Report Overview

Mining Equipment Market - Highlights

Mining Equipment Market Size:

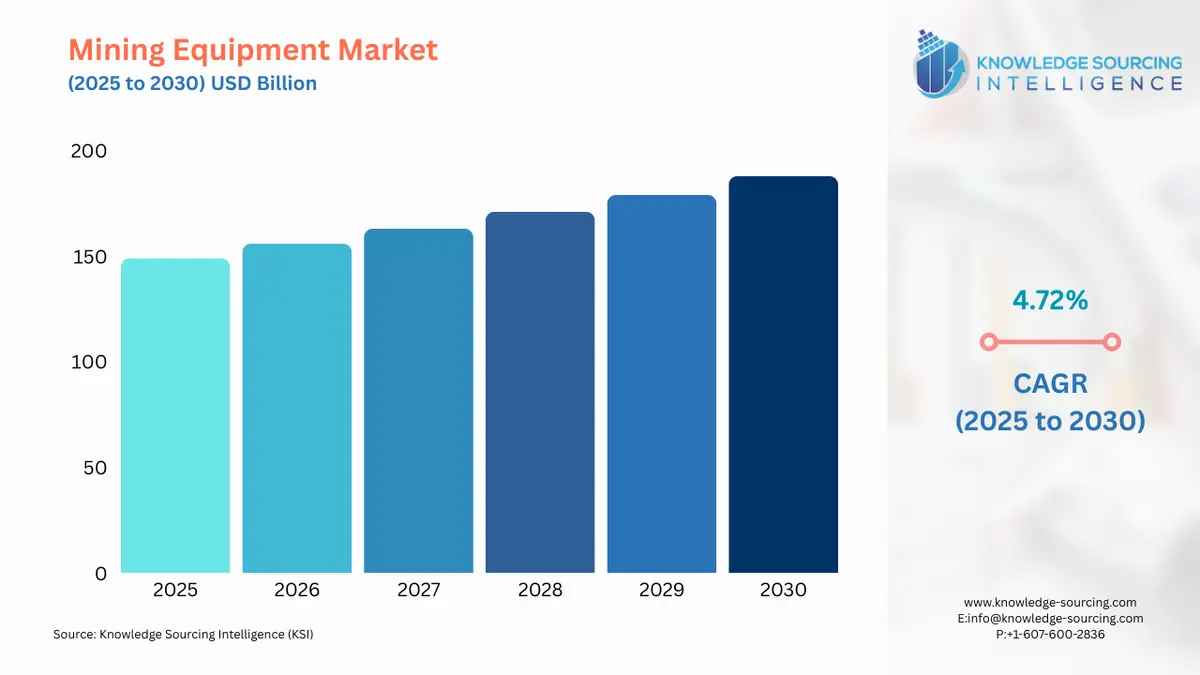

The Mining Equipment Market is expected to grow at a CAGR of 4.72%, reaching USD 187.654 billion in 2030 from USD 148.982 billion in 2025.

The mining equipment market is undergoing a significant transformation, propelled by the intersection of global commodity demand and a strong industry push for sustainability and operational efficiency. As the world transitions toward a low-carbon economy, the imperative to secure a steady supply of essential raw materials places considerable pressure on mining operations to expand and modernize. This dynamic environment is reshaping the demand for equipment, shifting the focus from traditional, high-capacity diesel machinery toward more technologically advanced, automated, and environmentally compliant solutions.

Mining Equipment Market Analysis

Growth Drivers

- Demand for Critical Minerals: The burgeoning demand for critical minerals directly propels the market for mining equipment. The global energy transition, which necessitates vast quantities of copper for electrical infrastructure and lithium for battery storage, is a primary demand catalyst. As mining companies initiate new exploration projects and expand existing operations to meet this surge, they require a full spectrum of equipment, from exploration drill rigs and crushing equipment to large-scale haul trucks and loaders. For instance, the expansion of copper mining in Chile to meet electrification targets creates a direct and measurable demand for large-class electric shovels and autonomous haulage systems, which are essential for maximizing output in open-pit environments.

- Operational Efficiency and Technology Integration: Furthermore, the industry-wide focus on operational efficiency and productivity improvement drives demand for technology-integrated equipment. Miners are under pressure to extract more value from lower-grade ore bodies. This imperative creates demand for high-precision drills and advanced sorting and mineral processing equipment that can accurately identify and separate valuable material. The adoption of semi-autonomous and fully autonomous systems, such as Komatsu’s Autonomous Haulage System (AHS), reduces labor costs and increases fleet utilization, directly justifying capital expenditure on new, digitally-enabled equipment. The ongoing shift toward data-driven maintenance and predictive analytics also fuels the demand for smart, sensor-equipped machinery that provides real-time operational data, enabling miners to minimize downtime and optimize equipment lifespan.

Challenges and Opportunities

- Cyclical Commodity Prices and Labor Shortages: The mining equipment market faces significant headwinds, primarily from the cyclical nature of commodity prices and the capital-intensive character of mining projects. Fluctuations in the price of key metals can cause mining companies to defer or cancel capital expenditures on new equipment, leading to periods of reduced demand for OEMs. This volatility creates a challenge in long-term production planning for equipment manufacturers. Additionally, the shortage of skilled labor to operate and maintain sophisticated, technology-enabled equipment presents a major constraint. This skills gap can deter miners from investing in the latest technology, as they must also fund significant training programs.

- Decarbonization and ESG Compliance: Conversely, these challenges present distinct opportunities. The global push for decarbonization and ESG compliance offers a powerful opportunity for OEMs to innovate and differentiate. The demand for battery-electric mining vehicles (BEVs) is a prime example. As miners commit to reducing their carbon footprint, they seek out equipment that aligns with these goals. This creates a market opportunity for manufacturers who can provide a viable, large-scale electric alternative to traditional diesel-powered fleets. Sandvik and Epiroc, for instance, have capitalized on this by developing and commercializing extensive fleets of BEVs for underground mining. The complexity of new technologies also creates an opportunity for expanded service and support contracts, as miners increasingly rely on OEMs for maintenance, software updates, and operational support.

Raw Material and Pricing Analysis

The manufacturing of mining equipment is a raw material-intensive process, heavily dependent on steel, aluminum, and various specialized alloys. The price volatility of these base metals directly impacts the production costs for OEMs. Furthermore, the increasing complexity of modern equipment, which incorporates advanced electronics and control systems, introduces dependencies on the semiconductor and rare earth element supply chains. A disruption in the supply of these components can lead to production delays and increased costs. Pricing in the market is not solely driven by material costs but is also influenced by the technological sophistication and automation features of the equipment. High-end, autonomous haul trucks command a premium due to their long-term operational savings and enhanced safety features, offsetting the initial capital outlay. The pricing strategy is often a blend of the initial purchase price and long-term service contracts, which account for a significant portion of the total cost of ownership.

Supply Chain Analysis

The global supply chain for mining equipment is a multi-tiered network. Tier 1 suppliers, which are the major OEMs, operate highly integrated global production networks. These companies often source components from a range of specialized Tier 2 and Tier 3 suppliers. Key production hubs are concentrated in North America (primarily the United States), Europe (especially in Sweden, Germany, and Finland), and Asia-Pacific (Japan, China). The logistical complexities are significant, given the size and weight of the equipment, which requires specialized transport. The supply chain is highly susceptible to geopolitical events and trade restrictions. A disruption in a single component from a key supplier can halt the production of an entire piece of equipment. The shift toward electrification is creating new dependencies on the battery supply chain, which is currently concentrated in a limited number of regions.

Government Regulations

- United States: Mine Safety and Health Administration (MSHA) regulations and standards: MSHA regulations, which mandate strict safety protocols, directly influence the design and features of mining equipment. This creates a demand for machinery with enhanced safety features, such as collision avoidance systems, remote-control capabilities, and advanced air quality monitoring systems, which reduce human exposure to hazardous environments.

- European Union: Machinery Directive 2006/42/EC and emissions standards (e.g., EU Stage V): The EU Machinery Directive sets mandatory safety and health requirements for machinery, forcing OEMs to design and produce equipment that meets stringent safety standards. Additionally, the EU Stage V emissions standards for non-road mobile machinery are a primary catalyst for the adoption of cleaner engine technologies, including hybrid and battery-electric power systems, directly driving demand away from traditional diesel-only fleets.

- Australia: Mining and Safety Act and state-level environmental regulations: Australia's stringent safety and environmental regulations, particularly in key mining states like Western Australia, compel mining operators to invest in equipment with advanced safety features and lower environmental impact. This regulatory environment fuels the demand for automated haulage and drilling systems that remove personnel from high-risk areas and for water-efficient processing equipment to mitigate water usage in arid regions.

Mining Equipment Market Segment Analysis:

- By Application: Metal Mining

The metal mining segment, which includes the extraction of copper, iron ore, gold, and bauxite, is a dominant driver of demand for mining equipment. The demand profile for this segment is distinct due to the scale and nature of operations. Large open-pit mines for iron ore and copper require immense quantities of ultra-class equipment, including hydraulic excavators, large electric shovels, and mechanical drive haul trucks with payload capacities exceeding 400 tons. The demand for these machines is directly tied to global steel production and electrification trends. As demand for copper and iron ore intensifies, mining companies expand their fleets and upgrade to more powerful, higher-capacity equipment to boost production volumes. The demand for automation is also particularly high in this segment; autonomous haulage systems are proving their value in large, repetitive open-pit environments by improving safety and increasing productivity through 24/7 operation. The imperative to process lower-grade ores also drives demand for sophisticated mineral processing equipment, such as crushing and screening plants, that can efficiently extract and concentrate valuable minerals.

- By Technology: Automated Equipment

The automated equipment segment is an increasingly critical component of the mining equipment market. This category includes a range of machinery, from semi-autonomous drills that assist operators with positioning and drilling parameters to fully autonomous haul trucks that operate without an on-board driver. The demand for this technology is not driven by the need for more horsepower but by the imperative to improve safety, productivity, and profitability. By removing human operators from hazardous environments, automation reduces the risk of accidents, a paramount concern for mining companies. Moreover, autonomous systems can operate continuously, minimizing downtime and maximizing output. This capability is a powerful demand driver, as it directly translates into a lower cost per ton of material moved. Miners are increasingly prioritizing capital investments in autonomous fleets to gain a competitive edge. This has led to a market where not only are new autonomous machines being purchased, but existing fleets are also being retrofitted with automation technology, creating a secondary market for automation kits and services.

Mining Equipment Market Geographical Analysis

- North America: US Market Analysis: The US market for mining equipment is mature and technologically advanced. The demand for equipment is strongly influenced by the nation's focus on domestic mineral production, particularly for critical minerals. MSHA regulations are a key factor, creating a demand for safety-enhancing features and technologies. The market is also driven by the ongoing replacement of aging fleets with more efficient and automated models. Mining companies in the US, particularly those in the copper and gold sectors, are early adopters of autonomous technology and digital solutions to manage their operations. The availability of skilled technical labor, particularly for maintenance and support of complex machinery, is a significant determinant of investment in new technology.

- South America: Chilean Market Analysis: Chile's market is dominated by large-scale copper mining. The demand for mining equipment in this region is a function of the global copper price and the long-term investment cycles of major mining companies. The country's mining operations, which include some of the world's largest open-pit copper mines, have a high demand for ultra-class haul trucks, shovels, and drills. The severe arid conditions in the Atacama Desert necessitate equipment designed for durability and low water consumption. The government's focus on sustainability and community engagement is also beginning to influence procurement, driving a preference for cleaner technologies, including BEVs, particularly for underground operations.

- Europe: Swedish Market Analysis: Sweden's mining equipment market is highly specialized, characterized by a focus on underground mining and a strong emphasis on technology and sustainability. The extraction of iron ore and base metals largely drives the market growth. The presence of major global OEMs like Epiroc and Sandvik, with extensive R&D facilities, has made Sweden a hub for the development and adoption of battery-electric and autonomous mining solutions. The demand for equipment is heavily influenced by the imperative to electrify operations to reduce ventilation costs and improve air quality in deep underground mines. Swedish miners are global leaders in the adoption of these technologies, creating a highly sophisticated and forward-thinking market.

- Middle East & Africa: South African Market Analysis: South Africa's mining equipment market is defined by its deep-level gold and platinum mines. This poses unique challenges that directly shape equipment demand. The demand profile is skewed toward specialized underground equipment that can operate in confined and hazardous environments. Regulatory pressures to improve worker safety are a primary driver for the adoption of remotely controlled and semi-autonomous machinery. While the market for large-scale surface mining equipment remains, a significant portion of demand is for drilling rigs, loaders, and haul trucks adapted for deep underground conditions. The market is also subject to economic and political stability, which can impact investment in new projects and equipment purchases.

- Asia-Pacific: Chinese Market Analysis: China's market is the largest and most dynamic in the region. The demand for mining equipment is driven by the country's immense coal, iron ore, and industrial mineral production, as well as its massive infrastructure development. The market is characterized by a strong mix of domestic manufacturers and a growing presence of international OEMs. While cost-effectiveness remains a key procurement factor, there is an increasing demand for more advanced, higher-efficiency, and environmentally compliant equipment to meet new regulatory mandates. The government's push for "smart mining" and automation is rapidly accelerating the adoption of new technologies, creating a significant and sustained demand for a wide range of surface and underground mining machinery.

List of Top Mining Equipment Companies:

The mining equipment market is dominated by a few global powerhouses that possess extensive product portfolios, established dealer networks, and significant R&D capabilities. The competitive dynamic is not solely based on product features but also on a company's ability to provide comprehensive after-sales support, financing, and integrated technology solutions.

- Caterpillar Inc.: Caterpillar is a dominant force in the global mining equipment market, particularly for large-scale surface mining. The company's strategic positioning is built on a legacy of providing durable, high-capacity equipment, including its market-leading haul trucks and large hydraulic excavators. The company is actively expanding its technological offerings, with a strong focus on autonomous systems. For example, Caterpillar's Command for hauling solution allows for autonomous operation of its large mining trucks, directly addressing the industry's need for enhanced safety and productivity in open-pit environments. Its broad product range, from small loaders to massive draglines, combined with a vast global dealer network, provides it with a formidable competitive advantage in service and support.

- Komatsu Ltd.: Komatsu is a key competitor, known for its technological innovation and integrated solutions. The company's strategic focus is on providing integrated hardware and software solutions that improve operational efficiency. The most notable example is its Autonomous Haulage System (AHS), which was the first of its kind to be commercially deployed in large-scale mining operations. Komatsu's product line includes a full range of equipment for both surface and underground applications, including electric rope shovels, dozers, and haul trucks. The company's emphasis on automation and digitalization, through products like KOMTRAX, which provides real-time equipment data, positions it as a leader in the next generation of smart mining.

- Sandvik AB: Sandvik specializes in a wide range of equipment for underground hard rock mining and rock excavation. Its competitive edge stems from a strong focus on technology, particularly in automation and electrification. The company is a frontrunner in the development and commercialization of battery-electric loaders and haul trucks, which are crucial for improving air quality and reducing ventilation costs in underground mines. Sandvik's strategic acquisitions and internal development have also focused on digital solutions, such as its AutoMine product line, which provides a comprehensive system for automating mining operations. This deep specialization in underground applications and a clear commitment to sustainable technology give Sandvik a distinct market position.

Mining Equipment Market Recent Developments:

- January 2025: Gainwell Engineering launches indigenous Room and Pillar Mining Equipment: Gainwell Engineering Private Limited (GEPL) achieved a significant milestone by delivering India's first indigenously manufactured Room and Pillar Mining Equipment Package. This includes a Continuous Miner and Feeder Breaker, designed and built at their facility in West Bengal. This launch is a major step towards strengthening India's self-reliance in the high-end capital goods sector and supports the nation's ambitious coal production targets through more efficient and mechanized underground mining.

- May 2024: Epiroc Completes Weco Acquisition: Epiroc completed the acquisition of Weco Proprietary Limited, a South African manufacturer of precision-engineered rock drilling parts and a provider of related repair and service. This acquisition strengthens Epiroc's manufacturing capabilities and expands its product portfolio in the important African region. The company's customers are mainly underground mining operations in Southern Africa.

Mining Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mining Equipment Market Size in 2025 | USD 148.982 billion |

| Mining Equipment Market Size in 2030 | USD 187.654 billion |

| Growth Rate | CAGR of 4.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Mining Equipment Market |

|

| Customization Scope | Free report customization with purchase |

Mining Equipment Market Segmentation:

- By Equipment Type

- Surface Mining Equipment

- Underground Mining Equipment

- Mineral Processing Equipment

- Drills & Breakers

- Crushing, Pulverizing & Screening

- Loaders & Haul Trucks

- By Automation Level

- Manual Equipment

- Semi-Autonomous Equipment

- Fully Autonomous Equipment

- By Powertrain Type

- Internal-Combustion Engine Vehicles

- Battery-Electric Vehicles

- Hybrid Vehicles

- By Power Output

- Less than 500 HP

- 500 - 1,000 HP

- Above 1,000 HP

- By Application

- Metal Mining

- Mineral Mining

- Coal Mining

- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa