Report Overview

Neural Processing Unit Market Highlights

Neural Processing Unit Market Size:

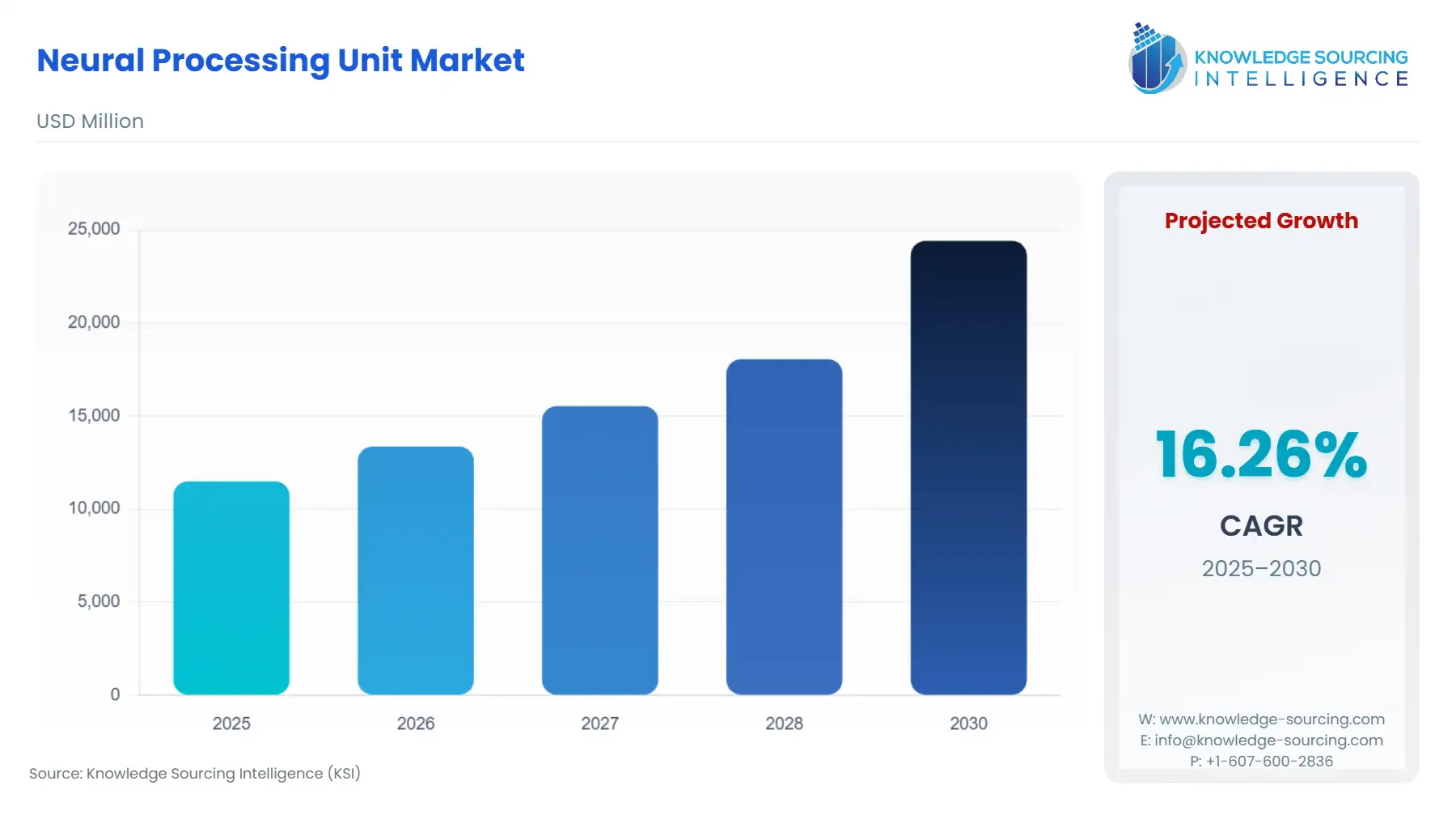

The neural processing unit market is projected to grow at a CAGR of 16.26% from US$11,496.383 Million in 2025 to US$24,420.685 Million in 2030.

Neural Processing Unit Market Introduction:

A neural processor, sometimes referred to as a neural processing unit (NPU), is a specialized circuit that carries out all the arithmetic and control logic needed to execute machine learning algorithms. These algorithms typically work with predictive models such as random forests (RFs) or artificial neural networks (ANNs). Digital and analog methods can be used to build neural processors. In analog design, only a small number of transistors are needed to replicate the differential equations of neurons. These units, therefore, theoretically consume less energy than digital neuromorphic computers.

The NPU market is a cornerstone of AI accelerators, driving advancements in deep learning processors and machine learning chips. NPUs, including AI SoCs, enable efficient AI inference and training chips for applications in edge AI and on-device AI. Neuromorphic computing enhances energy-efficient processing, mimicking brain-like computations for real-time tasks in IoT, automotive, and healthcare. These chips optimize complex neural networks, supporting low-latency, high-performance AI workloads. For instance, in June 2025, AMD launched the MI355X, a high-performance AI GPU accelerator with 4x faster processing than its predecessor, targeting generative AI and data center workloads. The market is pivotal for scalable, intelligent solutions across industries.

Neural Processing Unit Market Trends:

The NPU market is advancing with a focus on energy-efficient AI, optimizing power consumption for edge and mobile applications. Low-latency AI and real-time AI processing enable rapid decision-making in autonomous vehicles and IoT devices. Privacy-preserving AI techniques, such as federated learning, ensure secure on-device processing. Model compression and quantization for NPUs reduce computational demands, enhancing efficiency without sacrificing accuracy. These trends drive scalability and performance in AI workloads, catering to industries requiring compact, high-speed solutions. The market’s emphasis on sustainable, secure, and optimized AI processing positions NPUs as critical for next-generation intelligent systems.

Neural Processing Unit Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The neural processing unit market is segmented by:

- Type: The neural processing unit market is divided into several segments based on type, including Sequence-to-sequence Model, Shallow Neural Network, Convolutional Neural Network, Recursive Neural Network, Recurrent Neural Network, Multilayer Perceptron, and Long Short-term Memory. Neural processors of various kinds are regularly used in a wide range of industries, including manufacturing, entertainment, sports, automotive, aerospace, and electronics. Apart from this, deep learning commonly uses convolutional neural networks to process data, understand images, and lessen the need for human intervention, all of which contribute to the segment's growth in the market.

- Component: The neural processor market, based on components, has been divided into three segments: hardware, software, and services. The hardware category is expected to dominate the global neural processor market because of the rapidly evolving innovations and developments in the hardware used in neural processing.

- Application: The global neural processors market has been divided into several segments based on their respective applications, including automotive, electronics, defense, aerospace, entertainment, and others. Over the projected time, it is expected that the application of neural networks in the automotive industry will grow rapidly. Neural processor use in the industry is increasing due to the need for automation features like voice commands, automated driving, and artificial intelligence in automobiles.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East, Africa, and Asia-Pacific. North America is anticipated to dominate the market and might grow at the fastest CAGR.

Top Trends Shaping the Neural Processing Unit Market:

1. Growing Need for Applications of AI and Machine Learning

- The growing need for machine learning and artificial intelligence (AI) applications in a variety of industries is driving the neural processing unit market. The need for strong processing capabilities has been greater as companies want to use AI to boost consumer experiences, increase operational efficiencies, and spur innovation. While running large-scale machine learning algorithms, neural processors are made to handle complicated data sets and carry out calculations that conventional CPUs and GPUs find difficult. The growth of AI applications in fields like natural language processing, predictive analytics, healthcare diagnostics, and driverless cars is driving this demand.

2. Technological Progress in Neural Networks

- Neural network technology is advancing quickly, which is a key factor propelling market expansion. The capabilities of neural processors are being increased by advancements in neural network topologies and deep learning techniques. Organizations are progressively implementing complex neural network models that require more potent processing technology to enhance the performance of their AI applications. These developments are making it possible to create neural processors that can effectively handle greater model sizes and more intricate neural networks to achieve high accuracy and performance in AI applications.

Neural Processing Unit Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Use of Edge Computing: The market expansion for neural processors is being significantly impacted by the growing use of edge computing. Businesses are searching for effective methods to handle and analyze data at the point of generation due to the proliferation of IoT devices and the requirement for real-time data processing. In this context, neural processors are essential since they give edge devices strong computational capabilities. Edge computing is increasing demand for specialized hardware that can effectively manage AI workloads on-site by lowering latency, lowering bandwidth needs, and protecting data privacy.

- Increasing funding for cutting-edge technology: Every organization can benefit greatly from investing in AI and neural networks. Object and sound detection, sound recognition, object tracking, facial recognition, keyword spotting, and packet inspection are all powered by neural network processors. The government has also made significant investments in the development of AI and real-time analytics, which are expected to propel the processor industry.

Challenges:

- The availability of neural processor (NPU) compatible software and tools: Neural processor (NPU) usage across a range of applications is significantly influenced by the availability of suitable software and tools. The absence of customized software that can fully utilize the capabilities of neural processing units (NPUs) presents a difficulty for many developers and organizations, despite the rapid improvements in neural processing technology. This restriction may make it more difficult to apply NPUs effectively in practical settings, which could impede innovation and adoption rates.

Neural Processing Unit Market Regional Analysis:

- North America: The market for neural processors in North America is expanding rapidly, driven by the rising need for complex AI applications. Neural processor usage is accelerating in several industries, including healthcare, banking, and the automotive sector, due to the growth of cloud computing and edge devices. Furthermore, significant regional firms are making significant R&D investments to improve neural processor performance and capabilities.

Neural Processing Unit Market Competitive Landscape:

The market is moderately fragmented, with many key players including NVIDIA Corporation, Intel Corporation, Qualcomm Incorporated, and AMD.

- Product Innovation: In September 2024, the Core Ultra 200V processors from Intel Corporation improved laptop power economy and computational capacity by introducing a neural processing unit that is four times quicker than the previous version.

- Sustainable product launch: In June 2024, at the Computex technology trade expo, Advanced Micro Devices Inc. showcased new neural processing units made for on-device AI workloads in AI PCs through the introduction of its AI processors, which included the MI325X accelerator. It is anticipated that the MI350 series will have 35 times greater inference capabilities than previous models, demonstrating AMD's dedication to major performance enhancements.

Neural Processing Unit Market Key Developments:

- In May 2025, Intel announced that it achieved full neural processing unit (NPU) support with the MLPerf Client v0.6 benchmark. It is the first standardized evaluation of large language model (LLM) performance on client NPUs.

- In May 2025, Expedera announced the launch of its Origin Evolution™ NPU IP, which provides hardware acceleration for using LLMs on resource-constrained edge devices.

- In May 2025, Semidynamics announced the launch of Cervell, which is a scalable NPU that is a combination of CPU, vector, and tensor processing utilized for AI applications. Its features include delivering up to 256 TOPS at 2GHz, supporting edge and datacenter AI, and integrating with the Gazillion Misses memory subsystem for high-bandwidth, low-latency performance.

- In August 2025, ALi Corporation signed a strategic licensing agreement with Ceva to integrate Ceva's NeuPro-Nano and NeuPro-M NPUs into ALi's next-generation Video Display Sub-System platform

Neural Processing Unit Companies:

- NVIDIA

- Intel

- Qualcomm

- Apple

Neural Processing Unit Market Scope:

| Report Metric | Details |

| Neural Processing Unit Market Size in 2025 | US$11,496.383 million |

| Neural Processing Unit Market Size in 2030 | US$24,420.685 million |

| Growth Rate | CAGR of 16.26% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Neural Processing Unit Market |

|

| Customization Scope | Free report customization with purchase |

Neural Processing Unit Market Segmentation:

By Type

- Multilayer Perceptron

- Convolutional Neural Network

- Recursive Neural Network

- Recurrent Neural Network

- Sequence-to-sequence Model

- Shallow Neural Network

- Long Short-term Memory

By Component

- Hardware

- Software

- Services

By Application

- Automotive

- Electronic

- Defense

- Aerospace

- Entertainment

- Others

By Region

- North America

- USA

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Our Best-Performing Industry Reports:

Navigation

- Neural Processing Unit Market Size:

- Neural Processing Unit Market Key Highlights:

- Neural Processing Unit Market Introduction:

- Neural Processing Unit Market Trends:

- Neural Processing Unit Market Overview & Scope:

- Top Trends Shaping the Neural Processing Unit Market:

- Neural Processing Unit Market Growth Drivers vs. Challenges:

- Neural Processing Unit Market Regional Analysis:

- Neural Processing Unit Market Competitive Landscape:

- Neural Processing Unit Market Key Developments:

- Neural Processing Unit Companies:

- Neural Processing Unit Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025