Report Overview

Optical Coating Market - Highlights

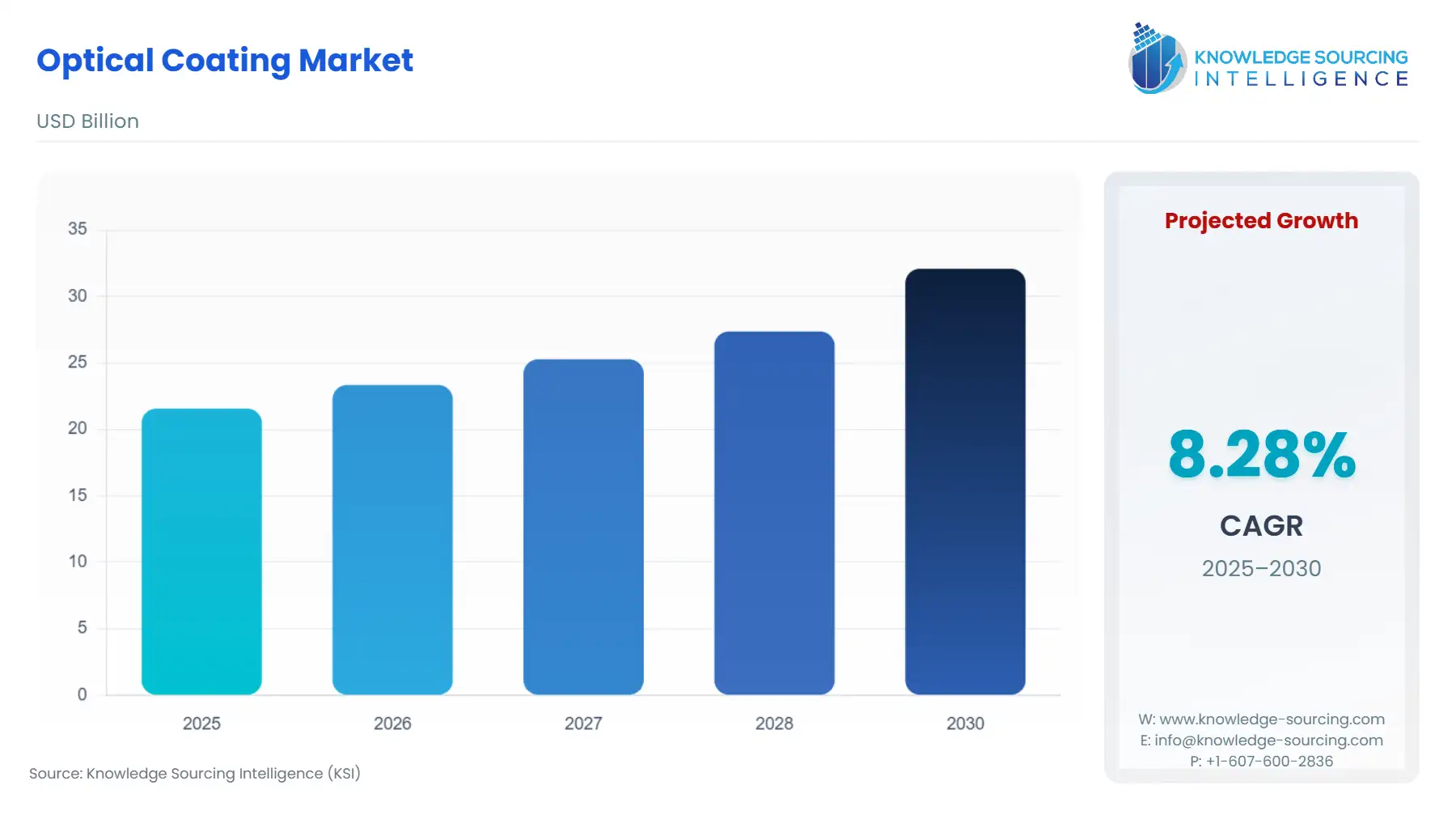

Optical Coating Market Size:

Optical Coating Market, with an 8.03% CAGR, is expected to grow to USD 34.281 billion in 2031 from USD 21.565 billion in 2025.

An optical coating is a technique for adding a thin layer of films to optical components like lenses and mirrors to improve the optical system's transmission and reflection properties. Depending on the intended use, optical coatings are typically built with various layers and dielectric substances like titanium dioxide, silica, aluminum, and the like. It can be applied to support concepts for transparent conductive coating, high-reflection coating, and anti-reflective coating. Home appliances, the auto industry, solar panels, and certain other industries can all benefit from optical coatings.

Optical Coating Market Growth Drivers:

Rising use of optical coating in the automotive industry

The value and adaptability of the vehicle have long been increased by the application of optical coating in automotive glazing. Veiling glare, which impairs a driver's vision, is the result of the interior of the windscreen reflecting to the observer. Furthermore, the issue of glare veiling is made worse by the recent rise in favor of high-installation-angle windscreen structures. The glare is removed, and reflectivity is decreased by adding optic antireflection (AR) coatings to the windscreen. Due to a ground-breaking three-layer AR structure created by this method, the inboard reflectivity of the laminated windscreen is decreased, as compared to the uncoated glass, thereby aiding in the market share increase in the automotive sector.

Increased demand for anti-reflective coating for different end uses.

The optical coating market size is anticipated to develop because of the rising demand for anti-reflective coatings used in the manufacture of photovoltaic solar panels, vehicle displays, doors, and GPS navigation systems. Due to the widespread use of solar panels, the conductive coatings category is anticipated to increase significantly over the course of the projection period. A rise in usage is also predicted to promote market expansion throughout the forecast period in screen windows, solar panels, heaters, LCD manufacturing, heads-up displays, protection for radio frequency interference, LED screens, and instrument display windows.

High growth to be expected in the telecommunication industry

The exchange of voice and data is the foundation for the interconnectedness of the global economy. The expansion of optical fiber networks has increased the activity of connections across continents which increases the optical coating market size. The exponential rise of the optical business is also being fueled using the internet. These coatings can be employed as an optical feature on a variety of devices or as a value-added component on lenses. The mass production and coating of numerous optical components could reduce costs and boost revenue for the coating industry. Utilizing sophisticated filters, optical fiber network signal transmission is tracked. Multi-layer thin film stacks expand the bandwidth of optical fiber distribution in the telecommunications industry.

Rising use in the electronics and semiconductor sector to propel the market growth

In many gadgets where light must travel through optical surfaces, optical coatings are used. Optical anti-reflective coatings are used in tablet and cell phone screens for a variety of reasons, including making it simpler to read outside. On consumer screens, they are also used in anti-glare applications. An electronic display may also use transparent conductive coatings. The market under investigation is being propelled by the steadily rising demand for consumer electronics. Demand for semiconductors, screens, and other electronic components is expected to continue to be driven by the manufacturing of mobile phones, portable computers, video games, and other gadgets for personal use which is increasing the optical coating market share.

Optical Coating Market Restraints:

Evaporation Deposition Process Errors that Prevent Market Growth

A low-cost method that can be used on a variety of materials, including metals and dielectrics, is evaporation deposition. A significant distance between the substrate source and the optical bits is also provided by the chamber's architecture. As a result, even for intricately formed and steeply bent optical components, high coating uniformity is attained. Nevertheless, it is frequently a labour-intensive production technique that is more prone to random and planned failures than other systems and depends significantly on operator feedback. The main cause changes in process factors include deposition rate, vapour distribution, temperature, pressure under vacuum, and others.

Optical Coating Market Geographical Outlook:

Asia Pacific is projected to be one of the significant optical coating marketplaces

During the projected period, the Asia-Pacific region is anticipated to lead the optical coatings market. The market is anticipated to increase because of the rising demand for optical coatings from the electronics and semiconductors industry, aerospace and defense industry, and other industries in nations like China, India, Japan, and South Korea. According to estimates from China's Civil Aviation Administration (CAAC), domestic air travel will eventually reach 85% of pre-pandemic levels. In addition, over the course of the next 20 years, Chinese airline businesses aim to spend around USD 1.2 trillion on 7,690 brand-new aircraft. It is also anticipated that this will increase demand for optical coatings.

Optical Coatings Market Segmentation:

By Type

Anti-Reflective Coatings

Reflective Coatings

Filter Coatings

Transparent Conductive Coating

Others

By Technology

Vacuum Deposition

E-Beam Evaporation

Sputtering Technology

Advanced Plasma Sputtering

Ion Beam Sputtering

Others

Ion-Assist Deposition (IAD)

Others

By End-User

Automotive

Aerospace & Defense

Consumer Electronics

Medical & Healthcare

Telecommunication

Energy & Power

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others