Report Overview

Night Vision Device Market Highlights

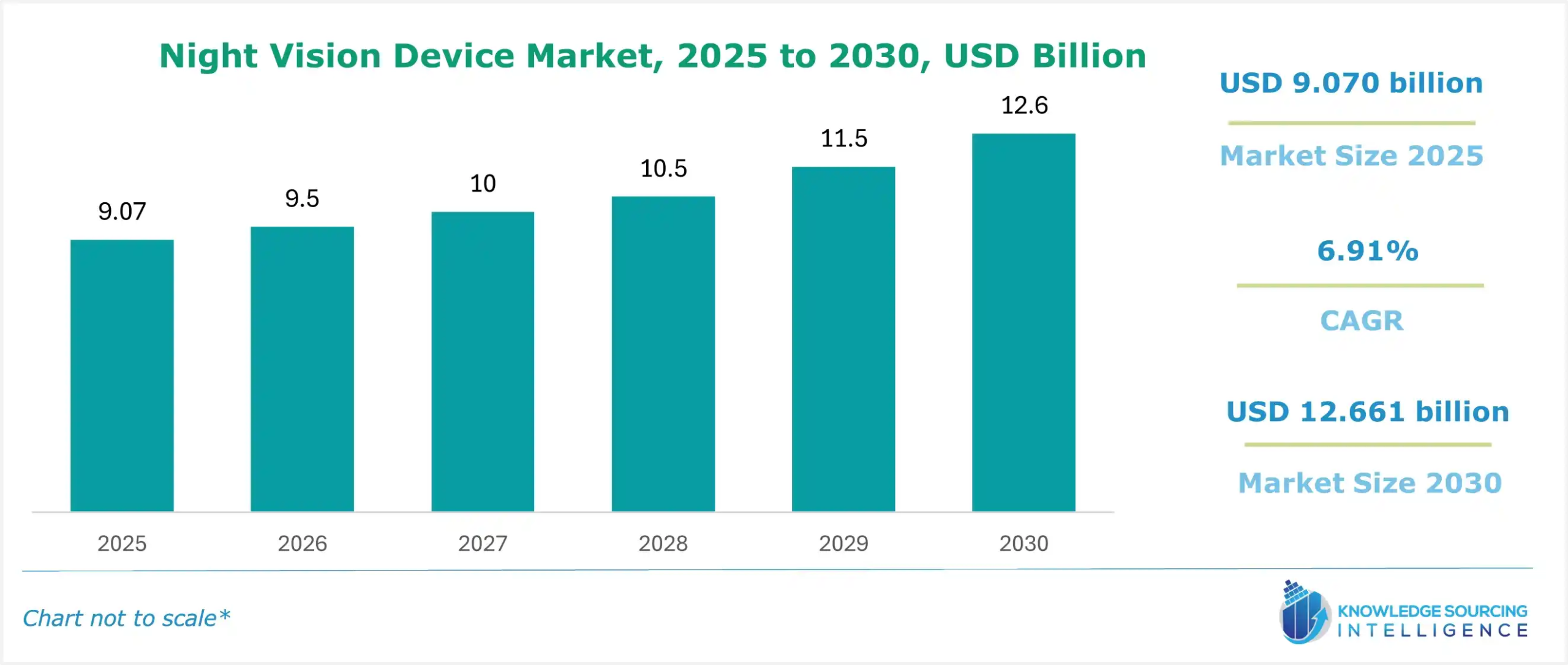

Night Vision Device Market Size:

The night vision devices market is expected to grow at a CAGR of 6.91%, reaching a market size of USD 12.661 billion in 2030 from USD 9.070 billion in 2025.

Night Vision Devices Market Introduction:

A night vision device is an electronic device that helps in viewing or imaging landscapes under very low-light conditions. These devices consist of an image intensifier, an optical mounting system, and a protective housing. They allow users to view in dark locations and enhance safety and security in low-visibility conditions.

The night vision device market is advancing rapidly, driven by innovations in night vision technology, including image intensification, thermal imaging, and digital night vision. Image intensification amplifies ambient light for clear low-light vision, while thermal imaging detects heat signatures, enabling visibility in total darkness. Digital night vision leverages high-sensitivity CMOS sensors for enhanced image clarity. Infrared illumination supports active imaging in zero-light conditions, and sensor fusion technology integrates multiple imaging modes for superior performance. These devices are used in various applications of defense, surveillance, and wildlife observation, demanding robust, versatile solutions for critical low-light operations.

Night Vision Devices Market Trends:

The global aerospace sector’s expansion is boosting the growth of the night vision devices market. In the aerospace landscape, these devices are mainly used to operate airplanes at night or dusk. The night vision devices are designed to use an electro-optical system.

The night vision device market is evolving with white phosphor and autobated Gen3 technologies, enhancing image clarity and contrast for improved low-light performance. Filmless tubes reduce noise, boosting resolution. HD thermal sensors and CMOS sensors enable high-definition imaging, enhancing situational awareness in defense and surveillance. Miniaturization and SWaP optimization (size, weight, and power) prioritize compact, lightweight designs for portability. ITAR-free night vision solutions expand global accessibility, bypassing export restrictions. Market players depend on these advancements to deliver reliable, high-performance devices that meet the rigorous demands of modern tactical and civilian applications.

The Aerospace Industries Association, in its report, stated that the US aerospace industry witnessed a growth of about 6.7% over the years. The agency stated that in 2021, the sales of the aerospace and defense industry were recorded at USD 843.972 billion, which increased to USD 892.216 billion in 2022. In 2023, the sales of the aerospace and defense sector increased to USD 955.229 billion in 2023.

Night Vision Devices Market Growth Drivers:

- Military and Defense Spending: Improvements in military budgets are expected to drive the overall night vision devices market growth. Night vision devices, owing to their infrared illumination and thermal imaging, find high applicability in military and defense applications. With the rising prevalence of terrorist attacks globally, the demand for such devices by security personnel is expected to show significant growth in the night vision devices market in the coming years.

Furthermore, major countries, namely India, China, the USA, and Russia, are increasing their military funding to bolster their overall defense capabilities against domestic and international threats, providing further growth opportunities for night vision devices.

According to the SIPRI (Stockholm International Peace Research Institute) Military Expenditure, in 2023, the global military expenditure reached US$2,443 billion. The United States witnessed a positive growth of 2.3% in 2022, with overall spending reaching US$916 billion. Their military also spent about USD 97 million on BAE Systems.

- Wildlife Conservation and Poaching Prevention: The growing need for animal tracking has propelled the night vision devices market globally. In wildlife sanctuaries & conservation, and research centres, tracking and observing animals in their natural habitat without disturbing them requires advanced technology options such as thermal imaging and infrared cameras.

With the growing prevalence of poaching and animal trafficking, the demand for such night vision devices for tracking animal movement and preventing such accidents has provided new growth prospects. For instance, according to the Wildlife Protection Society of India, in 2023, the number of poached tigers stood at 56, representing a 43.5% increase over the number recorded in 2022. Additionally, according to Save The Rhino International, in 2022, 448 Rhinos were killed in South Africa, and the same sources stated that for the first time in six years, rhino poaching has witnessed a significant increase.

Night Vision Devices Market Segment Analysis:

- By Product: Night vision cameras are anticipated to grow during the forecast period. The rise in demand for night vision cameras is attributed to the technological enhancement of their components, improved image quality, better image processing, better infrared illumination, and intelligent illumination control, among other factors. Advanced high-resolution sensors incorporated in most night vision cameras allow them to take high-resolution images even in the dark; sophisticated algorithms enhance the images in terms of clarity, contrast, and detail. The high-power infrared illuminators enhance the images in pitch darkness, such that the images can be easily distinguished.

Further, night vision cameras are widely used in a range of industries, including surveillance, monitoring wildlife, security forces, sports hunting, and several recreational activities. They play a crucial role in monitoring the borders, detecting intruders, and assisting in investigating crimes. For instance, Teledyne FLIR LLC is a prominent market player in designing, manufacturing, and selling various thermal imaging systems, infrared cameras, and night vision devices. One of its global products is the FLIR M232, a compact marine thermal camera with pan-tilt capabilities, a resolution of 320 x 240, and a 360-degree view. The camera also improves security by detecting ships and other objects during the night, and when connected to a Raymarine Axiom MFD, it offers FLIR ClearCruise™ smart thermal analytics features.

Night Vision Devices Market Geographical Outlook:

- North America is witnessing exponential growth in the night vision devices market during the forecast period.

The night vision devices market is experiencing robust growth, with North America projected to witness exponential expansion, driven by increasing demand for surveillance, reconnaissance, and military operations. Night vision devices (NVDs), including thermal imaging, infrared systems, and night vision goggles, are critical for low-light and no-light operations, enhancing situational awareness in defense and security applications.

In North America, particularly the United States, the military and defense sector drives market growth through significant government investments. According to USAspending.gov, the U.S. Department of Defense (DoD) received $1.94 trillion in FY 2024, representing 14.3% of the federal budget, supporting advancements in night vision technology (USAspending.gov, 2024). These funds bolster tactical operations, border control, counter-terrorism, and intelligence gathering, where NVDs are essential for night operations. The U.S. military relies on night vision devices for situational awareness, enabling personnel to operate effectively in challenging low-light environments.

Technological advancements, such as improved image resolution, lightweight designs, and AI integration, enhance NVD performance, driving adoption in defense, law enforcement, and homeland security. North America’s advanced technological infrastructure and R&D investments support innovations in thermal imaging systems and infrared optics, positioning the region as a market leader.

Globally, the Asia-Pacific, including China and India, is a fast-growing market due to military modernization and border security needs. Europe, led by Germany and the UK, focuses on defense applications and surveillance systems. The Middle East and Africa, and South America, are emerging markets, driven by security concerns and infrastructure development. Challenges like high costs persist, but economies of scale and technological innovation are mitigating these issues. The night vision devices market thrives on defense investments, security demands, and advanced optics, with North America leading due to its strategic focus and technological advancements.

Night Vision Devices Market Key Developments:

- November 2025: Theon International announced a new €100 million night vision goggle order from a European NATO member, with deliveries scheduled 2026–2028, expanding NVG supply backlog.

- September 2025: Exosens secured a major contract with the Spanish Army for 17,000 advanced night vision monoculars, leveraging 16 mm 4G intensifier tubes for enhanced soldier optics.

- May 2025: Elbit Systems of America was awarded a $112 million delivery order from the Marine Corps Systems Command for Squad Binocular Night Vision Goggle systems, which will be produced at the company's production facility in Roanoke until December 2026.

- March 2025: Thales introduced panoramic quad-tube night vision goggles, which are integrated with four light intensification tubes to offer an enhanced wide field of view. It is well-suited for the requirements of special operations forces and specialized army teams that are conducting sensitive missions like hostage rescue operations and counter-terrorism.

- Jan 2025: L3Harris Technologies received a $263 million U.S. Army contract for the production of Enhanced Night Vision Goggle-Binocular (ENVG-B) systems under an ongoing Indefinite Quantity program.

List of Top Night Vision Devices Companies:

- Thales Group

- BAE Systems

- L3 Technologies

- ATN Corporation

- Elbit Systems

Night Vision Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Night Vision Devices Market Size in 2025 | USD 9.070 billion |

| Night Vision Devices Market Size in 2030 | USD12.661 billion |

| Growth Rate | CAGR of 6.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Night Vision Devices Market |

|

| Customization Scope | Free report customization with purchase |

Night Vision Devices Market Segmentation:

- By Technology

- Thermal Imaging

- Infrared Illumination

- Image Intensification

- By Product

- Camera

- Goggle

- Scope

- By Application

- Navigation

- Security and Surveillance

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

- North America