Report Overview

Medical Device Testing Services Highlights

Medical Device Testing Services Market Size:

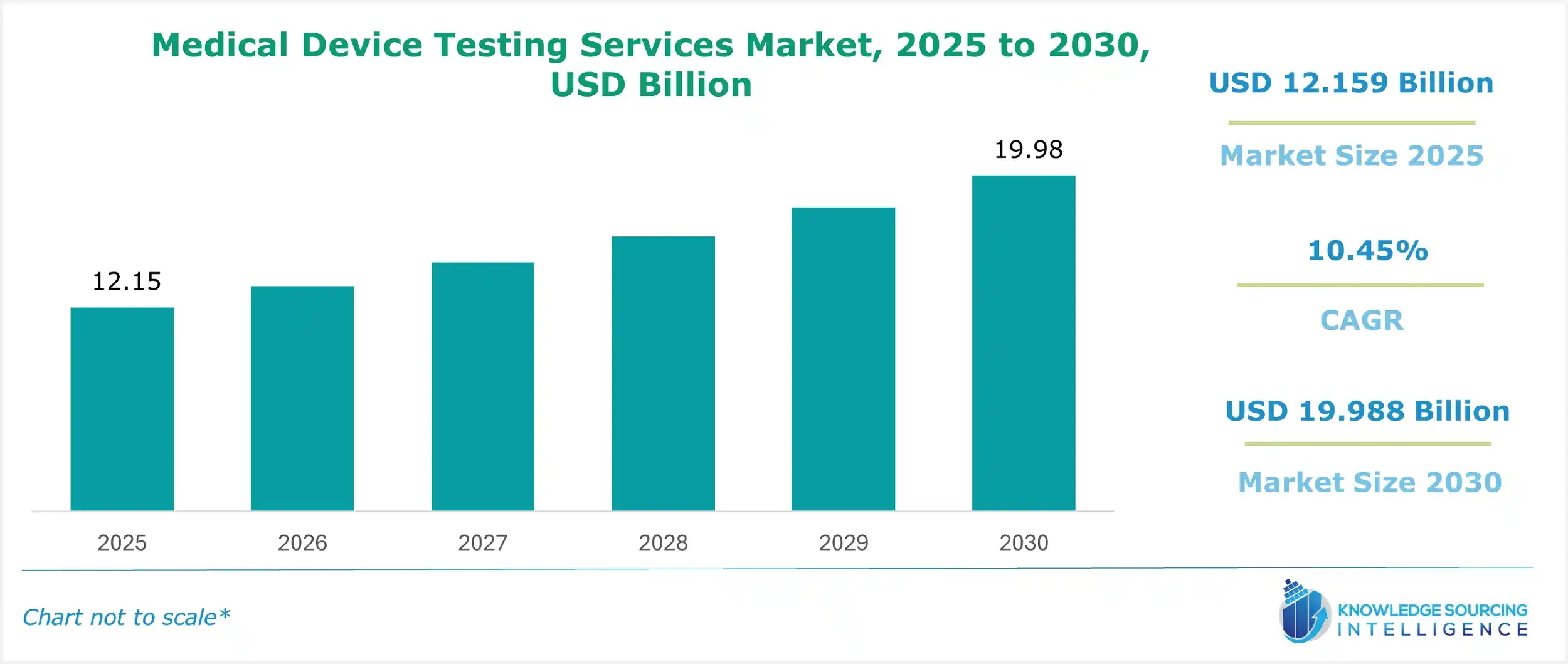

The medical device testing services market is estimated at US$12.159 billion in 2025 and is expected to grow at a CAGR of 10.45% to attain US$19.988 billion in 2030.

Medical device testing services are the most commonly utilized testing services and solutions performed within the medical industry. Hence, with the rising medical device industry globally, the market is projected to hold strong growth prospects during the forecast period. The increasing prevalence of chronic diseases requiring state-of-the-art medical devices for testing and treatment further augments the market expansion. The presence of companies offering varied medical device testing services further fuels the market growth. For example, companies offer medical device testing services for biocompatibility testing, biological safety, chemical characterization, analytical chemistry, environmental monitoring, and long-term and accelerated shelf-life testing.

Medical Device Testing Services Market Overview & Scope:

The medical device testing services market is segmented by:

- Type: By type, the medical device testing services market is divided into medical device testing solutions, certification & auditing, scientific support services, and others. Under the type segment, the medical device testing solution is expected to grow at a greater rate.

- Services: The service segment of the market is categorized into cardiovascular device testing, orthopedic implant testing, microbiological analysis, shelf-life testing, and others. The increasing global cases of cardiovascular diseases are expected to boost the growth of the cardiovascular device testing category under the segment.

- Sourcing Type: By sourcing type, the medical device testing services market is segmented into in-house testing and outsourced testing. The in-house testing category is expected to grow during the forecasted timeline.

- Region: The Asia Pacific region is estimated to be the fastest-growing market in the global medical device testing services market during the forecast period. The increasing governmental initiatives and growing technological advancement in the region are estimated to propel the market in the Asia Pacific region.

Top Trends Shaping the Medical Device Testing Services Market:

1. Stringent governmental regulation

- The introduction and implementation of strict governmental regulation to ensure the reliability of medical devices are among the key factors pushing the market’s growth.

2. Integration of automation and AI

- The integration of the latest technologies, including automation and AI-based technology in the medical device testing process, also enhances the efficiency and accuracy of the testing services.

Medical Device Testing Services Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing demand for reliable medical devices: With the growing need for testing the quality and reliability of medical devices, the market for medical device testing services holds strong growth opportunities during the forecast period.

- Advancement in technology: The advancement in medical device technology and integration of complex technologies into the devices increases the demand for an optimum and accurate testing process to determine their precision. Advancements and innovations in medical device technologies increase the demand for specialized testing services designed as per the newer device.

Challenges:

- Strict approval norms: The major factor challenging the medical device testing service market growth is the increasing need for testing service providers to meet strict governmental compliance, which differs in every major country.

Medical Device Testing Services Market Regional Analysis:

- North America: The major factor propelling the growth of medical device testing services in the North American region is the increasing technological advancement in the healthcare sector. The governments in the region, especially in countries like the USA and Canada, have introduced key policies and initiatives to integrate advanced technologies in the healthcare sector, increasing the demand for specialized and optimum testing processes for medical devices.

Medical Device Testing Services Market Competitive Landscape:

The market is fragmented, with many notable players, including SGS SA, Intertek Group plc, Bureau Veritas, DEKRA, Eurofins Scientific, The British Standards Institution, Nelson Laboratories, LLC, Bioneeds India Pvt. Ltd., Auriga Search Private Limited, Nemko, NAMSA, and TÜV Rheinland among others:

- Acquisition: In January 2025, NAMSA, a global leader in the MedTech testing sector, acquired the medical device testing operations of WuXi AppTec in the USA. Under the agreement, NAMSA will acquire testing facilities in Georgia and Minnesota.

- Service Expansion: In June 2024, Stryker Corporation, a global leader in medical technology, expanded its medical device testing facility in India. By extending the testing facility, the company also aims to boost its research and development capability in the sector.

Medical Device Testing Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Medical Device Testing Services Market Size in 2025 | US$12.159 billion |

| Medical Device Testing Services Market Size in 2030 | US$19.988 billion |

| Growth Rate | CAGR of 10.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Medical Device Testing Services Market | |

| Customization Scope | Free report customization with purchase |

The Medical Device Testing Services Market is analyzed into the following segments:

By Type

- Medical Device Testing Solution

- Certification & Auditing

- Scientific Support Services

- Others

By Services

- Cardiovascular Device Testing

- Orthopedic Implant Testing

- Microbiological Analysis

- Shelf-Life Testing

- Others

By Sourcing Type

- In-House Testing

- Outsourced Testing

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa