Report Overview

Photonic Integrated Circuit (PIC) Highlights

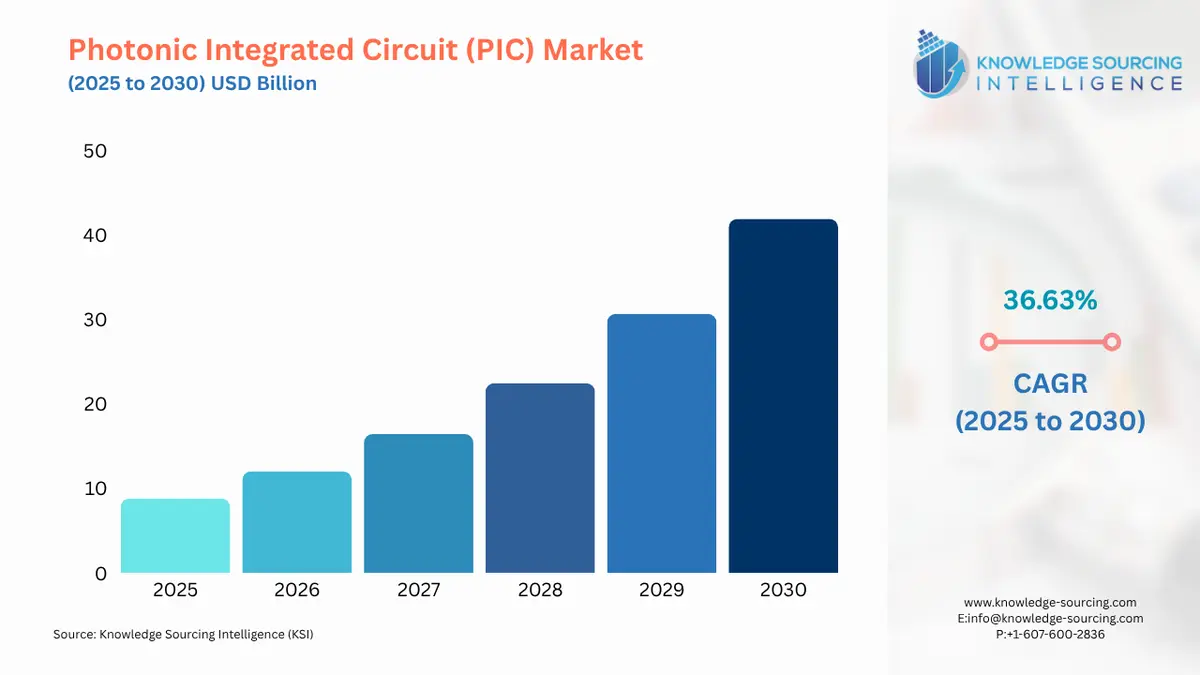

Photonic Integrated Circuit (PIC) Market Size:

The photonic integrated circuit (PIC) market is projected to grow at a CAGR of 36.63% to reach US$41.912 billion by 2030 from US$8.801 billion in 2025.

Photonic Integrated Circuit (PIC) Market Introduction

The photonic integrated circuit (PIC) market is a rapidly evolving sector at the intersection of optics and electronics, fundamentally reshaping data communication and processing. A PIC, often referred to as a "chip for light," integrates multiple photonic components—such as lasers, modulators, detectors, and waveguides—onto a single semiconductor substrate. By manipulating photons instead of electrons, PICs offer significant advantages in terms of speed, power efficiency, and bandwidth, which are becoming increasingly critical in a data-driven world. The market's growth is driven by the insatiable demand for faster data transmission, particularly from hyperscale data centers, telecommunication networks, and emerging high-performance computing applications.

The technology behind PICs is not a singular platform but a diverse ecosystem of materials and integration methods. Silicon photonics, for example, leverages the mature and cost-effective manufacturing infrastructure of the semiconductor industry, enabling mass production of complex optical circuits. Indium Phosphide (InP), on the other hand, is a direct-bandgap semiconductor that is ideal for integrating active components like lasers and amplifiers, making it a cornerstone for high-performance telecommunication applications. The synergy of these platforms and others, such as Silicon Nitride (SiN), is leading to a new era of hybrid integration, where the best of each material system is combined to create highly functional and efficient devices. This integration allows for the creation of components that were once bulky and expensive, but are now miniaturized onto a single chip, leading to a dramatic reduction in size, power consumption, and cost.

The commercialization of PICs is moving at a rapid pace, with significant investments from both established technology giants and innovative startups. Companies are deploying PICs in various applications, from optical transceivers for data centers to LiDAR systems for autonomous vehicles and advanced sensors for biomedical devices. The rise of artificial intelligence (AI) and machine learning (ML) has further accelerated this trend, as these technologies require immense data throughput and low latency, which traditional electronic circuits are struggling to provide. PICs are proving to be the ideal solution for these demanding workloads, enabling faster interconnects between GPUs and other processors within AI clusters. This strategic shift towards photonics for high-speed data transfer is a key market driver.

However, the PIC market is not without its challenges. The high initial capital requirement for R&D and manufacturing, as well as the inherent complexity of integrating diverse components on a single chip, can be a significant barrier to entry. The need for precise alignment of optical and electrical components and the development of specialized packaging techniques add to the overall cost and complexity. Another restraint is the technical complexity and reliability issues associated with mass production. Ensuring consistent performance and high yield rates for these intricate chips remains a challenge, particularly as integration levels increase. Despite these hurdles, the market's long-term trajectory is overwhelmingly positive. The ongoing research into new materials, fabrication methods, and integration architectures is addressing these restraints, positioning PICs as a foundational technology for the future of digital infrastructure. The convergence of photonics and electronics is not just an incremental improvement; it is a fundamental leap forward, promising a new generation of high-speed, energy-efficient, and highly integrated devices that will power the next wave of technological innovation.

Photonic Integrated Circuit (PIC) Market Overview

Photonic integrated circuits (PICs) are emerging as a highly dependable and forward-looking solution for optoelectronic devices, thanks to their superior efficiency, reduced energy use, and faster operational speeds. Compared to fully electronic systems, PICs stand out as strong contenders due to their greater bandwidth. These circuits are transforming their industry through technological breakthroughs, utilizing photons instead of electrons as data carriers. Advances in cost-effective indium phosphide-based PICs have enabled the integration of multiple functions onto a single chip. A key market for PICs is optical sensors, which serve industries like energy, defense, aerospace, and healthcare, among others. Nevertheless, ongoing research and development efforts are focused on achieving full integration of electronics and optics on a single circuit.

Geographically, the PIC market spans North America, Europe, the Middle East and Africa, Asia Pacific, and South America. North America currently dominates the market, driven by widespread use in data centers and wide-area network (WAN) applications within optical fiber communication systems. Meanwhile, the Asia Pacific region is seeing the most rapid growth, fueled by swift economic development that is spurring significant demand for PICs.

The PIC market report offers an in-depth exploration of the global industry, delivering strategic and executive-level insights backed by data-driven analysis and projections. Regularly updated, the report equips decision-makers with actionable insights into current trends, emerging opportunities, and competitive dynamics. It examines the demand for PICs across applications such as optical communications, data centers, and consumer electronics, as well as their adoption across various regions. The report also covers the latest technological advancements in the PIC sector, alongside key government policies, regulations, and macroeconomic factors, providing a comprehensive overview of the market.

Some of the major players covered in this report include Agilent Technologies, Enablence, II-VI Incorporated, Infinera Corporation, Intel Corporation, and NeoPhotonics Corporation, among others.

Photonic Integrated Circuit (PIC) Market Drivers

Exploding Demand for High-Speed Data Transmission

The photonic integrated circuit (PIC) market is primarily driven by the exponential growth in global data traffic. The proliferation of cloud computing, 5G and 6G networks, artificial intelligence, and the Internet of Things (IoT) has created an insatiable demand for high-speed data transmission with low latency. Traditional electronic circuits are reaching their performance limits due to issues like signal loss, heat generation, and bandwidth bottlenecks. PICs, which use light to transmit data, offer a superior solution by enabling significantly higher bandwidth and speed with much lower power consumption. In data centers, for example, PIC-based optical transceivers are replacing traditional copper interconnects to facilitate faster communication between servers and switches. The transition to 5G and beyond also relies heavily on PIC technology to handle the massive data volumes and low-latency requirements of next-generation wireless networks. This fundamental shift towards optical communication to overcome the limitations of electronics is a core catalyst for the PIC market's expansion.Rise of Hyperscale Data Centers and AI Accelerators

The rapid expansion of hyperscale data centers and the growing use of AI accelerators are fueling the demand for photonic integrated circuits. AI and machine learning models require massive amounts of data to be processed and transmitted between GPUs and other processing units at incredibly high speeds. Traditional electronic interconnects are becoming a bottleneck, limiting the performance and scalability of these AI clusters. PICs, particularly those based on silicon photonics, offer a solution by providing ultra-high bandwidth, low-latency, and energy-efficient optical interconnects. The move towards co-packaged optics (CPO), where PICs are integrated directly with electronic switch chips, is a recent development that further reduces power consumption and signal loss. This integration is critical for building next-generation AI infrastructure that can handle the massive computational demands of large language models and other complex AI workloads. Companies are making significant investments in this technology to stay at the forefront of the AI race.Integration of Photonics with CMOS Manufacturing

The market is significantly driven by the ability to integrate photonic components with existing CMOS (Complementary Metal-Oxide-Semiconductor) manufacturing processes. This is a crucial factor, as it allows for the mass production of PICs using the mature, high-volume, and cost-effective infrastructure of the semiconductor industry. Silicon photonics, in particular, leverages this compatibility, enabling manufacturers to produce complex PICs at a scale and cost that would be impossible with traditional optical fabrication methods. This integration not only reduces manufacturing costs but also allows for the seamless integration of optical and electronic components on the same chip, leading to highly compact and efficient devices. This capability is accelerating the adoption of PICs across various applications, from data communications to automotive LiDAR, as it makes the technology more accessible and economically viable for a wider range of industries.

Photonic Integrated Circuit (PIC) Market Restraints

High Initial Capital and Development Costs

The photonic integrated circuit market is restrained by the high initial capital expenditure required for research and development, as well as the complex manufacturing processes. The design and fabrication of PICs involve a high degree of technical expertise and specialized equipment, which can be prohibitively expensive. Unlike traditional electronics, which have a long history of standardized manufacturing, the PIC industry is still in a relatively nascent stage, with different material platforms and integration methods. This lack of standardization and the need for precision alignment of components increase the complexity and cost of the development cycle. For smaller companies and startups, the high investment required to build or access foundry services can be a significant barrier to entry, limiting competition and innovation. Furthermore, the specialized packaging required to protect the delicate optical components and ensure reliable performance adds to the overall cost, hindering mass adoption.Packaging and Integration Challenges

The inherent complexity of packaging and integrating photonic integrated circuits presents a major restraint to market growth. PICs require a seamless interface between the optical components on the chip and external fiber optic cables, which demands extremely precise alignment. Any misalignment can lead to significant signal loss, compromising performance. Furthermore, the heat generated by the electronic components on a hybrid PIC can affect the performance of the optical components, requiring sophisticated thermal management solutions. The packaging process itself is often a custom, labor-intensive task, which is a bottleneck for mass production and drives up costs. While new technologies like co-packaged optics (CPO) are emerging to address these issues, they are still in the early stages of adoption. Overcoming these packaging and integration challenges is critical for achieving the high-yield, low-cost manufacturing necessary for widespread commercialization.

Photonic Integrated Circuit (PIC) Market Segmentation Analysis

Hybrid Components are expected to grow significantly

The Hybrid Components segment is poised to become the dominant component type in the photonic integrated circuit market. This is because hybrid integration offers the best of both worlds, combining the strengths of different material platforms onto a single chip. For example, it allows the integration of a high-performance laser, which is typically made from Indium Phosphide, with a cost-effective silicon-based waveguide. This approach overcomes the limitations of monolithic integration, where a single material is used, by enabling a more flexible design and higher functionality. Hybrid PICs can be tailored to specific application requirements by selecting and combining the most suitable components from various material systems, leading to superior performance in terms of power efficiency, bandwidth, and cost. This versatility makes hybrid components ideal for complex applications in telecommunications and data centers, where a wide range of functionalities is required on a single chip.There is an increasing demand for Silicon-Photonics material, boosting market growth

Silicon-Photonics is the leading material platform in the photonic integrated circuit market, primarily due to its compatibility with the existing, mature CMOS manufacturing ecosystem. This allows for the mass production of PICs at a scale and cost that is unachievable with other materials. While silicon is an indirect-bandgap semiconductor and not an efficient light emitter, its excellent properties for passive components like waveguides and modulators make it an ideal platform for PICs. The ability to integrate silicon-photonics with traditional electronic circuits on the same chip is a game-changer, enabling the creation of highly compact and energy-efficient devices. This has made silicon-photonics the go-to choice for high-volume applications such as optical transceivers for data centers and fiber optic communication systems. The ongoing research and development in silicon-photonics, including the integration of other materials for active components, further solidifies its position as the major material segment.By Application, the telecommunication sector is predicted to hold the largest market share

The Telecommunication sector is the largest application segment for photonic integrated circuits. This is driven by the continuous need for higher bandwidth and faster data transfer rates to support the ever-increasing demand for internet services, mobile communication, and cloud computing. PICs are a fundamental technology for modern optical communication systems, enabling key functionalities such as wavelength division multiplexing (WDM), signal modulation, and amplification. By integrating these components on a single chip, PICs drastically reduce the size, power consumption, and cost of optical transceivers, which are the backbone of long-haul and metro networks. The rollout of 5G and the development of future 6G standards are creating a surge in demand for high-performance, compact, and energy-efficient PICs to handle the massive data volumes and low-latency requirements of these networks.

Photonic Integrated Circuit (PIC) Market Key Developments

March 2025: At GTC 2025, NVIDIA announced a new co-packaged silicon photonics switch system. This innovation integrates silicon photonics directly with switch ICs, reducing power consumption by a factor of 3.5 and dramatically improving network resiliency for next-generation AI data centers.

December 2024: IBM announced a new co-packaged optics (CPO) process designed to improve data center connectivity. By embedding optical waveguides in silicon photonics, this technology aims to enable faster training speeds for generative AI models, which are becoming increasingly prevalent.

December 2024: Ayar Labs, a leader in in-package optical interconnects, successfully raised $155 million to accelerate the high-volume manufacturing of its products. This investment, with contributions from industry giants like NVIDIA and AMD, underscores the market's confidence in optical interconnects for high-performance computing.

September 2024: SoftBank announced a collaboration with NewPhotonics aimed at advancing photonic integrated circuit technology. The partnership focuses on developing low-power optical (LPO) and coherent optical (CPO) applications, signaling a strategic move to integrate advanced photonics into next-generation networking solutions.

Photonic Integrated Circuit (PIC) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | US$8.801 billion |

| Total Market Size in 2030 | US$41.912 billion |

| Forecast Unit | Billion |

| Growth Rate | 36.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Material, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Photonic Integrated Circuit (PIC) Market Segmentation:

By Component

Optical Components

Electrical Components

Hybrid Components

By Material

Silicon Nitride

Indium Phosphide

Silicon-Photonics

By Application

Telecommunication

Data Centers

Consumer Electronics

Biomedical

Others

By Enterprise Type

Large Enterprises

Small and Medium Enterprises (SMEs)

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe Middle East and Africa

Germany

France

United Kingdom

Spain

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others