Report Overview

Global Nitrogen Gas Generator Highlights

Nitrogen Gas Generator Market Size:

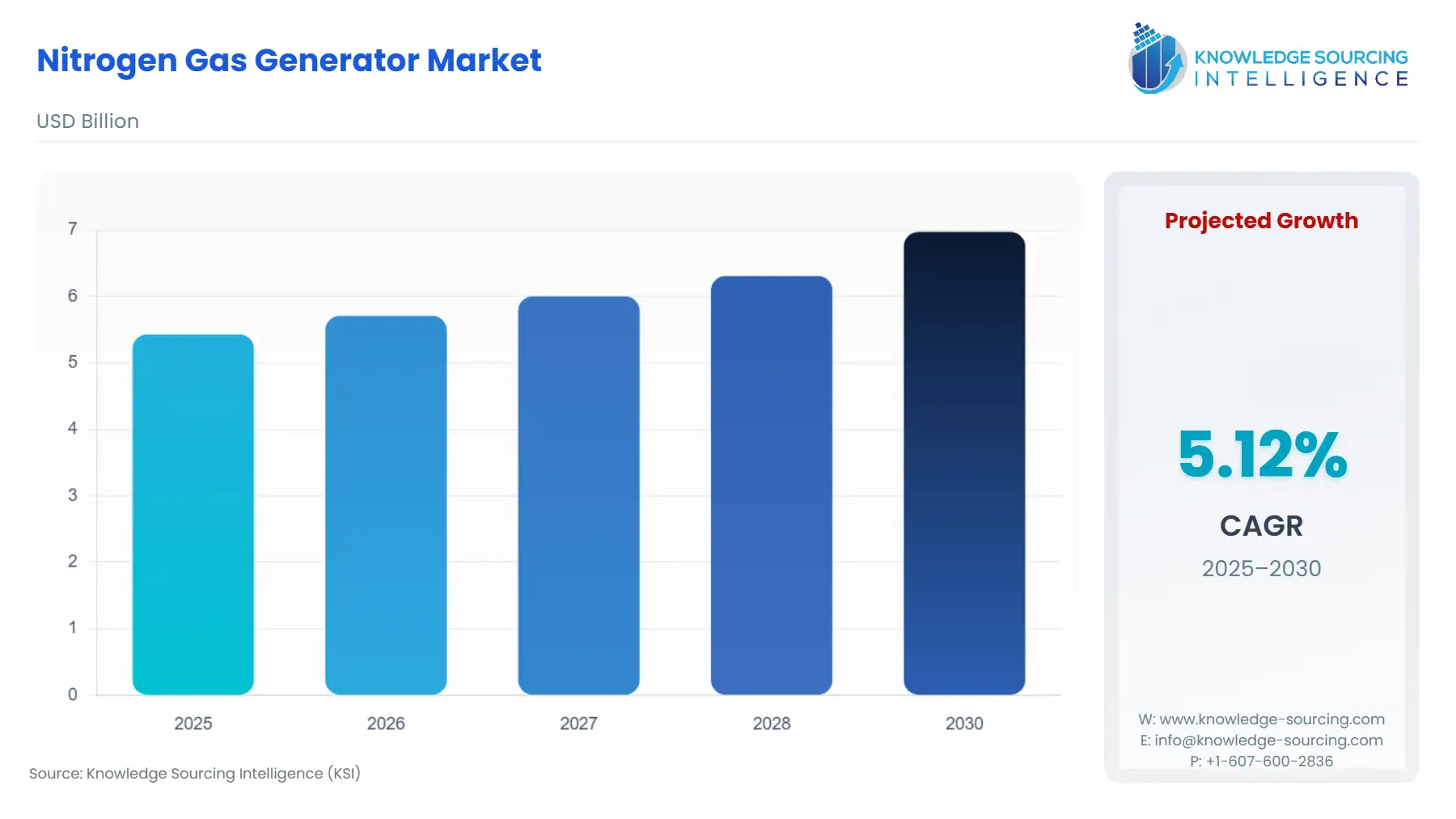

The Nitrogen Gas Generator Market will reach US$6.973 billion in 2030 from US$5.432 billion in 2025 at a CAGR of 5.12% during the forecast period.

Nitrogen Gas Generator Market Trends:

Stringent workers’ safety regulations across different industries are the major driver of the nitrogen gas generator market. The application of nitrogen gas generators as dielectric gases in high-voltage equipment and fire and corrosion control is fueling the overall market growth. There is a burgeoning demand for nitrogen gas to cater to various applications across different end-use industries, including aerospace, oil and gas, food packaging, and pharmaceuticals.

The use of nitrogen gas generators includes the manufacturing of fertilizers and pesticides, removal of some types of cancer and skin lesions via cryosurgery methods, and providing a safe, clean, dry, and unreactive environment for the manufacturing of electronics. The growing global oil and gas industry is one of the major drivers of the nitrogen gas generator market. With increasing E&P (exploration and production) activities in countries like the U.S., Mexico, and Brazil, the demand for nitrogen gas generators is increasing significantly for a wide range of areas to prevent fire and explosion hazards, both offshore and onshore.

Nitrogen Gas Generator Market Growth Drivers:

- The chemical industry held a noteworthy market share

The chemical industry accounted for a significant market share. Some of the major applications of nitrogen gas in the chemical industry include purging (before and during batch processing), blanketing (tanks and other storage volumes), and packaging to prevent reactions with oxygen and other volatile chemicals. Government quarantines for maintaining social distance to prevent the spread of this deadly virus have forced many companies across various industries to temporarily shut down factories and halt production in different regions. As such, the demand for chemicals has temporarily declined, which, in turn, is negatively impacting the global nitrogen gas generator market’s growth.

Nitrogen Gas Generator Market Geographical Outlook:

- APAC projected to witness a substantial CAGR during the forecast period

Geographically, the global nitrogen gas generator market is segmented into North America, South America, Europe, the Middle East and Africa (MEA), and Asia Pacific (APAC). The North American region is expected to hold a significant market share during the forecast period owing to the strict workers’ safety regulations implemented by OSHA along with the presence of major market players in the region. The booming oil and gas industry in the U.S. and Mexico, supported by favourable government initiatives and policies will continue to bolster the nitrogen gas generator market growth in this region.

The Asia-Pacific (APAC) region is projected to grow at a noteworthy CAGR during the forecast period owing to the growing end-user industries such as chemical, food packaging, and pharmaceuticals in countries like China and India. These, along with other APAC countries, are manufacturing hubs for electronics, which also contributed to the market growth of nitrogen gas generators in this region.

The global nitrogen gas generator market report provides an in-depth industry landscape analysis, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various nitrogen gas generator systems and technologies, such as pressure swing adsorption and membrane technology, while exploring end-user segments. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive market view.

Nitrogen Gas Generator Market Segmentations:

Nitrogen Gas Generator Market Segmentation by technology

The market is analyzed by technology into the following:

- Pressure Swing Adsorption (PSA) Technology

- Membrane Technology

- Others

Nitrogen Gas Generator Market Segmentation by size

The report analyzes the market by size as below:

- Stationary Nitrogen Generators

- Portable Nitrogen Generators

Nitrogen Gas Generator Market Segmentation by end-user industry:

The report analyzes the market by end-user industry as below:

- Pharmaceutical

- Chemical

- Food Packaging

- Electronics

- Aerospace and Defense

- Oil and Gas

- Others

Nitrogen Gas Generator Market Segmentation by regions:

The study also analysed the Nitrogen Gas Generator Market into the following regions, with country level forecasts and analysis as below:

Nitrogen Gas Generator Market Competitive Landscape:

The Nitrogen Gas Generator Market features key players such as Peak Scientific Instruments, Oxymat A/S, Parker Hannifin Corporation, Oy Atlas Copco Kompressorit Ab, INMATEC GaseTechnologie GmbH & Co.KG, Holtec Gas Systems, On Site Gas Systems, Linde plc, Kuraray Co., Ltd., GENERON, and NOVAIR INDUSTRIES, among others.

Nitrogen Gas Generator Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by size, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-user industry, with historical revenue data and analysis across various segments.

- Nitrogen Gas Generator Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the nitrogen gas generator market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Nitrogen Gas Generator Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Nitrogen Gas Generator Market Size in 2025 | US$5.432 billion |

| Nitrogen Gas Generator Market Size in 2030 | US$6.973 billion |

| Growth Rate | CAGR of 5.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Nitrogen Gas Generator Market |

|

| Customization Scope | Free report customization with purchase |