management to mitigate risks and ensure a steady supply of components.

Government Regulations

Government regulations play a crucial, albeit indirect, role in the media gateway market by mandating or influencing the standards for telecommunications infrastructure and network interoperability. These regulations create a legal imperative for network operators to ensure seamless and reliable communication, which in turn drives demand for compliant media gateways.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Federal Communications Commission (FCC) Regulations |

The FCC regulates interstate and international communications by radio, television, wire, satellite, and cable. Its regulations, particularly those related to universal service and network interoperability, create a framework that necessitates the use of media gateways. The FCC's rules on number portability and interconnection compel telecom carriers to ensure that their networks can communicate effectively with different technologies, thereby driving demand for media gateways as bridging devices. |

|

European Union |

European Telecommunications Standards Institute (ETSI) and various directives |

While ETSI is a standards body and not a regulatory agency, the standards it develops are often adopted into EU law or become de facto requirements. ETSI's work on Next-Generation Network (NGN) architecture and IP-based services influences the design and deployment of media gateways. EU directives that aim to foster a single digital market and ensure network neutrality create a legal and economic environment where interoperability is paramount, thereby sustaining demand for media gateways. |

|

China |

Ministry of Industry and Information Technology (MIIT) |

The MIIT oversees the telecommunications sector and sets the standards for network infrastructure development. The Chinese government's ambitious plans for 5G rollout and a fully digital economy directly drive massive investment in network infrastructure. This top-down push for modernization and expansion, which includes both legacy and modern networks, creates significant and sustained demand for media gateways that can facilitate the transition and ensure network compatibility on a massive scale. |

Media Gateway Market Segment Analysis:

- By Technology: Hybrid

The hybrid technology segment is a critical and highly demanded area of the media gateway market. A hybrid media gateway is engineered to handle both wireline and wireless traffic, acting as a single, multi-functional device that can bridge disparate networks. The necessity for these products is directly a function of the complex, real-world network environments that service providers and large enterprises operate. A telecommunication carrier, for instance, must manage connections from legacy PSTN lines, a growing number of 4G and 5G wireless subscribers, and IP-based business customers. A hybrid media gateway consolidates the transcoding and signaling functions required for all these traffic types, eliminating the need for multiple, single-purpose devices. This integration provides a compelling value proposition by reducing capital expenditure, simplifying network management, and lowering operational complexity. The continued growth of this segment reflects the ongoing reality that pure-play networks are rare and that most communication environments will remain a mix of technologies for the foreseeable future.

- By End-User Industry: Telecom & IT

The Telecommunications and IT sector is the largest and most critical end-user of media gateways. The industry’s core function fuels this sector’s growth by providing seamless and reliable communication services. Media gateways are not just an accessory; they are a fundamental component of a carrier's network infrastructure. As carriers worldwide continue their transition to all-IP networks, they must deploy media gateways to connect their new, packet-based core networks to the vast installed base of legacy copper lines and circuit-switched exchanges. This migration is a massive, multi-year undertaking that necessitates the continuous purchase and deployment of media gateways. The market is also fueled by the rise of new services, such as Session Initiation Protocol (SIP) trunking, which allows businesses to connect their IP-PBXs to the public network using a digital connection. Media gateways are essential for this service, acting as the translator between the customer's IP-based system and the carrier’s network. This direct and persistent need makes the telecom and IT segment the primary growth driver for the entire market.

Media Gateway Market Geographical Analysis

- US Market Analysis

The US media gateway market is mature and shaped by a complex interplay of network modernization and the continued presence of a vast legacy infrastructure. The market is driven by major telecommunication carriers and large enterprises that are actively migrating from their traditional TDM networks to modern IP-based networks. The FCC’s ongoing push for network unbundling and service-specific regulations necessitates that carriers ensure interoperability between new and old systems, thereby creating a sustained demand for media gateways. The growth of cloud-based communications and the rise of unified communications as a service (UCaaS) also contribute to demand for media gateways that can connect enterprise cloud platforms to existing PSTN endpoints.

- Brazil Market Analysis

Brazil's media gateway market is characterized by significant demand fueled by a large, developing economy and a growing need for improved telecommunications infrastructure. The market expansion is a direct result of the country’s ongoing efforts to modernize its national network and increase internet penetration. Local regulations and government-led initiatives to improve digital inclusion drive investment in telecommunications infrastructure, which includes the deployment of media gateways to bridge new IP networks with existing legacy systems. The market is price-sensitive, with a preference for cost-effective solutions that can handle high volumes of traffic reliably. The growth of local enterprises and the expansion of multinational corporations in Brazil also contribute to demand for gateways that can support VoIP and other advanced communication services.

- Germany Market Analysis

Germany’s media gateway market is a prime example of a highly advanced and technically arduous environment. The market is driven by a focus on high-quality, high-reliability communications and a strategic push toward a fully digital economy. German telecommunication providers and enterprises are at the forefront of the all-IP transition. The necessity is less about basic bridging and more about sophisticated, software-defined, and high-density media gateways that can seamlessly integrate into complex network architectures. The German market places a high value on engineering excellence and standards compliance, with a strong preference for products that are highly scalable and offer advanced security features. The country’s commitment to Industry 4.0 and smart manufacturing also creates a new demand for secure, high-performance gateways for machine-to-machine communication.

- Saudi Arabia Market Analysis

The media gateway market in Saudi Arabia is a growth-intensive segment propelled by the government’s Vision 2030 plan. The plan's focus on diversifying the economy and building a world-class digital infrastructure is the primary growth catalyst. Massive investments in telecommunications, smart cities, and industrial development require the rapid deployment of modern IP networks. Media gateways are essential for connecting these new networks to both the country’s existing telecommunications infrastructure and to global communication networks. The necessity is for highly reliable and scalable gateways that can handle the growing volume of voice and data traffic. International players dominate the market, as local enterprises and service providers often seek solutions that are internationally certified and can be deployed quickly and securely.

- Japan Market Analysis

Japan's media gateway market is highly advanced and driven by technological innovation and a mature telecommunications industry. The market requirement is not for basic hardware but for sophisticated, high-density, and space-efficient media gateways. Japanese carriers and enterprises are early adopters of new technologies, and the demand for media gateways is tied to the rollout of new services like Voice over LTE (VoLTE) and the expansion of fiber-optic networks. The market shows a strong preference for products that offer advanced features, such as enhanced security, low latency, and energy efficiency. The ongoing modernization of legacy systems and the continuous integration of new communication technologies ensure a steady, albeit evolving, demand for media gateways. The country’s expertise in electronics manufacturing also influences the market, with a focus on high-quality, miniaturized components.

Media Gateway Market Competitive Analysis:

The media gateway market is characterized by a competitive landscape dominated by a few key players who offer a full spectrum of telecommunications and networking solutions. Competition is based on product reliability, interoperability with existing network architectures, and the ability to provide comprehensive, end-to-end solutions.

- Ribbon Communications Inc.: Ribbon Communications has strategically positioned itself as a provider of real-time communications and IP optical networking solutions. The company's media gateway portfolio is a central part of this strategy, enabling service providers and enterprises to migrate to IP-based networks while preserving their legacy investments. Ribbon's products, such as the SBC Core and G9 Media Gateway, are designed to offer a blend of carrier-grade reliability and advanced features, including session border controller (SBC) functionality and network-based applications. The company’s focus on providing a seamless, secure migration path from TDM to IP helps it maintain a strong competitive position in the market.

- Nokia Corporation: Nokia's presence in the media gateway market is a component of its broader strategy as a global provider of networking and telecommunications equipment. Nokia's offerings, such as its media gateways for mobile networks (M-MGw), are engineered to provide high-performance media plane solutions for a wide range of mobile and fixed network applications. The company’s competitive edge comes from its ability to provide a full suite of products for network infrastructure, allowing it to serve large-scale projects and a global customer base. Nokia’s focus on 5G and cloud-native solutions positions it to address the evolving demands of carriers moving toward next-generation networks.

- Huawei Technologies Co., Ltd.: Huawei is a dominant force in the global telecommunications equipment market, with a comprehensive portfolio that includes media gateways. The company’s strategic positioning is to provide a complete, integrated solution for both fixed and mobile networks. Huawei's media gateways are designed to be highly scalable and adaptable to various network environments, from traditional PSTN to next-generation IP networks. Huawei's strength lies in its extensive research and development capabilities and its ability to offer a broad range of products that can meet the needs of diverse customer segments globally, particularly in high-growth markets in Asia and Africa.

Media Gateway Market Developments

- September 2025: Ribbon Communications announced the launch of Acumen, a new AIOps and automation platform. The platform is designed to help service providers and enterprises manage network complexities and reduce operational costs. This development is not a direct media gateway product launch, but it enhances the value of Ribbon's entire portfolio by providing advanced analytics and automation tools for network management, thereby increasing the attractiveness of its hardware solutions.

- July 2025: Ribbon Communications secured a contract to provide network transformation solutions for the Kerala Fiber Optic Network (KFON) deployment in India. This development showcases the company’s strategic expansion in the Asia-Pacific region by providing a new revenue stream and demonstrating its capability to support large-scale national infrastructure projects, including the deployment of its media gateway solutions.

- February 2025: Nokia completed its acquisition of Infinera Corporation. This merger creates a new powerhouse in the optical networks market. While not a direct media gateway product, the acquisition significantly strengthens Nokia's presence in the North American and webscale customer segments and enhances its overall portfolio of networking solutions, which complements its existing media gateway business.

Media Gateway Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.077 billion |

| Total Market Size in 2031 | USD 2.190 billion |

| Growth Rate | 1.07% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Technology, Deployment Model, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Media Gateway Market Segmentation:

- By Type

- Analog

- Digital

- By Technology

- Wireline

- Wireless

- Hybrid

- By Deployment Model

- Virtua/Cloud-Native

- Hybrid Deployments

- Others

- By End-User Industry

- Telecom & IT

- Healthcare

- Manufacturing

- Government

- Retail

- Others

- By Geography

- USA

- Canada

- Mexico

- Brazil

- Argentina

- Others

- Germany

- France

- United Kingdom

- Spain

- Others

- Saudi Arabia

- UAE

- Others

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America

- South America

- Europe

- Middle East and Africa

- Asia Pacific