Report Overview

Medical Transport Boxes Market Highlights

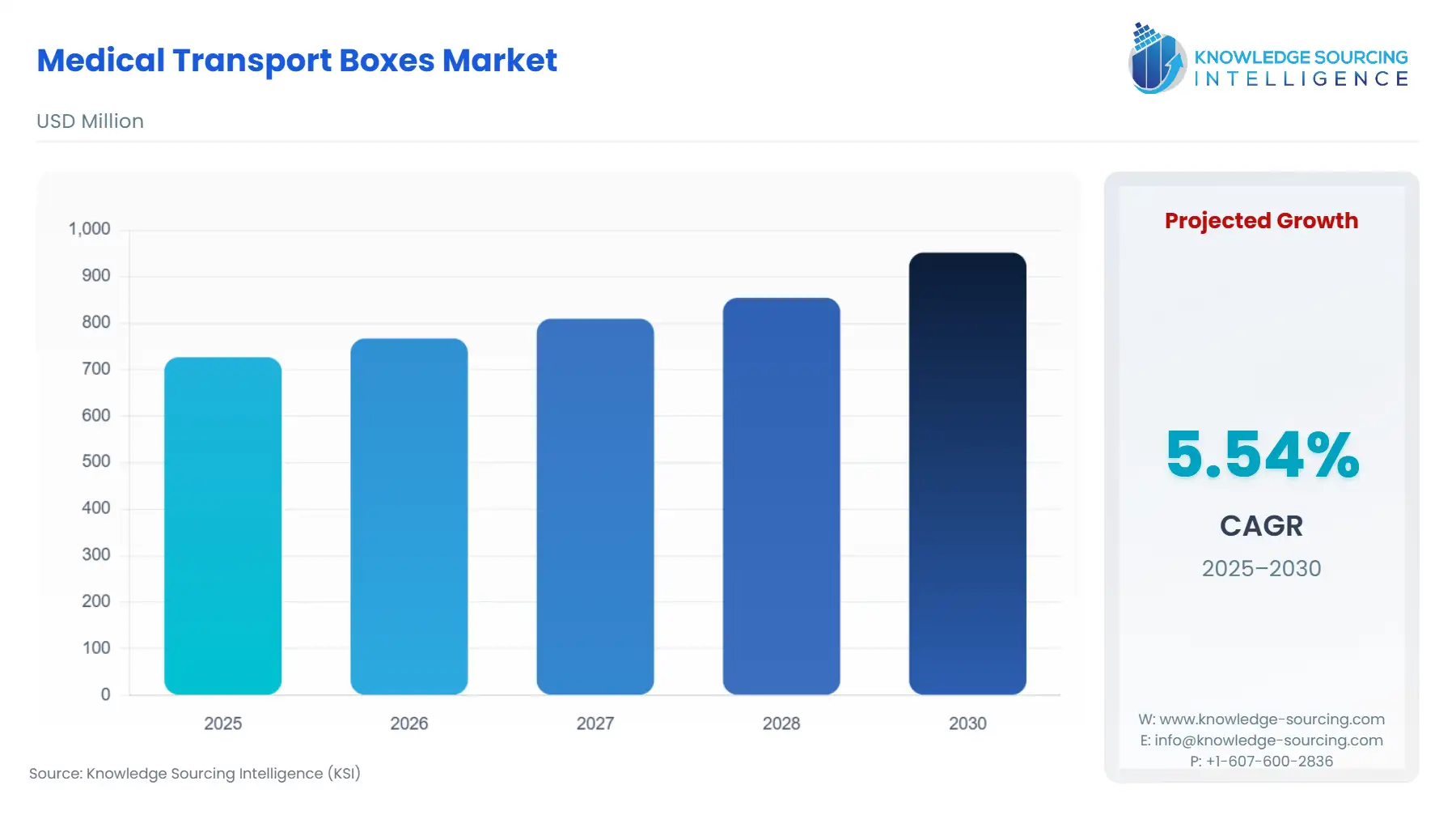

Medical Transport Boxes Market Size:

The medical transport boxes market, sustaining a 5.37% CAGR, is anticipated to rise from USD 726.887 million in 2025 to USD 995.091 million in 2031.

Boxes used to transport specimens are referred to as medical transport boxes. They are employed for the controlled temperature storage of urine, blood, organs and vaccines. The medical transport boxes offer a variety of transport options for storage space and temperature needs and comply with the strictest safety regulations for the user and patients.

Medical Transport Boxes Market Growth Drivers:

Growth drivers for the medical transport boxes market

The rise in chronic illnesses requiring organ transplantation is one of the main drivers propelling the medical transport boxes market. The market is expanding as a consequence of ongoing clinical trial research being carried out by various firms for improved outcomes. The medical transport boxes market growth is also impacted by the increase in healthcare spending, discretionary money, and the simplicity of transporting valuable and fragile goods.

Increased cases of people suffering from a chronic disorder

Chronic illnesses have become more common because of infections and the fast-growing population. The main causes of the increase in illness include personal risk factors, environmental variables, a lack of physical activity, and human lifestyles. The evaluation and replacement of organs are also anticipated to increase the demand for clinical trials. As of May 2023, there were over 452,947 clinical trial studies registered in 221 different nations, according to the U.S. National Library of Medicine. Therefore, it is anticipated that in the upcoming years, clinical studies would increase demand for medical transportation boxes. For a variety of causes, including a rise in the incidence of organ damage from automobile accidents, such as liver and renal illness, the number of organ transplant procedures has surged recently which is propelling the medical transport boxes market.

Rising instances of organ transplant

The worldwide medical transport box market share is anticipated to expand during the forecast period, mostly because of an increase in the number of organ transplants. According to United Network for Organ Sharing, in 2022, more than 42,800 organ transplants were carried out, breaking previous yearly records. For the first time in 2022, more than 25,000 kidney transplants were performed in 2022.

Additionally, Organ Procurement Organisations (OPOs) are nonprofit businesses in charge of obtaining organs from donors for use in transplants in the United States. There are 56 OPOs, each of which is required by federal legislation to carry out this vital task in the designated donation service region.

Increasing investment in healthcare and patient care services

The worldwide medical transport box market growth will be upsurged due to the rising healthcare and patient care service investments as well as rising consumer demand for very effective patient care. There is also an increase in the need for medical transport boxes due to increased knowledge and concern about safe organ transplantation and transportation if an urgent need for an organ replacement necessitates a lengthy transit process.

Increasing utilization of medical transport devices for blood and its components (WBC, RBC, Plasma)

The American National Red Cross reports that every day, the Red Cross organisation receives about 12,500 blood donations and 3000 platelet contributions. As a result, MT2 of B Medical System is crucial for transportation. Therefore, it is anticipated that a rise in blood donations would spur demand for transport boxes, ultimately fueling the expansion of the medical transport boxes market share.

The vaccine is also anticipated to see a significant increase throughout the projection period due to recent government attempts to provide cold chain services to low- and middle-income nations. For instance, in July 2022, through UNICEF, the Government of Japan helped the Government of Eswatini by supplying cold chain equipment to keep COVID-19 vaccinations at the proper temperature.

Rise in technological advancement for product development

Better critical care is made possible by improving healthcare infrastructure and technology, which promotes quicker recovery and return to regular life. Additionally, as healthcare spending rises, more individuals are becoming aware of needing modern critical care technology as well as having their health diagnosed for prevention and treatment. Faster transportation of medical supplies, medications, and other consumables is required for this procedure.

The expanding use of technology in product creation necessitates transportation improvements, which in turn enables patients to receive hassle-free enhanced therapy for faster recovery and better diagnosis. The use of more sophisticated tools, goods, and technology in healthcare results in improved care for patients in need of critical care and speedier recovery due to the delivery of medical boxes.

Medical Transport Boxes Market Geographical Outlook:

North America is predicted to hold a significant market share

The medical transport boxes market growth is anticipated to be the fastest in the North American region. This can be due to the region's dense concentration of businesses involved in the development, production, and marketing of medical transport. These services enable a smooth transition from clinical trial launches in the U.S. and Europe. Asia Pacific region is also anticipated show significant growth during the forecast period. This expansion of the medical transport box market can be ascribed to rising expenditures in healthcare logistic infrastructure and increasing healthcare spending. For instance, according to Invest India, India’s medical cold storage infrastructure accounts for 43.5% of the overall income of the cold chain sector propelling the medical transport boxes market.

Increasing Investment and Product Innovation by Key Players:

Among the most important tactics used by market participants to obtain a competitive edge in the medical transport boxes market are strategic collaborations, significant R&D investments, and new product developments or product changes. For instance, on May 2023, the Ministry of Aid and European Affairs (MAEE) and B Medical Systems worked together. Using medical transport boxes, they were able to directly obtain the necessary biological and medicinal supplies. B Medical System provided the MAEE with 50 medical transport boxes as part of this agreement.

Medical Transport Boxes Market Key Developments:

In July 2023, The RCW25 transport box from B Medical Systems, a pioneer in worldwide medical cold chain solutions, received CERTICOLD Pharma certification to meet EU Good Distribution Practises (GDP) standards.

In May 2023, The Customer Excellence Centre, a research and development centre, was opened by B Medical System India Pvt Ltd, a B Medical System company, in Mumbai, India.

In November 2022, B Medical Systems, the industry leader in vaccine cold chain solutions, and Secop GmbH, the world pioneer in sophisticated cooling systems and compressor technology in commercial refrigeration, formed cooperation.

List of Top Medical Transport Boxes Companies:

B Medical Systems (Azenta)

Avantor, Inc.

Thermo Fisher Scientific Inc.

Sonoco Products Company

Haier Group

Medical Transport Boxes Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Medical Transport Boxes Market Size in 2025 | USD 726.887 million |

Medical Transport Boxes Market Size in 2030 | USD 951.717 million |

Growth Rate | CAGR of 5.54% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Medical Transport Boxes Market |

|

Customization Scope | Free report customization with purchase |

Medical Transport Boxes Market Segmentation

By Material

Plastic

Stainless Steel

By Application

Blood and its Components

Vaccine

Urine

Organs

Others

By End-User

Hospital & Clinics

Blood Banks

Laboratories

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others