Report Overview

Near Infrared Imaging Market Highlights

Near Infrared Imaging Market Size:

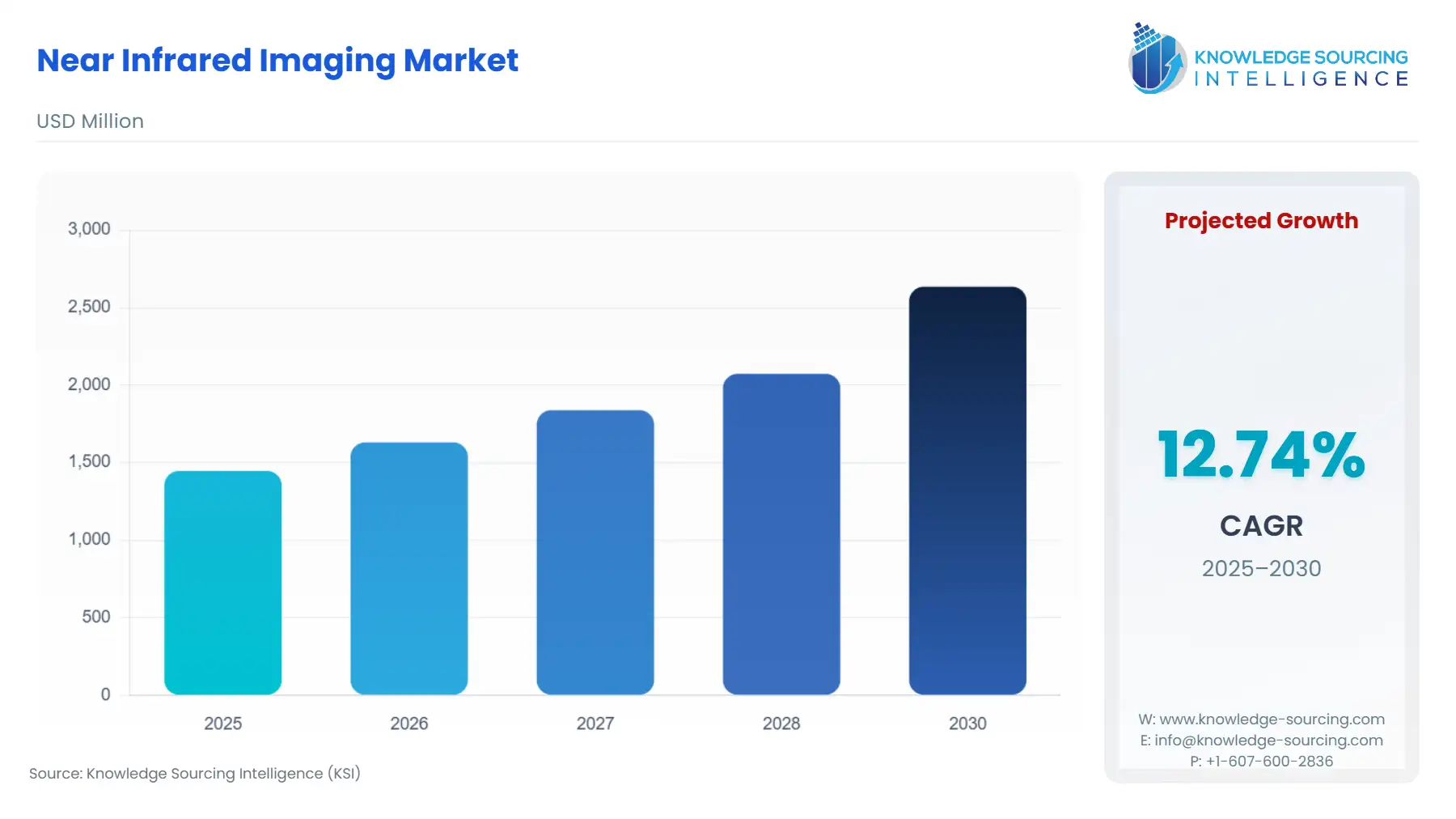

The near infrared imaging market is set to grow at a 12.36% CAGR, reaching USD 2910.381 million in 2031 from USD 1,446.540 million in 2025.

A picture of a variety of objects can be created using the non-destructive imaging technology known as near-infrared (NIR) imaging. There are various advantages of near infrared imaging technology which drive the market growth. Moreover, the growing prevalence of chronic diseases particularly cancer along with the research and development in fluorescent agents are further expected to propel the near infrared imaging market.

Near Infrared Imaging Market Growth Drivers:

Multiple Associated Advantages

There are numerous advantages associated with the application of near infrared imaging market which is a significant growth driver of the near infrared imaging market. For instance, it offers a non-ionizing imaging modality that enhances patient safety as compared to other imaging techniques such as X-ray or CT scans. Moreover, it helps in the early detection of diseases such as cancer which may lead to timely intervention and improved patient outcomes. Additionally, the non-invasive nature of near infrared imaging reduces the discomfort, lowers the risk of complications, and allows for repeated imaging as needed.

Growing Burden of Chronic Diseases

The increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, has driven the demand for advanced imaging technologies like near infrared imaging for better disease management and treatment planning. For instance, according to the National Health Council, 81 million Americans had several chronic ailments in 2020 signifying a high prevalence of chronic conditions. Moreover, chronic diseases account for more than 50% of all deaths in India according to the Ministry of Science and Biotechnology. Additionally, there are 77 million Indians affected with diabetes presently and this number is projected to reach 134 million by 2045 as per the International Diabetes Federation.

Increasing Cancer Cases

Near infrared imaging technology is extensively used in oncology for various applications, including tumor localization, surgical guidance, and monitoring treatment response. NIR fluorescent agents can be used to target specific cancer cells, providing real-time feedback during surgery and aiding in the complete removal of tumors. The increasing number of cancer cases and the huge burden on people around the globe are contemplated to aid the near infrared imaging market. For instance, cancer is the leading cause of death worldwide which accounted for almost 10 million deaths in 2020 according to the WHO reports. Moreover, around 400,000 children develop cancer every year according to the same source.

Rising Demand for Minimally Invasive Surgeries (MIS) and Remote Imaging

Near infrared imaging offers a non-invasive imaging modality and it can be designed to be portable and suitable for point-of-care or remote imaging applications. Therefore, the near infrared imaging market is anticipated to grow due to the rising demand for MIS and remote imaging. For instance, there were 13.2 million minimally invasive cosmetic procedures conducted out of a total of 15.6 million cosmetic procedures in 2020 as per the American Society of Plastic Surgeons (ASPS). Moreover, according to the U.S. Centers for Disease Control and Prevention (CDC), around 95% of healthcare centers in the United States offered telehealth services during the pandemic. The development of portable imaging devices by the market leaders further enhances the accessibility of remote imaging solutions.

Opportunities in the Market

The growing prevalence of chronic diseases along with the rising elderly population is rapidly aiding the near infrared imaging market growth thereby providing an opportunity for market players to enhance the technology and patient experience. The development and approval of novel and effective NIR fluorescent agents opens up new opportunities for targeted imaging and diagnostics. For instance, Astellas Pharma received the US FDA fast-track designation for the development of ASP5354 in October 2020. It is an imaging agent for intraoperative ureter visualization in patients undergoing minimally invasive and open abdominopelvic surgeries.

Near Infrared Imaging Market Restraints:

The near infrared imaging market has experienced growth and development however some restraints or challenges can impact its expansion. For example, near-infrared light has limited penetration depth in biological tissues compared to other imaging modalities, like ultrasound or MRI. This can restrict its ability to visualize deeper structures in the body, especially in patients with increased tissue thickness or body mass index (BMI). Moreover, the lack of standardized protocols and imaging procedures for NIRI can hinder its seamless integration into existing healthcare practices and imaging workflows.

Near Infrared Imaging Market Geographical Outlook:

North America is Expected to Grow Significantly

North America is expected to hold a significant share of the near infrared imaging market during the forecast period. The factors attributed to such a share are rising cancer cases, increased healthcare expenditure, government support, and earlier adoption of technological advancements. For instance, 1,603,844 new instances of cancer were reported in the United States in 2020, while 602,347 cancer-related deaths were recorded according to the CDC data. Moreover, the presence of major market leaders such as Infiniti Electro0Optics, OmniVision, and Karl Storz further accelerates the near infrared imaging market in the region.

Near Infrared Imaging Market Major Players:

OmniVision Technologies, Inc. is a well-established company specializing in the design and manufacturing of advanced digital imaging solutions. It offers Nyxel® near infrared technology that consumes less power and sees better and farther in low light.

Karl Storz is a renowned German medical equipment company specializing in the development and manufacturing of endoscopy and medical visualization systems. The company’s newest development in endoscopic imaging, the IMAGE1 S Rubina multimode visualization system, was introduced in January 2021.

Olympus Life Science focuses on providing advanced imaging and microscopy solutions for various life science research applications. It offers Fluoview™ FV3000 Red near infrared solution which has greater multiplexing and deeper imaging capabilities.

Near Infrared Imaging Market Key Developments:

In August 2022, Shimadzu developed the LuminuousQuester NI near-infrared imaging system, which combines a highly adaptable camera with software that is extremely user-friendly, to advance drug discovery research. Near-infrared light that is less obstructed by interior illumination is captured.

In March 2022, Swift Medical launched a hyperspectral imaging device named Swift Ray 1 that wirelessly attaches to a smartphone camera and provides comprehensive clinical data to better support the monitoring and treatment of skin and wound conditions.

Near Infrared Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Near Infrared Imaging Market Size in 2025 | USD 1,446.540 million |

Near Infrared Imaging Market Size in 2030 | USD 2,635.104 million |

Growth Rate | CAGR of 12.74% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Near Infrared Imaging Market |

|

Customization Scope | Free report customization with purchase |

Near Infrared Imaging Market Segmentation

By Product

Near Infrared Flourescence Imaging Systems

Near Infrared Flourescence & Bioluminescence Imaging Systems

By Application

Pre-Medical Imaging

Medical Imaging

Clinical Imaging

By End-User

Hospitals & Clinics

Research Laboratories

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others