Report Overview

Point-Of-Care Ultrasound Systems Market Highlights

Point-Of-Care Ultrasound Systems Market Size:

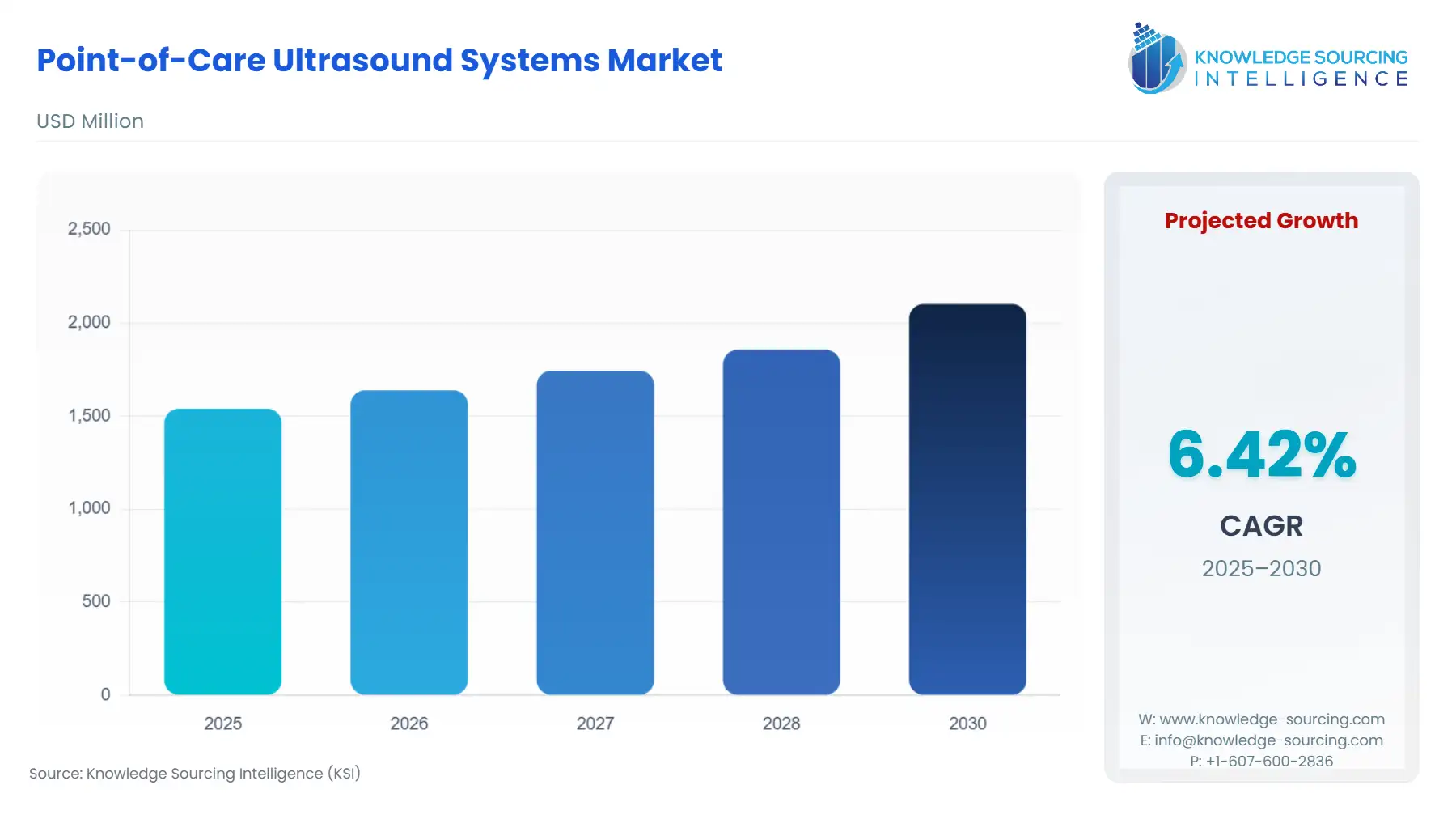

The point-of-care ultrasound systems market is projected to grow at a CAGR of 6.42% over the forecast period, increasing from US$1,540.404 million in 2025 to US$2,102.904 million by 2030.

Point-of-care ultrasound is the use of a portable ultrasound by medical professionals for diagnosis and treatment, particularly in distant areas. Using POCUS, clinicians quickly and accurately handle patients' conditions without incurring the long travel barriers that traditional bedside ultrasound entails. POCUS can suit many clinical situations and be combined with other medical technologies, such as using an intensive care unit (ICU) monitor for clinical conditions observation, emergency use for assessment of internal-external pathological findings, and physiological monitoring like hemodynamic assessment, heart function, and volume status.

Moreover, there is more shift in the present health care scenario toward outpatient care as opposed to inpatient care resulting in an increased demand for ultrasound systems at the point of care. Also, the increase in the demand for ultrasound systems for point-of-care applications has supplemented the emergence of emergency and intensive care, especially in, but not limited to, cardiology and obstetrics. Added to that, a strong inclination toward intensive research and development from large corporations has triggered the introduction of numerous technologically advanced products.

Point-Of-Care Ultrasound Systems Market Growth Drivers

- The rising demand for diagnostics procedures is increasing the point-of-care ultrasound systems market growth.

One of the major factors driving demand for ultrasound equipment worldwide is the increased diagnostic procedures and screening among patients. Conventional cart-based ultrasound equipment in normal diagnostics imaging produces high-resolution images with a wide variety of applications in the healthcare environment. Still, some limitations associated with conventional ultrasound, increasing acquisition costs, and limitations in portability have fueled the shift to the demand for portable equipment among health practitioners. Moreover, compact and hand-held devices are portable, safe to operate, relatively inexpensive, and give instant results for physicians. On top of that, the cost of hand-held devices is lower than that of conventional ultrasound machines.

- The growing prevalence of chronic diseases is anticipated to increase the market demand.

The growing demand for point-of-care ultrasound devices is experiencing increased growth with the rise in the incidence of chronic diseases. According to the World Health Organization, chronic diseases account for 71% of total mortalities worldwide or 41 million deaths every year. Cardiovascular disorders are responsible for 17.9 million of these deaths due to chronic diseases. Point-of-care ultrasound is quite important for both diagnosing and following patients with cardiovascular issues; thus, it is becoming increasingly popular. Moreover, a key trend influencing this market is the gradually rising population of elderly citizens. Older adults will often require medical examinations and monitoring more frequently; therefore, this would induce a higher demand for effective diagnostic instruments for point-of-care ultrasound.

- Rising technological advancement is anticipated to increase the market demand.

The introduction of point-of-care ultrasound has been made better by technological advancements. It is brightening the scope of the use of ultrasonography in emergency and critical care countries that have instituted POCUS health care insurance in ultrasound-equipped emergency and intensive care units. This fantastic rate of acceptance of POCUS has been due to advances in technology, making the devices portable and perhaps easier to use. Moreover, the market has seen rising demand for handheld and portable POCUS devices due to an easily-moving, convenient, fast-diagnostic tool at the point of care. All these tiny devices allow health services to take the ultrasound beyond normal clinical environments.

Point-Of-Care Ultrasound Systems Market Segmentation Analysis:

- By end-user industry, hospitals are anticipated to grow during the forecast period.

The hospital segment accounted for a large market share throughout the projection period because of the increasing demand for critical care units and medical probes used in hospitals. Imaging in emergency care units is expected to drive considerable demand for point-of-care ultrasound devices during the projected period. Increased personal disposable income and advances in technology in the medical sector will further drive market growth during the forecast period.

In addition, hospital authorities are adopting modern-day technology to ensure high accuracy in medical imaging systems, and this is expected to spur growth in the market in the coming years. In addition, leading market players, such as Butterfly Network Inc., have launched their next-generation Butterfly iQ+ point-of-care ultrasound (POCUS) technology to convert a smartphone into a diagnosis imaging device. Thus, these launches are likely to support the growth of the market.

Point of Care Ultrasound Systems Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

The point-of-care ultrasound market is forecasted to be dominated by North America during the time frame under study. Its driving factors will include increased global prevalence of chronic diseases and rising incidences of emergency and road accidents due to more technology adoption in the region, leading to increased demand for affordable treatment and cost-effective therapies, all happening in the United States. According to the Centers for Disease Control and Prevention, cardiovascular diseases are the number one cause of death among American males. Other causes of the market's buoyancy are booming healthcare spending and the need for improving health outcomes at lower costs, further buoyed by the very well-developed infrastructure and the existence of a substantial industry.

Point of Care Ultrasound Systems Market Key launches:

- In September 2024, GE HealthCare announced the release of upgraded Venue ultrasound equipment as well as Venue Sprint, a new solution that is accelerating point-of-care ultrasound (POCUS) adoption. The Venue Sprint is a revolutionary ultrasound device built for maximum portability that combines powerful, familiar Venue software and AI-enabled capabilities, unrivalled image quality, and wireless probe capability with Vscan Air handheld ultrasound systems. Venue ultrasound devices will now have wireless probe connectivity, improved clinical tools, and ViewPoint™ 6 improvements to improve efficiency and workflow.

- In September 2024, Mindray, a leading global developer of healthcare technologies and solutions specializing in patient monitoring, anesthesia, and ultrasound, announced that it will exhibit at the American College of Emergency Physicians (ACEP) Scientific Assembly at Mandalay Bay in Las Vegas, Nevada, from September 29 to October 2. They will present their most recent advances in point-of-care ultrasound (POCUS), including a revolutionary whole-body handheld ultrasound system, as well as an intuitive suite of patient monitoring tools.

Point-Of-Care Ultrasound Systems Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Point-Of-Care Ultrasound Systems Market Size in 2025 | US$1,540.404 million |

| Point-Of-Care Ultrasound Systems Market Size in 2030 | US$2,102.904 million |

| Growth Rate | CAGR of 6.42% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Point-Of-Care Ultrasound Systems Market | |

| Customization Scope | Free report customization with purchase |

The point-of-care ultrasound systems market is analyzed into the following segments:

- By Type

- 2D ultrasounds

- Doppler ultrasounds

- Harmonic imaging

- By End-User Industry

- Hospitals

- Clinics

- Other

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Others

- North America