Report Overview

OBGYN EMR Software Market Highlights

OBGYN EMR Software Market Size:

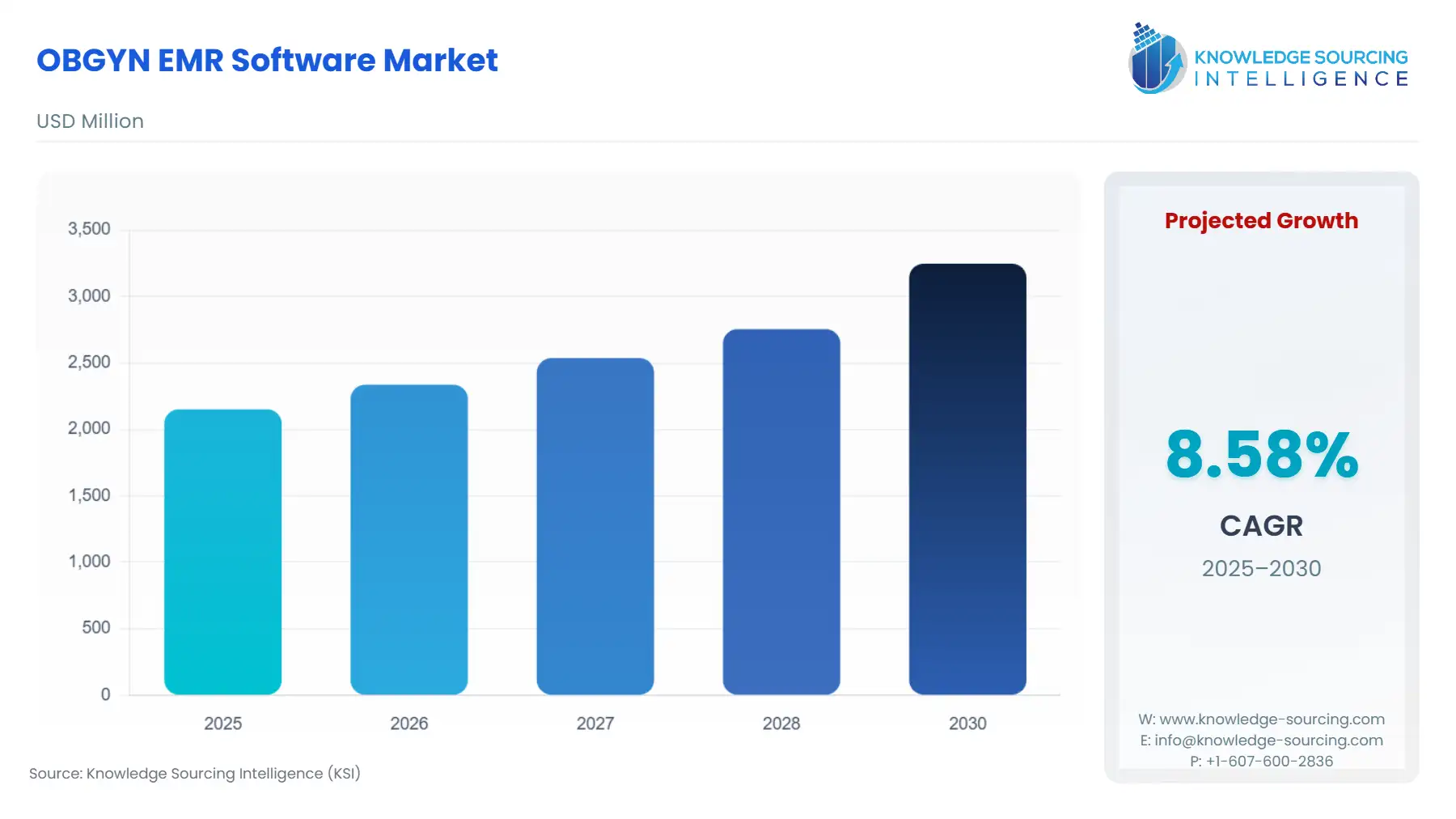

The OBGYN EMR Software Market is expected to grow at a CAGR of 8.58%, reaching a market size of US$3.248 billion in 2030 from US$2.152 billion in 2025.

The OBGYN EMR Software Market is a pivotal segment of the healthcare IT industry, providing specialized electronic medical record (EMR) solutions tailored to the unique needs of obstetrics and gynecology (OBGYN) practices. These solutions streamline practice management software functions, enhance workflow optimization, and improve patient care by integrating clinical decision support, revenue cycle management (RCM), and medical billing software. Designed for obstetricians and gynecologists, OBGYN EMR software addresses the complexities of managing prenatal care, gynecological procedures, and patient data while ensuring HIPAA-compliant data security. As healthcare digitization accelerates, the market is experiencing significant growth, driven by the need for efficient documentation, regulatory compliance, and enhanced patient engagement.

OBGYN EMR software facilitates comprehensive patient management through specialized features like prenatal charting, fetal monitoring, and OB-specific templates for conditions such as menopause, infertility, and gynecologic oncology. These systems integrate seamlessly with diagnostic tools, such as ultrasound devices, and support clinical decision support with evidence-based alerts and drug interaction checks. Additionally, revenue cycle management and medical billing software streamline administrative tasks like claim submissions and payer contract tracking, while HIPAA-compliant protocols ensure patient data security. The market caters to diverse practice sizes, from solo practitioners to large hospitals, with cloud-based and on-premise deployment options. Recent advancements, such as AI-driven analytics and telehealth integration, are transforming OBGYN practices, enabling workflow optimization and improved patient outcomes.

The major factors driving the market’s growth include:

Increasing Adoption of Healthcare IT: The push for digitization in healthcare, driven by regulatory incentives like the U.S. Meaningful Use program, fuels demand for OBGYN EMR software. The need for HIPAA-compliant systems and clinical decision support to enhance care quality is critical. The CDC reported that 88.2% of office-based physicians used EMR systems, reflecting widespread adoption.

Demand for Specialty-Specific Solutions: OBGYN practices require tailored EMRs to manage complex workflows, such as prenatal tracking and gynecological charting. The integration of practice management software and medical billing software streamlines operations, driving market growth. In September 2023, Modernizing Medicine introduced maternal-fetal medicine (MFM) features to its OBGYN EMR, enhancing high-risk pregnancy management.

Focus on Patient-Centric Care: The rise of patient portals and telehealth, integrated into OBGYN EMRs, supports patient engagement and workflow optimization. These tools allow patients to access records, schedule appointments, and communicate securely, aligning with HIPAA-compliant standards. Athenahealth enhanced its patient portal with AI-driven engagement tools, improving patient satisfaction.

The market faces challenges, including:

High Implementation Costs: The upfront costs of OBGYN EMR software, including hardware, training, and data migration, can be prohibitive for smaller practices. Even cloud-based solutions with subscription models require ongoing investment, impacting adoption rates.

Learning Curve and Integration Challenges: The complexity of transitioning to new EMR systems and integrating them with existing tools can disrupt workflows. Resistance from staff unfamiliar with technology further hinders adoption, despite benefits like clinical decision support and RCM.

Cost and Pricing Models of OBGYN EMR Software:

The cost of OBGYN EMR software varies widely based on practice size, deployment type, and feature set. Pricing models typically include subscription-based (cloud-based) or upfront one-time license (on-premise) options, with additional costs for implementation, training, and support. Below is an overview of costs and inclusions, based on recent industry insights:

Subscription-Based Models (Cloud-Based): These are the most common, with monthly or annual fees ranging from $149 to $899 per user, depending on the vendor and features. For example, PracticeFusion starts at $149/user/month (billed annually), while Greenway Health’s Intergy costs around $899/user/month approximately. These models include:

HIPAA-compliant cloud storage and regular updates.

Revenue cycle management tools, such as claim scrubbing and payer underpayment detection.

Medical billing software for automated coding and billing.

Practice management software for scheduling, patient portals, and telehealth.

Free data migration and training in some cases (e.g., RevenueXL offers free migration).

Technical support, often 24/7, via phone, email, or chat.

Upfront One-Time License (On-Premise): These require a significant initial investment, often $10,000–$50,000 for setup, hardware, and licensing, depending on practice size. Additional costs include maintenance and upgrades. For instance, AdvancedMD offers customizable on-premise solutions, with pricing upon request. These models include:

HIPAA-compliant local servers for data control.

Clinical decision support with specialty-specific templates.

Revenue cycle management and medical billing software for in-house billing.

Limited ongoing costs compared to subscriptions, but higher initial expenses.

Additional Costs: Implementation services (e.g., data migration, staff training) can range from $1,000 to $10,000, depending on complexity. Customization for OBGYN-specific workflows, such as prenatal charting, may incur extra fees. Some vendors, like PrognoCIS, offer free demos and start at $280/month for cloud-based solutions.

A La Carte Options: Practices can select specific modules (e.g., RCM, telehealth) to reduce costs. For example, MD Clarity offers modular RCM pricing based on patient encounter volume, with unlimited users at no extra cost.

The choice between subscription and upfront models depends on practice needs. Cloud-based subscriptions offer flexibility, scalability, and lower initial costs, ideal for smaller practices, while on-premise solutions suit larger practices prioritizing data control. Both models emphasize HIPAA-compliant security, workflow optimization, and integration with RCM and medical billing software to enhance financial and clinical efficiency.

OBGYN EMR Software Market Trends:

The OBGYN EMR Software Market is evolving rapidly, driven by technological advancements that enhance clinical efficiency and patient care. Cloud-based EMR systems dominate due to their scalability, cost-effectiveness, and seamless updates, enabling remote access for prenatal and gynecological care. Recently, Athenahealth enhanced its cloud-based EMR with telehealth integration, streamlining virtual consultations for OBGYN practices. Telehealth integration supports remote monitoring and virtual visits, critical for high-risk pregnancies, while patient portals empower patients to access records, schedule appointments, and use secure messaging for communication, aligning with HIPAA-compliant standards.

AI in EMR is transforming workflows with predictive analytics to identify risks like preeclampsia earlier. Modernizing Medicine introduced AI in EMR features for maternal-fetal medicine, improving diagnostic precision. Voice recognition streamlines documentation, reducing clinician workload, while interoperability via FHIR API ensures seamless data exchange across systems. For instance, Epic’s recent update enhanced FHIR API integration for obstetric data sharing. These trends reflect a market prioritizing workflow optimization, patient engagement, and data-driven care, with cloud-based EMR leading adoption.

OBGYN EMR Software Market Drivers:

Adoption of Cloud-Based EMR Systems: The OBGYN EMR Software Market is driven by the widespread adoption of cloud-based EMR systems, which offer scalability, cost-effectiveness, and remote accessibility tailored to obstetrics and gynecology practices. These systems enable seamless management of prenatal charts, gynecological records, and patient communications while ensuring HIPAA-compliant data security. Cloud-based EMR solutions reduce the need for costly on-premise infrastructure, making them ideal for small to mid-sized practices. For example, Athenahealth enhanced its cloud-based EMR platform with telehealth integration, streamlining virtual consultations for OBGYN patients and improving workflow optimization. The flexibility of cloud solutions supports real-time updates and integration with patient portals, enhancing care delivery for high-risk pregnancies and routine gynecological visits. As practices prioritize efficiency and patient-centric care, cloud-based EMR adoption continues to drive market growth by offering scalable, secure, and cost-efficient solutions.

Demand for Practice Management Software Integration: The growing need for integrated practice management software is a key driver of the OBGYN EMR Software Market, as it streamlines administrative tasks like scheduling, revenue cycle management (RCM), and medical billing software. OBGYN practices require specialized tools to manage complex workflows, such as prenatal visit tracking and billing for obstetric procedures. Integrated systems enhance workflow optimization by automating claim submissions and reducing billing errors. For instance, Modernizing Medicine introduced maternal-fetal medicine features to its EMR, incorporating practice management software to improve appointment scheduling and RCM for high-risk pregnancies. These solutions align with HIPAA-compliant standards, ensuring secure data handling. The demand for seamless integration drives market growth, as practices seek to reduce administrative burdens and focus on patient care, particularly in busy OBGYN settings with diverse clinical and financial needs.

Rise of Telehealth Integration and Patient Engagement: The rise of telehealth integration and patient engagement tools is propelling the OBGYN EMR Software Market, driven by the need for accessible, patient-centric care. Telehealth integration enables virtual consultations for prenatal care, postpartum follow-ups, and gynecological consultations, improving access for patients in remote areas. Patient portals facilitate secure messaging, appointment scheduling, and access to medical records, enhancing patient satisfaction and compliance. eClinicalWorks updated its EMR platform with enhanced telehealth integration and patient portal features, tailored for OBGYN practices to support virtual maternal care. These advancements align with clinical decision support tools, such as AI-driven alerts for preeclampsia risks, improving outcomes. The emphasis on patient engagement and remote care, accelerated by post-COVID healthcare trends, drives demand for EMRs that integrate these features, positioning the market for continued growth in OBGYN settings.

OBGYN EMR Software Market Restraints:

High Implementation and Maintenance Costs: High implementation and maintenance costs are a significant restraint on the OBGYN EMR Software Market, particularly for smaller practices. The initial investment for cloud-based EMR or on-premise systems, including hardware, software licenses, data migration, and staff training, can be substantial. For instance, on-premise solutions like AdvancedMD may cost $10,000–$50,000 upfront, while cloud-based EMR subscriptions range from $149–$899/user/month. Ongoing costs for updates, technical support, and HIPAA-compliant security measures further strain budgets. Smaller OBGYN practices, with limited financial resources, may delay adoption or opt for basic systems lacking advanced features like clinical decision support or RCM. In 2024, a report highlighted cost barriers as a key challenge for EMR adoption in specialty practices. These financial constraints limit market penetration and slow the adoption of advanced EMR solutions.

Complexity of Interoperability and System Integration: The complexity of achieving interoperability and integrating EMR systems with existing healthcare IT infrastructure poses a significant restraint on the OBGYN EMR Software Market. OBGYN practices often use multiple systems, such as diagnostic tools (e.g., ultrasound) and medical billing software, requiring seamless data exchange. However, inconsistent standards and legacy systems hinder interoperability, disrupting workflow optimization. The adoption of FHIR API is improving data sharing, but integration challenges persist, especially for smaller vendors. In August 2024, Epic Systems reported progress in FHIR API integration for obstetric data, yet noted ongoing issues with legacy system compatibility. Staff training to navigate these integrations adds to the learning curve, causing resistance among clinicians. These challenges delay implementation, increase costs, and limit the adoption of advanced features like clinical decision support, constraining market growth as practices struggle to achieve fully integrated, efficient workflows.

OBGYN EMR Software Market Segmentation Analysis:

Clinical Management is predicted to be the most popular application: The Clinical Management segment dominates the OBGYN EMR Software Market due to its critical role in streamlining patient care and documentation for obstetrics and gynecology practices. This segment encompasses specialized tools for prenatal charting, fetal monitoring, gynecological procedure tracking, and clinical decision support, enabling precise management of complex OBGYN workflows. Features like customized templates for prenatal visits, menopausal care, and gynecologic oncology ensure accurate record-keeping and compliance with HIPAA standards. For example, Modernizing Medicine enhanced its Clinical Management suite with maternal-fetal medicine features, improving high-risk pregnancy documentation and integrating ultrasound data for better outcomes. The segment’s prominence is driven by the need for workflow optimization and real-time access to patient data, which enhances diagnostic accuracy and patient safety. As OBGYN practices prioritize evidence-based care, Clinical Management remains the cornerstone of EMR adoption, supporting clinicians in delivering specialized, patient-centric care.

By End-User, Hospitals & Clinics are anticipated to grow rapidly: The Hospitals & Clinics segment is the largest end-user category in the OBGYN EMR Software Market, driven by the high volume of OBGYN services provided in these settings. Hospitals and clinics require robust EMR systems to manage diverse patient needs, from routine gynecological exams to complex obstetric care, integrating revenue cycle management (RCM) and medical billing software. These facilities benefit from interoperability features, such as FHIR API, to share data across departments, ensuring continuity of care. For instance, eClinicalWorks upgraded its EMR for Hospitals & Clinics, adding telehealth integration and patient portal features tailored for obstetric care. The segment’s dominance stems from the need for comprehensive solutions that support large patient volumes, regulatory compliance, and advanced clinical decision support. As hospitals adopt cloud-based EMR systems for scalability, this segment continues to lead, addressing the complex demands of OBGYN care in high-throughput environments.

North America is expected to hold the largest market share: North America, particularly the USA, holds the largest share of the OBGYN EMR Software Market due to its advanced healthcare infrastructure, high adoption of cloud-based EMR systems, and supportive regulatory frameworks. The region’s focus on healthcare billing and revenue management, coupled with HIPAA compliant mandates, drives demand for specialized EMR solutions. The U.S. benefits from widespread EHR adoption, with 88.2% of office-based physicians using EMR systems, as reported by the CDC. Furthermore, Athenahealth introduced AI-enhanced clinical management tools for OBGYN practices, boosting workflow optimization in North America. The region’s market leadership is further supported by investments in telehealth integration and patient portals, addressing the needs of high-risk pregnancies and women’s health. North America’s robust IT ecosystem and regulatory incentives, such as the Meaningful Use program, ensure its dominance in driving EMR innovation and adoption.

OBGYN EMR Software Market Key Developments:

In February 2024, NextGen Healthcare launched the NextGen Office EHR for Women's Health, a dedicated solution designed specifically for smaller to mid-sized OB/GYN practices. This new product provides specialized templates for prenatal, gynecological, and postpartum care, aiming to offer a more efficient and comprehensive tool than a general-purpose EHR. The focus is on streamlined documentation, better billing workflows tailored for women's health procedures, and enhanced patient engagement tools.

2024-2025: Epic, a dominant EMR provider in large healthcare systems and hospitals often including OBGYN departments, advanced its AI-driven Revenue Cycle Management (RCM) module. The updated module uses predictive AI models (like GPT-4 integration) to automate and streamline complex billing processes, including improved claim validation, automated denial tracking, and optimized coding accuracy, which is crucial for maximizing revenue and reducing administrative overhead in high-volume OBGYN practices.

Oracle Health (formerly Cerner) integrated new generative AI tools directly into its EHR systems, which are used by many large healthcare organizations, including OBGYN departments. These tools automate time-consuming administrative tasks for providers, such as transforming physician-patient conversations into structured notes, automatically suggesting ICD-10 coding, and streamlining tasks like appointment scheduling and lab order processing via voice command or chat portal.

OBGYN EMR Software Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 2.152 billion |

| Total Market Size in 2030 | USD 3.248 billion |

| Forecast Unit | Billion |

| Growth Rate | 8.58% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Application, Deployment Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

OBGYN EMR Software Market Segmentations:

By Application

Workflow Management

Clinical Management

Healthcare Billing and Revenue Management

By Deployment Type

Cloud-Based

On-Premises

By End-User

Hospitals & Clinics

Ambulatory Surgical Centers

Maternity Centers

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

South Korea

Australia

India

Indonesia

Thailand

Others